John D.

Founded in 2013, Rigetti Computing (Nasdaq:R.G.T.I.) is a company developing full-stack quantum supercomputing services available through its cloud-based platform, Forest.

The company went public through a SPAC transaction in 2021, but the stock has been disappointing so far, trading around $9. RGTI was trading at $1 at the time, but since then the stock has fallen 89%. Currently, RGTI is trading at $1. That said, RGTI has been gaining momentum year to date, and is up about 16% so far this year.

I rate the stock a Buy. My one-year price target of $1.4 per share indicates an upside of about 35%. At these levels, RGTI offers a decent buying opportunity. In my opinion, the recently launched QPU Partnership Program will benefit RGTI greatly, allowing it to unlock and capture greater opportunities in the quantum computing industry in a variety of ways. The risk/reward balance seems attractive.

Financial Review

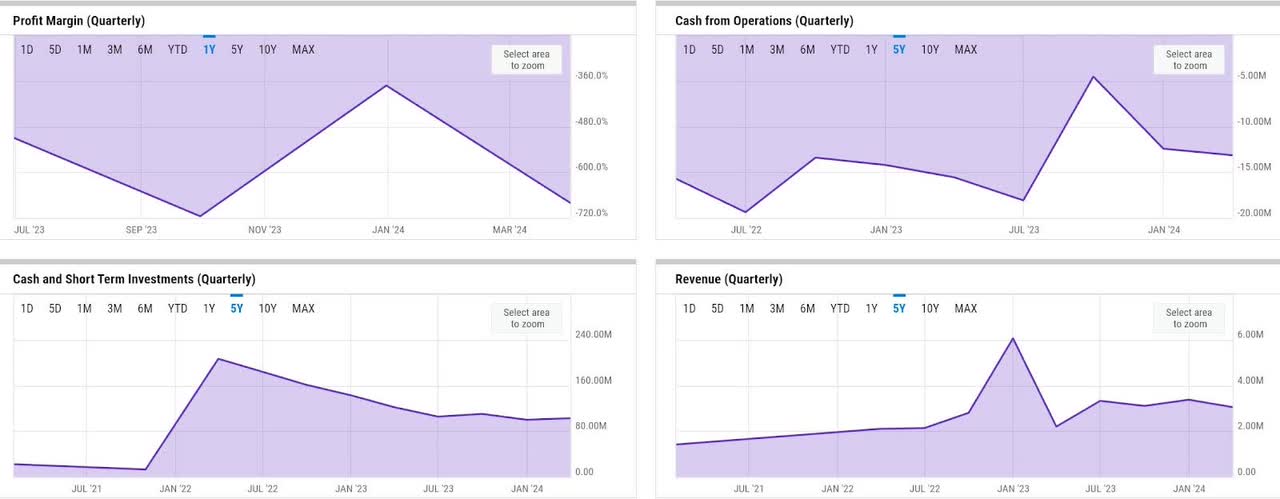

As with any company developing highly novel and disruptive technology, I believe RGTI is currently in the investment stage. In Q1, RGTI generated over $3 million in revenue, growing 39% year over year. Revenue is primarily driven by technology development contracts and QPU sales. As an investment stage company, RGTI is spending heavily on research and development. In fact, as of Q1, R&D expenses were more than 3x revenue, resulting in an operating loss of -$16.5 million for the quarter. However, Q1 operating and net losses have narrowed by -25% and -10%, respectively, which represents a considerable improvement. Continued losses have resulted in negative operating cash flow (OCF). OCF losses have also narrowed over the past five years, but RGTI still appears a long way from becoming cash flow positive. This has put pressure on liquidity since going public, but liquidity levels have been relatively stable recently. During the first quarter, RGTI’s liquidity increased slightly, ending the quarter with more than $102 million in cash and short-term investments. A cash infusion of $20.7 million, primarily from the issuance of common stock, contributed to RGTI’s increased liquidity in the first quarter.

catalyst

In my opinion, the recently launched Novera QPU Partnership Program should not only help RGTI further the quantum computing industry, but also position them well in driving future QPU sales.

The quantum computing industry is still in its very early stages, so I believe an ecosystem development approach to advance technology development across different parts of the stack through partnerships is a strategic move that should first position RGTI as a leader in the space and position it to secure dominant market share in the future.

Second, as management noted during the first quarter earnings call, partnerships will enable the industry to progress faster and further. This is likely due to the fact that quantum computing is a complex technology that requires deep focus on specific parts of the stack to achieve continuous improvement more quickly.

Fundamentally, we believe that an open modular approach is the right way to innovate quickly, so we allow other partners to develop what they’re good at. For example, we work with Riverlane in Cambridge, UK, who are really good at error correction. We also work with Quantum Machines in Israel and Zurich Instruments in Switzerland, who are both really good at control systems. So we allow our QPUs to interface with other parts of their stack. We think this is the right approach to develop quantum computing systems more quickly and efficiently.

sauce: First quarter earnings report.

Last but not least, I believe the success of the partnership program is an indication of future revenue growth, as the most visible early adopters of on-premise quantum computing solutions will be among the partners in this program. This happened in Q1 when RGTI sold Novera QPUs to Horizon.

danger

I believe RGTI remains a very high-risk investment opportunity given the relative nascent state of the current technology: for example, as per management’s comments in Q1, the industry is still in its developmental stages at this point, and further educating potential customers on the current and potential state of the technology remains important to manage expectations.

Overall, if you look at the number of customers, we’re in active discussions right now, around 10-15. We also make sure that, A, they have funding secured, and B, they’re serious about it and they understand quantum computing. Obviously, we’re not at the stage right now where quantum computers can be proven to be better than classical computers. So these are primarily for research purposes. So before we chase every lead we get, we make sure the customer understands what exactly they’re getting and how they can get value from it.

Source: Q1 earnings report.

As such, it is important to keep in mind that RGTI’s potential TAM is very limited in the near term. Additionally, RGTI will likely continue to incur relatively high R&D expenses as a percentage of revenue, so investors interested in the stock should also expect further equity dilution going forward. In my opinion, RGTI will continue to rely on financing cash flow rather than OCF generation in the short to medium term.

Rating/Pricing

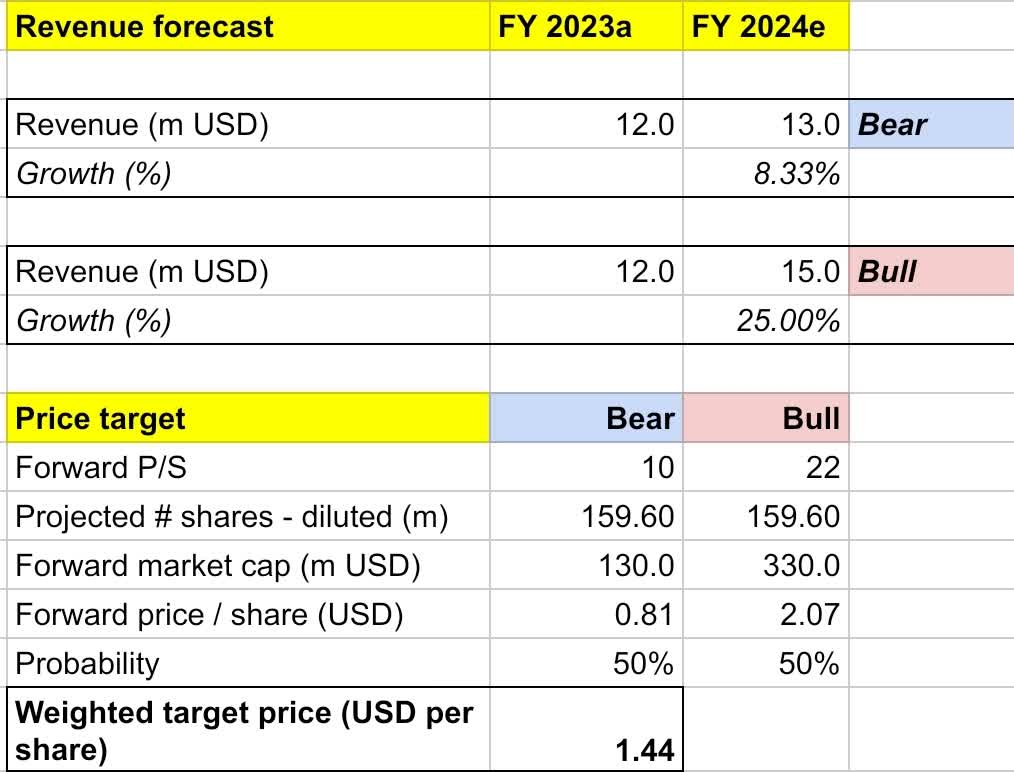

My price target for RGTI is based on the following assumptions for bull and bear scenarios for the 2024 forecast.

Assuming a bullish scenario (50% probability) – Revenues will increase 25% year over year to $15 million, Market estimatesWith a forward P/S of 22x, we expect the stock to rise to the $2 level and return to year-to-date highs. We expect RGTI’s P/S to reach year-to-date highs if it can achieve 25% YoY revenue growth, with a strong rebound starting in 2023.

Assuming a bearish scenario (50% probability) – RGTI expects FY2024 revenues of $13 million, up 8.3% YoY, $1 million below the low end of the consensus target, which could trigger a revision to $0.80 per share.

Original Analysis

Integrating all of the above information into my model, I arrive at a weighted price target of $1.44 per share for fiscal 2024, projecting an upside of about 35% over the course of the year. I rate the stock a Buy.

My 50/50 bull/bear odds assignment is based on my belief that despite promising developments to date, revenue growth prospects remain minimal to moderate. However, RGTI appears to be undervalued. The company slowed in 2023, but is on track to see stronger revenue growth and better bottom line performance in 2024. The company burned through about $13 million of OCF in the first quarter, but its $102 million of liquidity should provide enough of a cushion to continue executing at current levels through the fiscal year.

Conclusion

RGTI is a company developing quantum supercomputing services. The company should continue to benefit from its recently launched partnership program, which aims to bring all the leading quantum computing players across the technology stack under one ecosystem. This should benefit RGTI in unlocking more QPU sales opportunities, as well as advancing the technology to accelerate commercialization. Given the novelty and development of the industry, risks remain very high. That said, in my view, the risk/reward balance is attractive. My price target is $1.4 per share, which allows for an upside of about 35%. I rate the stock a Buy.