Iridi

Investment Thesis

ALPS Sector Dividend Dogs ETF (NYSEARCA:S-Dog) is the ultimate contrarian investment. Ranking low in the large-cap value stock category across key factors like growth, momentum, quality and sentiment, SDOG will likely only be of interest to value investors who are drawn to its appeal. It has a 4% dividend yield. However, in today’s article, I’ll cover the sacrifices you need to make to get a slightly higher income from investing in SDOG. To do so, I’ll explain the basics of two large value ETFs with dividend yields close to 4% and show that at least one of them should be safer and provide a higher income over the long term. As a result, I do not recommend SDOG. I’ll explain why in more detail below.

Overview of SDOG

Strategy Discussion

SDOG tracks the S Network Sector Dividend Dogs Index and selects the top five dividend-paying S&P 500 stocks. It is calculated based on stocks from each sector (excluding real estate). The index has an equal weighting of 50 stocks, but notably, it does not undergo any financial strength screening beyond that required for inclusion in the S&P 500 index.

Although the index provider highlights the lack of these qualitative screens in the third section above and describes them as a positive feature to keep the index a “pure play” for dividend yield, I view this feature as a negative. Dividend growth, consistency, and coverage screens are necessary to avoid the yield trap. Moreover, yield growth is modest. I would not recommend the Schwab US Dividend Equities ETF (SCHD) represents a future dividend yield of 3.91%, compared to 4.00% for SDOG. We’ll explain later what SDOG shareholders are giving up for this additional dividend yield of 0.09%.

Performance Overview

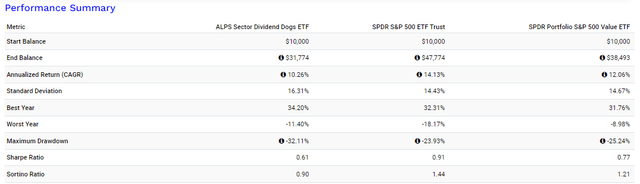

SDOG was launched on June 29, 2012 and has an expense ratio of 0.36% as of April 1, 2023. Since August 2012, it has delivered a total return of 217.74% compared to 374.74% and 284.93% for the SPDR S&P 500 ETF (spy) and SPDR S&P 500 Value ETF (Spy V). SDOG was also more volatile and its risk-adjusted returns (Sharpe and Sortino ratios) declined significantly.

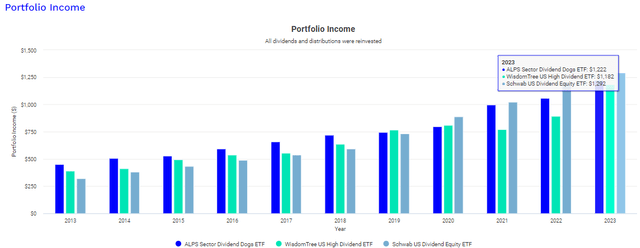

We included SPYV in the benchmark because SDOG is firmly in the large value category. While SDOG has a significantly higher dividend yield (4.16% vs. 1.81%), the 67% total return is a big sacrifice. Additionally, investors who chose to reinvest their dividends in 2013 would have been better off investing in SCHD and the WisdomTree US High Dividend ETF (Department of Homeland Security).

Still, that doesn’t mean SDOG is doomed to fail. On the contrary, it has previously performed quite well compared to other large-cap value ETFs. Let’s take a look at its annual returns and rankings from 2013 to 2023.

- 2013: 34.20% (#6/35)

- 2014: 15.00% (#6/39)

- 2015: -3.19% (#30/42)

- 2016: 22.48% (#4/48)

- 2017: 12.66% (#53/58)

- 2018: -11.40% (#56/64)

- 2019: 24.00% (#55/67)

- 2020: -0.35% (#52/69)

- 2021: 24.60% (#54/73)

- 2022: -0.21% (#13/80)

- 2023: 4.21% (#71/86)

SDOG’s performance has been rather volatile, achieving first or fourth quartile returns but rarely anything in between, so a comprehensive analysis is needed before declaring SDOG a turnaround. We do that next.

SDOG analysis

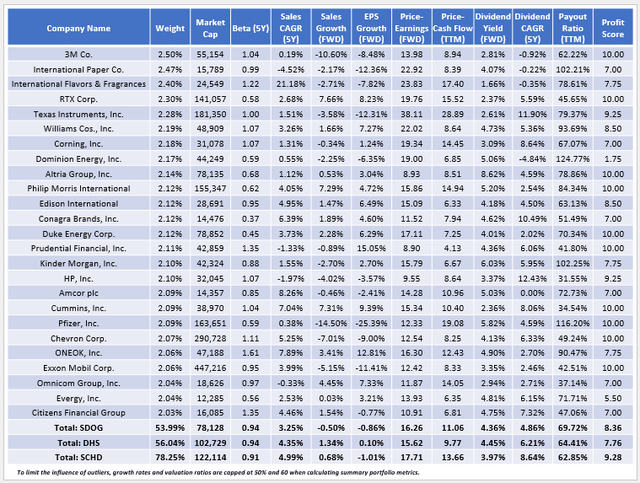

The following table shows selected fundamental metrics for the top 25 stocks in SDOG, which together account for 53.99% of the portfolio. We also list summary metrics for DHS and SCHD in the rows below.

Here are four things to consider:

1. SDOG has an index dividend yield of 4.36%, which is the weighted average yield of all 50 stocks. After deducting the fund’s expense ratio of 0.36%, the current price estimates a net return to shareholders of 4.00%. In comparison, DHS and SCHD have forward dividend yields of 4.07% and 3.91%, respectively, which is not that different. However, the holdings in DHS and SCHD are more Motivation They do have a propensity to increase their dividends, as evidenced by their five-year annualized dividend growth rates (6.21% and 8.64% vs. 4.86%). Additionally, here are the Dividend Scores for SDOG, DHS, and SCHD, calculated using Seeking Alpha Factor Grades and converted to a 10-point scale:

- Dividend Consistency: 7.51 / 7.73 / 8.46

- Dividend Growth Rate: 6.28 / 6.54 / 8.13

- Dividend Yield: 7.62 / 6.85 / 6.91

- Dividend Safety: 6.62 / 6.85 / 7.29

These scores show how SCHD has the highest dividend stability and dividend growth potential. It also has a slightly higher Dividend Safety Score, which is partly related to its low dividend payout ratio (62.85%). Notably, SDOG ranks last in every category except Yield.

2. SDOG trades at 16.26 times forward earnings using the simple weighting method, and 12.82 times forward earnings using the harmonic weighting method found on sites like Morningstar. Regardless of which method you prefer, this valuation is the 13th lowest among the 97 large-cap value ETFs I track. Additionally, its Value score of 6.25/10 from Seeking Alpha Factor Grades is the fourth best and impactful because it takes into account sector differences.

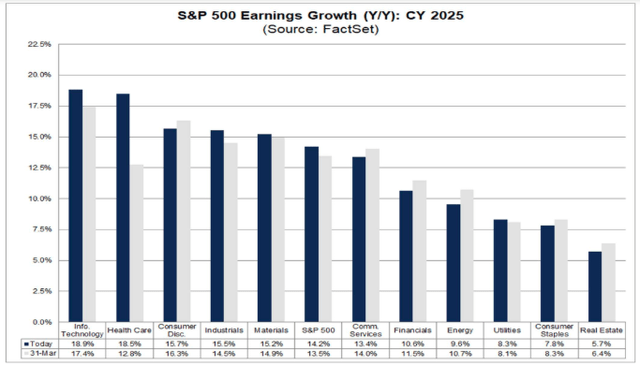

3. The estimated growth rates of the three ETFs are flat, which is an unfortunate reality for income investors. But this wasn’t always the case. April 2022 Review SDOG’s earnings per share growth rate was 10.69%. the -0.86% and Wall Street analysts are expecting earnings to decline for 27 of their holdings. FactSet analyst Most sectors are expected to see double-digit earnings growth in 2025, but ETFs with flat earnings growth will struggle.

4. SDOG’s Profit Score is 8.36/10, beating DHS and SCHD’s 7.76/10 and 9.28/10. For this reason, I do not recommend DHS as an alternative. However, despite SCHD’s recent underperformance, I still believe SCHD is one of the best large cap value ETFs available because it holds high quality stocks. The issue is growth, but as mentioned above, that is true for many dividend ETFs. In other words, if you’re sticking with holding a high yield stock fund, you’d be better off getting something else out of it. In SCHD’s case, it’s quality.

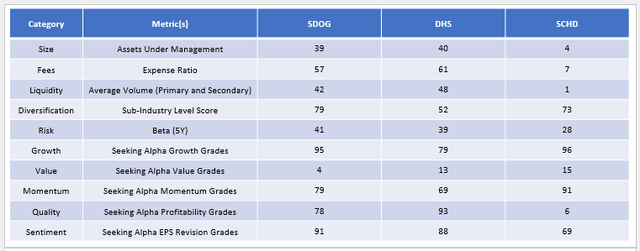

Finally, I want to highlight how SDOG compares to other large cap value ETFs across 10 key factors. This table summarizes many of the points already discussed. It can be used as a quick snapshot to identify the strengths and weaknesses of an ETF. In this case, SDOG should only perform well in a value-oriented market, but below average across all other factors.

Investment Recommendation

SDOG is a sector-neutral fund with a forward dividend yield of 4.00%. It follows a “dividend dog” strategy that selects the five stocks with the highest dividend yields in each of the 10 GICS sectors (excluding real estate). SDOG is also heavily discounted, but has little chance of success in a market that does not favor value stocks. While SDOG is not doomed to failure, I am discouraged by the flat expected sales and earnings growth rates of its constituent stocks and think it will struggle in the near term. SCHD is not perfect, but it has much more exposure to quality factors and a competitive forward dividend yield of 3.91%, so I recommend SCHD between the two. Thank you for reading. I look forward to your comments.