Ivan-balvan/iStock via Getty Images

For most of 2024, and especially recently, whether you’re an astute market observer or simply a market participant, it’s easy to see that momentum has been a key theme, at least from the start of the year through May 2024 to date. I don’t know if this is due to algorithms, quant funds, or hedge fund pod shop positioning, because they are very profitable, but many stocks in good “beat guidance, raise guidance” cycles are rallying into the stratosphere, valuations don’t matter!

If you believe that what you’re seeing on your screen is sustainable, that this is the way forward, then you can unleash almost everything you’ve been taught in business school, including some of the best work of the last 50 years on fundamentals and understanding. How to evaluate a public company. Now, let’s take a look at Cava Group, Inc.New York Stock Exchange:Kava) is a classic example of an extremely overvalued stock.

With two very simple charts, I’ll show the reader why the current valuation is completely out of whack.

What they do

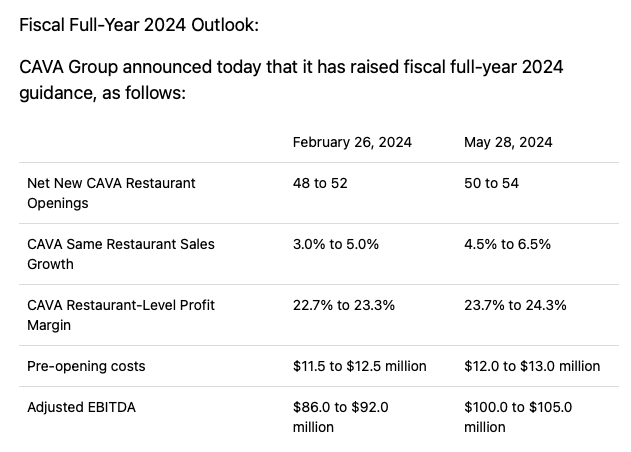

Cava Group’s first restaurant opened in 2011, and as of December 31, 2023, the company operates 309 fast-casual restaurants in 24 states and Washington, DC. The company serves Mediterranean cuisine, including customized bowls and pitas. The company believes it has a unique offering given its untapped Mediterranean-style food menu and healthier meal options compared to other fast-casual and dine-in concepts. According to the 10-K, the company believes it can grow to 1,000 CAVA restaurants in the U.S. by 2032. In 2024, the midpoint of its guidance, the company indicates 52 new stores.

evaluation

According to CAVA’s 10-Q dated May 29, 2024, the company has 117.9 million fully diluted shares outstanding. On March 30, 2024, CAVA shares closed at $93.15, giving the company a market capitalization of $10.98 billion.

At the midpoint of fiscal 2024 guidance of $102.5 million in adjusted EBITDA, CAVA shares are trading at an impressive market cap-to-adjusted EBITDA ratio of 107x.

Find Alpha

Sure, the company has $329 million in cash on its balance sheet from the IPO proceeds, but that money will be used to fund capital expenditures needed to rapidly expand its new restaurant division.

Bullish story

The bullish case is clear: CAVA boasts impressive AUV (average unit volume, or average annual sales per restaurant, for readers unfamiliar with the space) and strong restaurant-level margins, projected to reach 24% (midpoint) in 2024. So the sell-side, perhaps masters of recency bias, likes to take today’s numbers and extrapolate them out to 2032. Their model assumes AUV, comparable sales growth, and restaurant-level margins. The model then assumes they can easily build at least 50 new restaurants with this concept. So by waving a magic wand, the sell-side somehow justifies today’s $11B market cap.

The Bearish Argument

I present three very simple, yet compelling arguments that explain why I believe Cava Group is wildly overvalued at its current market cap of $11 billion ($93.15 per share).

1) Cava Group is not Chipotle Mexican Grill.CMGB)

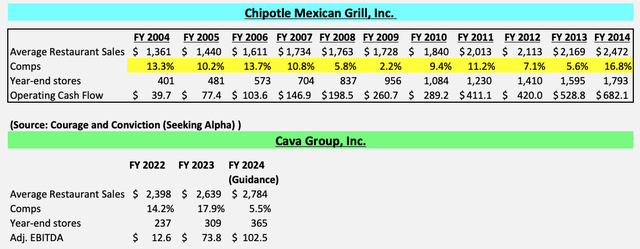

For the market to value Cava so highly, one needs to go back in time and look at the performance growth trajectory of best-in-class competitor Chipotle Mexican Grill. Don’t worry, I spent 45 minutes digging through CMG’s 10-K and created this chart (see below).

CMG currently operates 3,500 restaurants and is on track to surpass CAVA’s sales in 2024, but I digress. So, for our purposes here, looking back at CMG’s sales history, in the early days, when the company only operated 401-573 restaurants (FY2004-FY2006), the company was consistently growing sales in the low double digits.

The big issue for Cava is that same-store sales are expected to decline 5.5% in FY24 and traffic is expected to decline in Q1 FY24. To me at least, this tells us that CAVA is not a CMG. Remember, the Cava Group has a very small baseline of restaurants and any new, hot concept that captures the imagination of the American public can create word-of-mouth buzz and a halo effect that drives curiosity-driven traffic and same-store sales growth. Because CAVA is such a new concept nationally, the fact that it will not see double-digit positive same-store sales in FY24 is troubling.

2) Given record food and labor inflation in 2022 and 2023, it was easy to post high pay as almost all restaurants were weathering this inflation.

In retail, the off-mall and off-price store concept has proven exceptionally successful, as consumers love buying branded goods at deep discounts and the treasure-hunt experience of engineered scarcity. View the long-term stock chart for TJX Companies, Inc.Tx), Ross Stores Inc. (lost), and Burlington Stores, Inc.barIn the restaurant industry, “fast casual” is all the rage and has been for over a decade. This is because Americans are time-constrained and want to eat out, but want to save money. So, generally speaking, the concept of dine-in is too slow for the fast-paced lives of many Americans. Not to mention, dine-in restaurants are more expensive when you include tips, etc.

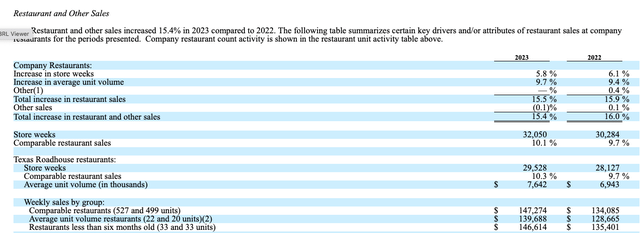

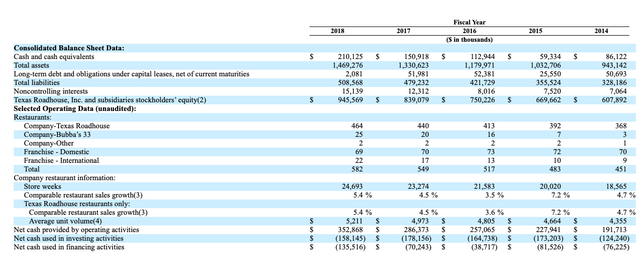

So, with record food and wage inflation impacting the entire restaurant industry, let’s take a look at best-in-class Texas Roadhouse, Inc. to prove to our readers that doing compensation well was a no-brainer.TXRH), dining restaurant.

Heck, in FY22 and FY23, TXRH posted same-store sales growth of +9.7% and +10.1%, respectively. Texas Roadhouse is a “dine-in” and doesn’t have the tailwinds of “fast casual.” Sure, they’re great operators, but TXRH is much further along in the restaurant buildout and growth cycle. This is a concept that’s been around for a much longer period of time.

Additionally, from fiscal 2014 through fiscal 2018, a time when inflation was very low, TXRH’s comparable sales growth rates ranged from +3.5% to +7.2%.

Do you understand what I mean?

Because the food industry as a whole needed to maintain operating margins, it is abundantly clear to anyone thinking critically that a new and popular restaurant concept could easily post positive comparable sales in the mid-teens at a time of record inflation in food and wages.

For comparison, TXRH is significantly more profitable than Cava Group, yet its market capitalization as of May 30 was just $11.5 billion.

3) High reward growth is very easy in the early stages

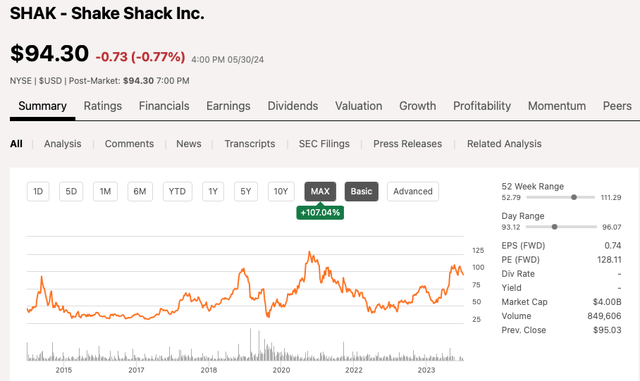

Shake Shack Inc.ShackThere was much fanfare when Yahoo! Auctions Inc. debuted its shares on the public markets. The company argued that its then-very aggressive valuation was justified based on high AUVs, attractive restaurant-level profit margins, and the fact that the concept could be scaled nationally. This is the usual strategy and story that every new popular restaurant concept tells Wall Street. And periods of such extreme valuations and irrational exuberance can come during a bull market.

Surprisingly, AUV was over-hyped (in the sense that it cannot be easily replicated nationally) because the initial store base was concentrated in high density/high disposable income areas of the US. The stock price soared in the first year, and then it took several years for SHAK stock to grow into a valuation multiple and justify that valuation. Today, over nine years later, the company’s market cap is just $4B (Cava Group is $11B), even though SHAK is doing pretty well.

Additionally, I know Massachusetts extremely well, having lived here my whole life, and if you look at Cava Group’s Massachusetts store locations, most of them are in high-end neighborhoods – high population density, high disposable income real estate. Take a look at our stores in Back Bay, Dedham (Legacy Place), Harvard Square, Hingham (Darby Street), Kendall Square, Mansfield Crossing, and Prudential Center, for example. Trust me, it’s a no-brainer. These are all “A” locations, with high population density and lots of affluent people living nearby.

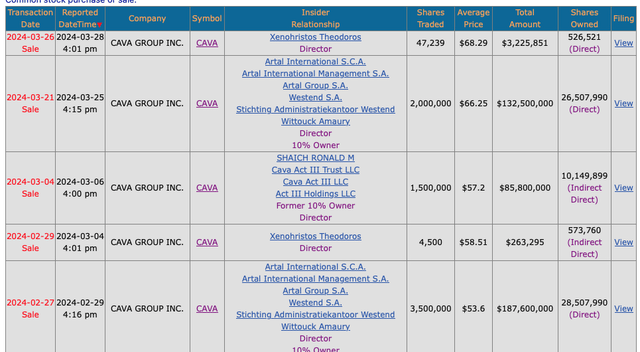

Insider trading

Cava has only been public for about a year, and so far only some of its original investors have sold their shares, though at much lower prices.

risk

Needless to say, short-term ideas can keep markets irrational for long periods of time. Second, perception is reality and multiples could expand further if sell-side and investors think Cava will be the next CMG. Third, there is a risk that companion growth in FY2025 will exceed expectations, but this is a workaround.

Putting it all together

Around May 31, 2024, the US stock market will be (mostly) driven by momentum. Whatever the price, stocks that play the “out” or “up” game will soar into the stratosphere. It’s hard to pinpoint exactly whether it’s algorithms, quant shops, or pod shops that learned this is the fastest way to make a ton of money. Either way, Cava Group is a great example of the extreme disconnect between valuation and valuation gravity, and it assumes no issues or failures in rolling out its next 700 stores. Its market cap is on par with best-in-class Texas Roadhouse, which will outperform CAVA in FY24.

As I pointed out in today’s article, three simple but astute observations prove/suggest that CAVA’s early growth phase, the company’s low comparable sales growth in FY24 (and declining foot traffic in Q1 FY24) proves/suggests that the company is not the next CMG. Second, it was very easy for a new and hot concept to post comparable sales in the mid-teens during a period of record food and wage inflation in 2022 and 2023. Finally, the first 300 store cluster is in Class “A” retail locations, so maintaining the $2.6 million AUV will be very hard. The second phase, and the next 300 stores, will require a similar real estate profile of high population density and high disposable income, but there are limited such stores across the US. The next phase is much more difficult, and especially at CAVA’s current valuation, Mr. Market does not factor these risks in at all.

Finally, I conclude my argument.