Matte Gouache

of stocks ConocoPhillips (New York Stock Exchange:Police Officer) fell more than 3% on Wednesday. Announced Acquisition of Marathon Oil Company (M.R.O.The stock price is down more than 10% from its peak but is up 16% year-over-year. In September, I bought Conoco stock atbuy” Since then, they have become dead money, losing 2% while the market has risen over 20%. Given the complementary assets of both companies and the strong return on capital, I am positive on this deal and it could be a catalyst for stock upside in the long term.

under Terms As part of the deal, COP would pay 0.255 of its own shares for each MRO share, a premium of about 15%, near the low end of M&A premiums. COP would assume $5.4 billion of MRO’s net debt, for a purchase price of $22.5 billion. Based on consensus estimates, Conoco’s stock is trading at a P/E of 13.3 today. MRO is buying at 10.1 times consensus earnings, compared with an expected and trading price of about $29.50. MRO’s small size, lack of diversification, and emphasis on share buybacks over dividends contribute to its sustained discount multiple, but I am fundamental Advantageous asset baseCOP would be wise to take advantage of this discount.

In other words, even with a premium, MRO trades at a discount to COP, which is why Conoco expects the deal to be beneficial for shareholders, and I agree. COP also expects cost synergies of approximately $500 million due to the overlapping asset base. On this basis, Conoco plans to buy back $7 billion in year one and $20 billion over three years. It also plans to increase its dividend by 34% to $0.78 by the end of the year, regardless of the deal closing, and to sell assets of approximately $2 billion as it optimizes its portfolio.

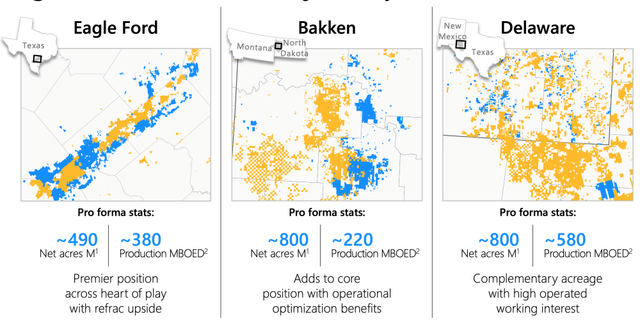

As shown below, the asset bases of both companies overlap (COP assets are in orange, MRO assets are in blue). This overlap will allow the company to realize significant cost savings of $250M in G&A, $150M in OpEx, and $100M in CapEx. The combined company will have a production volume of approximately 2.3mboe/day. The OpEx savings are approximately $0.18/BOE and CapEx savings are approximately $0.12/BOE. These are fairly modest savings, each assuming less than 1.5% cost savings over pro forma company spending. I consider such targets credible, if not conservative. Given the significant overlap, COP and MRO should be able to optimize their drilling crews and leverage them at a larger scale to negotiate better prices with suppliers.

The G&A target seems a bit too ambitious to me. The COP is about $700 million This year’s G&A $320 million Since we are focused on G&A, our goal here is a 25% reduction. Currently, Conoco is over 5x the size of MRO, so the fact that MRO spends about 40% on G&A speaks to the potential for significant cost savings. This is the economy of scale. Even if we increase production, we still need only one CEO, one CFO, one investor relations team, maybe a similarly sized accounting department, etc. I expect there will be significant scale opportunities and redundancies. Even assuming we run MRO at COP level efficiency and no scale benefits, we could reduce traditional MRO G&A by about $180 million.

So while the $250 million target seems quite large at first glance, in my view it only assumes an “ambition” of about $70 million, which I believe is achievable. That said, the G&A target appears to be a bit more aggressive than the production-related cost savings. Given that this target is more conservative, there may be some upside in capital savings compared to the $100 million target, which could offset a slight underperformance on the G&A savings side. Overall, I believe that a one-year run-rate savings of about $500 million is a very achievable target, although the mix may vary slightly.

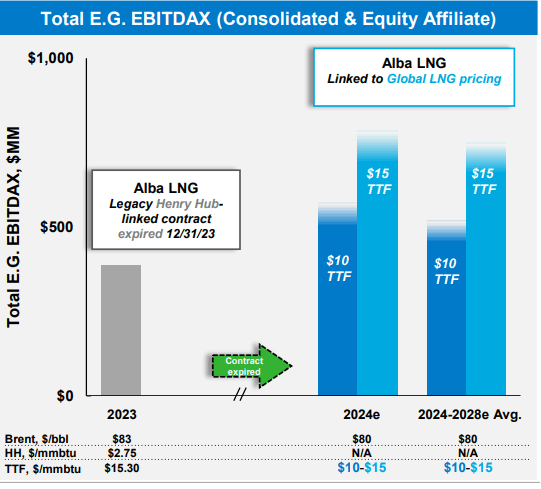

I also like MRO’s asset mix. About 53% of the company’s U.S. production is oil. Just under 50% of Conoco’s production is oil, so MRO will slightly increase the company’s liquids preference versus natural gas. I like this, given that oil has higher margins. OPEC+ provides some floor on the price of oil, but natural gas has no cartel to support the price. Additionally, oil is a global market, while natural gas is a relatively local market, with high transportation costs and limited export capacity. The U.S. has an abundance of natural gas, so prices have struggled to stay around $3 for extended periods, and this will continue to be the case. Currently, only a quarter of MRO’s international business is oil (representing just 11% of the combined company). However, half of the natural gas is sold as LNG rather than gas, which provides oil-like revenues given European LNG demand redirected from Russian gas. MRO has a stake in an LNG export hub in Equatorial Guinea that is currently benefiting from the expiration of a low-price contract, which will provide a tailwind of over $200 million for COP.

Marathon Oil

This asset is Conoco’s Our own LNG As efforts continue and Russian natural gas exports to Europe seem unlikely to resume anytime soon, demand for LNG should remain strong. Biden Administration There have also been delays to construction of new LNG export facilities in the U.S., which could continue to limit supply and keep profit margins high. Of course, the outcome of the election could change that, but these projects could take years to complete, so delays will only prolong supply constraints and signal that economic conditions will remain favorable for an extended period of time.

With oil prices at $80 and natural gas prices at $2.50, MRO could generate approximately $2 billion in free cash flow, and with cost savings this could increase. I see a base case of $75-85 for oil and $2.50 for US natural gas, assuming no global recession and current OPEC policies, but recognize that weather could cause significant near-term fluctuations. COP is paying approximately 9 times free cash flow, which I consider attractive. COP should generate approximately $10 billion in free cash flow in this environment, and the stock is trading at approximately 14 times. This is a significant valuation gap that the company is exploiting.

With combined free cash flow of approximately $12.5 billion, assuming energy prices remain flat, the combined company can safely meet its $7 billion share repurchase target and pay dividends, which would cost approximately $5.5 billion. The combined company’s pro forma free cash flow yield is 8%, attractive given modest production growth, rising LNG prices, and the potential for further capital cost reductions. COP has found value-add assets in MRO to add to its portfolio, and the combined company is smaller than ExxonMobil (ZOM) and chevron (CVX), I do not anticipate any significant antitrust challenges.

I continue to rate COP a Buy. While M&A announcements often drive down stock prices, this is a buying opportunity. The 8% free cash flow yield is attractive for a large, scaled oil and gas company, and I see upside risk to the three-year $20 billion share repurchase target, assuming oil prices stay above $75. With 1-2% production growth and cost controls, the new COP could generate 10% sustainable margins even in a flat commodity environment, with rising oil prices likely to be an additional tailwind. As share counts are reduced through repurchases and the benefits of this deal become clear, I expect the stock to rise towards $130 over the next 12 months.