no_limit_pictures/iStock via Getty Images

introduction

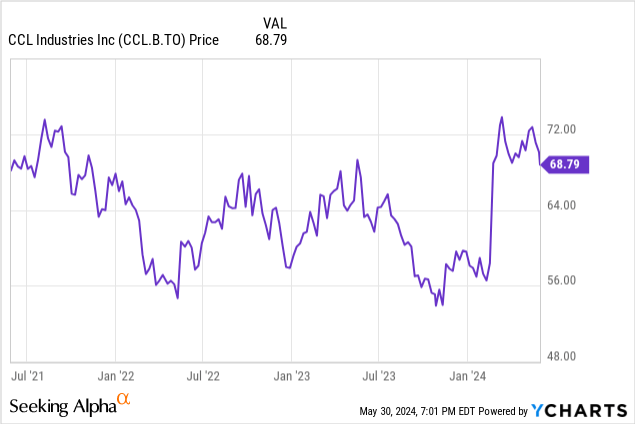

CCL Industries (OTCPK:CCDBF) (TSX:CCL.B:CA) (TSX:CCL.A:CA) is an increasingly important player in RF and RFID technology, which is being used in stores to reduce theft. Additionally, the company is the world’s largest converter. The company produces pressure-sensitive and extruded film materials for a wide range of applications in the consumer packaging, healthcare and chemical sectors and is also a significant manufacturer of labels.

CCL Industries has two different classes of shares issued. The 11.8 million Class A shares are a voting class with one vote per share, while the 166 million Class B shares have no voting rights except in special circumstances. Except for the dividend policy, both shares have the same economic rights. Class B shares are entitled to an annual dividend of one cent higher than Class A shares. Shares. This article refers to Class B shares. The base currency of this article is Canadian Dollars. This article is written as a follow-up to an earlier article. Previous article.

The company’s website mainly uses “download only” files, All relevant documents can be found here.

I’m still focused on free cash flow.

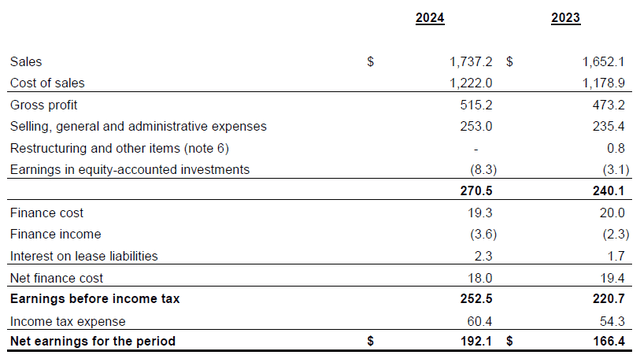

Looking at CCL’s financial results for the first quarter of the year, I was pleasantly surprised. Revenues increased by about 5% Meanwhile, cost of sales increased just over 4%. As shown below, this resulted in gross profit increasing from CAD$473 million to CAD$515 million, an increase of 8.9%.

CCL Industries Investor Relations

While this is obviously good news, CCL did have to contend with higher selling, general and administrative expenses, which increased by approximately CA$17.6 million, but income from equity method investments increased by CA$5.2 million while a CA$0.8 million restructuring charge incurred in 1Q23 will not occur in 2024. On top of that, lower net finance expenses allowed CCL to post pre-tax profits of CA$252.5 million, up approximately 15% compared to 1Q23. Net income was CA$192.1 million, or earnings per share of CA$1.08.

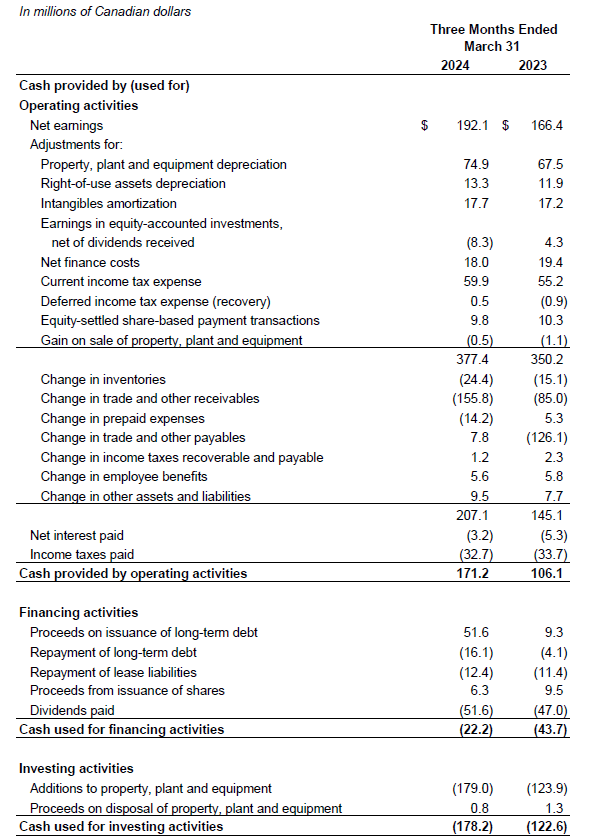

Given that the earnings report was quite strong, we were hoping the cash flow statement would show similarly strong free cash flow performance.

On a reported basis, total operating cash flow was C$171 million, which included a net investment in working capital position of approximately C$170 million, while cash taxes were only C$32.7 million, approximately C$28 million lower than the total taxes shown on the income statement. Lease expenses totaled C$12.4 million, resulting in adjusted total operating cash flow of C$301 million.

CCL Industries Investor Relations

Total capital expenditures were high at C$179 million, more than double the C$74.9 million in depreciation and amortization incurred in the first quarter, clearly signaling that the company is investing in growth.

Underlying free cash flow, adjusted for changes in working capital and including growth investments, was C$122 million, or approximately C$0.69 per share.

I think it is important to understand the details of capital expenditure requirements. CAD 455 million to be spent on capital expenditures It’s also clear that Q1 was a very high quarter for capex, as capex this year is up 20% compared to Q1 2020 (and about 40% above the pace of depreciation), and about 40% of the full year capex has already been spent in Q1. Unfortunately, CCL Industries did not provide a breakdown of sustaining vs growth capex, but that is likely given that two new factories in Vietnam and Singapore are scheduled to come online in 2024 and construction of a new factory in Turkey is scheduled to begin in 2025.

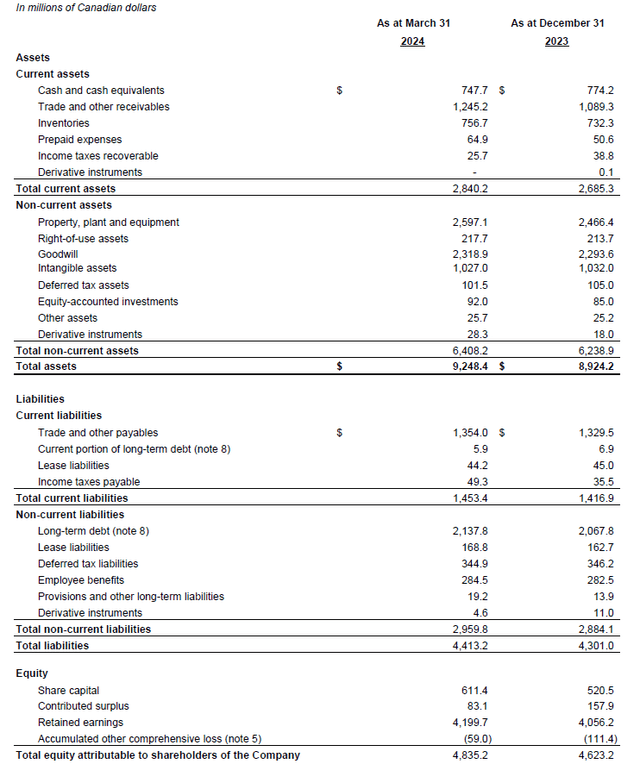

CCL is well positioned to continue on its growth path. Despite rising capital expenditures, CCL’s expenses are still below its operating cash flow and the balance sheet is cash-rich. As shown below, CCL Industries’ balance sheet has a positive working capital position of approximately CA$1.4 billion, including approximately CA$750 million in cash. The balance sheet includes total debt of approximately CA$2.14 billion, resulting in a net debt position of approximately CA$1.4 billion.

CCL Industries Investor Relations

Adjusted EBITDA was C$368 million, lease amortization expense was approximately C$357 million and net debt-to-EBITDA ratio (excluding the impact of leases) was approximately one.

Investment Thesis

With the current share price at about C$69 per share, CCL has an enterprise value of about C$13.7 billion. This means that the stock is currently trading at just under 10 times EBITDA. This is not cheap, but CCL Industries has shown resilience, and as it continues to invest in growth, it is likely that revenue and EBITDA will continue to grow as well. The consensus estimate is EBITDA increased mid-single digits We expect net debt to continue to decline over the next few years (assuming no major M&A transactions occur). We believe EBITDA will be CA$1.55 billion (adjusted for lease payments) in 2026, reducing net debt to approximately CA$750 million (we expect CA$1.05 billion in free cash flow after growth capex and dividends over the 2024-2026 period, and assume CA$400 million in acquisitions in this scenario). This would reduce the EV/EBITDA multiple to around 8.25-8.5x.

I don’t currently own any shares in CCL Industries, but if the share price drops, I think that would be the time to start accumulating shares.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.