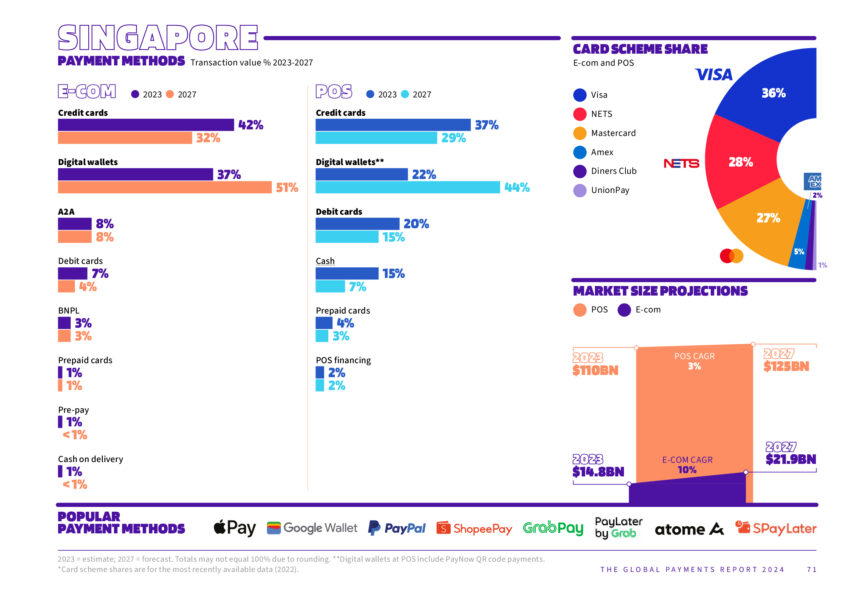

E-wallets are gaining momentum in Singapore and are predicted to become the dominant payment method by 2027.

by Global Payments Report 2024 According to payment processing company Worldpay, e-wallets are expected to process more than 50% of online spending in Singapore by 2027.

By 2023, e-wallets will be used for 70% of online spending in Asia Pacific.

In Singapore, this trend is expected to continue, with digital wallet usage predicted to account for more than half of all online transactions by 2027, while credit card usage will fall to 32% from 42% in 2023.

The report also predicts that Singaporeans’ spending via e-wallets will more than double from S$41 billion in 2023 to S$89 billion in 2027.

This growth will be driven by increased interoperability of regional payment systems and Singapore Quick Response Code (SGQR)The world’s first unified payment QR code.

In contrast, credit card usage for online transactions in Singapore is expected to decline from 42% in 2023 to 32% in 2027.

Although buy now, pay later (BNPL) payment methods still account for just 2% of transaction value, they are projected to grow at a compound annual growth rate (CAGR) of 8% from 2023 to 2027.

Here is a detailed breakdown of payment methods and market size forecasts: Both e-commerce and POS transactions are showing a major shift towards e-wallets.

Source: Worldpay’s 2024 Global Payments Report

Phil Pomford

“In card-heavy countries like Singapore, digital wallets are fast becoming a popular way to facilitate credit card transactions and provide consumers with a streamlined payment experience that prioritizes efficiency.

The Singapore Government has built an extremely robust infrastructure to accelerate the use of digital wallets, and we expect to see continued investment from both the private and public sectors in this space, expanding capabilities and partnerships, ultimately benefiting both merchants and consumers.”

Phil Pomford, general manager of global e-commerce for APAC, said: WorldPay.

Featured Image Credit: Free Pick

post Worldpay says e-wallets will dominate online payments in Singapore by 2027 First appeared in fintech singapore.