Richard Johnson

Notes:

I’ve got you covered Pangea Logistics Solutions Co., Ltd. (Nasdaq:Nasdaq:Bread L) so investors should look at this as my update. Previous Post About the company.

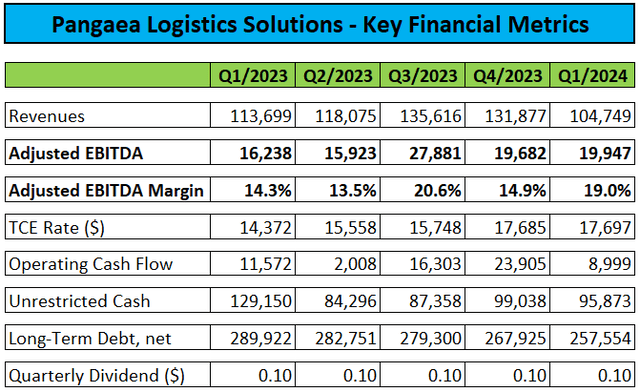

Earlier this month, Pangea Logistics Solutions, a major dry bulk shipping company known as Pangea, report Results for the first quarter of 2024 were mixed, with profitability beating expectations. Agreed Expectations There is a lack of revenue due to a decrease in the number of charter-in days.

Company Press Releases/Regulatory Documents

Adjusted EBITDA margins improved sequentially and year-over-year as the majority of cargo was transported by our company-owned fleet during the quarter.

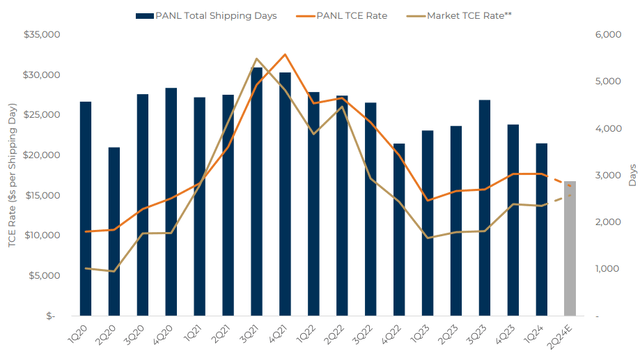

Pangaea’s average time charter equivalent (“TCE”) rate was $17,697, essentially unchanged from the fourth quarter but up from the provisional $17,430 announced in March.

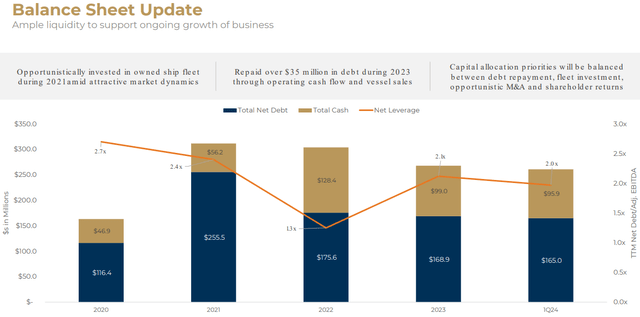

However, operating cash flow of $9 million was impacted by higher working capital requirements. Pangea ended the quarter with cash and cash equivalents of $95.9 million and $260.8 million. In debt obligations.

The company declared a quarterly cash dividend of $0.10 per common share, unchanged from the prior quarter.

Pangaea will continue to invest in its owned fleet. Acquisition The company will purchase two 2016-built Supramax aircraft carriers after the end of the quarter for a total purchase price of $56.6 million, with delivery scheduled for the third quarter.

As a result, net debt could rise later this year.

So far in the second quarter, the company has 2,890 days of shipments booked, but the average daily TCE rate is a rather disappointing $16,300 — just slightly above market rates and nowhere near Pangaea’s usual stellar performance.

Pangaea has struggled with charter profitability in recent quarters. Following an unexpected loss in the fourth quarter, the company managed to make a small profit in the first quarter, but Conference callManagement still expects a loss in the second quarter (emphasis added):

Although charter days were down 14% year-on-year, total charter costs increased 20% compared to 1Q23 as market realized rates increased 41%. Charter rates for the first quarter of 2024 were $17,580 per day, and to date there are approximately 1,400 days booked at around $16,700 per day.

During a question-and-answer session, management attributed the problem to the need to reallocate new chartered vessels with lower-margin return cargo.

Given lower TCE rates in the second quarter and projected losses in the charter fleet, Pangaea’s profitability is expected to be below current consensus expectations.

Also note that the company has a $20 million balloon payment due in the second quarter. Combined with the down payment for two Supramax airliners, cash at the end of June could be significantly lower quarter-over-quarter. However, Pangaea does plan to set up new borrowing facilities to refinance its near-term cash outflows.

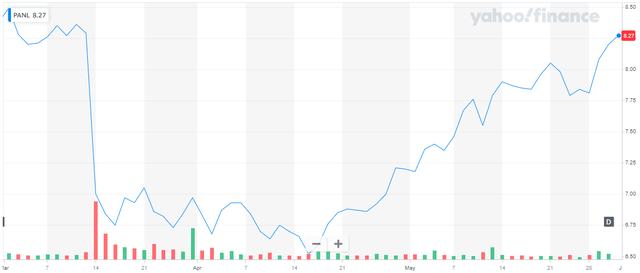

Although the company had a mixed first-quarter report and a lackluster second-quarter outlook, its shares have fully recovered from the sharp sell-off that followed its March announcement. Q4 2023 performance disappoints.

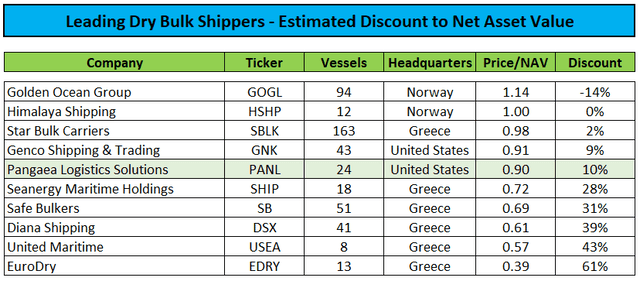

As a result, the estimated discount to net asset value (“NAV”) has narrowed to approximately 10%.

Given the recent share price rally and poor near-term outlook, I am rating Pangaea shares atbuy“To”Ownership” “.

Conclusion:

Pangea Logistics Solutions reported mixed results for the first quarter of 2024 and weak preliminary TCE guidance for the second quarter as the company continues to struggle with profitability in its charter fleet.

Management expects recent trends to reverse later this year, but second-quarter earnings are likely to fall short of consensus estimates.

Given the recent share price rally and poor near-term outlook, I am rating Pangaea Logistics Solutions shares asbuy“To”Ownership” “.

Editor’s Note: This article features one or more microcap stocks. Please be aware of the risks associated with these stocks.