Procter & Gamble Headquarters, Cincinnati, Ohio Sherlock

Article: Procter & Gamble demonstrates superior capital allocation performance despite volatility in CPG industry

Procter & Gamble Company (New York Stock Exchange:PG) is a global leader in consumer packaged goods (CPG). Although CPG is a great innovator, the category as a whole is maturing and near-term challenges are expected. These include cyclical declines in consumer demand, foreign exchange fluctuations, and more broadly, the fight to avoid commoditization and price wars. This article explores these challenges in more detail.

What P&G is really good at is allocating capital to reward shareholders. In the past two years, P&G has invested more than $10 billion in share buybacks. In addition, the company Dividend KingsWith 67 consecutive years of increasing dividends, P&G is, in my opinion, a great stock to hold for the long term. Near-term challenges in the CPG category.

P&G stock has lagged the market over the past decade, but for investors looking to reduce volatility in their portfolio or prioritize dividends, I think it’s a stock worth owning.

P&G is good at allocating capital to reward shareholders.

I believe P&G is a leader in innovation in the CPG space, as I will explain later in this article. Really The company excels at allocating capital to reward shareholders. Bought back Since September 2022, over $10 billion in shares have been acquired.

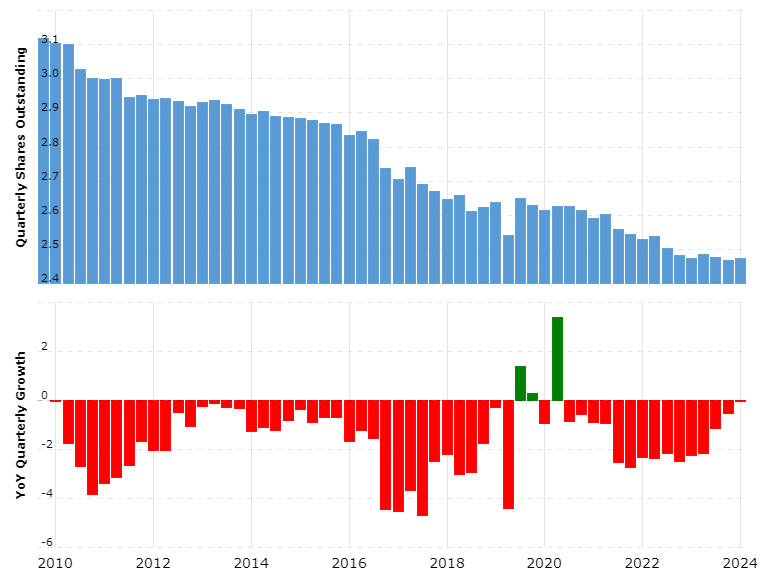

PG Shares Outstanding, 2010-2024 (MacroTrends.com)

A look at shares outstanding over the past 14 years shows how efficiently P&G has allocated capital. The company has reduced its share count by nearly one-third, a result of steady share repurchases. The company has consistently reduced its shares outstanding over the past 14 years, except in 2020.

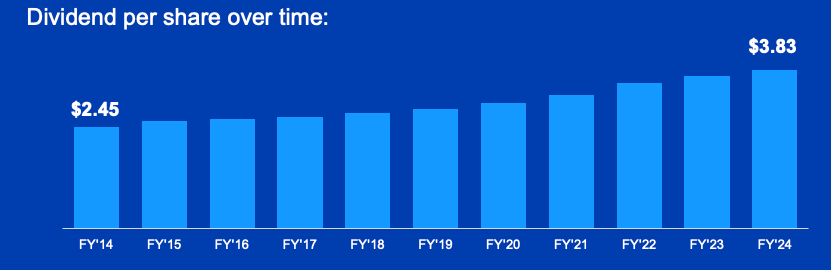

Dividend per share, PG (P&G 2023 Report)

Another way P&G rewards shareholders is by continually increasing its dividend. The company is a dividend king, having increased its annual dividend for the past 67 years. While P&G’s dividend history is impressive, I see it primarily as a signal from management to investors of how shareholder-centric the company is. As of this writing, the dividend yield is 2.44%, which is hardly a reason to add PG to a portfolio. We are still in a high interest rate environment, and a sub-3% yield is not attractive in itself.

The company has generated most of its shareholder returns through stock price appreciation, which has also been driven by share buybacks. What’s really impressive, in my view, is that Procter & Gamble has returned $145 billion over the past decade, taking into account both dividends and share buybacks.

P&G’s financial performance and why near-term headwinds are expected

P&G has had a strong performance over the past five years. Since 2020, the company has steadily increased revenue by more than 20% and EPS by an impressive 41%.

However, the latest second-quarter fiscal 2024 results reveal that headwinds are expected in the near term.

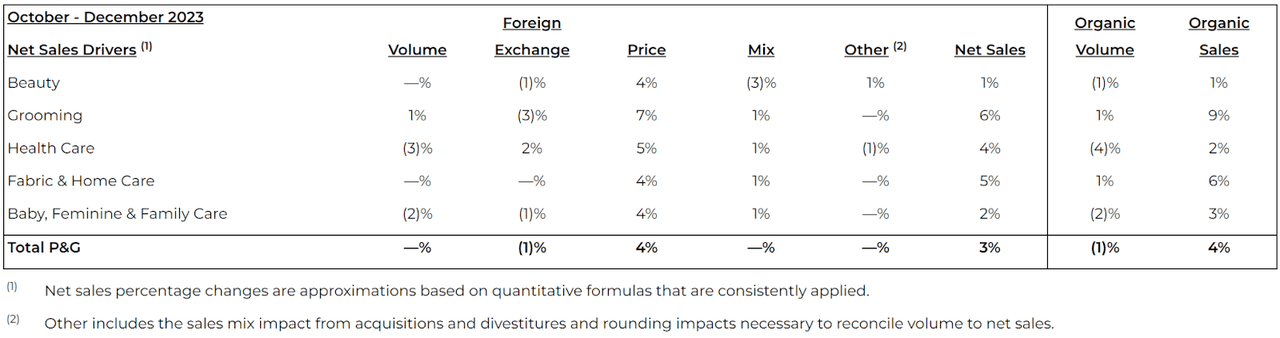

PG Q2 Performance Summary (P&G Q2 Presentation)

P&G saw no volume growth in any category except grooming, growing by just 1%. Currency effects were negative in every segment except healthcare. The company’s overall net sales growth of 3% was driven by price increases.

The presentation told shareholders that the relative lack of sales growth was due to sales in Greater China, which saw sales in the region fall 15% overall, and, more importantly, a whopping 34% drop in sales at its premium, high-margin beauty brand, SK-II.

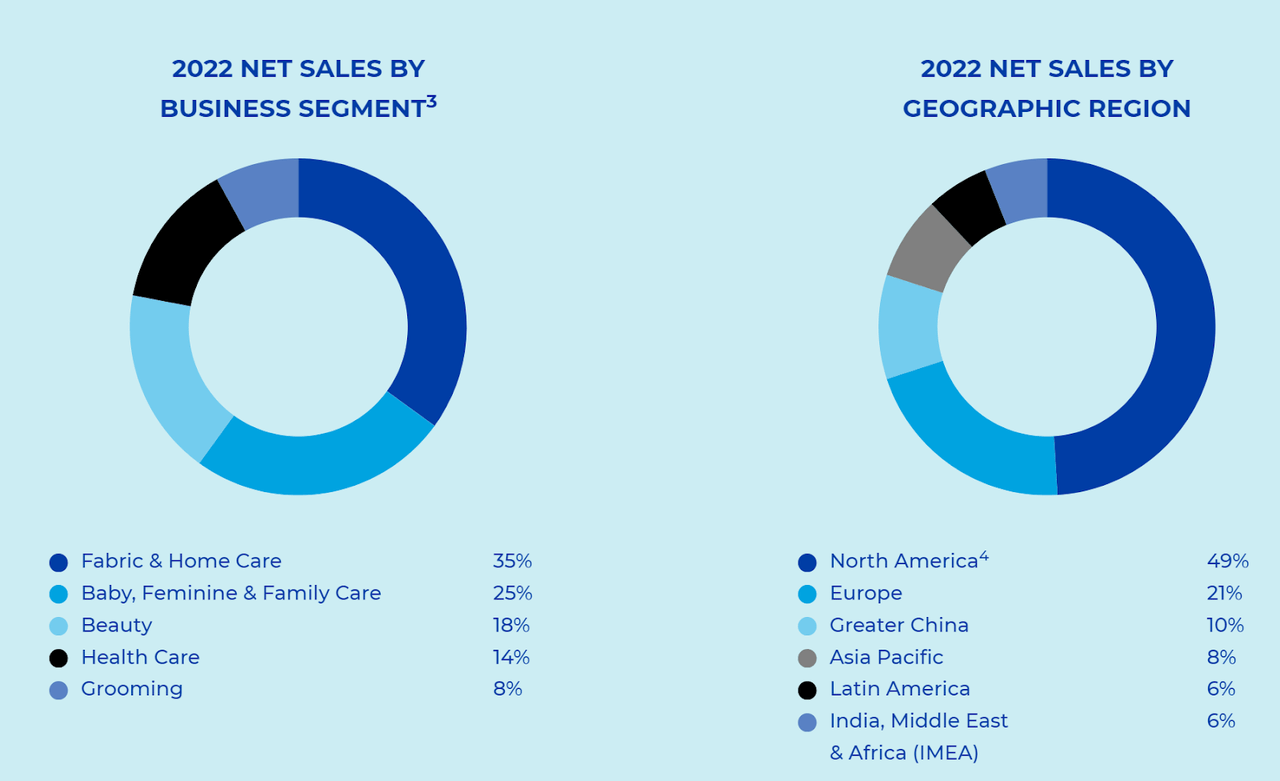

PG Sales by Region and Business (P&G 2023 Shareholder Report)

About half of P&G’s sales are generated outside the U.S. Not surprisingly, the company is highly exposed to foreign currency fluctuations and global consumer demand, especially given P&G’s tendency to focus on its products. SuperiorityThis often leads to premium products and gives companies more pricing power.

P&G reported a slowdown in its China business last quarter.

The CPG category and the battle against commoditization: P&G is the winner

Across the CPG category, Growing Sales are expected to grow at a compound annual rate of 5% through 2031. As a mature category, CPG products tend to be sold with a focus on price. McKinsey in 2021 study We see that 28% to 50% of retail volume is promotional.

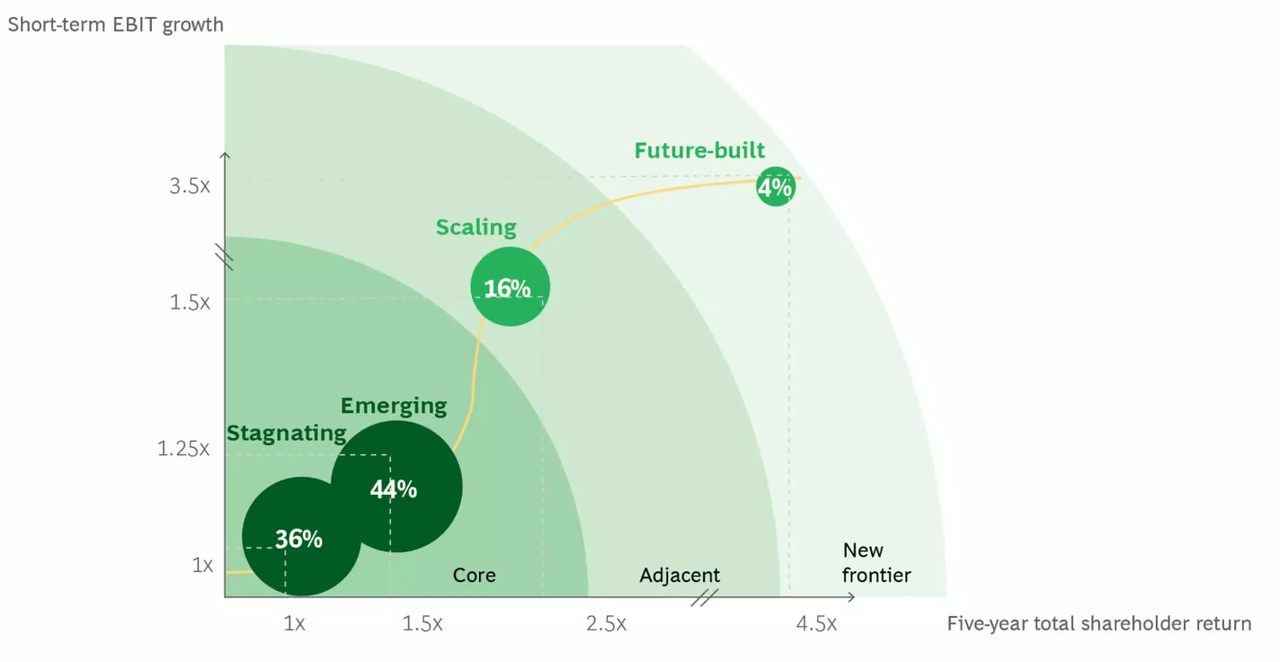

2023 study A study by consulting firm BCG found that 80% of companies surveyed in the CPG sector were in the “stagnant” or “emerging” sector, meaning they have low near-term EBIT growth and limited five-year shareholder returns.

What emerges from these data points is that P&G operates in a highly price-sensitive category that is stagnating in terms of volume, sales, and profitability. As a result, CPG companies are aggressively competing on price.

As a company that operates in a price-sensitive category, it is notable that P&G has used pricing to offset volume declines and the impact of foreign exchange rates. This shows that P&G is a winner and that its strategy of focusing on superior products is working. I consider this the company’s “moat.”

A clear example of P&G’s successful product strategy is Gillette, part of its fabric care and grooming business. In Gillette, P&G Rebuilt The brand has established itself as a category leader despite a trend in favor of shaving over beards. The company has embraced this trend by launching new products that appeal to a younger generation and offer better value than competitors.

In fabric care, P&G has transformed a stagnant category into a growth area. invent new product, Laundry Pods. Both examples highlight a common theme: when faced with an industry challenge, P&G focused on improving the consumer experience and delivering products that offered great value.

Overall, we expect P&G will continue to face short-term headwinds, which are common given the nature of the company’s business. However, long-term investors need not worry. P&G has consistently rewarded shareholders through prudent capital allocation and has demonstrated resilience to short-term challenges in the industry.

Is P&G beating the market? It depends on who you ask, but it doesn’t matter if you understand the stock’s role in your portfolio.

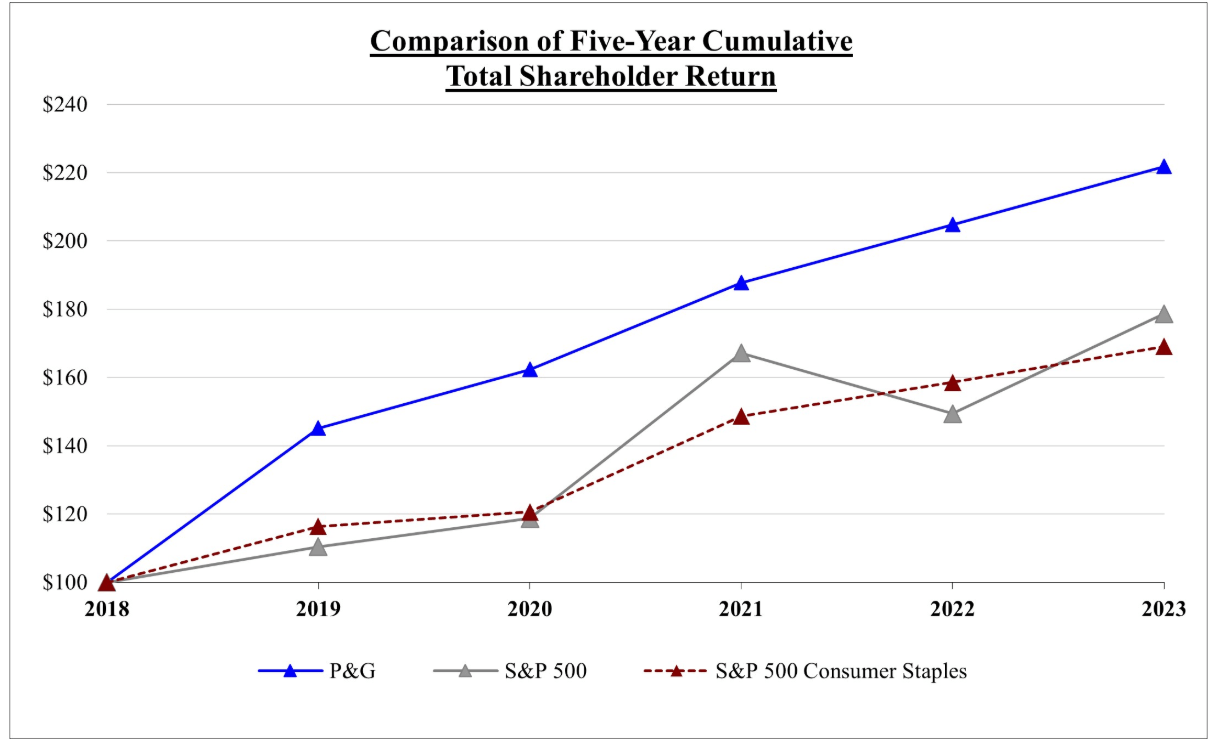

P&G’s 2023 financial report reportManagement takes pride in how its stock price is performing: Pages 23 and 24 of the 88-page report are devoted to how the company is performing relative to the S&P 500.

Comparing PG’s returns to the S&P 500 (P&G’s 2023 shareholder report)

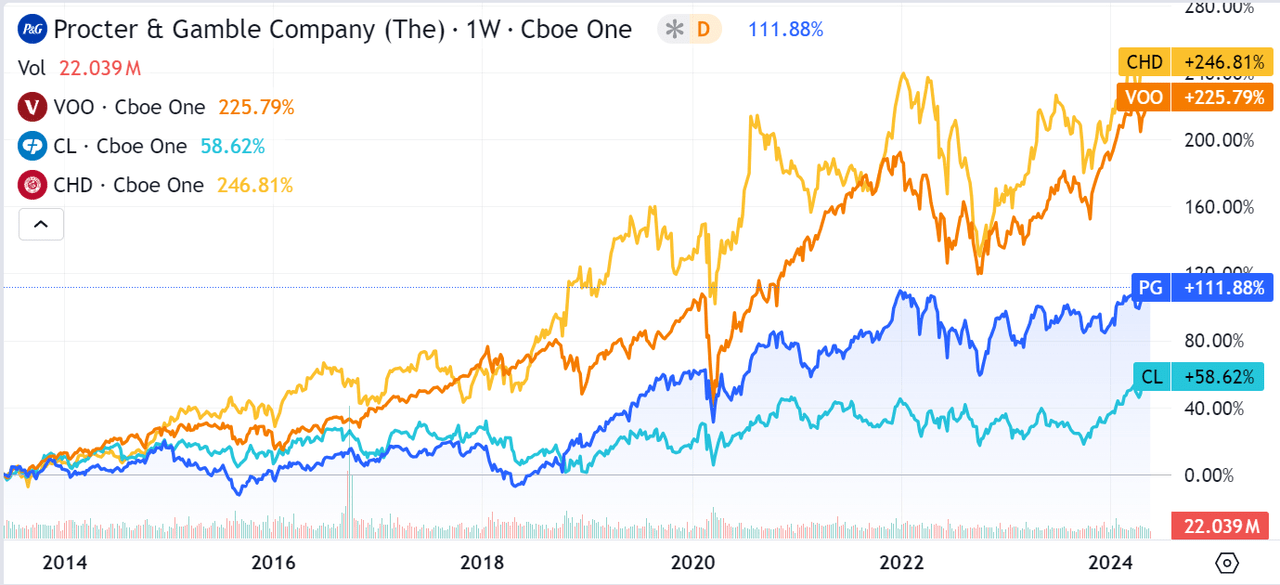

While P&G’s performance over the past five years has been impressive, looking at the longer term tells a different story: P&G has underperformed the S&P 500 since 2014. The company has even underperformed its direct competitor, Church & Dwight Co.C.H.D.) and outperformed the market over the long term.

PG vs. VOO vs. CL vs. CHD, last 10 years (Seeking Alpha)

In my view, P&G’s relative underperformance compared to the market is not a problem. It operates in a very mature sector, so it’s unrealistic to expect its stock price to outperform the market.

I believe P&G excels at delivering for shareholders and addressing long-term challenges in the CPG space. For investors looking to reduce portfolio volatility or build a dividend-focused portfolio, P&G is a great stock to hold for the long term.

Risks to my thesis

The main risk in my theory is that P&G could lose its “bulwark,” be unable to innovate, and face long-term headwinds in the CPG space, which could cause the company to fall behind its competitors.

In such a scenario, P&G may not be able to continue raising its dividend or buying back shares, even though its current payout ratio is just 60% and the dividend appears safe for now.

Another risk concerns the CPG category as a whole. As mentioned above, this is a relatively stagnant category and is highly dependent on global consumer demand. If consumer demand were to decline significantly for an extended period of time, P&G would face strong headwinds in the near term.

Conclusion

P&G is a great company at allocating resources to reward shareholders. Over the past decade, the company has allocated over $145 billion to dividends and share repurchases. Additionally, the company has been great at navigating any challenges it faces in the CPG space by focusing on delivering great products to consumers. For these two reasons, I rate P&G a Buy.

These two factors make P&G an easy choice for those looking to build a dividend portfolio or simply reduce volatility.