Daku

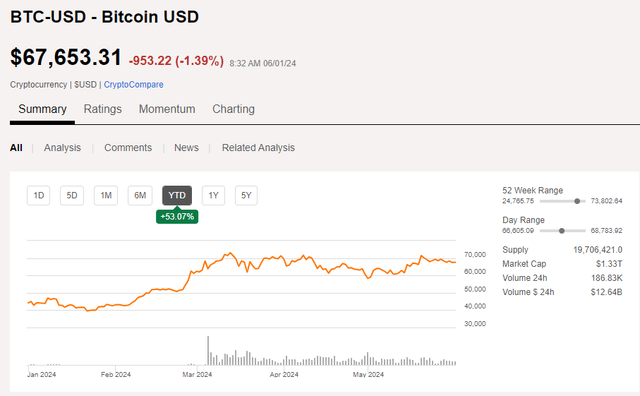

It’s been another great year for Bitcoin and other cryptocurrencies, with inflows into coins and tokens remaining strong following the SEC’s approval of 11 Bitcoin ETFs in January, followed closely by an Ethereum fund. Bitcoin’s rally has come to a halt near the all-time highs it hit in late 2021. The continued focus on AI has also taken some of the shine off cryptocurrency-related stocks.

I repeat VanEck Digital Transformation ETF (Nasdaq:DappI still think valuations are a risk, but the fund is underperforming the Information Technology sector (which is close to where it was so far in 2024).XLK) and the S&P 500 have fallen in recent months.

Bitcoin to rise 53% in 2024

Find Alpha

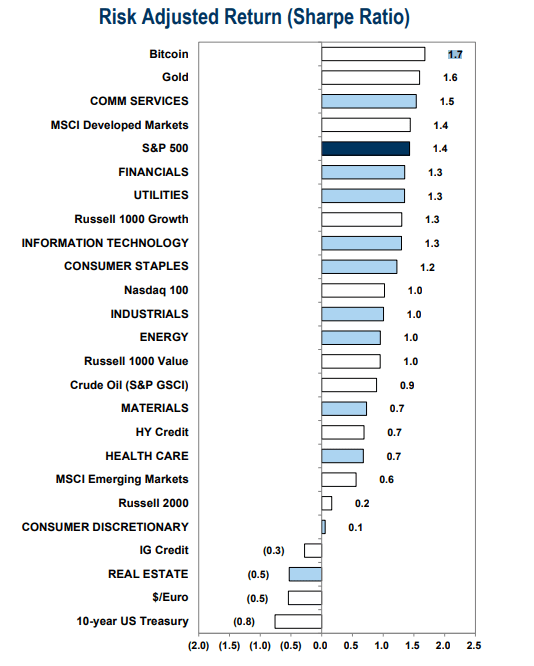

Bitcoin and Gold Lead YTD (Sharpe Ratio)

Goldman Sachs

according to To IssuerDAPP aims to track as closely as possible the price and yield performance of the MVIS Global Digital Asset Equity Index, which aims to track the performance of companies participating in the digital asset economy, before fees and expenses. The ETF aims to invest in companies at the forefront of the digital asset transformation, while providing investors with diversification through exposure to exchanges, miners and infrastructure companies. The issuer states that DAPP provides access to companies that have the potential to earn 50% of their revenue from digital assets.

The ETF’s assets under management have remained stable at just above $100 million this year and have not seen inflows despite a surge in cryptocurrency holdings. Annual expense ratio: 0.51% It is in the middle position, and the fund Does not pay dividends. still, Stock price momentum It has remained at high levels over the past year, but we will challenge the near-term momentum trend by highlighting technical features later in this article.

DAPPs will remain High Risk ETFs Analyzing the standard deviation trends and somewhat concentrated portfolios, Liquidity concerns According to VanEck, the average daily trading volume over the past 90 sessions is around 270,000 shares, and the average bid/ask spread is 55 basis points, so we recommend using limit orders when trading DAPP.

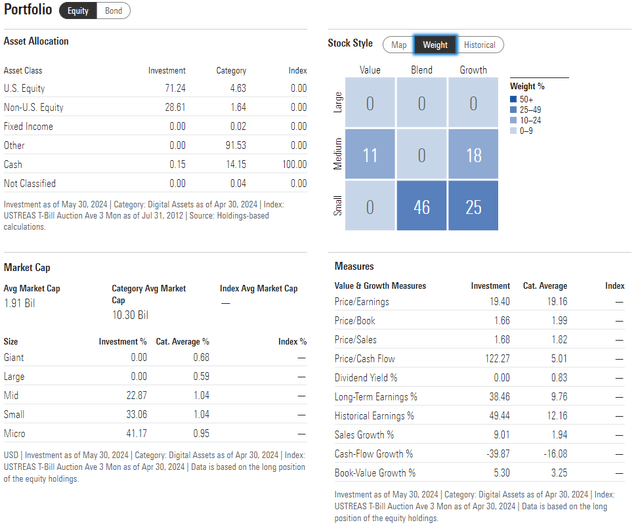

Taking a closer look at the portfolio, the fund plots in the bottom right corner of the style box, indicating an allocation to small-cap growth stocks, though with a substantial 29% exposure to mid-cap stocks. The main driver of price movement is the cryptocurrency theme and investors’ collective willingness to take risks on companies with a mix of fundamental characteristics.

Overall, DAPP’s price-to-earnings multiple is significantly lower than when I looked at the ETF last year. Currently, the multiple is below 20, but VanEck points out that the price-to-book multiple is just 1.97 as of April 30, 2024. In other words, the valuation situation is much improved today.

DAPP: Portfolio and evaluation data

Lucifer

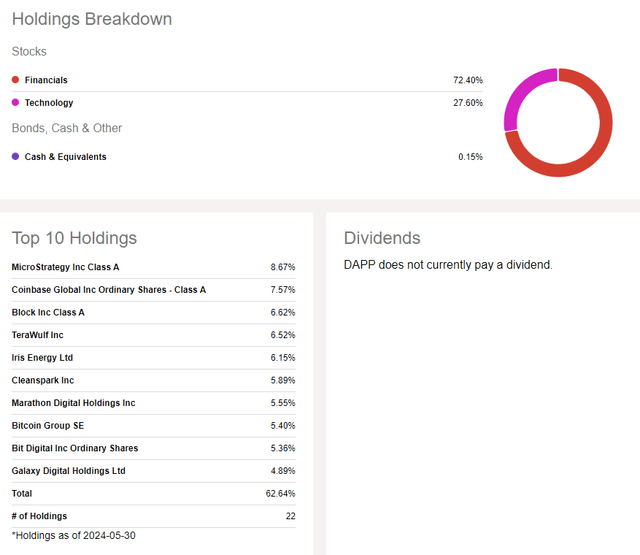

My biggest concern with DAPP is the top allocation: over 60% of the fund is invested in the top 10 assets, which works well in periods of rising prices, as we have seen in the last three months of 2023.

However, prices have only been stable this year, resulting in high volatility and weak risk-adjusted returns. Being a niche thematic ETF, it does not hold stocks from sectors other than finance and IT, with a high exposure to the fintech sector.

DAPP: Sector Allocation and Positioning Details

Find Alpha

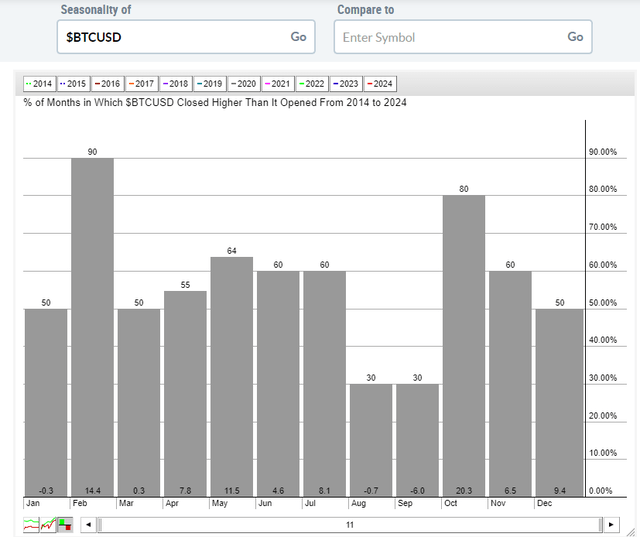

Readers know that whenever I research stocks or ETFs, I like to look at seasonality. In this case, since DAPP doesn’t have a long enough track record to analyze, let’s take a peek at Bitcoin’s seasonal trends. We can see that June and July have historically been bullish months.

Both months have seen gains 60% of the time, with typical gains ranging from 5% to 8%. However, investors should be cautious with crypto-related assets in August and September, as these two months saw lower-than-usual Bitcoin prices, which could be bearish for digital asset stocks.

Bitcoin Seasonality: June and July Bullish

Stock Chart

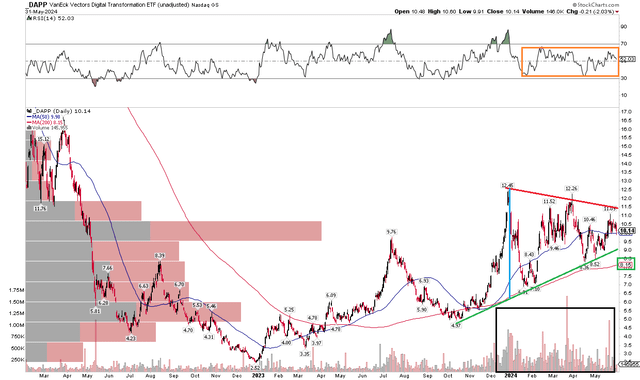

Technical insight

Bitcoin has been stable in recent months after a big surge that began in January this year, but DAPP price volatility has not been anything to write home about. Looking at the chart below, we can see that there has been a series of lower highs and higher lows since the peak in early 2024. This is a consolidation pattern, and if there is a bullish breakout above the downtrend resistance, we see an upside price objective of around $17.50. This resistance is currently sitting around the $11.50 mark. The symmetrical triangle range was around $6, so we would add that to a possible breakout price of $11.50.

Also take a look at the rising 200-day moving average, which is currently just above $8. This indicates that bulls remain in control of the primary trend despite months of price consolidation. It is also worth noting that DAPP has seen heavy trading volume in its shares since December of last year, meaning that higher volumes could lead to price consolidation, amplifying any eventual breakout or breakdown from the current symmetrical triangle formation.

Lastly, the RSI Momentum Oscillator at the top of the chart remains in a neutral zone between 30 and 70, so we are not seeing any overbought conditions or sell-offs that would lead to a significant sell-off in DAPP.

Overall, we currently see support near the $9 level and resistance in the $11.00 to $11.50 range.

DAPP: Consolidation pattern with target of $17.50, awaiting breakout

Stock Chart

Conclusion

I reiterate my hold rating on DAPP. It’s good to see valuations rising, but the technical picture is neutral while I await a breakout or breakdown. I warned potential investors that the late Q4 rally last year was a dangerous parabolic move, so I wouldn’t be surprised to see the fund grow to reach valuations.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.