Max Satori

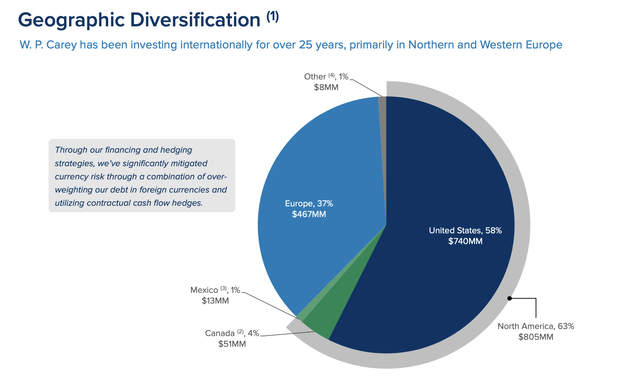

In my opinion, one of the most interesting REITs on the market right now is W.P. Carey (New York Stock Exchange:Worldwide). For those unfamiliar with the company, it is a diversified REIT that primarily owns single-tenant properties. It owns industrial, warehouse, retail and self-storage facilities. At the time of writing, it has a market capitalization of $13.03 billion and operates in 26 countries, making it one of the largest REITs in the world.

The reason I find this company so interesting is primarily because it is undergoing some pretty significant changes. These changes create uncertainty and can lead to attractive upside. For example, last September I I wrote about The company decided to execute a series of highly controversial transactions that essentially stripped shareholders of their office portfolio, including a spin-off and multiple asset sales. Sell. At the time, this strategy appealed to me, but the way the stock was priced meant I couldn’t rate the business anything more than a “hold.”

Unfortunately, the company did not even live up to those expectations. When I give a company a “hold” rating, it is my view that the stock is more or less likely to rise in line with the overall market. However, since then, the company’s stock price has only risen 11.1%, half of the 22.2% rise recorded by the S&P 500 over the same period. Given the passage of time, I thought that things might have changed. However, having considered the company’s business in more detail, I would argue that a “hold” rating is still very appropriate.

A complicated situation

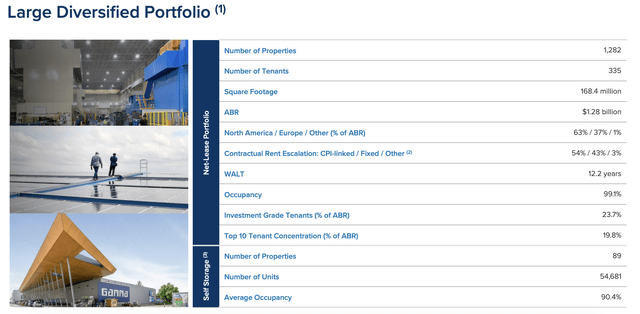

As we’ve already mentioned, WP Carey is a pretty big company. At the time of writing, the company Own The company has 1,282 properties in its net leased portfolio. These represent approximately 168.4 million square feet and generate $1.28 billion in annual base rent. Approximately 63% of this figure is in North America, and the remaining 31% is in Europe. And as of the end of the first quarter of this year, these assets had an occupancy rate of 99.1%. But that’s not all the company owns. The company also owns 89 self-storage properties with 54,681 units. And as of the first quarter, they had an occupancy rate of 90.4%.

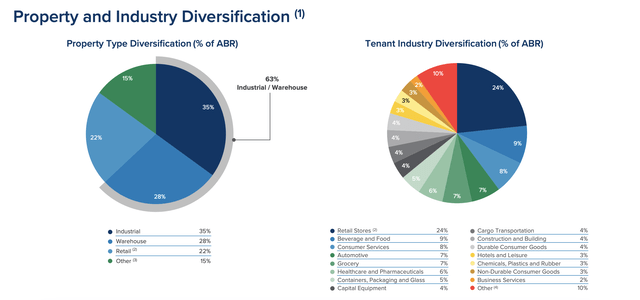

In terms of property type, industrial properties dominate at 35%, followed by warehouses as a separate category at 28%. This makes the company a fairly interesting player as it should benefit from the growth of industries in general, such as e-commerce, which as we all know is almost certain to continue to expand. 22% of annual base rent is derived from retail, while the remaining 15% comes from a mix of assets including offices, self-storage facilities, laboratories, and hotels. In terms of its focus on specific industries, a whopping 24% of annual base rent is derived from retail. In second place is the beverage and food space, followed by consumer services at 9% and 8%, respectively.

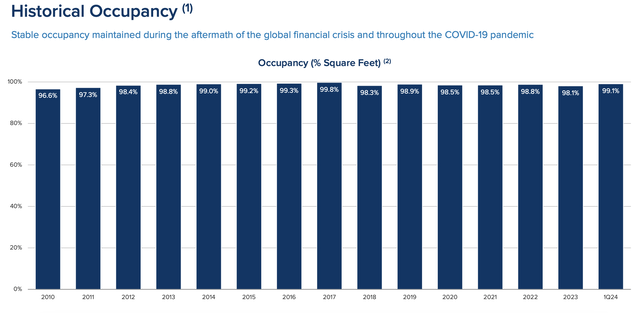

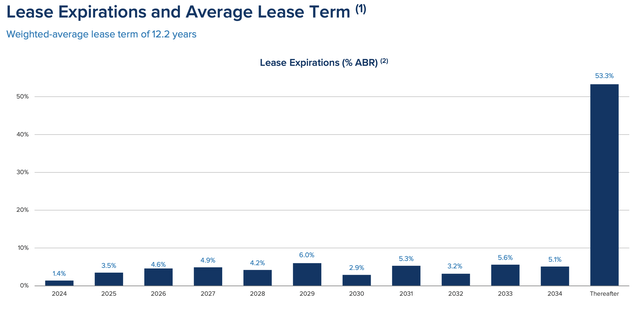

Historically, the company has always had high occupancy rates. As you can see in the first image below, this number has always hovered between about 96.6% and 99.8%. This shows the quality of the company’s assets. In addition to this, as the second image below shows, the weighted average remaining term of the company’s leases is quite long, at about 12.2 years. 53.3% of the leases expire after 2034. And over the next five years, starting this year, leases for properties that account for just 18.6% of annual base rent are scheduled to expire. This means great stability for the company and the chances of something terrible happening are very low.

As for the current fiscal year, things are pretty interesting. Historically speaking, I have always found value in looking at financial performance over multiple periods. But I don’t think that’s as relevant now, given the changes the company has undergone and will continue to undergo. For example, in early November last year, the company spun off 59 office properties into a separate public company called . Net lease office property (non-linear). This was in addition to plans to sell the remaining 87 office properties the company decided to retain at the time. Between the initial announcement in September of last year and now, management has sold 80 of these properties for total proceeds of $630.8 million. The remaining seven properties are expected to be sold in the first half of this year.

Beyond this, WP Carey has undergone some pretty big changes. First Quarter This year alone, the company has sold 153 properties for $889.2 million. Of those, 72 are 80 properties sold for the office divestiture program that management launched last year. But in addition to this, the company also sold 81 properties outside of the office divestiture program for an additional $478.6 million. By far the largest of these was the sale of the U-Haul portfolio in exchange for $464.1 million. This is not to say that the company isn’t making purchases. It certainly is. In fact, from the start of the year through the end of April, WP Carey has made a total of $374.5 million in purchases. It also has six capital investments and commitments, with $66.4 million due to close this year.

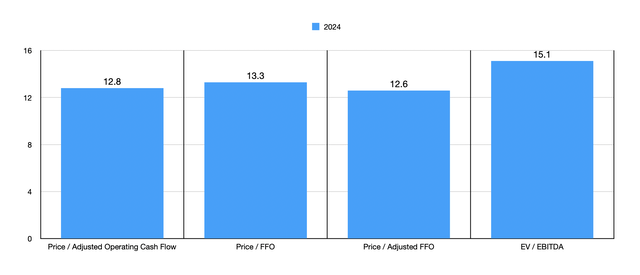

For fiscal 2024 as a whole, the company has provided enough detail to determine what opportunities exist. Management expects adjusted FFO (cash flow from operations) to be between $4.65 and $4.75 per share. At the midpoint, that should be about $1.03 billion. This assumes investments totaling $1.5 billion to $2 billion and asset sales of $1.2 billion to $1.4 billion. Assuming other profitability measures change at the same percentage as adjusted FFO year-over-year, FFO is expected to be $981.2 million, adjusted cash flow from operations to be $1.02 billion, and EBITDA to total $1.33 billion.

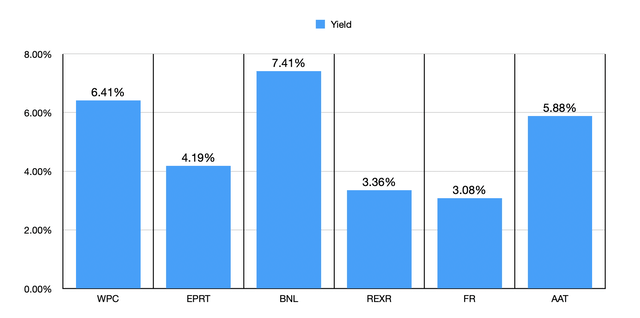

Considering these metrics, it is fairly easy to value this company, as shown in the chart above. This is not bad for a REIT, especially one that yields 6.41%. However, it doesn’t put this company in the value category for me either. However, it is not uncommon for REITs to trade at a slightly higher price than I would normally like. However, compared to similar companies, this stock appears to be more or less fairly valued. As you can see in the table below, two of the five companies I compared trade at a lower operating cash flow multiple than this company. The same results can be seen when it comes to EV to EBITDA multiples.

| company | Price / Operating Cash Flow | EV/EBITDA |

| W.P. Carey | 12.8 | 15.1 |

| Essential Properties Realty Trust (EPRT) | 16.4 | 17.7 |

| Broadstone Net Lease (BNL) | 11.5 | 11.3 |

| Rexford Industrial Realty (Rex) | 21.8 | 24.2 |

| First Industrial Realty (France) | 21.4 | 15.9 |

| American Asset Trust (What is an AT-AT?) | 9.1 | 11.5 |

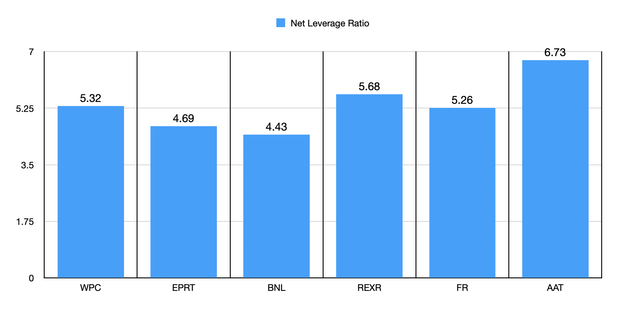

Valuation isn’t the only thing to consider here. There are a few other metrics to look at. One of them is definitely the yield. Four of the five companies have lower yields than WP Carey’s current yield, so it’s definitely encouraging to see the company sitting at the higher end of the range. Another question is whether the yield is sustainable. One way to answer this is to look at the net leverage ratio of our prospective company versus the net leverage ratios of the other five companies we compared it to. As the second chart below shows, three of the five companies have lower net leverage ratios than WP Carey.

Author – SEC EDGAR Data Author – SEC EDGAR Data

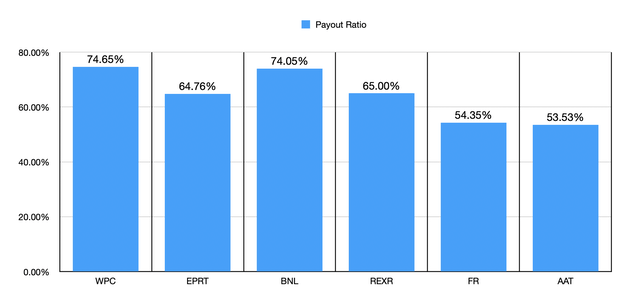

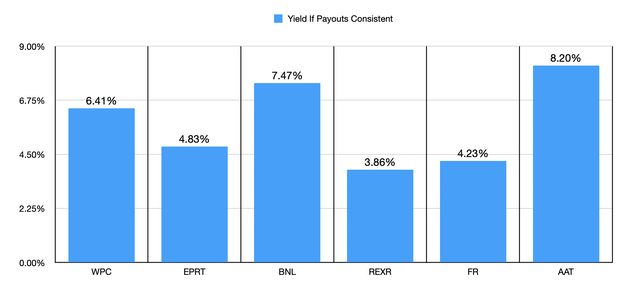

Another thing I decided to do as part of this analysis was to see what the dividend yield of each business would be if each company’s dividend payout ratio were exactly the same as WP Carey’s current dividend payout ratio. Currently, about 74.7% of WP Carey’s adjusted operating cash flow is used for the common dividend. If we normalize the other companies to match this, three out of five companies would have a lower dividend yield than they currently have, meaning that the candidates are slightly better than average.

Author – SEC EDGAR Data Author – SEC EDGAR Data

remove

All things considered, I think WP Carey is an interesting company with a bright future. It’s not a bad company by any means, but it’s not a great company either. It looks middling relative to its peers by and large. Plus, on an absolute basis, the stock is priced at a reasonable level. Given these factors, I still think a “Hold” rating makes the most sense at the moment.