Daku

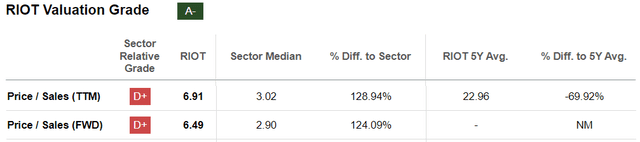

I am a member of Riot Platforms (Nasdaq:Riots) paper In June 2021, the company highlighted how it was growing, and since then, its shares have fallen 71.5% and are trading at around $10. The company’s growth strategy has been recently Bitfarms (NASDAQ:Vitafe)about $950 million. In the highly competitive cryptocurrency mining industry, where bitcoin is becoming increasingly difficult to produce, I believe other transactions should follow suit.

This difficulty is Bitcoin (BTC-USDThe halving occurred last month, significantly reducing the rewards miners receive for adding blocks to the blockchain as operational costs remain high in a market that could see prices coming under pressure.

Against this backdrop, the thesis suggests that Riot is not a buy, despite a 35% decline year-to-date.

Instead, this could be an opportunity, given how they are scaling their operations while controlling the direct costs of mining.

Cutting costs to address declining compensation issues

First, energy remains the largest cost item for Bitcoin miners as it limits their ability to bring hashrate online and increase production capacity.

So, for Riot, electricity costs in the first quarter (Q1) of 2024 were $16,764. This represents 73% of the mine’s total direct costs. The remaining 27% includes labor costs, insurance, network maintenance, equipment repairs, land leases and taxes, network costs and other utility costs.

Looking across this competitive industry, miners like Bitfarm typically target low-cost, stranded, renewable electricity. However, Riot has adopted a different strategy by purchasing electricity plans from Texas power companies. Moreover, instead of using it all to maximize cryptocurrency production, they use it on an economically efficient basis. This means that Riot uses only a portion of the energy they purchase for their business operations and sells the rest to the power company in exchange for credits that can be applied to future electricity bills.

Secondly, the efficiency of mining operations depends, in addition to energy, on the Bitcoin mining machines and the type of cooling used. In this regard, to compensate for the decline in revenue, miners are improving the average energy efficiency of their fleet by replacing older, less efficient mining machines with newer, more efficient ones.

Riot chose the Micro BT M66S machine for its Rockdale facility, one of the features of which is that it can use immersion liquid cooling, a technology that is being implemented in its Corsicana facility, which it purchased in 2022. For investors, immersion cooling is More efficient More than air cooling, data centers equipped with this technology 50% You will have less energy.

Overall, flexible power planning, more efficient mining fleets, and cooling technologies are ways to improve margin profiles, but an equally pressing issue is the need to increase production capacity, as the reward for adding blocks to the blockchain has been split in half, from 6.25 BTC to 3.125 BTC after the halving. Without additional hashrate, mining revenues will decrease.

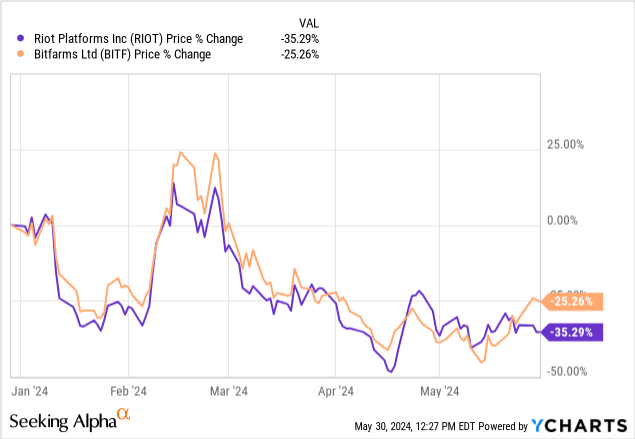

Mining difficulty and the possibility that Bitfarm could boost Riot’s status

To further complicate things, there is also the mining difficulty. So, looking at production, only 1,364 BTC were mined in Q1, showing a significant drop of 36% year-on-year. This can be explained by the doubling of average difficulty from around 40 in Q1 2023 to 80 during the same period this year, as shown in the graph below. This is due to the increase in global hashrate, which caused miners to increase production in the pre-halving period in order to get higher rewards, making the next block more difficult to mine.

ycharts.com

Currently, unless miners diversify into AI or other industries, the only way to overcome the difficulty effect and maintain production levels is to increase the hash rate. For Riot, this means more than doubling the 12.4 exahashes deployed at the end of Q1 to 31 exahashes by the end of 2024. The company is currently executing on plans to increase capacity organically, and has acquired Bitfarms, which will enable it to boast 10 million hashrate by the end of 2024. 12 Exahash That effort will accelerate significantly by the end of this year.

However, the acquisition was rejected as undervaluing Bitfarm, triggering a strategic review or reassessment of the company’s strategy and finances. achieve Maximize shareholder value through mergers, divestitures and other transactions.

Additionally, from a competitive perspective, a 43 (31 + 12) exahash would have brought Riot closer to Marathon Digital (Mara) will increase production capacity and 50 Exahash By the end of 2024. To achieve this feat, The world’s largest Bitcoin miners have been aggressively acquiring mining sites, helping to increase the hash rate from 11 exahash to 27 exahash by the end of the first quarter.

Scaling therefore allows miners to increase their hash rate and earn more block rewards, while at the same time providing a larger operating base to spread fixed costs and improve gross profits. Additionally, since voting power is proportional to a miner’s hash power, miners have more influence over changes to the network.

Thus, Marathon is ahead with 27 exahash compared to Riot’s 12.4 exahash. From this perspective, it looks like Riot is trying to catch up with its acquisition of Bitfarms.

Riot Increased Hashrate Organically, But It’s Not Enough

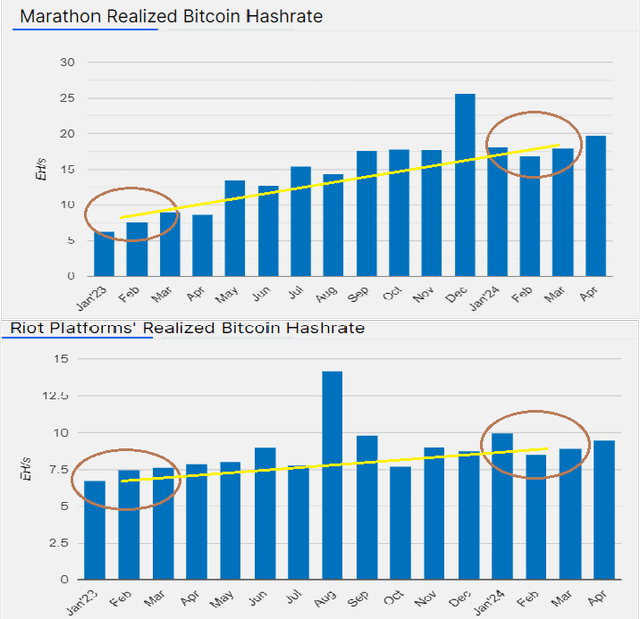

Moreover, in addition to the absolute number of Bitcoin mined, investors are likely to look at the extent to which miners are able to avoid revenue shortfalls. In this regard, when comparing actual achieved Bitcoin hashrate (actually achieved hashrate against installed operational capacity), Marathon increased its production capacity faster in Q1, which is indicated by the steeper slope of the yellow line below. Slower For Riot.

Capacity Differences Created Using Chart Data (pro.theminermag.com)

In this situation, and given that mining difficulty remains above 80, Riot is likely to see a decline in mining revenue again in Q2 compared to the same period last year, as April BTC production was 41% Decreased compared to the previous year.

As a result, they may have to sell more Bitcoin to make up for the shortfall and avoid a hit to their bottom line. However, other miners who have not been able to increase production capacity to offset the impact of the mining difficulties may be forced to sell some of their coin holdings, which analysts say could total as much as $5 billion, likely putting pressure on prices. 10x Research.

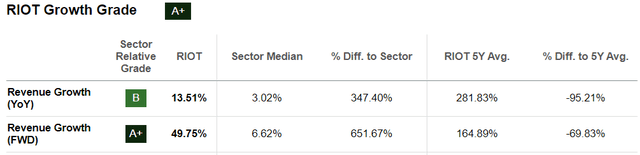

As a result, Riot may see slower revenue growth compared to its average of about $1 billion over the past five years. 282% As the chart below shows, stock prices can be volatile.

Riot is a holdover with a power credits differentiator

This creates a risk of potential volatility when the company reports its second-quarter results later in the year. JulyVolatility also rocked Riot’s stock when its takeover bid was rejected, and could affect the stock again if another miner merges with Bitfarms. This is why its price-to-sales multiple over the past year has risen by 1.2%. 6.91 times As shown in the table below, now is not a good time to invest, as it is 3x lower than the 5-year average of 22.96x, but I am not bearish.

Analysts expect revenue growth to grow 54% YoY The company expects to reach 31 exahash by 2024. This is explained by the miner’s deployment of 12.4 exahash hashrate at the end of the first quarter, an 18% increase in production capacity year-over-year. At the same time, the miner’s powering up of the Corsicana facility as part of the first phase deployment puts the company on a clear path to reach 31 exahash by the end of 2024.

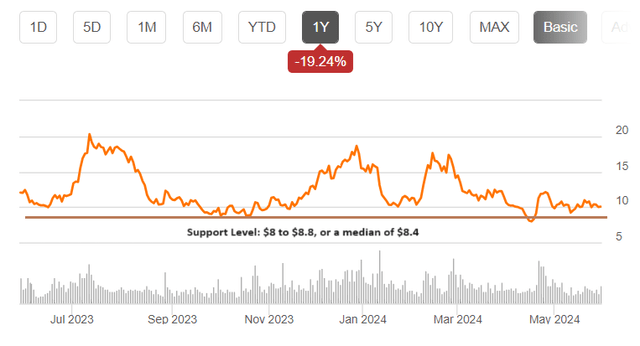

Therefore, for those wanting to enter a position, support levels have ranged from $8 to $8.8 over the past year, as shown in the chart below, with the median being $8.4, which would make a reasonable entry price.

Chart created using the following data: (www.seekingalpha.com)

Additionally, looking at the financials, the miner had 8,490 coins in Q1, which at $70,000 per coin is worth approximately $594.3 million. Combined with $688.5 million in cash on the balance sheet, the total comes to $1.28 billion. This means that they have enough funds to cover their operating expenses, which averaged $216 million over the past three years, in the event of a revenue decline due to a combination of halvings and difficulty. Also, after exiting hosting contracts and leasing data center space to miners, the Rockdale facility is focused on maximizing its self-mining operations.

Therefore, this stock is a hold while it is efficiently increasing its hash rate, and it may profit again this summer with one more prediction ahead. Texas’ hottest summer on record. To this end, the company has already secured a total of $71.2 million In the 12 months to December last year, Bitcoin holdings were worth just $27.3 million, compared to just $27.3 million for the same period in 2022. This is a significant amount, as it equates to roughly 1,017 BTC given the unit price of $70,000 per coin, or 12% of the actual Bitcoin reserve.

Equally important, if the electricity savings credits had been applied to cost of goods sold, gross margins would have been Non-GAAP 2%that is, 45% to 47%.

Volatility risks associated with industry consolidation cannot be eliminated

However, Riot has already been criticized for its energy strategy, which could pose a risk of stock volatility if the U.S. experiences an energy shortage as a result of increased AI and Bitcoin activity. GreenpeaceThe company has been criticized as the “largest and most energy-intensive bitcoin mine” that causes pollution and climate change. In response, the miners offer a flexible approach to bitcoin mining, helping to stabilize the power grid, especially during the summer when electricity demand is high.

Finally, Bitfarms has received additional expressions of interest suggesting that other parties may be interested in the company’s assets, sparking a wave of consolidation in the mining industry. Potential bidders could include miners who choose to acquire or merge with existing mining capacity instead of, or in addition to, investing in building or expanding mining capacity. However, Riot, which acquired a 9.25% stake, is not expected to take any stake in the company. Largest Shareholder The company plans to request an extraordinary shareholders meeting to add independent directors to Bitfarms’ board of directors, which could ultimately give it the upper hand.