eternalcreative/iStock via Getty Images

The rate-cutting frenzy dulled the pain, but it’s over now.

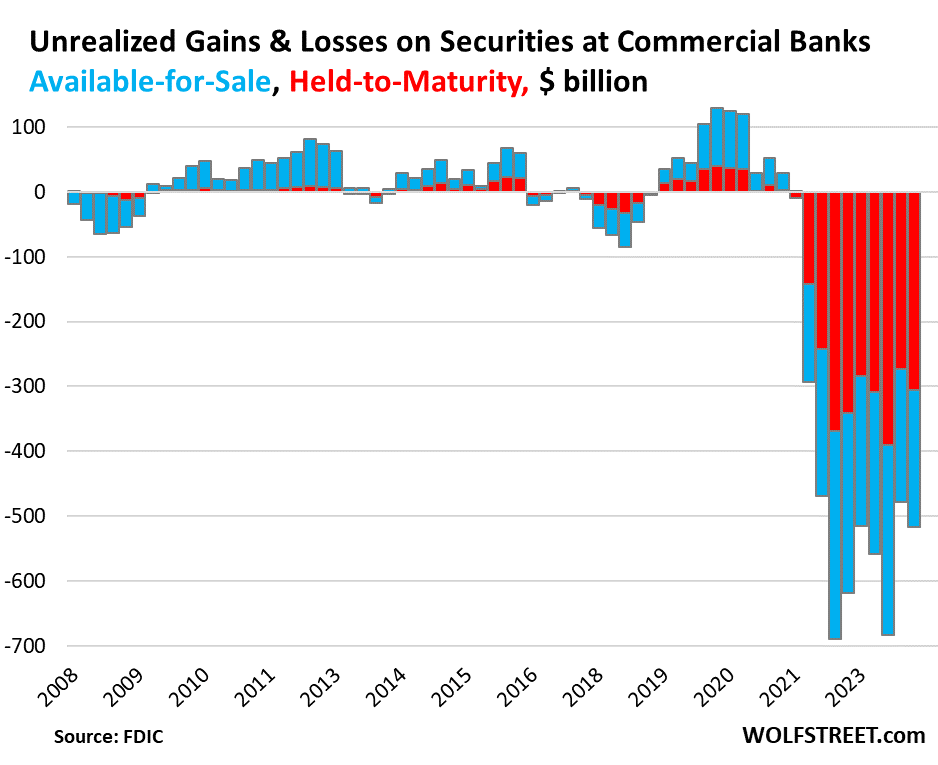

In the first quarter of 2024, “unrealized losses” on securities held by commercial banks increased by $39 billion, or 8.1%, from the fourth quarter, bringing cumulative losses to $517 billion. These unrealized losses represent 9.4% of the $5.47 trillion in the first quarter of 2024. According to FDIC first quarter banking data released today, the securities held by these banks were:

These securities, primarily Treasury bonds and government-guaranteed mortgage-backed securities, do not incur credit losses, unlike loans, especially commercial real estate loans, which banks do. These are brand new securities whose market value has fallen due to rising interest rates. When these securities mature, or in the case of MBS, when pass-through principal payments are made, the face value of these securities is paid to holders of these securities. But until then, as yields rise, prices fall.

These unrealized The loss was spread across securities accounted for according to two methods:

- Held to Maturity (HTM): Unrealized losses in the first quarter increased by $31 billion from the fourth quarter, bringing cumulative losses to $305 billion (red).

- Available for Sale (AFS): Unrealized losses in the first quarter increased by $8 billion from the fourth quarter to $211 billion (blue).

HTM securities (red) are valued at amortized purchase cost, and losses in market value do not affect earnings on the equity portion of the balance sheet, but are recorded separately as an “unrealized loss.” Problems exist with these HTM securities, and with HTM accounting in general.

AFS securities (blue) are valued at market value and losses due to fluctuations in market value are deducted from earnings on the equity section of the balance sheet.

Rate-cutting mania dulled the pain, but it’s over

Yields on longer-term securities began to plummet in November and bottomed out earlier this year amid a general rate-cutting mania. The sharp drop in yields has sent prices soaring, with unrealized losses in the fourth quarter shrinking from huge levels in the third quarter.

However, the rate-cutting frenzy began to die down in the second half of the first quarter, and yields rose again, though not to October levels, leading to higher unrealized losses in the first quarter.

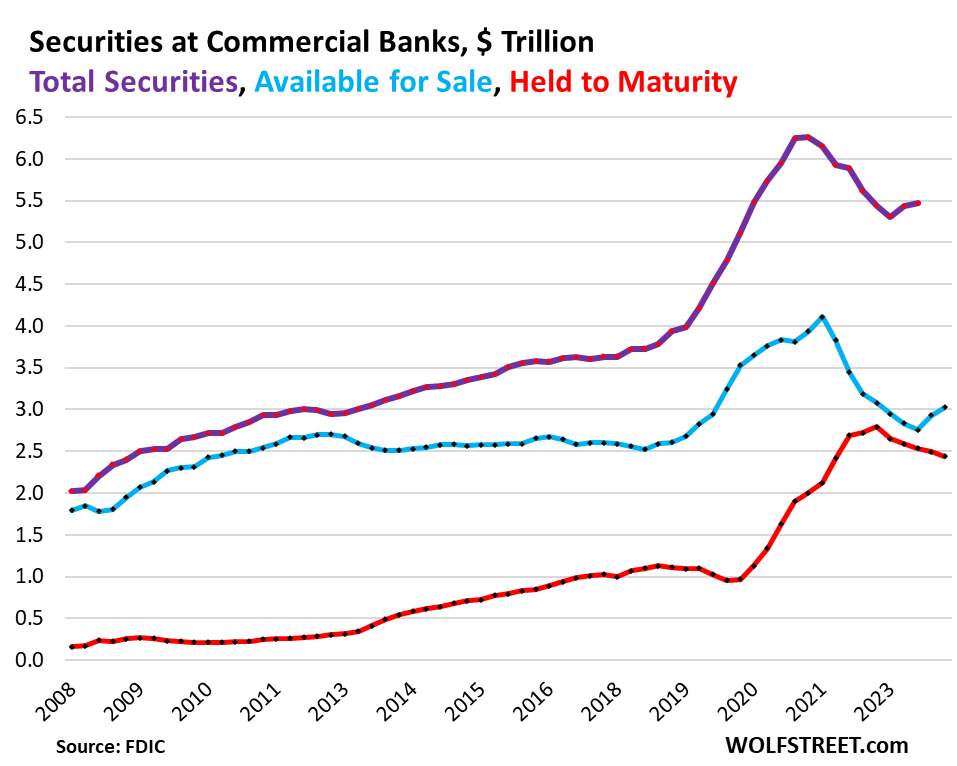

$5.47 trillion in securities held by banks

During the pandemic money-printing era, banks received a flood of cash from depositors and bought up securities to put that cash to work. They bought up mostly long-term securities because their yields were visibly above zero, unlike short-term Treasury bills, which at the time were yielding zero or close to zero, and sometimes even below. During that time, banks’ securities holdings grew by $2.5 trillion, or 57%, to a peak of $6.2 trillion in the first quarter of 2022.

It was a huge miscalculation of future interest rates. It has already caused four regional banks to Silicon Valley Bank, Signature Bank, First Republicand Silvergate Bank In the spring of 2023, banks will collapse as frightened depositors withdraw their money.

In theory, “unrealized losses” on securities held by banks are not a problem because the bank receives the face value at maturity and the unrealized losses decrease as the securities approach maturity, reaching zero at maturity.

In reality, unrealized losses are a big problem. We saw in the four banks above that depositors found out what was on the banks’ balance sheets, withdrew their deposits, forcing the banks to sell those securities, taking losses, and then they didn’t have enough capital to absorb the losses and the banks failed. Unrealized losses aren’t a problem until they suddenly become a problem.

The value of securities held by banks rose to $5.47 trillion in the first quarter after already rising in the fourth quarter, but was still down $786 billion, or 12.6%, from its first-quarter peak (shown in purple in the graph below).

HTM securities have declined steadily from their peak in Q4 2022 and fell further in Q1, dropping 12.7% from their peak to $2.44 trillion (red).

AFS securities increased for the second consecutive quarter to $3.2 trillion but remain 26.4% below their Q1 2022 peak (blue).

Factors behind the decline in securities on bank balance sheets from their peak include:

- Some of the securities of failed banks that the FDIC sold to nonbanking companies are no longer part of the FDIC.

- The bank wrote down its AFS securities to market value.

- Some securities have matured.

- Banks may have sold some securities.

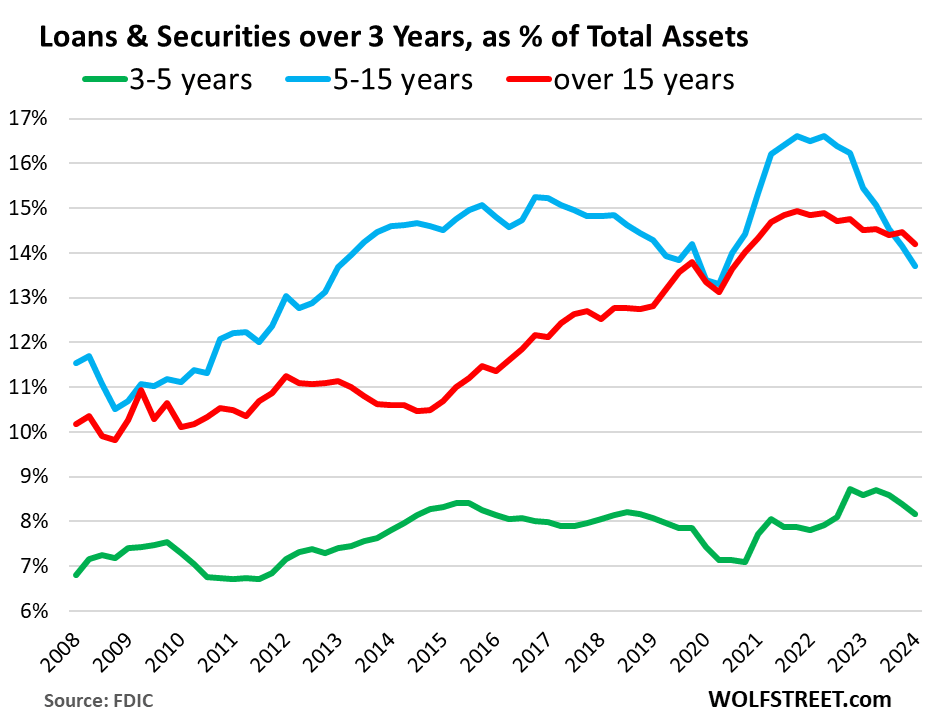

The longer the maturity, the greater the interest rate risk.

Interest rate risk — the risk that prices will fall as yields rise — increases as the term of a security or loan increases. The 30-year Treasury notes sold in the summer of 2020 saw the biggest decline in market value, while the 5-year notes sold at the same time have just one year left until maturity and are trading at a small discount from their face value.

To measure this risk on banks’ balance sheets, the FDIC provides data on securities and loans by remaining maturity.

- Lowest risk (green): 3-5 years: 8.2% of total assets.

- Riskier (blue): 5-15 years: 13.7% of total assets, after a significant decline, the lowest since Q2 2020.

- Most Risky (Red): 15+ years: 14.2% of total assets, the lowest since Q2 2020.

Editor’s note: The summary bullet points for this article were selected by Seeking Alpha editors.