Tifono Image

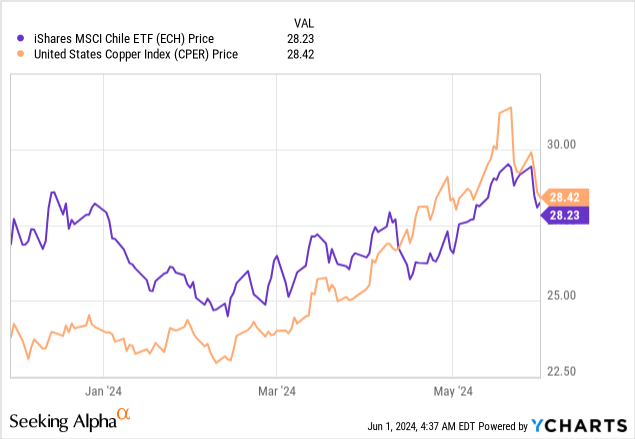

Chilean stocks have fallen on hard times in the second half of 2023. This is because I was looking at the iShares MSCI Chile ETF (Bat:ECH) (look ECH: Don’t chase the 8% yield Chilean stocks are offering) weighed on results. However, things have changed in 2024, with ECH poised to recoup most of the losses of recent months. It is no coincidence that this rally coincided with a cyclical rise in copper prices. Despite ECH not having a copper producer in its portfolio, Chile’s underlying earnings are highly correlated with copper prices as copper is linked to the overall economy. This effect extends to the peso, so benefits from higher copper prices have allowed investors to benefit from both prices and a stronger currency.

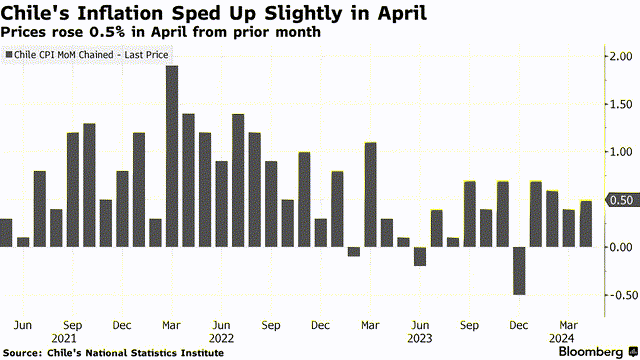

The problem for me The positive drivers of equity performance are largely cyclical, while the negatives are structural (political instability, long-term economic and earnings growth potential, etc.). It is also worth keeping in mind that Chile’s monetary easing tailwind is coming to an end, with “persistent” inflation forcing the Central Bank (or “BCCh”) to slow the pace of interest rate cuts. This is not a very favorable outlook for the non-banking portion of ECH’s portfolio.

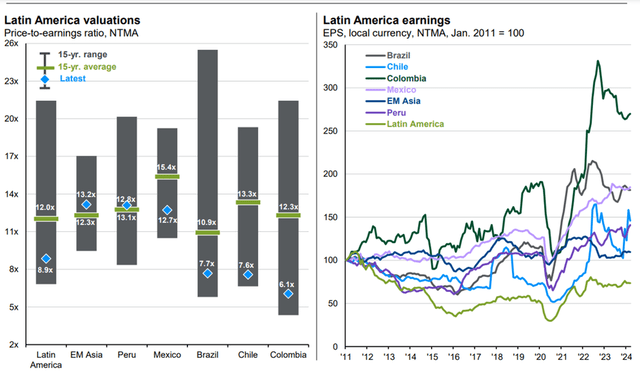

The bulls are currently At first glance, this seems to be a discount of about 8 times the forward P/E ratio. (roughly 11x its all-time high) is a good reason to hold the Chilean stock here. However, ECH’s revenue base is also highly cyclical – the low to mid double-digit year-over-year revenue decline last year is a good example, as is the consensus forecast for low single-digit growth this year.

The implication here is twofold: first, cyclical earnings profiles are harder to underwrite (and therefore require a larger discount to compensate); second, cyclical portfolios look “cheap” on a P/E basis if their constituents are over-earning (and vice versa); and perhaps most importantly, Chilean corporate earnings have disappointingly compounded over the cycle, as reflected in ECH’s poor track record. Overall, I don’t find the risk/reward particularly attractive and will continue to avoid them.

ECH Overview – The Largest and Most Liquid Chilean Tracker

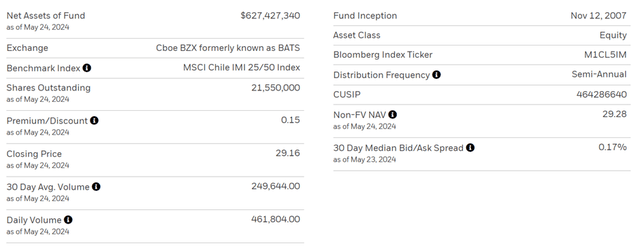

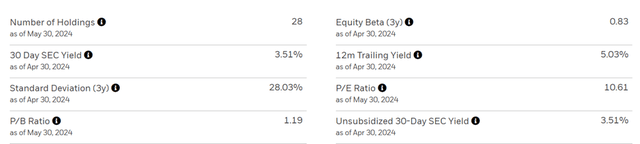

The iShares MSCI Chile ETF tracks the country’s largest and most liquid stocks through the MSCI Chile IMI 25/50 Index, making it one of the few single-country investments in Chile. As the 28-stock portfolio shows, there’s little breadth here, but concentration limits (25% cap on any single stock, 50% cumulative cap on all holdings above 5%) help. But with an expense ratio of about 0.6%, it’s hard to beat ECH on the cost front. Liquidity is also relatively good for an emerging markets fund, although the median bid/ask spread, now around 17 bps, is slightly wider than before, despite the larger asset base.

ECH Portfolio – Some restructuring but remains concentrated as before

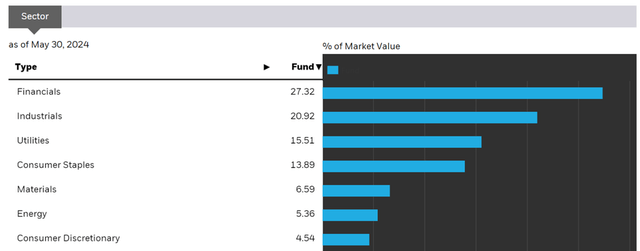

While Chile’s economy is heavily dependent on copper, ECH’s sector breakdown is heavily skewed towards financials (now up to 27.3%) rather than materials (6.6%). This is because the country’s largest copper miner, Codelco, is a state-owned company, while the other major mining companies are multinationals. Notably, other sector exposures such as industrials (down to 20.9%), utilities (down to 15.5%) and consumer staples (remaining roughly stable at 13.9%) also make up significant portions of the ECH portfolio.

In terms of individual stock breakdown, the fund has a relatively small portfolio of 28 stocks, which means it is fairly concentrated in percentage terms. Topping the list is still Sociedad Quimica e Minera de Chile SA (Square meterBanco Chile, Chile’s main lithium and chemicals producer, saw its share shrink to 14.4% due to cyclical headwinds, but the country’s two largest banks, Banco Chile (Bitcoin Cash) and Banco Santander Chile (BSAC) continued to grow their shares by 11.5% and 6.6%, respectively. Other notable gainers were energy company Empresas Copec (5.4%) and pulp and paper company CMPC (5.1%). Despite the restructuring and some portfolio expansion, ECH remains a highly concentrated fund, with a top five concentration of about 43%.

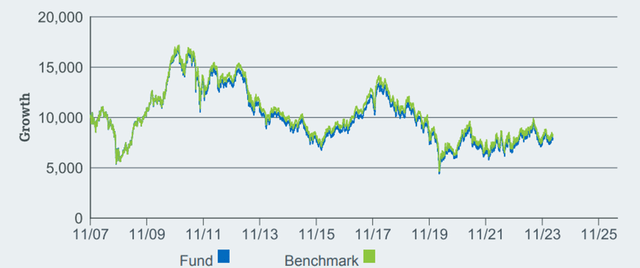

ECH Performance – Limited Shareholder Value Creation Through the Cycle

ECH hasn’t had a great start to the year, but the recent rally in copper has reversed its fortunes, resulting in slightly positive year-to-date returns. Still, it’s worth noting that the fund has delivered negative total returns on all other timelines. Over the past year, it has delivered a total return of -1.8%, and on the longer 5-year and 10-year timelines, ECH has delivered annualized returns of -5.1% and -2.5%, respectively.

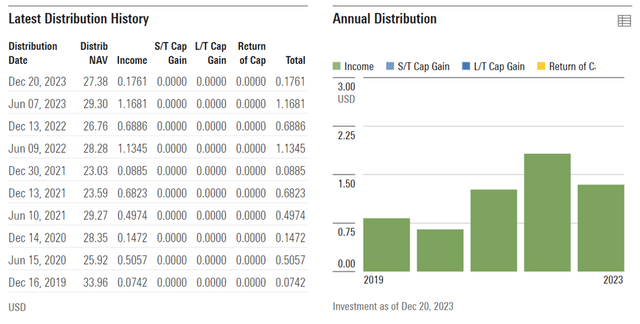

As for distribution yields, they peaked at around 8% when I last covered the fund, but dividends have normalized with a significant decline in recent quarters. As I’ve highlighted in previous articles, yields tend to move in cyclical fashion, so it may not be surprising to see ECH currently offering a significantly lower 30-day SEC yield of 3.5% (around 5% over the past 12 months). If we see a cyclical downturn, I would expect this yield to fall further, but the recent increase in holdings of dividend-paying banks should maintain a “floor” on income for the time being.

Similarly, cyclicality here has caused ECH’s P/E valuation to more than double since I last covered the fund. Looking over the past year, ECH shares are currently trading at around 11x earnings and around 8x forward estimates, with the fund trading at around a 20% premium to book value. Given the lack of a track record of earnings growth across cycles and lackluster forward estimates, there’s not much value on offer here.

Eliminate the copper bounce of Chile

With all the positive news about copper in recent months, it’s easy to forget the many reasons why copper prices are falling. do not have Invest in Chile. Sure, there is a respectable yield, albeit much smaller than before. But at the current P/E of about 11x, investors aren’t getting much for their money, especially given the earnings growth trajectory. Until expectations are significantly reset following the recent copper price recovery, I don’t see a compelling reason to hold ECH here.