Luis Alvarez

Investment Thesis

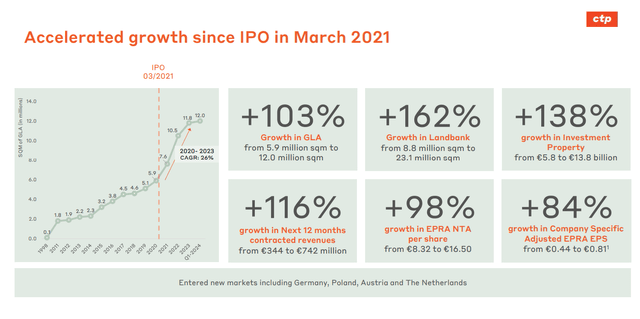

Since its IPO in 2021, CTP NV (OTC:CTPVF) (AMS:CTPNV) stock price has not changed much. I think the company is still not well known among the broader investor base, but once it does, the company’s stock price will You may experience a significant increase.

Company Profile

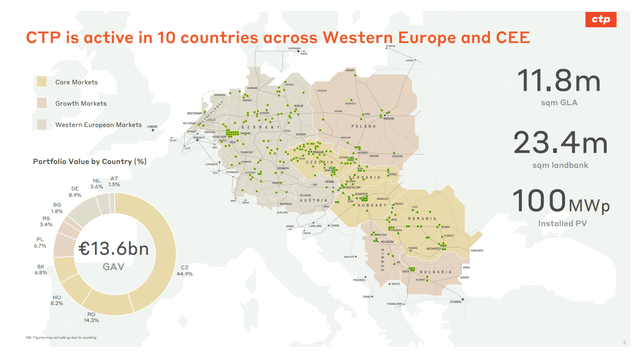

CTP is a leading European industrial property developer and operator specializing in the development and management of high quality business parks. Headquartered in the Netherlands, CTP operates an extensive portfolio of prime logistics and industrial properties. place CTP is a real estate development company based in Central and Eastern Europe, including the Czech Republic, Slovakia, Hungary, Romania, Serbia and Poland. CTP’s integrated approach covers the entire property lifecycle, from land acquisition and development to long-term ownership and management, ensuring consistent quality and performance. With a commitment to sustainability, CTP seeks to minimize its environmental impact through innovative building practices and energy-efficient solutions, positioning itself as a responsible and forward-thinking leader. Real Estate Division. In recent years, CTP has experienced strong growth driven by strong demand for industrial space and strategic expansion into new markets.

CTP’s latest earnings release CTP’s latest earnings release

Financial Analysis

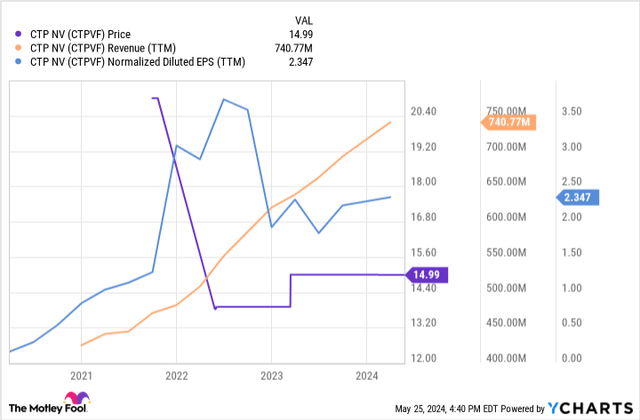

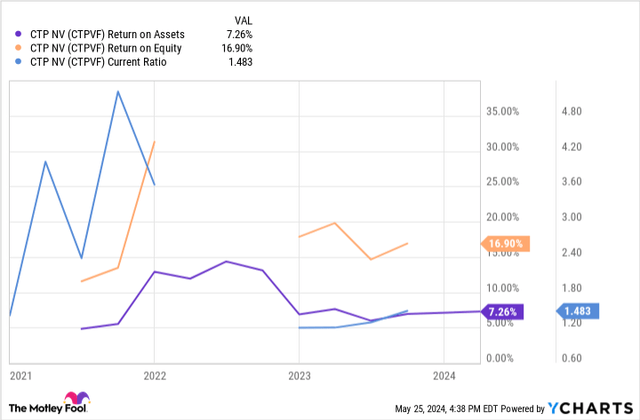

Regarding financial statements, Balance sheet The company has a healthy debt load (long-term loan ratio of 45-50%), which helps it convert a typical 7% ROA into an impressive ROE of nearly 17%. Finally, the company has ample liquidity, with its current ratio hovering above 1.4.

Looking at individual years, CTP’s financial position was even better at the start of 2022. It has deteriorated slightly since then, but this trend is more likely to be ending rather than continuing. The company also boasts excellent EBIT margins (currently 65%), which have followed roughly the same trend over the past few years and are unlikely to rise or fall dramatically in the coming years.

Catalysts on the horizon

Although analysts are currently expecting a “higher interest rate policy for longer,” it seems like it’s only a matter of time before interest rates fall again, which could be a macro catalyst for equities and CTPs as well. The impact of low interest rates on DCF models is clear and needs no further explanation.

DCF Analysis

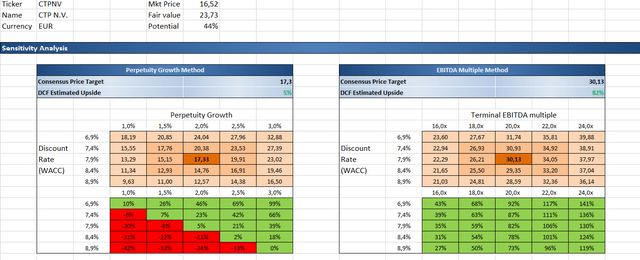

Plugging CTP’s financial statement figures into my discounted cash flow (“DCF”) template reveals that the company’s shares are undervalued. Using the perpetuity growth method, which assumes a terminal growth rate of 2%, annual revenue growth of 23% over the next five years tapering by 1%, and stable operating margins of 65%, the model estimates an intrinsic value for the shares of €17.3. The discounted cash flow model’s EBITDA multiple approach implies that the company’s intrinsic value per share is roughly €30, assuming a reasonable exit EV/EBITDA multiple of around 20x five years from now.

Of course, a DCF model is only an estimate of the intrinsic value of a company’s shares and is highly dependent on analytical inputs. The basis for my terminal growth rate figure is an expectation that the economy will grow at 2 percent indefinitely. The revenue growth figure is a simple linear extrapolation of the current pace of growth in revenue, and the 65 percent operating margin assumption is based on the average of margins over the past few years and assumes they will remain flat for the foreseeable future.

Main risks

An investment in CTP shares involves several significant risks of which potential investors should be aware. First, fluctuations in the real estate market may affect the company’s property values and rental income. An economic downturn or changes in market demand could lead to lower occupancy rates and rental prices, which could affect CTP’s revenues and profitability. In addition, regulatory risk is also significant, as changes in local or international real estate laws, environmental regulations and tax systems could adversely affect CTP’s operations and financial performance.

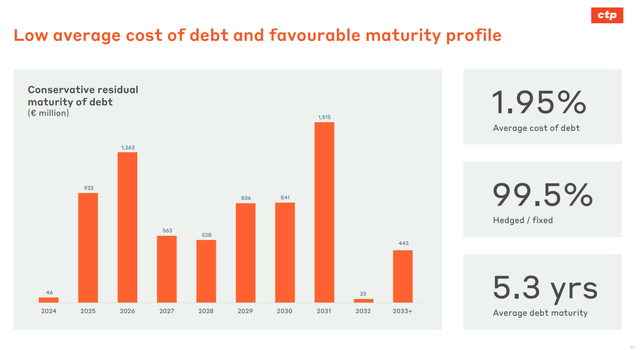

To some extent, the company also faces liquidity risk because real estate investments are relatively illiquid, which can complicate the process of quickly selling real estate and shares without a significant decline in value. In addition, interest rate risk is also significant, and rising interest rates could increase borrowing costs and make real estate investments less attractive. Finally, operational risks, such as the effectiveness of management, problems with maintaining properties, and the ability to secure and retain tenants, can all affect the success of the company and, ultimately, the performance of its shares.

Conclusion

In summary, CTP NV has a very low cost of debt and is a prime example of a company that uses debt wisely (Only about 2 percent), which minimizes its weighted average cost of capital and maximizes return on equity. The company has a strong and diversified international client base, minimizes individual counterparty risk exposure, and boasts high utilization rates of over 90 percent. With a trailing 12-month price-to-earnings ratio of just 8x and a price-to-book ratio of 1.1x, CTP NV shares are trading at an attractive valuation and the stock is poised to soar.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.