Mario Tama/Getty Images News

Introduction

AirBnb (NASDAQ:NASDAQ:ABNB) has always been a unicorn in the accommodation sector, paving the way with its first mover advantage into the peer-to-peer accommodation sharing industry in 2009. Since then, it has opened up opportunities for homeowners who want to interact with travelers of various walks of life via subletting, to homeowners that own multiple properties and rent them out frequently to travelers for profit generating. With such a decentralized, authentic and versatile value proposition, it was no surprise that it entered the S&P 500 (SP500) within 3 years of its IPO (Dec 10, 2020). As 1 out of 4 in the index fund (alongside Booking Holdings Inc. (NASDAQ: BKNG), Hilton Holdings Inc. (NYSE:HLT) and Marriott International (NASDAQ: MAR)), it is a strong contender amidst the other vacation booking giants. Once the IPO debuted, investors snapped up shares, causing its share price to skyrocket from $61 to $146 in less than a day, a 112% increase. 4 years later, however, we now return to IPO level prices, a price that investors may be apprehensive about. In my opinion, while such hesitation is justified, it is not the be all and end all for ABNB. Instead, investors should wait for ABNB to intrinsically enhance its business model, while remaining cognizant of the cyclical nature of seasonal trends that affect its quarterly prices; the time to hold is now, but the time to buy is coming.

Market Share: Shift Towards Vacation Rentals?

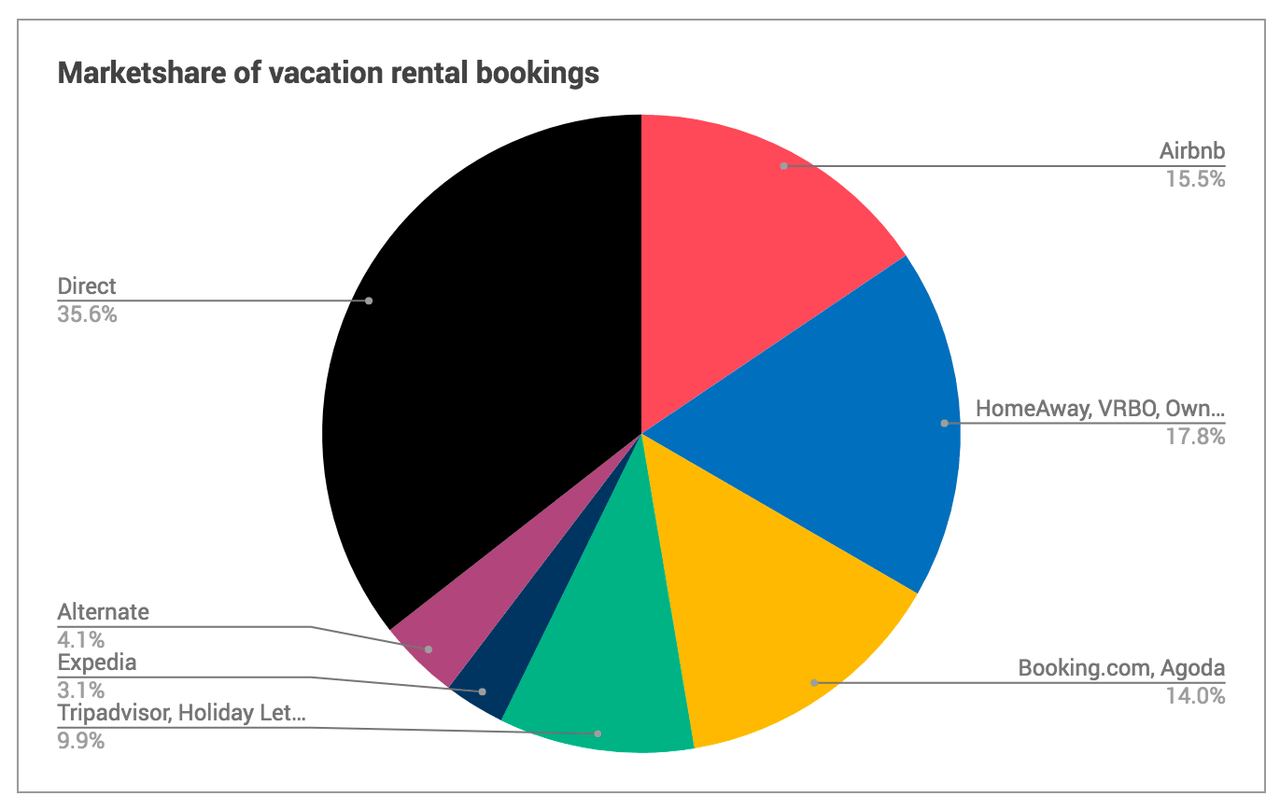

Marketshare of Vacation Rental Bookings (Rentivo.com)

Looking at the vacation booking market share, ABNB holds a 15.5% stake, the second amongst all online booking services behind VBRO (under Expedia Holdings). While there are over 20 market competitors, there are 4 key players excluding the “Direct” segment: ABNB, BNKG, Expedia Holdings (NASDAQ:EXPE), Tripadvisor (NASDAQ:TRIP). Unlike ABNB which solely focuses on short term rentals. The latter three own a series of services in vacation planning, including booking of plane tickets, tour packages and budget hotels.

Traditional hotel bookings fall under the “Direct” segment, which includes services from MAR, HLT and other conglomerates that offer services besides hotel stays. However, we are seeing a shift towards short-term rentals of properties, propelled by the increased accessibility of online booking platforms.

In my opinion, the sudden impact of COVID was a silver lining for online vacation rental marketplaces, as the hit in tourism numbers ‘reset’ the vacation industry and allowed travelers to be more open to alternative forms of accommodation and experiences. This sentiment was reflected in a McKinsey & Company report that states that travelers seek more flexible and spacious accommodations over hotels post-pandemic. With a forecasted CAGR of 5.12% from 2023 to 2028 and a slight boost from pent-up demand in 2023, the industry is in a healthy position for stable, incremental growth.

With recent fluctuations in macroeconomic sentiment that posed great uncertainty to cyclical sectors, including consumer discretionary, how will ABNB continue to fare from here?

Investment Thesis

As seen, albeit not being the biggest competitor in the vacation and hotel industry, I believe several factors such as the shift in travel demographics, resilience to macro forces, ease of entering less penetrated regions and listings with flexibility and affordability will serve as the core impetus for further growth. In essence, traveler preferences are shifting away from traditional hotel stays and towards a fresher alternative that ABNB has pioneered since the start. Furthermore, with much more room to expand its moat towards novel features (via ABNB’s roadmap), the potential for continuing growth and returns is unprecedented, considering with its already high profit margins from current growth. However, risk factors such as potential overvaluation, legal restrictions and solo traveling preferences may affect ABNB sentiment and growth.

Assuming no extreme changes to seasonal trends, an apt time would be Q3 and Q4 of this, where ADRs are lower but more time will have passed for ABNB to grow further.

Q1 Earnings

On the surface, Q1 2024 financials were strong like many others in the SP500: revenue grew 18% YoY, net income and adjusted EBITDA were Q1 records and TTM FCF was $4.2B, bringing FCF margins of 41%. Mobile app downloads accelerated, with 60% increase in downloads YoY. Active listings continued strong with 17% growth YoY, creating a healthy supply of accommodation services for travelers. Yet, cautious guidance on ABNB’s part gave uncertainty and hawkishness to investors of the stock, explaining the fall in prices by 7% within a day of the earnings release.

More specifically, due to the release of pent-up demand following the same period last year, ABNB finds it difficult for Q2 2024 to outperform boosted Q2 2023 bookings and thus earnings.

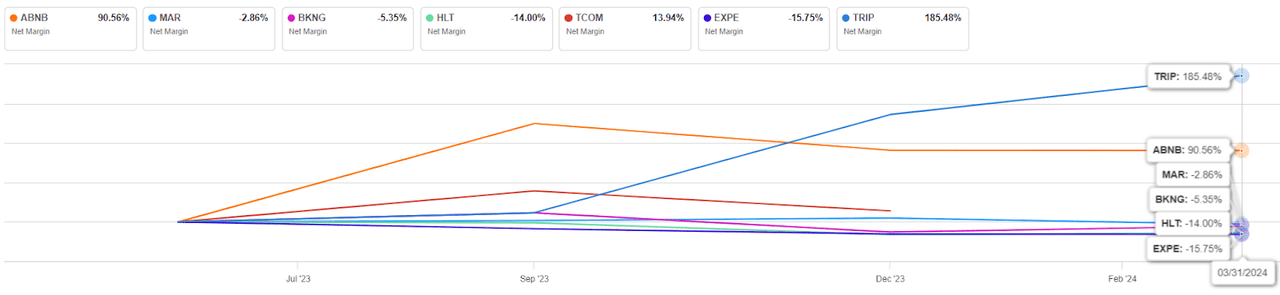

In addition, a non-recurring tax benefit of approximately 1 billion dollars boosted the EPS value to 6.63 in Q3 2023 as seen below.

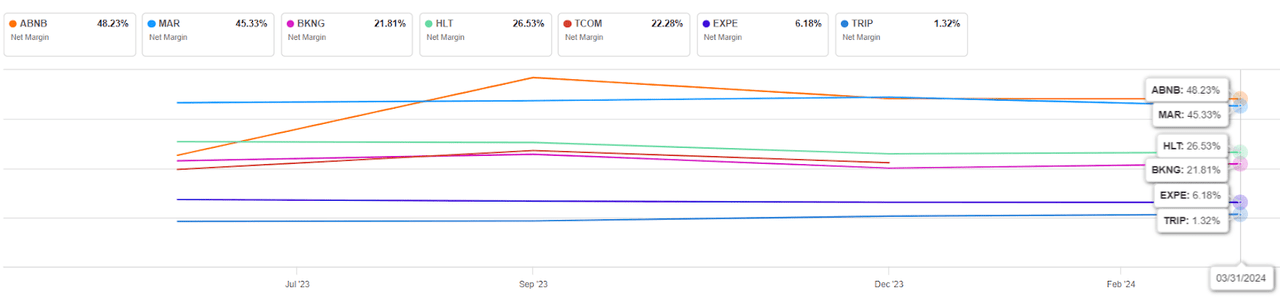

Vacation Booking Comps (Net Margin) (Seeking Alpha Comps)

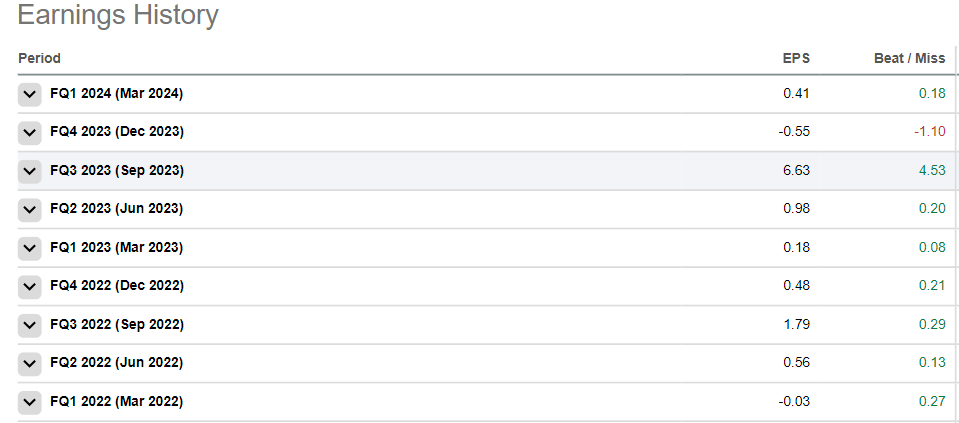

ABNB’s Historical EPS Values (Seeking Alpha)

Drivers

Great Marketing Potential towards Core Demographics

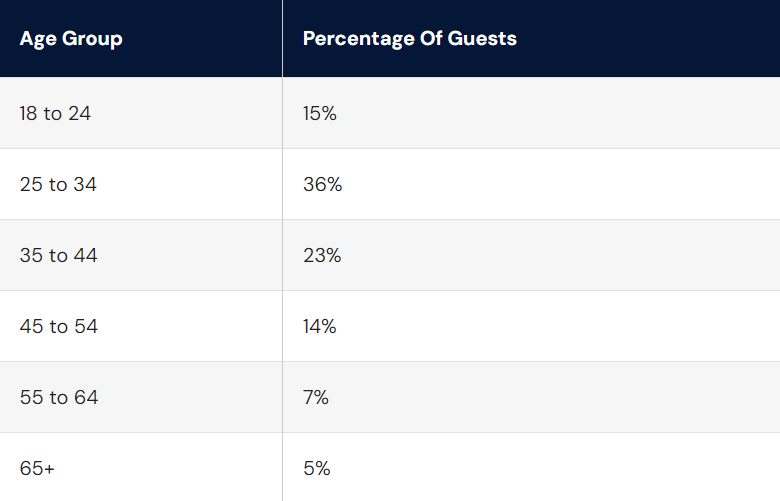

Demographic Breakdown of ABNB Guests (searchlogistics.com)

When we look at the demographic breakdown of ABNB guests, with more than half of guests within the ages of 18-34 and up to 74% of guests within 18-44. In particular, young travelers that travel with friends are likely more budget conscious, while middle-aged travelers likely have traveled more through traditional hotel means. Hence, both these demographics fit the traveler profile that ABNB aims to target: those open to affordable, unique and authentic experiences in a foreign environment. Within this age-range of tourists where internet penetration rates are 98% on average, ABNB’s ability to focus more on making its platform user-friendly and accessible with memberships and new categories of rental homes will further appeal to this core demographic of travelers in a time where alternative experiences are increasingly sought after.

Vacation Rentals: Moat that Solidifies Reach to Other Regions

ABNB’s moat is strongly exemplified through its supply growth. In Q1 24, active listings grew 15% YoY even after filtering out low-quality listings. ABNB also states that “We continued to see double-digit supply increases across all regions, with the highest growth in Asia Pacific and Latin America”, 2 key regions ABNB is trying to penetrate. Its efficiency in penetration is done in two ways: untapped non-urban demand and seasonal demand.

First, non-urban demand. Vacation rentals stand out in their ability to reach non-urban areas, both in developed and developing countries. This is because to expand into less developed regions or areas, hotel providers would need to build new hotels in these areas, requiring immense infrastructure and material costs on top of time for construction. However, marketplaces like ABNB completely bypass this barrier, as the suppliers are the ones providing their homes as accommodations. Hence, homeowners can offer up their homes for rental much more readily than hotels. This explains the surge in listings that ABNB experienced in Q1 2024, and the disparity in both supply and demand growth of rentals versus hotels in small cities/rural locations; ABNB can facilitate the matchmaking without owning any of these homes.

ABNB has plenty of room for accelerated expansion into non-urban areas. Even though the growth of gross nights booked in expansion markets was more than double the core markets on average in Q1, it still represents a minority of total nights booked. There is still “relatively low penetration in the majority of countries around the world”, and ABNB is cementing its foundation with solid progress thus far. For urban demand, it grew while non-urban demand was resilient in Q1, a consistent trend post-pandemic. This also shows that there are still opportunities to expand into non-urban areas, and ABNB’s moat has yet to catalyze growth in this area.

Second, seasonal demand. While seasonal effects can benefit all in the industry, its moat thrives again in its ability to readily ramp up supply in response to significant events. Major events such as World Cups and Olympics attract fans all over the world. Thus, ABNB plays a significant role in hosting this surge in travelers in an “organic and easy way”, easing the strain on local infrastructure that would otherwise not be able to manage the sudden inflow of tourists. This provides locals a money making opportunity while also appealing to travelers that want an alternative living experience.

Strong Profitability Margins and Affordability

Another strong point of ABNB is its profitability, which falls in line with its most recently improved profit margins in Q1. Here, ABNB’s moat shines through; the vacation home suppliers are individual homeowners with their own interests to maintain and market their homes for travelers, while ABNB serves as the platform and marketplace for these listings to be circulated. For traditional companies like MAR and HLT, they need to account for the hotel themselves. Regardless of the type of supplier (individual homeowners or corporate services), the principle idea will always stand; authentic and diverse listings for personalized stays. This two-sided marketplace creates an internally reinforcing supply and demand cycle.

Thus, ABNB serves to promote their platform to prospective travelers, taking commissions per listing instead of worrying about maintenance and development costs of the infrastructure itself unlike most other competitors. In turn, operating expenses and Capex are lower, leading to higher net incomes and hence margins that stand out.

Vacation Booking Comps (Net Margin) (Seeking Alpha)

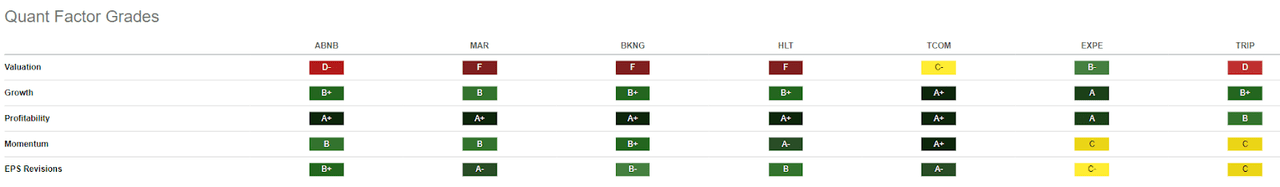

Growth, momentum and EPS revisions are otherwise solid throughout the industry, explained by the seasonal factors that ABNB also faces above.

Quant Factor Grades of Comps (Seeking Alpha)

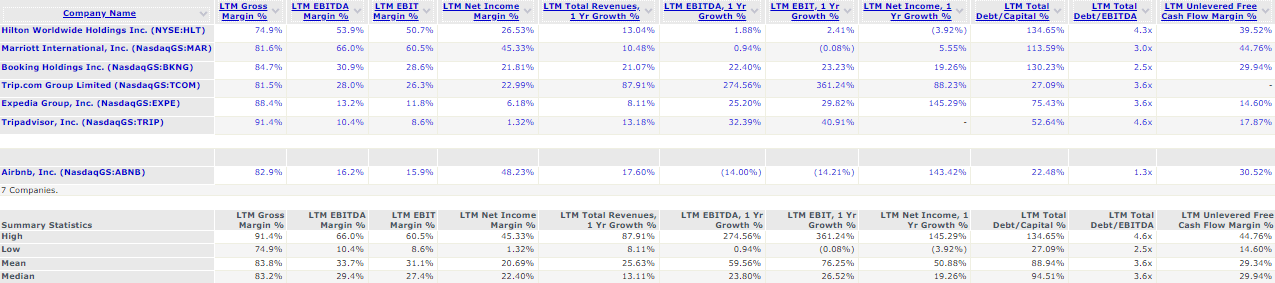

Operating Statistics of Comps (CapIQ)

ABNB has come a long way since its 2020 IPO. Pre-IPO, EBITDA margins were -5%, but 3 years later, EBITDA margins have risen to 16.2% in 2024 (LTM). Furthermore, while its EBITDA and EBIT margins are lower than average, its total debt/capital is the lowest in its comps, with unlevered free cash flow margins being the highest out of all online travel agent (OTA) platforms. This showcases the strengthening business model ABNB possesses in terms of net income and free cash flow profitability, allowing it to fork out less to repay its debt relative to its competitors and providing more opportunities for reinvestments into the capabilities of its marketplace.

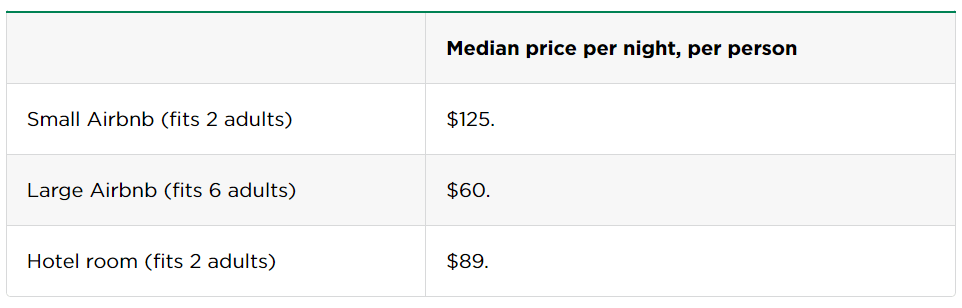

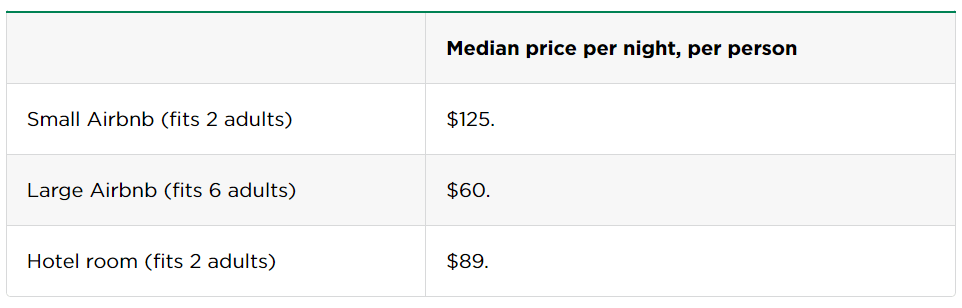

ABNB vs Hotel Room Median Price Per Pax (nerdwallet.com)

In the Q1 2024 earnings call, Brian Cheskey stated that “Oftentimes our ADRs do go up because people increasingly, more and more of our travel is group travel. 81% of our trips now have two or more guests and increasingly we’re seeing people booking more space, larger homes, just as travel’s mixing towards larger groups.”

From the perspective of travelers and suppliers, ABNB outshines hotel accommodations in price per pax when it comes to longer term stays with multiple people. Because groups will book larger, more costly accommodations and share the cost, this allows families and/or friends to leverage on “economies of scale”, greatly shaving the cost per pax whilst allowing home providers to receive customers. This becomes a win-win solution for group travelers and suppliers; travelers enjoy cost savings while suppliers gain additional income on space that would otherwise not be rented out, incentivizing both ends of the ABNB ecosystem and driving key metrics like ADR.

Business Model: Steady Demand and Supply Resilient from Macroeconomic Conditions

From consistent Fed signals towards keeping rates higher for longer, to global equities heading for record highs after strong tech rallies, to hypersensitivity towards inflation reports, greatly driven by shelter data adjustments and broadening labor supplies.

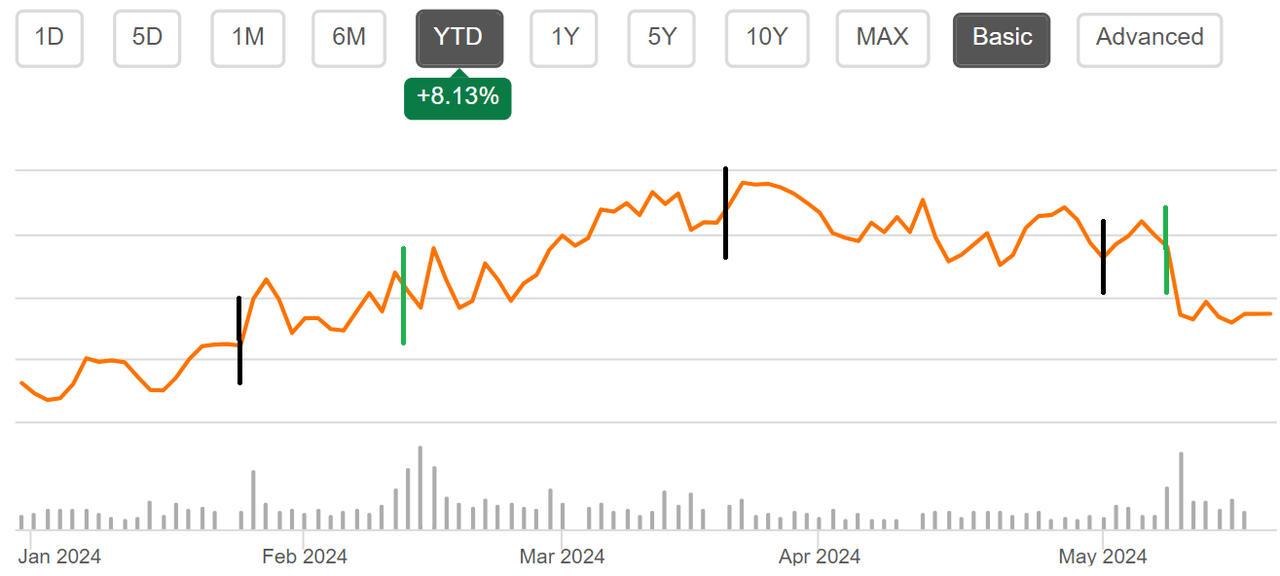

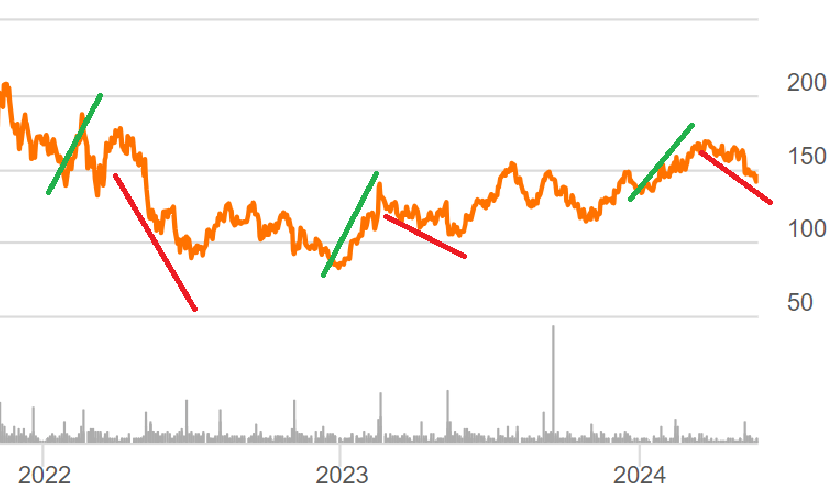

ABNB’s YTD Share Price Chart (Seeking Alpha)

This explains the turn in prices after the Fed’s decisions to delay rate cuts (black line) from the current 5.25%-5.5%, when the economy was highly volatile and consumer optimism was at all time lows from a slew of quantitative easing in the late March period. Hence, the contrasting signs of disinflation (cooling shelter, gasoline and auto insurance prices, core components in CPI and PCEPI) and inflation (solid corporate earnings spurring stock rallies, to rising infrastructure spending, trade disputes and fiscal deficits) will continue to leave investors on edge. Subsequent macroeconomic indicator news will keep investors on their toes, at least for the next few months until the Fed sees inflation (through PCEPI) move steadily towards the coveted 2% mark.

With the high weightage shelter costs have on inflation indicators (CPI and PCEPI) and the current hawkish state of the economy, investors may worry that ABNB will be especially vulnerable to these forces as a short-term property rental marketplace.

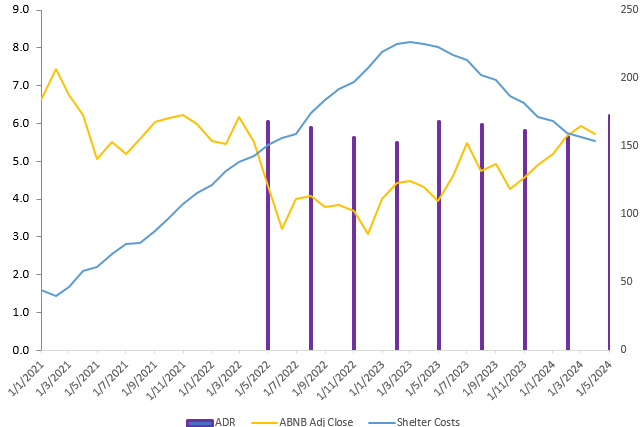

To tangibly measure how affected ABNB would be to the macroeconomic forces seen today, we can look at how its adjusted close price and gross booking value per night and experience booked (i.e ADR) has changed overtime with shelter costs.

Share Price, Shelter Cost and ADR Chart (Author)

The data shows two things: firstly, ADR in general is increasing YoY, but its cyclicity follows seasonal rather than economic forces. For the last two years, the ADR in Q1 is the highest, and slowly decreases to the lowest in Q4. Secondly, it appears that shelter costs have a dampening effect on stock prices, where prices steadily decreased up till Jun 2023 and shelter costs reached near all time highs.

However, after taking a step back, both ADR and ABNB share price are largely unaffected by these shelter costs, as 1) ADR reflects seasonal trends, and 2) the fall in share price and subsequent inflection was largely driven by the pandemic’s easing of restrictions nearing the end of 2022 which proceeded with pent-up demand.

Hence, because of how dynamic ABNB’s supply (listings) is compared to its traditional hotel booking or vacation planning competitors, ABNB prices and quantities are largely resistant to macroeconomic headwinds, and more contingent on internal industry forces, in which demand and supply are both growing at healthy rates post-pandemic.

Risk Factors:

Valuation: Overvalued?

In terms of SA Quant Ratings, the main factor that most competitors in the industry suffer from is valuation, albeit ABNB having a slightly higher rating than the other 3 SP500 companies of D- compared to F.

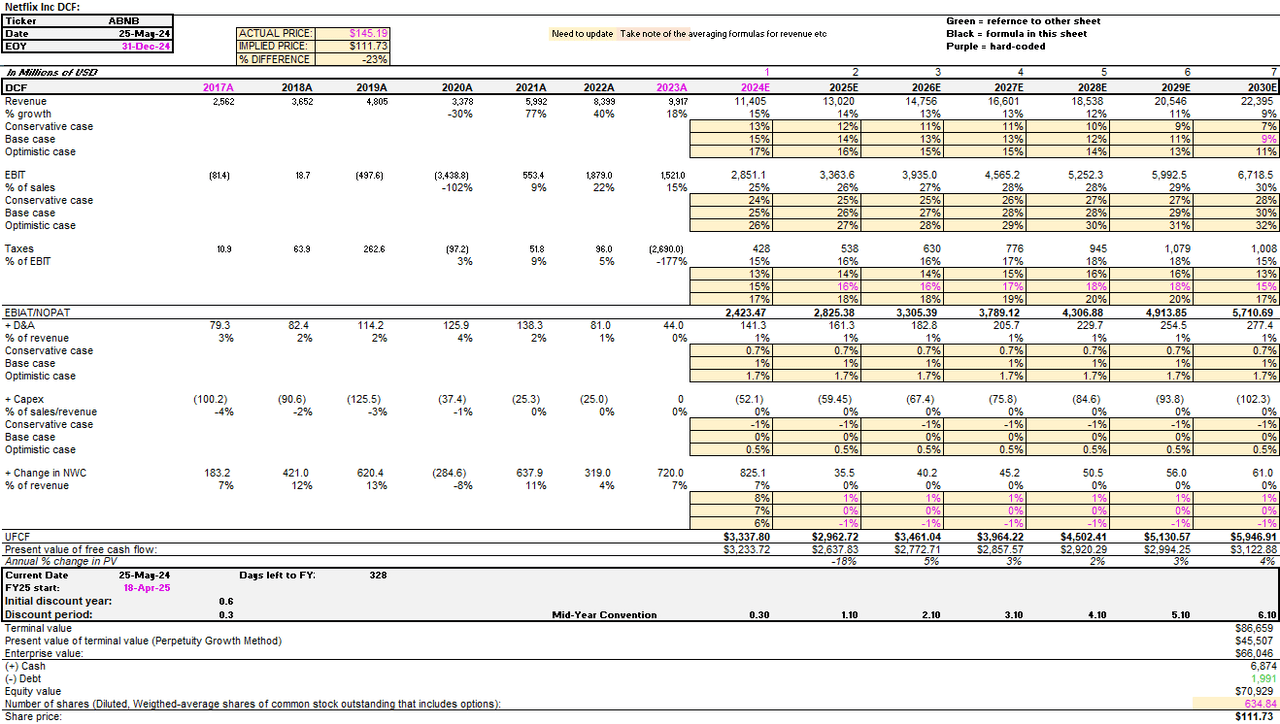

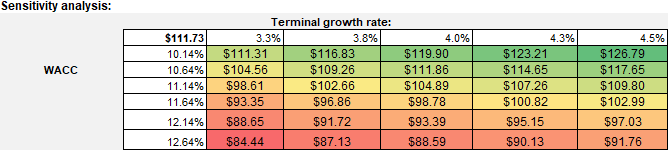

For my DCF analysis, I used the CAPM pricing model to derive a WACC of 11.13%. Using the perpetuity growth model, my valuations derive an implied share price of $97.41-$127.51, a 23% downside of its base case of $111.73 from its current price of $145.19.

ABNB DCF Valuation Model (Author)

Using sensitivity analysis for WACC and terminal growth rate (TGR), even the most optimistic scenario of 10.14% WACC and 4.5% TGR gives an implied base case price of $126.79, still far from its actual value and justifies the poor quant valuation rating.

ABNB Sensitivity Analysis (Author)

This could be attributed to the seasonality of travel, as travelers usually book summer holidays in Q1 of each year, leading to the highest unearned fees and the most positive consumer sentiment in this quarter. This trend can be seen through ABNB’s share price, where the price tends to pick up early in the year, then reverses in Apr or May.

Seasonal Trend of ABNB Share Prices (Seeking Alpha)

Hence, because annual data was used in the DCF, it did not account for seasonality and caused ABNB to be valued less from an intrinsic standpoint.

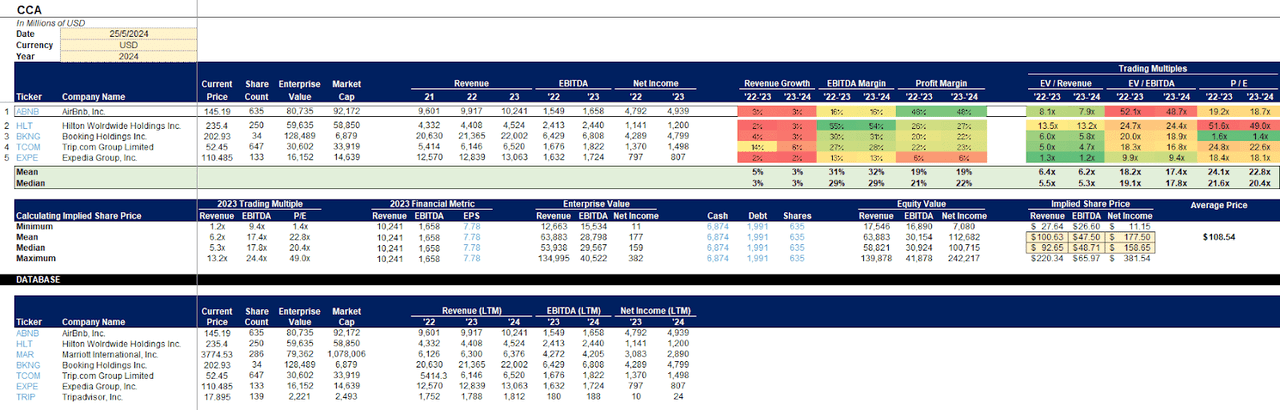

Comparable Comps Analysis of ABNB (Author)

For my comparable comps analysis (CCA), I removed MAR and TRIP due to their high P/E multiples of over 200X each to ensure P/E trading multiples were less extreme. Using LTM data, this gives a mean implied share price of $47.50-$177.50 and an average of $108.54, similar to my DCF valuation.

I believe profit margins matter more to ABNB than EBITDA margins considering it is a relatively mature company where overall profitability and returns to shareholders are important. However, with profit margins possibly elevated by significant income tax benefits, I decided to look at EBITDA and EV/EBITDA. With high EV/EBITDA but underwhelming EBITDA margins, this implies that expectations of the stock are high, but current EBITDA margins do not justify the price it is at now. Thus, with the great disparity of EV/EBITDA to EBITDA margins, my verdict is still overvaluation.

Hence, if sentiment towards the stock becomes less optimistic (e.g worse than expected performance in future quarter), the stock’s current valuation may become less justified, resulting in overall downward pressure in price closer to its intrinsic value.

Trend towards Solo Travel and Hotels

Current room prices for ABNB remain lower than that of average hotel rooms, being roughly 30% cheaper on a global average. However, in order for this to remain as part of its value proposition, we must acknowledge what factors can dampen these costs (surge in supply via listings), and what trends could drive it higher in the long run.

Firstly, average price per listing. ABNB began with a vision of being a cheaper alternative to hotels. In general, short-term rentals are 20% cheaper than hotels, but are slightly more expensive in other location types like rural areas with more open space, reflecting the greater spaces and amenities it offers. According to their Q1 2024 Earnings Call, the average cost of a one-bedroom listing on ABNB is $114, 30% less than an average hotel room of $148 globally.

ABNB vs Hotel Room Median Price Per Pax (nerdwallet.com)

However, the issue lies in solo traveling. As mentioned previously, ABNB outshines hotel accommodations in price per pax when it comes to longer term stays with multiple people. But according to Amex’s 2024 Global Travel Trends Report, over 76% of millennials and Gen-Zs plan to take a solo trip in 2024, with 66% planning one focused on self-treatment and 57% that were more likely to go solo for a quick weekend than plan for a longer, more expensive trip. The most likely destination to choose was a new urban city (29%). Hence, unless such trends are temporary, considering that hotels are in abundance in cities, and the per pax cost of an ABNB is higher than a hotel room for an individual, there may be a shift back to hotel rooms in urban areas as a more economical choice for tourists.

Legal Restrictions on Rentals

Another battle that ABNB is fighting is against legal regulations. While this varies across the world, different countries have different restrictions. Certain areas such have London and Japan limit rentals to 90 and 180 days a year respectively, affecting the number of current active listings in these regions. In addition, places like Barcelona are heavily regulated, allowing rentals in certain areas and affecting its convenience to travelers.

While regions such as South America and the Asia Pacific have less of these regulations, there is a risk that more stringent laws will arise as ABNB continues to penetrate these areas.

Hence, news of new laws imposed on short-term rentals would not only affect ADRs and revenue there, but also influence investor sentiments on ABNB’s prices.

Future Development Roadmap?

ABNB plans to use AI to reduce friction and enhance the platform’s experience through improved location, maps and search capabilities, driving higher conversions. It also aims to expand into segments beyond accommodations, suggesting more growth to enhance its moat of peer-to-peer accommodation. With its rising EBITDA, net income and cash flow margins, ABNB flagged out areas to focus on incremental growth. This includes marketing and accelerating the roadmap planned for further development.

For instance, Icons were introduced in May, with the first 11 icons showcased such as spending a night in the Ferrari museum or a VIP experience with celebrities. 4000 tickets will be offered ranging from free to less than $100. While only a select few travelers can get these incredible experiences, I believe that this is a unique approach to generate a new wave of interest towards ABNB, aiding its brand positioning efforts to become more of a household name then it already is. Since the announcement, ABNB saw a large bump in user traffic, a sign that people are curious about this new concept.

On top of this, ABNB’s roadmap also consists of several innovative developments. First, new property categories: Vacation Home, Unique, B&B and Boutiques (on top of the existing: Entire Home, Private Room and Shared Space). This expands on ABNB’s moat, providing a wider variety of peer-to-peer accommodations to suit traveler preferences better. Next, new tiers like Airbnb Plus (homes with the highest inspection and verification ratings) and Luxury that allows ABNB to compete with the luxury hotel market. Finally, a membership program (“Superguest” and “Superhost”) to provide benefits and incentives for guests and hosts. I believe that ABNB is heading in the right direction to further deepen its influence on the peer accommodation market. Furthermore, the effectiveness of these measures can be quantifiably measured through the user pickup rate, website visiting rate and booking rates of new vacation categories, allowing for timely improvements if necessary. Thus, with ABNB’s great margins and cash flows, I am confident that it can effectively roll out these initiatives.

Conclusion

In conclusion, if future news reflect risk factors such as potential overvaluation, legal restrictions and solo traveling preferences, ABNB’s ability to generate returns and thus its value may diminish.

However, I believe that ABNB is in a unique situation. It has immense long term growth potential as it continues to develop its peer-to-peer accommodation capabilities, not just to different markets but to different rental types to appeal to a wider tourist audience. With regards to overvaluation, I feel that on top of its intrinsic value, sentiment on the platform must be accounted for as well, which continues to be positive post-pandemic. With factors such as its travel demographics, resilience to macroeconomic forces, ease of entering less penetrated regions and listings with flexibility and affordability, ABNB will offer steady returns albeit seasonal trends that affect quarterly performances.

As a result, its share price will likely fluctuate based on seasonal demand and optimism by quarter, but will be driven upwards over time as its strengthening moat and business model will drive ABNB’s intrinsic value.

For the time being, investors should hold out as ABNB’s roadmap for expansion, and thus strong gains, has yet to kick in.