SusanneSchulz/E+ via Getty Images

The world faces two enormous and interconnected challenges: one arising from climate change, and the other in the realm of nature and biodiversity. The world is not yet on the trajectory needed to reduce net emissions, Zero CO2 Emissions are projected to reach 20 million tonnes by 2050, while at the same time we face the grim prospect of over 1.2 million plant and animal species facing extinction. Solving these twin crises is no easy feat, and will only be compounded by the need to feed a world population that is projected to reach 10 billion by 2050. From an investor perspective, these significant challenges present risks for some companies and opportunities for those that can provide solutions. This article provides perspective by identifying companies on how investors can navigate these complexities. Structural benefits and challenges.

Why should investors care about the biodiversity and nature crisis?

Biodiversity has risen to the top of many regulators’ and investors’ agendas in recent years, but the concept remains unclear to most market participants. One reason for this is that, unlike climate change, there is no single measure that encompasses the challenge. Rather, protecting biodiversity and nature is a complex task, and it takes different forms, whether it’s farmland in most developed countries or the Amazon rainforest.

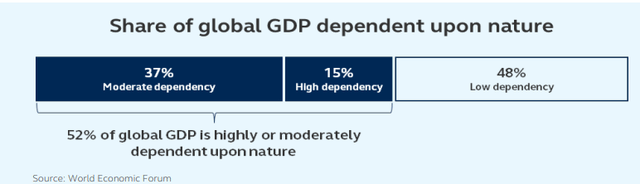

From an investor perspective, it is clear that most of the world’s economic activity depends on nature and functioning ecosystems. Estimates vary, but the World Economic Forum estimates that roughly half of the world’s gross domestic product is moderately or highly dependent on nature or biodiversity, which equates to $44 trillion in economic value. Examples of dependency include farmers who need thriving ecosystems to grow their crops, or the construction industry, which continues to rely on readily available natural materials. Until recently, companies could mainly rely on abundant resources that are easy to extract. However, at current levels, the world consumes resources that require 1.75 Earth biocapacity units. This number is expected to reach 2 units by 2030. This means that companies with business models that rely on readily available natural resources are likely to face more scarce and disruptive conditions in the future. For investors, this is a risk that needs to be considered when investing in companies with a moderate or high dependency on nature, which could lead to higher operating costs and supply chain disruptions.

Food producing companies are at the center of this dependency. In recent decades, the global food system has become increasingly complex and interconnected. Today, more than 80% of the world’s population depends on food imports. This globalization of food production has contributed to lowering world food prices, but at the same time, the combination of the COVID pandemic, ongoing regional droughts, and the war in Ukraine has created dependency and vulnerability, leading to widespread food inflation. NASA expects growing conditions and ecosystems to come under increasing pressure due to climate change, and this vulnerability may not be eliminated anytime soon. In this regard, food producing companies need to future-proof their operations to mitigate this risk. Diversification is one way, but a more effective approach is to work with suppliers to make their supply chains more resilient. Such increased resilience can be achieved by implementing best practices through technologies and agricultural techniques such as regenerative agriculture that help improve soil conditions and yields. From an investor’s perspective, this helps to mitigate significant risks for the benefit of long-term value creation.

Does resolving the crisis lead to value creation?

Over the past year, we have seen an increasing number of companies adopt biodiversity strategies. While this increased focus and disclosure is welcome, questions remain about their relevance, measurability and relevance to financial materiality. For some companies, the biodiversity and nature crisis will either pose a material revenue risk or contribute to its solution and become a growth opportunity. To capitalize on structural opportunities, it is important that investors are able to distinguish when a crisis becomes a material risk, when it becomes an opportunity, and when investors will turn their attention elsewhere.

In the previous section, we mentioned that the agriculture and food industry remains one of the industries most exposed to biodiversity and nature. Crop cultivation is intrinsically dependent on properly functioning ecosystems, and historical improvements in agricultural practices have enabled farmers to feed 3.7 times more people while expanding cultivated land by only 40% over the past 100 years. This is an incredible achievement, but it has had some negative effects on biodiversity. What remains clear is that the historical path to increasing food production cannot be applied to feed the expected 10 billion people by 2050 without negatively impacting the environment. This makes agriculture at risk on the one hand, but at the same time one of the industries that can make the biggest difference. At this complex intersection with the societal challenge of cost-effectively feeding a growing world population without compromising environmental friendliness, one of the most promising avenues for improvement is the adoption of technology. Historically, agriculture has been one of the least digitalized industries. However, in developed markets, things are starting to change in recent decades.

One example is precision agriculture. Data and vision technologies such as cameras and sensors allow fields to be treated not uniformly, but based on optimal or customized solutions for specific needs. From a biodiversity perspective, this means that herbicides can be sprayed with high precision only on weeds, rather than uniformly over the entire field. Moreover, this approach allows optimal amounts of fertilizer to be applied exactly where it is needed. These methods allow for significant reductions in usage and runoff into nature, with real benefits for local ecosystems. This leads to real cost-efficiencies for farmers and significant value creation potential for companies providing such solutions.

In addition to the agricultural industry, the durable goods and construction industries also remain highly dependent on nature. In these two industries, this dependence stems from the extraction of resources and materials from nature that are used to manufacture and build physical products. Over the past century, this extractive relationship with nature has continuously expanded with the rise in population and income, benefiting from readily available resources that can be procured at relatively low marginal cost. This has brought material benefits to the world’s people, but as mentioned above, it also means that resource consumption is unsustainable and we are heading towards a doubling of the planet’s biocapacity. From an investor’s perspective, this means that companies that rely on these readily available resources are likely to face further risks in the future. To balance the equation, the world needs to decouple economic growth from environmental degradation. To achieve this, a range of solutions will be needed, including increased recycling, optimizing production and using regenerated materials. To achieve this, innovative companies will need to play a key role by innovating and scaling solutions that increase the efficiency of resource production and consumption. In this regard, industrial and technology companies will be central to making this possible. For industrial companies, automating production to increase efficiency in order to reduce waste, and adopting new technologies to digitize production and supply chains, will be key. Technology companies can further help improve processes across industries, including construction, enabling them to design buildings that use less resources and produce less waste. Such improvements will be key to making economic growth less resource-intensive, while also leading to value creation opportunities through increased efficiency and cost savings.

Where do we go from here?

Providing solutions to address the biodiversity and nature crisis may lead to opportunities for some companies. However, many companies may also face significant risks in the future. These risks may take the form of increased regulation that restricts business activities and dependencies, leading to disruptions in less resilient systems. Regulatory risks are not new for most companies, but they may grow in magnitude in the future as the world increasingly focuses on the biodiversity and nature crisis. This was seen both in the EU’s Biodiversity Strategy for 2030 and in the work at the UN Biodiversity Conference. Regulation so far has centered around setting minimum standards for environmental protection and restricting harmful activities, but this may change in the coming years.

Human activities and climate change are threatening biodiversity. From population growth to increasing resource use and emissions, the planet is undergoing critical transitions. These challenges pose risks for some companies and opportunities for those that can provide solutions to address them. Therefore, we look for better companies that can adapt to our evolving world and drive revenue growth in the long term.

Risk Considerations

Past performance is no guarantee of future results. Investing involves risk, including possible loss of principal. Stock markets are affected by many factors that can affect returns and volatility, including economic conditions, government regulations, market sentiment, domestic and international political conditions, environmental issues and technology issues. International investing involves greater risks, including currency fluctuations, political/social unrest and differences in accounting standards.

Editor’s note: The summary bullet points for this article were selected by Seeking Alpha editors.