July Alcantara/E+ via Getty Images

Investment Thesis

Have you already planned your next vacation trip? How about constructing an extensively diversified dividend portfolio that allows you to fund your next vacation with dividend payments from companies such as Coca-Cola (NYSE:KO), Verizon (NYSE:VZ), Altria (NYSE:MO) and Realty Income (NYSE:O)?

Appropriately selecting high dividend yield companies is crucial for a well-balanced dividend portfolio that can generate a significant amount of passive income via dividend payments.

In today’s article I have selected 10 high dividend yield companies which I believe are currently particularly attractive for investors due to their attractive Valuation, their appealing Dividend Yield, potential for dividend growth, financial health and competitive advantages.

However, it should be noted that some of the companies come attached to a higher risk level. For this reason, I suggest setting an allocation limit for those companies. This strategy allows you to reduce the overall risk level of your portfolio and to increase the chances of producing positive investment outcomes.

Since I have already described the detailed selection process of high dividend yield companies in a previous article. You can skip the following section written in italics, If you are already familiar with it.

First step of the Selection Process: Analysis of the Financial Ratios

In order to identify companies with a relatively high Dividend Yield (FWD), I use a filter process to make a pre-selection. From this pre-selection, I will later choose my top 10 high Dividend Yield companies of the month. To be part of this pre-selection of high Dividend Yield stocks, the companies should fulfil the following requirements:

- Market Capitalization > $10B

- Dividend Yield (FWD) > 2.5%

- P/E (FWD) Ratio or P/AFFO (FWD) < 30

In the following, I would like to specify why I have chosen the metrics mentioned above in order to select my top 10 high Dividend Yield stocks of the month.

A Market Capitalization of more than $10B contributes to the fact that the risks attached to your investments are lower, since companies with a higher Market Capitalization tend to have a lower volatility than companies with a low Market Capitalization.

A P/E (FWD) Ratio of less than 30 implies that the price you pay for the company is not extraordinarily high, thus filtering out those that have stock prices in which high growth expectations are priced in. High growth expectations imply strong risks for investors, since the stock price could drop significantly. Again, the filtering process helps us to reduce the risk so that we are more likely to make an excellent investment decision.

Second step of the selection process: Analysis of the Competitive Advantages

In a second step, the companies’ competitive advantages (for example: brand image, innovation, technology, economies of scale, etc.) are analyzed in order to make an even narrower selection. I consider it to be particularly important for companies to have strong competitive advantages in order to stand out against the competition in the long term. Companies without strong competitive advantages have a higher probability of going bankrupt one day, thus representing a strong risk for investors to lose their invested money.

Third step of the selection process: The Valuation of the companies

In the third step of the selection process, I will dive deeper into the Valuation of the companies.

In order to conduct the Valuation process, I use different methods and criteria, for example, the companies’ current Valuation as according to my DCF Model, the expected compound annual rate of return as according to my DCF Model and/or a deeper analysis of the companies’ P/E (FWD) Ratio. These metrics should serve as an additional filter to only select companies that currently have an attractive Valuation, which helps you to identify companies that are at least fairly valued.

The Fourth and final step of the selection process: Diversification over Industries and Countries

In the fourth and final step of the selection process, I have established the following rules for choosing my top picks: in order to help you diversify your investment portfolio, a maximum of two companies should be from the same industry. In addition to that, there should be at least one pick that is from a company that is based outside of the United States, serving as an additional geographical diversification.

My Top 10 High Dividend Yield Companies to Consider Investing in for June 2024

- Altria Group

- Coca-Cola

- CVS Health (NYSE:CVS)

- Enbridge (NYSE:ENB)

- ING Groep N.V. (NYSE:ING)

- Realty Income

- Telefónica (NYSE:TEF)

- The Bank of Nova Scotia (NYSE:BNS)

- Verizon

- VICI Properties (NYSE:VICI)

Coca-Cola

Coca-Cola is among the largest positions of Warren Buffett’s investment conglomerate Berkshire Hathaway (NYSE:BRK.A, NYSE:BRK.B), and I believe that the company is currently an attractive pick to be included in your dividend portfolio.

Today, Coca-Cola exhibits a P/E (FWD) Ratio of 21.97. This is particularly appealing for investors when considering the company’s excellent growth metrics: Coca-Cola presently showcases an EBIT Growth Rate (FWD) of 6.27%.

In addition to that, it is worth highlighting Coca-Cola’s impressive Profitability, evidenced by an EBIT Margin (TTM) of 29.41%. Moreover, it is worth noting the company’s wide economic moat.

I am convinced that Coca-Cola is a must-have stock for any investor focusing on dividend income. The company is on my watchlist for potential inclusion into The Dividend Income Accelerator Portfolio.

When compared to its competitor PepsiCo (NASDAQ:PEP), it can be highlighted that Coca-Cola has the slightly higher Dividend Yield (FWD) (3.13% compared to 3.05%), the higher Profitability metrics (EBIT Margin (TTM) of 29.41% compared to PepsiCo’s 14.74%), and the lower Total Debt to Equity Ratio (156.61% compared to 239.02%).

However, I see PepsiCo being ahead of Coca-Cola when it comes to Growth: PepsiCo showcases a 5-Year Revenue Growth Rate (CAGR) of 7.17% while Coca-Cola’s stands at 5.84%. So, for those investors prioritizing dividend growth, PepsiCo might be the superior choice in comparison to Coca-Cola.

Telefónica

Telefónica is headquartered in Madrid, Spain, and it offers telecommunications services in Europe and Latin America. The company was founded in 1924. Today, Telefónica has a Market Capitalization of $25.42B.

At its current price level, Telefónica offers investors a Dividend Yield (FWD) of 7.40%, which stands 110.30% above the Sector Median, indicating that the company is particularly attractive for dividend income investors.

Telefónica presently exhibits a P/E (FWD) Ratio of 12.34, which stands 26.13% below the Sector Median. This suggests that the Spanish telecommunication services company is presently undervalued, reinforcing my belief to include it in this list of high dividend yield companies.

The Elevated Risk Factors of an Investment in Telefónica – The Case for a 2% Limit on Your Overall Portfolio

Given Telefónica’s limited growth perspective (Revenue Growth Rate (FWD) of 1.95%), the fact that its dividend is not entirely safe, and its elevated Total Debt to Equity Ratio of 170.12%, I see an elevated risk level for investors.

For this reason, I suggest limiting the proportion of the Telefónica stock to a maximum of 2% compared to the overall portfolio. This approach decreases your portfolio’s risk level, raising the chances of positive investment outcomes.

VICI Properties

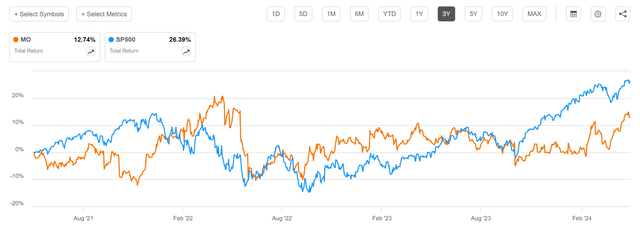

Within the past 3-year period, VICI Properties has significantly underperformed the S&P 500. While the S&P 500 has shown a Total Return of 26.39%, VICI Properties has shown a performance of 4.33% within the same period.

This underperformance has contributed to VICI Properties’ currently attractive Valuation: at this moment in time, the company exhibits a P/AFFO (FWD) Ratio of 12.58, which is 11.67% below the Sector Median, indicating an undervaluation.

Today, VICI Properties provides investors with a Dividend Yield (FWD) of 5.87%. At the same time, it is worth mentioning that the company has shown a 5-Year Dividend Growth Rate (CAGR) of 7.76%, which demonstrates that it is not only an excellent choice for this list of high dividend yield companies, but is also very attractive for any investor aiming to combine dividend income with dividend growth.

ING Groep N.V.

ING Groep N.V. offers its clients banking products and services in both Europe and internationally. The Dutch bank, headquartered in Amsterdam, was founded in 1762.

ING Groep N.V. pays a Dividend Yield (FWD) of 9.18%, which lies 158.23% above the Sector Median. Its 5-Year Dividend Growth Rate (CAGR) stands at 8.74%.

Today, the bank’s P/E (FWD) Ratio stands at a relatively low level (8.78, which lies 17.80% below the Sector Median), reinforcing my belief that it is an attractive choice for investors at this moment in time.

The above metrics indicate that ING Groep N.V. is also an attractive candidate for incorporation into The Dividend Income Accelerator Portfolio. This is the case since the portfolio prioritizes companies that merge dividend income and dividend growth. So with that in mind, I have added ING Groep N.V. to my watchlist for closer observation.

The Elevated Risk Factors of an Investment in ING Groep N.V. – The Case for a 2% Limit on Your Overall Portfolio

Given the elevated risk level that an investment in ING Groep N.V brings (I do not consider the bank’s dividend to be entirely safe), I suggest that you limit its proportion to a maximum of 2% compared to your overall portfolio. This strategy ensures that you reduce the downside risk of your investment portfolio, thus increasing the probability for successful investment outcomes when investing over the long term.

The Bank of Nova Scotia

The Bank of Nova Scotia, founded in 1832, and currently with 89,249 employees, has already been incorporated into The Dividend Income Portfolio. At this moment in time, the company represents 2.39% of the overall portfolio.

The bank’s Dividend Yield (TTM) of 6.60%, its 5-Year Dividend Growth Rate (CAGR) of 4.32%, and its Payout Ratio of 66.59% have significantly contributed to selecting the Canadian bank for this dividend portfolio and this list of high dividend yield companies.

At this moment of writing, The Bank of Nova Scotia has a P/E (FWD) Ratio of 10.16, which is 7.78% below the Sector Median, serving as an indicator that the bank is presently undervalued.

When compared to competitors such as JPMorgan (NYSE:JPM) or Bank of America (NYSE:BAC), The Bank of Nova Scotia pays a significantly higher Dividend Yield (FWD) of 6.53% (compared to JPMorgan’s Dividend Yield (FWD) of 2.29% and Bank of America’s 2.42%).

However, it should be noted that an investment in The Bank of Nova Scotia is also related to a higher risk level. This is evidenced by its significantly higher Payout Ratio of 66.58% (while JPMorgan’s Payout Ratio stands at 25.66% and Bank of America’s at 32.53%).

These metrics indicate that a dividend reduction for The Bank of Nova Scotia is more likely than a dividend reduction for JPMorgan or Bank of America, underscoring a higher risk level for The Bank of Nova Scotia. Therefore, I suggest limiting the proportion of The Bank of Nova Scotia to a maximum of 3% when compared to your overall portfolio.

Verizon

The Seeking Alpha Quant Ranking presently indicates that Verizon is an attractive pick for investors: the company is ranked 5th out of 27 within the Integrated Telecommunication Services Industry and 47th out of 239 within the Communication Services Sector. In the overall ranking, Verizon is placed 934th out of 4482.

Source: Seeking Alpha

Today, Verizon pays a Dividend Yield (FWD) of 6.69%, while exhibiting a Payout Ratio of 56.81%, indicating that the company is an attractive pick for dividend income investors looking for dividend growth potential at the same time. The company’s low Payout Ratio indicates potential for dividend growth.

It is further worth highlighting that Verizon presently has a P/E (FWD) Ratio of 8.87, which stands 46.89% below the Sector Median, clearly indicating that the company is undervalued.

Altria Group

Considering the past 3 years, Altria has significantly underperformed the S&P 500. While the company has shown a performance of 12.74%, the S&P 500 has shown a Total Return of 26.39% within this time frame.

Today, Altria exhibits a P/E (FWD) Ratio of 8.90. The company’s P/E (FWD) Ratio presently stands 53.49% below the Sector Median and 25.03% below its average from the past 5 years. These metrics indicate that Altria is undervalued. Moreover, the company’s currently attractive Valuation reinforces my buy rating.

With its attractive Dividend Yield (FWD) of 8.62% and 10-Year Dividend Growth Rate (CAGR) of 7.51%, Altria is an attractive choice for dividend income investors that want to benefit from steadily increasing dividend payments and for those aiming to protect their capital against inflation.

Realty Income

With a proportion of 3.94%, Realty Income is presently one of the largest positions of The Dividend Income Accelerator Portfolio and I plan to continue overweighting the company.

Among the reasons why I have decided to make Realty Income one of the portfolio’s largest positions is its attractive risk-reward profile, its appealing Dividend Yield (FWD) of 6.04%, its attractive 10-Year Dividend Growth Rate (CAGR) of 3.81%, its relatively low Payout Ratio of 73.56%, and its extensively diversified product portfolio.

I am convinced that Realty Income is presently highly attractive for investors not only due to its attractive Dividend Yield (FWD) of 6.04%, but also because of its current Valuation. At this moment of writing, the company exhibits a P/AFFO (FWD) Ratio of 12.50, which is 12.19% below the Sector Median, reflecting its undervaluation.

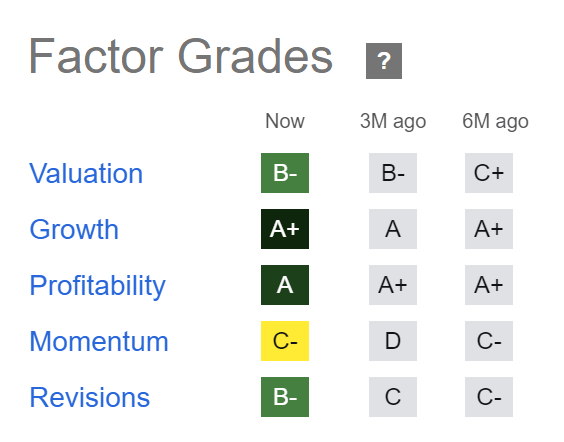

Realty Income’s current attractiveness for investors is further underlined by the Seeking Alpha Factor Grades: at this moment, the company receives an A+ Rating for Growth, an A for Profitability, a B- for Valuation and Revisions, and a C- for Momentum.

Source: Seeking Alpha

Enbridge

Enbridge is a company from the Oil and Gas Storage and Transportation Industry that was founded in 1949.

It can be highlighted that the company operates through the following segments:

- Liquids Pipelines

- Gas Transmission and Midstream

- Gas Distribution and Storage

- Renewable Power Generation

- and Energy Services

Enbridge presently pays an attractive Dividend Yield (TTM) of 7.33%, which has reinforced my decision to include it in this list of high dividend yield companies to consider investing in during the month of June. This Dividend Yield is particularly attractive for investors when considering the company’s 10-Year Dividend Growth Rate (CAGR) of 7.88%, reflecting the growth potential of its dividend.

At the time of writing, Enbridge showcases a P/E (FWD) Ratio of 17.47, which stands 14.75% below its average from the past 5 years, indicating a current undervaluation for the company.

CVS Health

CVS Health made it into this list of dividend yield companies to consider investing in due to its attractive Dividend Yield (FWD) of 4.79%, its low Payout Ratio of 31.59%, its 5-Year Dividend Growth Rate (CAGR) of 4.90%, and its presently attractive Valuation: CVS Health’s P/E (FWD) Ratio currently stands at 7.95, which is 59.58% below the Sector Median.

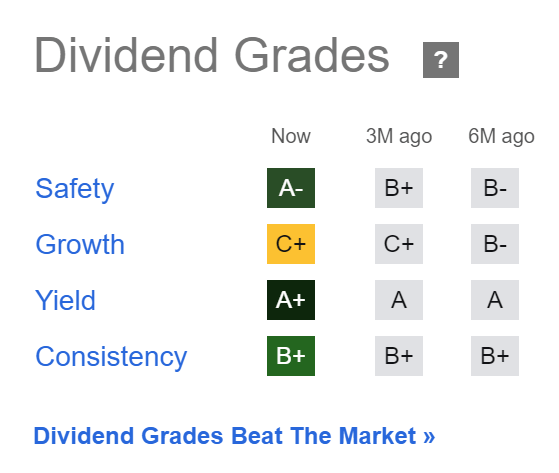

The Seeking Alpha Dividend Grades have further contributed to CVS Health being included in this list of high dividend yield companies. Today, the company receives an A+ Rating for Dividend Yield, an A- for Dividend Safety, a B+ for Dividend Consistency and a C+ for Dividend Growth.

Source: Seeking Alpha

Conclusion

I believe that the companies presented in this article today are all worth taking a closer look at due to their attractive Dividend Yield, potential for dividend growth, attractive Valuation, financial health, and competitive advantages.

Combining high dividend yield companies with dividend growth companies offers substantial benefits for investors. This is the case as doing so not only generates significant immediate income but also increases this income year over year.

Such an investment strategy enables you to steadily increase your extra income through dividend payments, helping you cover your monthly expenses effectively. How does funding your next vacation trip with the dividend payments you receive from companies such as Coca-Cola, Realty Income, Verizon and VICI Properties sound?

The dividend payments of these companies can provide an additional source of income for your retirement, and they could even help you reach financial freedom one day.

I am applying this dividend income-oriented investment approach to both my personal investment portfolio, which primarily focuses on dividend growth and companies with attractive risk-reward profiles, and the construction of The Dividend Income Accelerator Portfolio, which effectively balances dividend income and dividend growth, and which I am documenting here on Seeking Alpha.

In my upcoming article, I am planning to present you with my top 2 high dividend yield picks for the month of June.

Author’s Note: I would appreciate hearing your opinion on my selection of high dividend yield companies to consider buying in June 2024. Do you already own or plan to acquire any of the picks? Which are currently your favorite high dividend yield companies?