Klaus Wedfeldt

summary

Continue My Report About Bowlero Corp. (New York Stock Exchange:bowl) In February 2024, I reaffirmed my buy rating due to my positive outlook on the business, as management is executing very well on multiple fronts. This post was originally posted in Providing an update on my thoughts on the business and the stock, BOWL continues to receive a Buy rating from me as the business growth outlook remains very positive, supported by multiple visible growth drivers. BOWL’s capital return policy is also promising as it has the potential to further boost total returns.

Investment Thesis

On June 5, 2024, BOWL Q3 2024 RevenueThe company posted revenue of $337.7 million, gross profit of $111.8 million, adjusted EBITDA of $122.8 million, adjusted EBITDA of $71.0 million, and adjusted EPS of $0.07. Revenue increased 7%, in line with the company’s guidance range of 6.1% to 10.9%. However, EBITDA was up 1.2%. Revenues of $133.4 million were below consensus estimates, and adjusted EPS also missed consensus estimates. Apart from the disappointing earnings performance, I believe weak same-store sales (SSS) growth (down 2.1%) also influenced the stock price movement. That said, I believe the outlook remains very positive, with multiple indicators and catalysts supporting my view.

I remain optimistic on SSS growth as the slowdown does not appear to be structural. Rather, it was impacted by adverse weather conditions in Q1 as seen from monthly SSS growth performance. January was down 7% and the first three weeks were down over 10%. February was up 1% and March was up 3%. Importantly, quarter-to-date (April to first week of May), SSS growth accelerated further to 6%. The launch of the new Summer Season Pass ($10-15M opportunity) which was not available last year further supports my view that SSS performance will improve in Q4. For reference, this could be a 6% tailwind to total revenue growth in Q4. Readers should also note that Q4 SSS was down 2.6% so Q4 growth will be easier.

Looking ahead to FY2025, SSS in Q4’24 could see moderate single-digit growth, which provides a very positive baseline for FY2025 SSS growth expectations. Also, in my view, there are multiple visible catalysts that inspire confidence. First, the rebranding from Bowlero to Lucky Strike will significantly improve customer awareness (survey conducted by Nielsen based on Q3’24 earnings report), which should boost traffic. Second, I expect traffic to improve with the launch of a new website that streamlines the online reservation process (improved user experience). Finally, BOWL plans to upgrade its food menu across all centers in July, which should lift average transaction value.

In terms of earnings, the improved SSS should naturally benefit both EBITDA and EPS due to inherent operating leverage. Additionally, as fixed cost leverage has increased due to increased online traffic volumes, BOWL expects to reduce customer acquisition costs (CAC) from the new website. CAC has fallen from $200 six to nine months ago to half that amount in Q3’24. The combination of improved SSS and reduced CAC should drive EBITDA and EPS growth in the coming quarters.

Finally, BOWL’s balance sheet has improved significantly compared to the previous quarter, with net debt to EBITDA ratio declining from 2.7x in Q2’2024 to 1.4x in Q3’2024. Keep in mind that management’s leverage target is 3x. This means that BOWL has plenty of room to increase debt to continue its M&A strategy (increasing growth opportunities). A strong balance sheet also means that BOWL can continue to support its capital return policy, which management has been successfully executing so far, i.e., repurchasing an additional 1.1 million shares, bringing year-to-date total repurchases to 20.8 million shares (repurchasing 11% of shares outstanding in Q4’2023).

evaluation

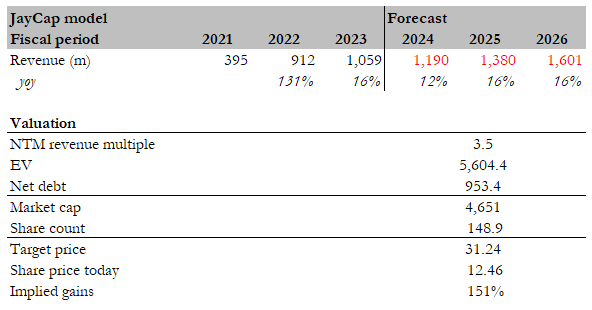

Own calculations

The target price for BOWL based on my model is $31.24. I have become much more confident about BOWL’s prospects given the visible growth drivers mentioned above, and therefore continue to believe that BOWL can grow at the pace I initially expected (12% in FY2024 and 16% in FY2025/26). There are two areas in my model where I’m implicitly underestimating the upside potential.

- I continue to assume BOWL will trade at its historical average multiple of 3.5x forward earnings, and do not expect any further earnings rating upgrades, despite BOWL’s lower CAC (improving earnings outlook) and lower leverage ratios.

- Share buybacks, which management has been vocal about, are not included in FY25. An additional 11% share buyback, similar to what happened in Q3F24, would be a bonus for shareholders.

Overall, I still believe BOWL offers attractive returns for shareholders, and an upturn in SSS and earnings growth in the coming quarters should spur positive sentiment towards the stock and drive the share price higher.

danger

BOWL’s revenue depends on discretionary spending and an overall economic slowdown may cause people to cut back on their discretionary spending, which may impact BOWL’s revenue. A shift in customer entertainment preferences from bowling to other entertainment options may also impact BOWL’s growth prospects.

Conclusion

In conclusion, my rating on BOWL is a Buy. Multiple growth drivers support my view, including the recovery in SSS growth, positive impact of rebranding to Lucky Strike, new website, and improved food menu. These factors should drive revenue growth and improve margins. Additionally, BOWL’s balance sheet is very strong and should easily support further capital return corporate activities to benefit shareholders.