The Good Brigade/DigitalVision via Getty Images

Everyone shops. Whether online or in-store, people need to shop. As online shopping becomes more common, so does the need for debit and credit cards. In fact, about 93% of American adults Have a debit card82% of people own at least one credit card. All that plastic is tied to a payment network. Largest payment processors visa(New York Stock Exchange:Five).

Most of Visa’s business is conducted in the United States. One-third of revenue As credit cards become more popular, more customers may be available in markets outside the U.S. This could increase revenue for card processors.

Processing networks like Visa make money every time a consumer swipes their card. The fees at the store are 1.5% to 3.5% rangeThese fees are effectively the cost of convenience, allowing companies to avoid handling large amounts of cash. Credit cards also come with some pretty strong consumer protections. The revenue generated from swipe fees is also fairly insensitive to inflation. As prices go up, so do the fees charged by the processing network. This is because payments are based on a percentage of the transaction, not a flat amount. Visa seems a little pricey at the moment, but that’s normal. The company is a worthwhile company for many investors to own.

Visa Finance

Visa has been growing rapidly in recent years, and investors have been doing pretty well. Visa’s revenue has more than doubled over the past decade, from $14.5 billion in 2014 to $32.6 billion by 2023. In fact, the only year Visa’s revenue declined was in 2020, when the economy slowed due to COVID-19. While revenue has increased by nearly 125% over this period, net income has increased even more rapidly. In 2014, Visa’s net income was $5.4 billion. By 2023, that figure will increase to $17.2 billion, a 219% increase over 10 years.

Looking at the company’s debt, it has been steadily increasing over the past decade. In 2014, the company reported zero debt, but now this figure stands at Over $20.6 billionThis isn’t much higher than the company’s net profit last year, but Grows to $18.4 billion Based on the past 12 months.

Year-to-date free cash flow As of the second quarter, Visa had revenue of $7.6 billion. Visa is a cash cow to say the least, and its business model, unlike most of the vendors it serves, generates huge profit margins. The market is expected to grow in the near term.

Shareholder Returns

Much of Visa’s return over the past decade has come from the appreciation of its stock price. On June 2, 2014, Visa’s stock price was $53.25. As of May 30, 2024, the stock price is $270.68. This means the stock price has risen 408% over the past decade. This may not be as big a return as Apple investors would have received (though it’s worth noting that the stock price is still up 408% over the past decade).AAPL) or Microsoft (MSFT), which is still well above the overall market level. For example, the S&P 500 (Vaux)’s stock price has risen 169% over the past decade. Long-term Visa investors have been rewarded for their investment.

As for more tangible returns, Visa has been repurchasing a significant portion of its outstanding shares over the past decade. Currently, the number of shares is approximately 20% lower than it was at the time of its 2014 annual report. This has had a positive impact on the company’s earnings per share, which has increased from $2.16 in 2014 to $8.28 (diluted basis) at the time of its latest annual report. EPS has been growing at a faster pace than both sales and net income. The company has announced new share buybacks, which could lead to further reductions in the number of shares in the coming months. $25 billion share repurchase program October 2023. Over the past year, Visa has $12.7 billion in share buybacks.

Visa has a history of returning capital to investors through dividends. Those interested in dividend income may want to ignore V for now. Its dividend yield is fairly low at 0.77%. While the S&P 500 has a low dividend yield, Visa’s dividend yield is just over half the market’s (1.33%).

Despite the low yield, Visa has shown strong dividend growth over the past decade, averaging an 18% annual increase. Over the past five years, that growth has declined slightly. Just under 16% per yearIf the company continues to grow at this rate, the dividend will double in about 4.5 years. In fact, today’s dividend is about five times what it was a decade ago, growing from $0.42 per share to a current annual dividend of $2.08. Double-digit revenue growth The company should be able to continue its strong record of dividend increases over the next year.

The current dividend growth has been achieved without a significant increase in the dividend payout ratio. Despite this strong dividend growth, the dividend payout ratio is around 21%, not too different from the 2014 dividend payout ratio of 18.5%.

evaluation

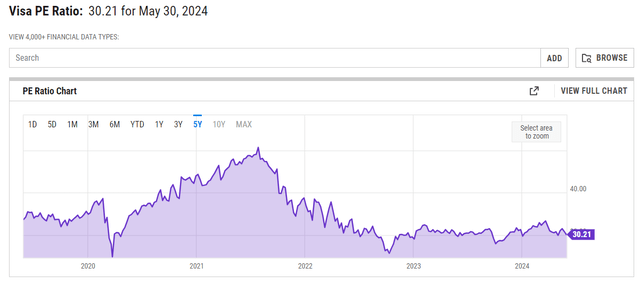

This may give some potential investors pause. The current price-to-earnings ratio is 30. Seeking Alpha Ratings estimates Visa to have an F grade. However, the current price-to-earnings ratio is actually at the low end of where Visa has been for the past five years.

Despite the stock’s high valuation, Visa’s stock price has risen 66% over the same period, which is slightly lower than the S&P 500’s growth over the same period (89%), but still a healthy double-digit compound annual growth rate.

risk

One of the bigger risks that could affect Visa’s future revenue comes from Congress. Credit Card Competition Act The company plans to cap card swipe fees. Whether that translates into lower costs for consumers (though it should) remains to be seen. But it will likely cut lucrative credit card perks, potentially reducing usage as well as reducing revenue for companies like Visa. There is also competition in the payment processing space, and new technology could chip away at Visa’s advantage. But for now, the company dominates in payment processing.

Conclusion

Visa has been a great investment over the past decade. As long as it can continue to charge the same fees, its earnings should grow. While its current dividend is low, investors can expect a fairly high cost yield in the coming years and decades (investors who bought 10 years ago are seeing a cost yield approaching 4%). Dividend growth has been very high over the past decade, and the dividend payout ratio has remained largely unchanged. If Visa can continue this growth in the future, it will be a great boon for income investors. Since the company continues to buy back shares with its massive free cash flow, investors who stick with the company should be rewarded in the form of higher EPS in the future, which could lead to a higher stock price. There is a lot to like about Visa stock.