RyanJLane/E+ via Getty Images

Investment Thesis

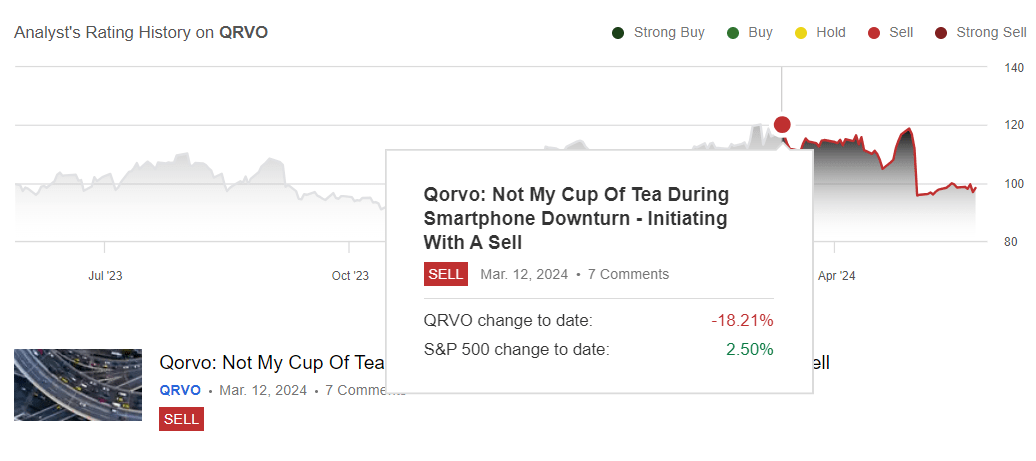

Qorvo (Nasdaq:question) report Fourth Quarter Fiscal Year 2024 Results and Outlook. Sell rating As of mid-March, Qorvo stock was underperforming the S&P 500 by about 20%. See below. My investment thesis following the earnings release is to reiterate a sell. I believe a lot of bad news has already been priced into the June quarter stock price action and management outlook, but I see even greater downside risks in the next quarter.

TheTechie – SeekingAlpha

company report Revenues in March were $914 million, slightly above the consensus estimate of $925 million. I view Qorvo’s Advanced Cellular Group revenues as a measure of the company’s risk/reward scenario, and weak smartphone demand this year is why I’m less optimistic about Qorvo in 2024.

Total sales fell 12% sequentially to $941 million, below the $925 million consensus estimate. The company’s largest division, the Advanced Cellular Group, fell 23% sequentially to $654 million as demand from smartphone market leader Apple weakened.AAPL)(AAPL:CA). Apple’s results for the quarter also did not impress me. While the market reacted well to the news of Apple’s results and share buybacks, with shares rising, the results did not indicate a real recovery in end demand and I am less optimistic about Qorvo’s near-term performance. To get an idea of how exposed Qorvo is to the smartphone market, it should be noted that Apple’s revenue in FY24 was 46%, FY23 was 37%, and Samsung’s revenue was 12% in both years. This is to say nothing of the additional risk Qorvo faces from competition from Qualcomm in the 5G market (QCOM) and Huawei, some of whose management touched on the matter this quarter.

Keep in mind that Qorvo’s other segments are growing revenue: High-Performance Analog revenue was up 38% sequentially, and Connectivity and Sensors Group revenue was up 13% sequentially. Still, as long as Advanced Cellular Group revenue remains weak, I don’t think the growth in other segments (albeit double digits) is relevant to Qorvo’s performance, and given management’s outlook, I think they would agree with me.

The company guide The company’s revenue is expected to decline another 10% sequentially in the next quarter, i.e., fiscal 1Q25, to $850 million, well below the consensus estimate of $925 million. Notably, management expects advanced mobile phone revenue to decline 8-9% sequentially due to lower Apple demand and flat demand in the Chinese Android market. Therefore, this reaffirms my pessimistic view on Qorvo’s near-term performance, specifically the next 1-2 quarters. Management still expects the smartphone total addressable market (TAM) to grow at a single-digit percentage rate year-over-year in 2024, with the 5G market growing at roughly 10% year-over-year.

What could be the problem?

One could argue that the stock is attractive at current levels given that management has a very negative outlook for the next quarter. Apart from the projected decline in advanced mobile phone sales, management also expects a decline in high-performance analog sales (11-12% QoQ) and flat sequential growth in connectivity and sensor sales. Management and the market are aware of this bad news. Why am I still bearish? I believe the upside potential this year is limited as I do not see any near-term catalysts that could revive end demand for smartphones in 2024. Other players with similar exposure, such as Skyworks (Swift) showed similar results. And I think part of the disappointment in the quarter is based on the market being positive about a smartphone recovery in 2024 since the second half of last year, and some of that optimism was already priced into the price. So I think results will continue to disappoint in the near term.

evaluation

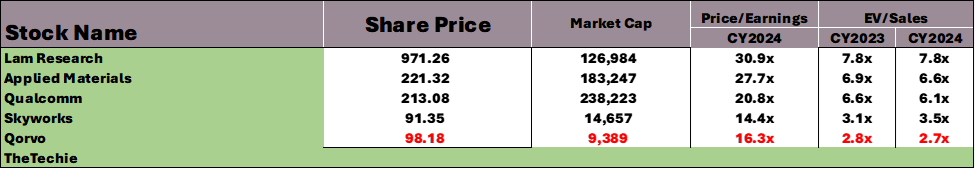

Qorvo shares are undervalued based on how the company’s peers are valued relative to theirs. The company’s P/E is 16.3, while the peer average is a much higher 31. The same is true for FY2024 EV/Revenue. As shown in the table below, generated using Refinitiv data, the company’s P/E is 2.7, while the average is 7.1. While this valuation is attractive when compared to companies with similar exposure to the smartphone market and Apple as peers Qualcomm and Skyworks, I don’t think this valuation alone is enough of a reason to buy the stock when it’s weak if we don’t see a catalyst to boost growth in the near term. My expectation of a lack of growth in the first half of 2024 has come true, and I expect the same to continue for the remainder of 2024.

Image created by The Techie using data from Refinitiv.

What’s next?

Qorvo will continue to struggle to grow sales in the near term, especially over the next quarter or two. Smartphone TAM is expected to grow significantly year over year, and I expect the actual recovery to be more pronounced in 2025 as management ties the increased end demand in 2025 to its expected increased sales to Apple in fiscal years 2025 and 2026. I would advise investors to keep an eye on Apple’s performance and Qorvo’s Advanced Mobile Phone Group sales in the next quarter to better identify the moment of recovery and invest ahead of it. I don’t think this turnaround moment will happen in 2024, but I think it will become more attractive if the stock approaches its 52-week low of around $80.62. The reason I don’t think this moment will materialize this year is not only because of weak orders from Apple, but also because the inventory cycle is putting pressure on Qorvo’s margins. The company’s non-GAAP gross margins fell to 42.5% this quarter and are expected to fall again to the 40-41% range next quarter due to a higher proportion of high-cost inventory. I expect Qorvo to underperform, or at best be on par with, its peers this year.