FG Trade

By P.J. Collins

When it comes to investing in consumer debt, headlines can be misleading. We see opportunity.

As banks continue to scale back their lending activity, consumer lending is taking up more space in investors’ private credit allocations. We believe this form of asset-backed lending is an engine of the real economy and has the potential to enhance portfolio returns, reduce volatility and diversify existing exposure to public and private corporate credit.

But with interest rates set to remain high for an extended period of time, is now the right time to increase your exposure to consumer debt? It’s a natural question, especially in the United States. Recent Federal Reserve Survey It turns out some borrowers are behind on auto loans and credit card payments.

The answer is yes, and here’s why: Not all loans are the same. Loans made to borrowers with comparable credit scores and similar collateral. The key consideration for investors is not the type of loan or short-term economic outlook, but the quality of the underwriting — the private lender’s assessment of the borrower’s creditworthiness and the quality of the loan.

In this sense, private credit investors are underwriting securities companies.

Asset-backed lending: a fast-growing market

Asset-backed lending, also known as specialty finance, has grown significantly over the past two decades. A $6.3 trillion market They offer a range of loans in a variety of niches, including residential and commercial real estate, automobiles, credit cards, small business loans, commercial equipment, and revenue streams tied to intellectual property royalties. Most of their loans are made against collateral, usually financial assets or real assets such as cars or business equipment.

Of course, U.S. and European banks once made many of these loans themselves, but increased regulation forced them to cut back. Private lenders filled the gap. Many banks now sell a significant portion of the loans they originated to private credit investors, often through forward-flow agreements in which the buyer agrees to purchase a certain amount of the loans within a certain period of time.

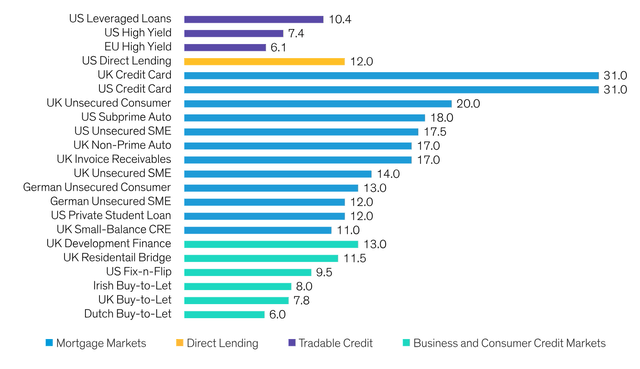

These assets tend to be less liquid and more complex, and therefore typically offer higher yields than high-yield bonds, leveraged loans, and other public credit (screen).

Specialty Finance Illiquidity Premium (percent)

Current analysis is not a guarantee of future results. CRE: Commercial real estate, SME: Small and medium sized enterprises. US Leveraged Loans reflects the YTM of the Morningstar LSTA US Leveraged Loan Index, US and EU High Yield reflect the ICE BofA High Yield Index effective yield (US and Europe, respectively), and Direct Loans reflect the yield of the Cliffwater Direct Lending Index (CDLI). Yields for other asset-backed financing categories are taken from Integer Advisors. As of 12/31/2023 (Source: Bank of America, Cliffwater, ICE Data Indexes, Morningstar, AllianceBernstein (AB) & Cliffwater, ICE Data Indexes, Morningstar)

North America is a more mature market given its size, depth and data availability, but Europe’s smaller size, different legal systems and different levels of data quality can create inefficiencies and opportunities for private credit investors with the ability to navigate these new markets.

In loan vintages, a year or two can make a big difference.

But because private lenders are so diverse, their underwriting standards can vary widely. In our view, how strong the underwriting is is one of the most reliable indicators of performance. And loose underwriting standards can quickly cause problems.

As the COVID-19 pandemic subsided, many nonbank lenders rushed to accelerate growth by maximizing loan volume, and underwriting standards plummeted. At the same time, stimulus checks with large lump-sum payments spurred consumer spending. Many consumers splurged on big-ticket items, such as new and used cars, whose prices had skyrocketed. It was not uncommon for buyers to make down payments of 20% or more. But because the purchases were funded in a lump sum, they were not a very reliable indicator of performance.

The collapses and delinquencies in the U.S. auto, credit card and other loan markets that are making headlines today are driven primarily by loans made in 2022, when lax underwriting was the norm.

On the other hand, 2023 loans are performing better thanks to tighter standards and market-in-line rates. In our view, now seems like a good time to acquire quality new loans in general (for those who don’t care about the 2022 loan headlines). Furthermore, after the post-COVID weakness, fewer investors are actively buying whole loans. We believe that those with the ability to be selective can isolate quality assets and originators and increase their return potential.

Raising loans: risk-taking is key

The ability to source loans remains important, and there are multiple lenders and platforms where investors can do this. To build in diversification and potential downside protection, investors can also require loan issuers to retain a percentage of all loans, colloquially known as “taking risk.” This creates an incentive to keep underwriting standards strict.

A typical portfolio may contain hundreds or even thousands of loans with different collateral types and cash flows, potentially providing diversification. A typical portfolio also has low correlation to public equities and bonds as well as direct corporate lending, a segment that represents a large portion of many investors’ private credit allocations.

Lenders have much less control over the direction of the economy than they do when underwriting loans. Slowing growth and rising unemployment could lead to higher losses. But by analyzing historical data and the performance of assets at different stages of the economic cycle, managers may be able to identify characteristics that make loans more likely to perform well in different credit environments.

The views expressed herein do not constitute research, investment advice or trading recommendations and do not necessarily represent the views of the AB portfolio management team as a whole. Views may change over time.

Editor’s note: The summary bullet points for this article were selected by Seeking Alpha editors.