PM Images/DigitalVision via Getty Images

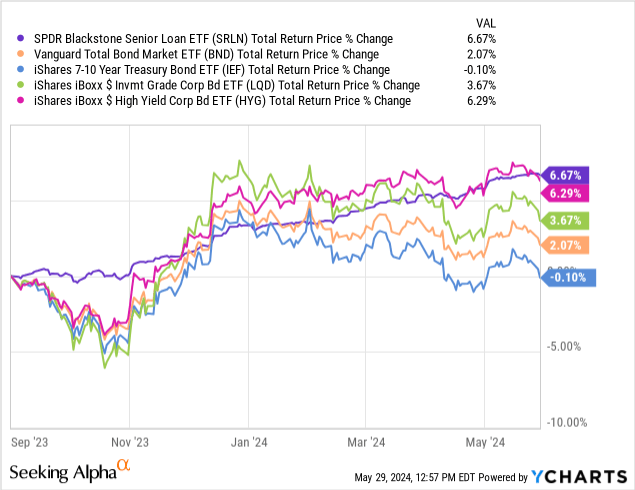

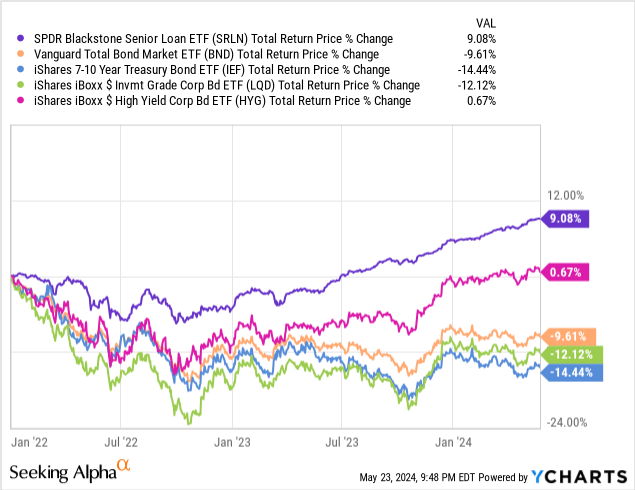

Last time, we looked at the SPDR Blackstone Senior Loan ETF (SRL) in late 2023. In that article, I argued that SRLN’s strong and growing yield and low interest rate risk make the fund a worthy buy. Since then, they’ve delivered pretty good returns, outperforming most fixed income and fixed income sub-asset classes, and delivered double-digit dividend growth. They’ve performed very well and are broadly in line with expectations.

SRLN continues to offer investors a high dividend yield with low interest rate risk, making this fund a buy, however, it is a slightly riskier choice due to its high credit risk.

SRLN – Basics

- Investment Manager: State Street

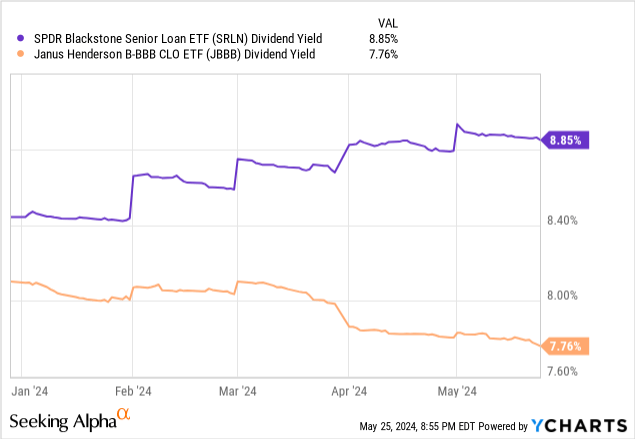

- Dividend Yield: 8.85%

- Expense ratio: 0.70%

- Total Revenue CAGR 10 years: 3.43%

SRLN – Overview and Analysis

Strategy and Portfolio

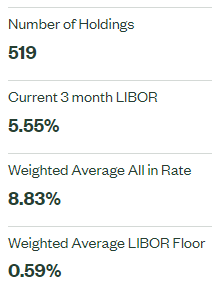

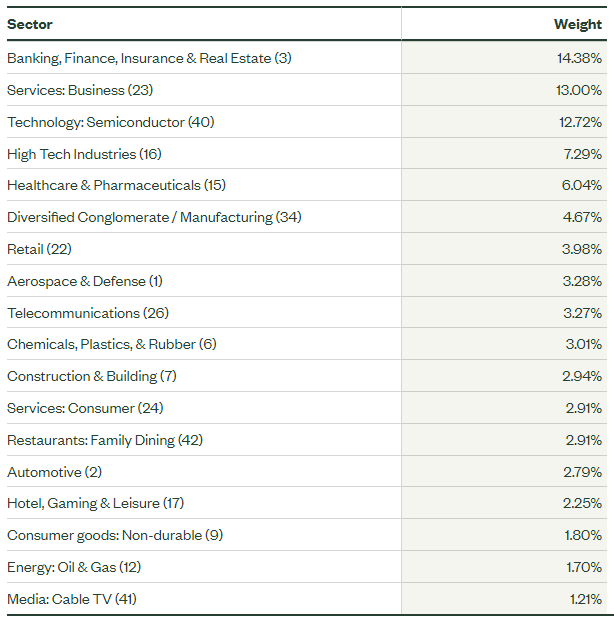

SRLN is an actively managed ETF focused on the following areas: Senior loans are senior secured floating rate loans from companies that are not investment grade. SRLN offers investors diversified exposure to these securities by investing in over 500 loans across multiple sectors.

SRL SRL

Notwithstanding the above, SRLN is an investor in the Vanguard Total Bond Market Index Fund ETF (NASDAQ:BND) and iShares Core US Aggregate Bond ETF (NYSEARCA:AGGG),these are Several Fixed income sub-asset class.

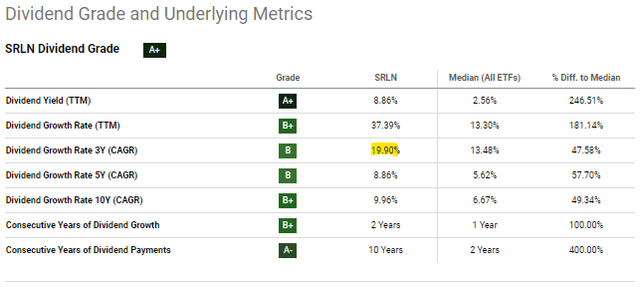

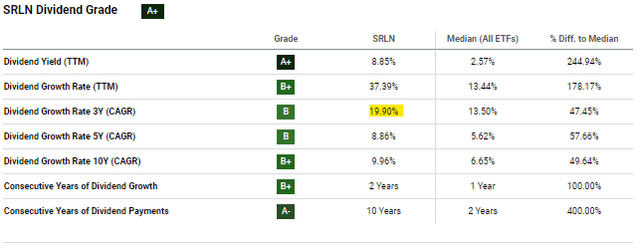

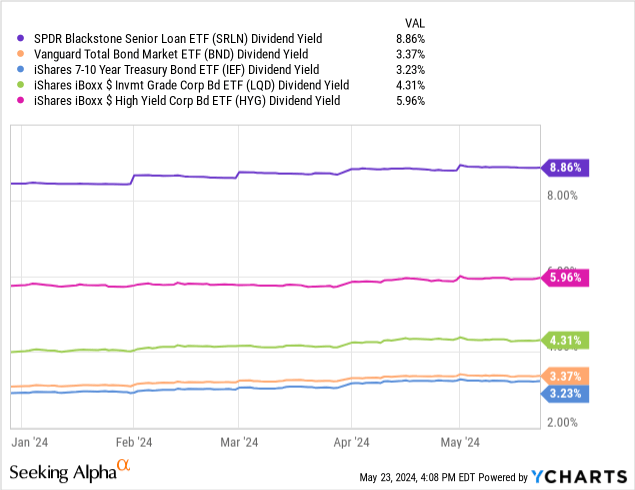

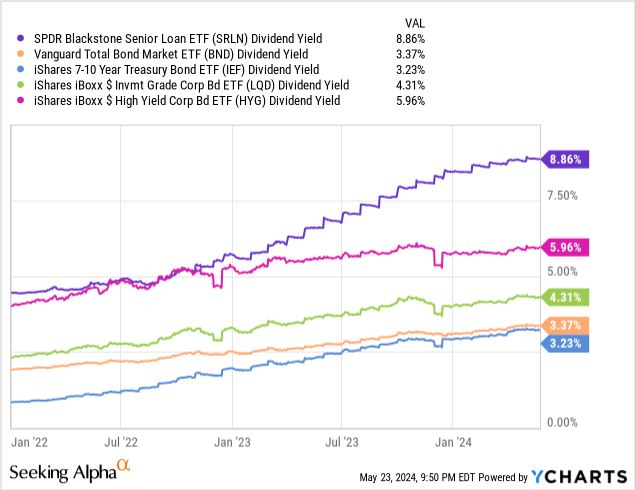

The dividend yield is high at 8.9%.

The Federal Reserve’s rate hikes have led to higher interest rates across the board, and senior loans are among the loans that have benefited most from these. variable Senior loan rates have risen by about 4.2% in recent years, well above average.

SRLN’s dividends have also grown substantially over the past few years, in line with the above.

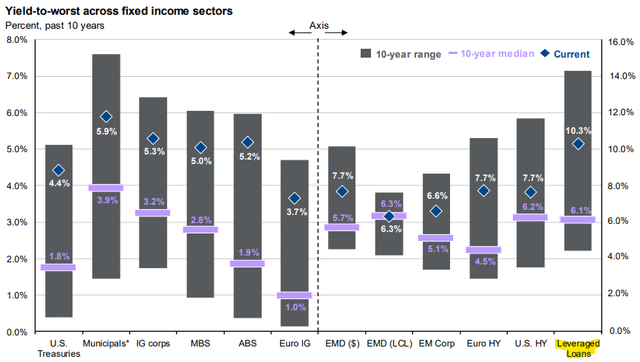

Currently, the fund’s dividend yield is 8.9%, which is quite high in absolute terms and higher than the dividend yields of most bonds and bond sub-asset classes.

Data by YCharts

SRLN’s high dividend yield of 8.9% is a great benefit to shareholders and is the fund’s main advantage over its peers.

As is the case with most bond and loan funds, dividends should be reduced if the Federal Reserve cuts interest rates later this year. Dividend cuts should be swift and as large as the interest rate cut. If the Federal Reserve cuts rates by 1.0%, dividends should be reduced by 1.0%. Investors should be able to lock in interest rates by focusing on long-term bond funds, but do not have They do so by investing in SRLN.

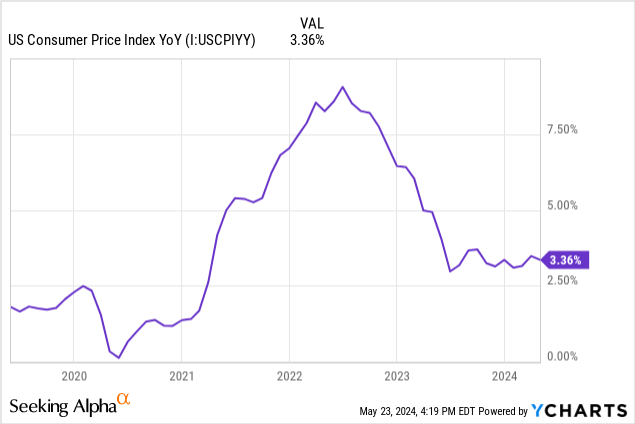

In my opinion, interest rates are almost certain to fall in the future, but I don’t expect a big, rapid cut in interest rates. Inflation is still above target and has been flat for about a year. In these circumstances, a cut in interest rates in the near term seems unlikely. Powell seems to agree. Almost the same argument After April CPI report.

Data by YCharts

Because SRLN trades at a healthy spread to its peers, it would take a significant rate cut for the fund’s yield to begin to undercut its peers. In the current environment, this seems unlikely for at least the next two years or so. However, a lot will depend on future Fed policy.

Credit Risk

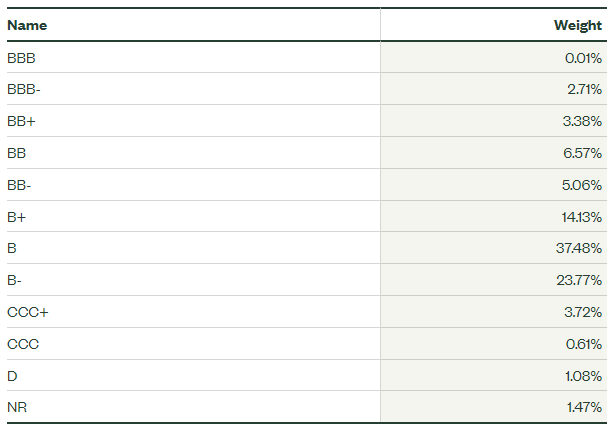

Senior loans are almost always sourced from non-investment grade companies. These are relatively weak companies with lower credit ratings. SRLN itself focuses on B-rated loans, which is a relatively weak rating even for a senior loan (or high yield) ETF. As per previous reporting, most of SRLN’s peers focus on BB-rated bonds/loans.

SRL

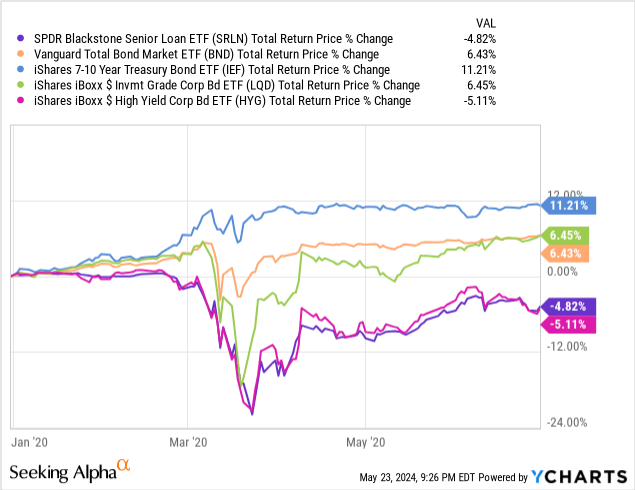

SRLN issuers are generally able to meet their financial obligations without any problems. right nowHowever, if economic conditions worsen, most bonds will start to run into problems and default rates will spike, so we expect SRLNs to experience larger than average losses during a recession or depression, as happened in early 2020. The losses would be substantially different from those of high-yield corporate bonds and slightly higher than expected.

Data by YCharts

SRLN’s above-average credit risk is a significant negative for the Fund and may discourage risk-averse investors from trading.

Interest rate risk

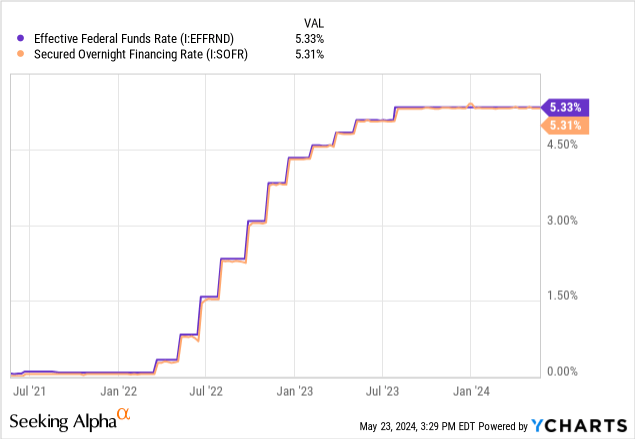

Senior loans are almost always Variable interest rate Loans are indexed to a specific interest rate, so as interest rates rise, so will your coupon rate. Interest rates are typically reset quarterly. Most loans are indexed to SOFR, which for our purposes is functionally the same as the Federal Reserve rate.

Data by YCharts

Therefore, the coupon rate on a senior loan will fluctuate with the Fed’s interest rate each quarter. Remember, unlike senior loans, most bonds have a fixed interest rate from issuance to maturity.

SRLNs are focused on senior loans and therefore have negligible interest rate risk and duration, similar to those securities, and are expected to experience below average losses and outperformance during periods of rising interest rates, which has been the trend since the beginning of 2022.

Data by YCharts

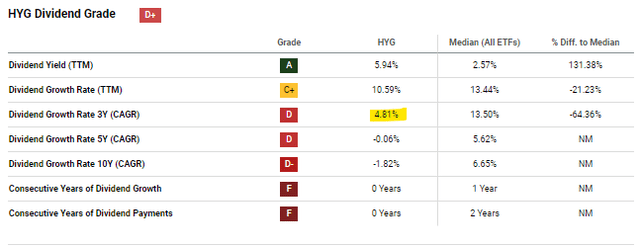

At the same time, if interest rates rise, this fund’s dividends should increase much more quickly than other funds. For example, SRLN is the largest investor in the iShares iBoxx $ High Yield Corporate Bond ETF (HiggOver the past three years, issuance of the largest high-yield corporate bond ETF, the Treasury ETF, has reached $1 billion.

SRLN Growth:

HYG Growth:

This is also evident when comparing SRLN’s yields to those of its peers since the beginning of 2022. SRLN’s yields have increased much more than average, which is easy to see especially when comparing this fund to HYG.

Data by YCharts

On a more negative note, as mentioned above, if the Fed begins to cut interest rates, SRLN’s dividend should decrease. Any cuts in the dividend should be swift and comparable in magnitude to the rate cut. Since SRLN trades at a healthy spread versus its peers (see above), interest rates would need to fall substantially for the fund’s dividend to become uncompetitive. In my opinion, this is unlikely to happen in the near term.

Achievements

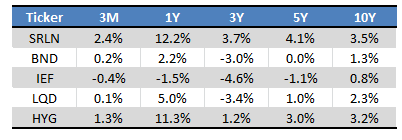

SRLN’s performance track record is pretty good, with the fund consistently outperforming its peers.

Seeking Alpha – Author Table

Any further comments on the above.

SRLN’s long-term returns are very low. many It has been lower in the past, in part due to defaults and a recent drop in prices.

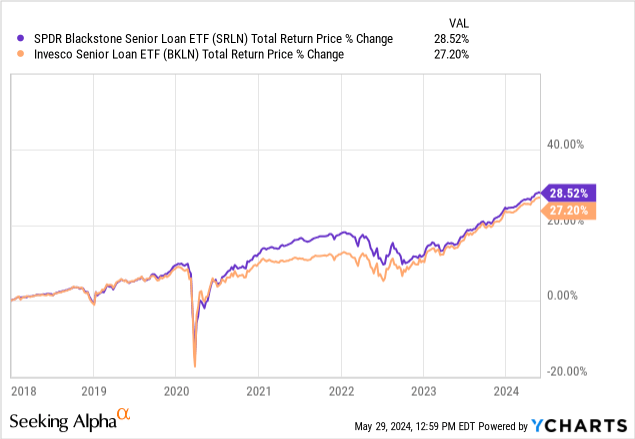

SRLN’s medium-term returns are significantly weaker than expected. 3-year returns should Interest rates have been pretty high over the past three years, so SRLN will go higher. I’m not sure why that happened, but I think timing and credit spread changes played some role. SRLN and the Invesco Senior Loan ETF (NYSEARCA:Brun), we expect relatively strong returns in 2021 and weaker returns in 2022, but similar returns over the longer term. This pattern is consistent with and explains SRLN’s relatively weak three-year returns.

SRLN’s short-term returns have been pretty strong due to rising interest rates and narrowing credit spreads. As long as interest rates remain high, returns should remain pretty good going forward. At least in the long term, credit spreads aren’t going to continue to narrow continuously and the fund doesn’t boast a double-digit yield, so it’s hard to see double-digit annual returns.

Overall, SRLN’s performance track record has been pretty good, though a bit weaker than expected for a floating rate fund.

SRLN vs JBBB – A quick comparison

Long-time readers will know that I Bullish on CLO Debt ETFs These are nearly identical to the SRLNs, so I thought I’d do a quick comparison. Here’s a comparison of the SRLNs and the Janus Henderson B-BBB CLO ETF (BATS:J.B.B.B.), we focus below on BBB-rated CLOs.

Both SRLN and JBBB focus on floating rate investments. Interest rate risk and duration are both negligible.

Both are somewhat pricey funds, with SRLN being a bit more expensive: SRLN’s expense ratio is 0.70%, compared to JBBB’s 0.49%.

SRLN’s credit risk is significantly higher due to its focus on non-investment grade loans compared to JBBB’s investment grade holdings. CLO default rates are also very low, mitigating the fund’s credit risk.

Both funds boast high, above-average dividend yields, although SRLN’s dividend yield is over 1.0% higher, which we’ll explain in more detail later.

Data by YCharts

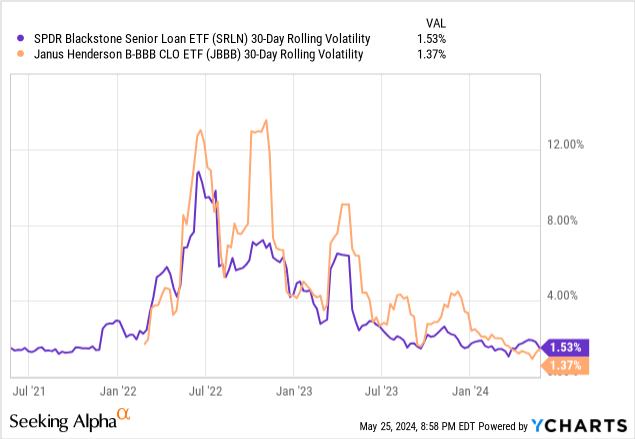

Overall, SRLN is a riskier, more volatile choice due to its focus on non-investment grade loans. JBBB should Given the characteristics of the underlying CLOs, they are a much safer and more stable option. In fact, their volatility is comparable to SRLNs. I believe this is because CLOs are perceived as a somewhat illiquid investment and therefore very risky.

Data by YCharts

Notwithstanding the above, the actual credit risk of most investment grade CLOs is very low, which should be reflected positively in JBBB’s long-term stock price and earnings.

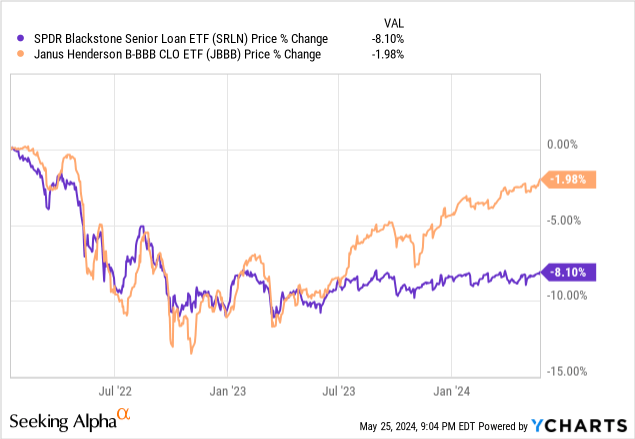

For example, SRLN and JBBB experienced capital losses/stock price declines in 2022 due to (slightly) rising default rates and a bearish market. JBBB stock price has been steadily recovering since mid-2023, while SRLN stock price has not. Looking at the fundamentals, JBBB stock price is simply do not have It’s down, but it’s not a temporary drop. Too Far from what we expected.

Data by YCharts

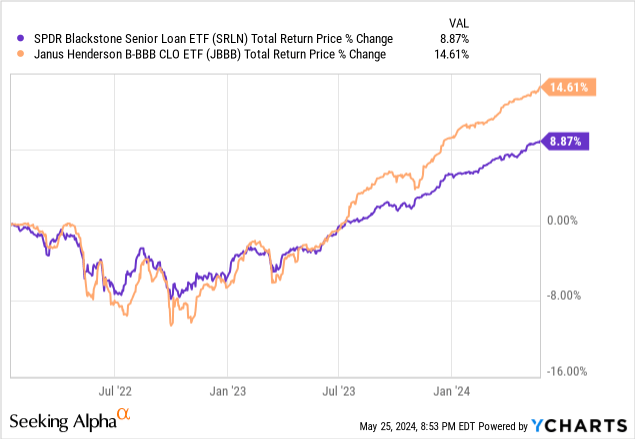

In my opinion, given current market and industry conditions, JBBB should achieve higher long-term returns than SRLN, and as expected, that has been the case since inception.

Data by YCharts

Overall, JBBB appears to be performing significantly better than SRLN, on which I maintain my buy rating. strong Overall, it is an investment opportunity, but JBBB is Stronger.

Conclusion

SRLN’s high dividend yield of 8.9%, low interest rate risk, and strong recent performance make this fund a buy.