DKosig

The following segment was excerpted from this fund letter.

Arrow Electronics (NYSE:ARW)

Arrow Electronics (“ARW”) is the world’s largest authorized electronics components distributor (15% market share including larger shares in key markets) serving both electronics OEM customers and component suppliers. Most large component manufacturers buy directly from component suppliers. ARW has over 220,000 customers with a 90% customer retention rate and over 3,700 suppliers. ARW also distributes IT products such as servers, software, storage and computer security products. ARW has over 22,000 employees at over 219 sites located in 85 countries, including 39 distribution centers and 180 offices. Over 67% of its revenue is associated with products that include value-added services such as component design services and supply chain management services. The large portion of components associated with value-added services allows ARW to generate industry leading operating margins of 5.3%.

Arrow Radio, the predecessor to ARW, was founded in 1935 on Radio Row in New York City. In 1946, ARW was incorporated. In 1961, ARW had $4 million in sales and went public via an IPO. In 1968, Mr. Glen, Green and Wadell bought a controlling interest in ARW and executed a leveraged roll-up strategy. By 1970, ARW was generating $9 million in sales and was the 12th ranked electronics distributor. At that time, Avnet was the largest. By 1979, ARW had $177 million in sales and was the second largest distributor listed on the NYSE. In 1980, Mr. Green and Glen were killed in a fire and Mr. Wadell stepped in as CEO until 1982 when Mr. Kaufmann became CEO. In the 1980’s and 1990’s, under Kaufman’s leadership, ARW participated in more than 50 mergers and acquisitions transactions, expanded its range of products distributed and spread geographically around the world. In 1988, Arrow joint ventured (JVed) with Maruban to distribute components in Japan. In 1994, ARW entered the IT products distribution market with the purchase of Gates/FA. In the 2000s, under the leadership of Mr. Duval and Mitchell, ARW continued to purchase 17 distribution firms worldwide. In the 2010s, under the leadership of Mr. Long, ARW purchased an additional 40 distribution firms. In 2022, Mr. Keirnes became CEO, and is currently serving this role. ARW has been recognized over the past 11 years as one of Fortune’s “Most Admired Companies”.

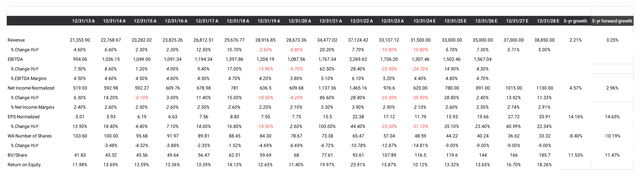

ARW has repurchased about 50% of its shares over the past 10 years most of that in the past 5 years as the pace of consolidation has slowed down. These repurchases have been accretive as ARW has sold between 5 and 10 times earnings over the past 10 years despite revenue and profit growth in-line with overall semiconductor sales growth. This has resulted in mid-teens EPS growth rates which I believe will continue if not accelerate as component demand increases through the end of the decade. Historically, ARW’s revenue has grown with the growth in worldwide component sales.

A distribution productivity measure is return on working capital, pre-tax profit/working capital. One of the best distributors in Europe, Bergman & Beving, has a goal of 45% pre-tax return on working capital. ARW’s competitors have returns on working capital of 14% for Avnet and 24% for Manica. ARW’s pretax return on working capital ranged from 20% to 30% over the past few years. This far exceeds its competitors and compares well even with the best among distributors.

ARW has generated 20% to 30% free cash flow returns on tangible equity over the past 10 years. The ability to generate these returns is the result of high customer retention rates (higher than 90%) and high free cash flow conversion ((CFO less cap-ex/CFO) – 90%). These are characteristics of a business with a durable moat. During the 2010s and into the 2020s, ARWs return on equity increased as the acquisitions and divestitures generated high incremental returns on capital (see analysis below).

ARW has five levers for cash flow growth: 1) electronic component market growth; 2) expanding the distribution franchise to new suppliers; 3) operational improvements; 4) paying down debt; and 5) distributing excess cash by buying back shares. The firm generates cash flows in excess of what is needed to modestly grow the firm, which is used to purchase firms in its target or adjacent markets. If no firms can be found that meet management’s operational and valuation criteria, then management will buy back shares as the shares have typically traded at modest valuations reflecting modest organic growth. ARW currently spends about 10% of operational cash flow on capital expenditures leaving 90% for buy-backs and mergers and acquisitions.

The business sector in which ARW competes is subject to economies of scale from distributing and value-added services and have route density characteristics with respect to the distribution of components. Evidence of the increasing scale is ARW’s high margins compared to its authorized distributor competitors.

Authorized Component and IT Products Distribution Services

ARW competes in the authorized components distribution and IT product distribution markets worldwide. ARW is the largest worldwide authorized component distribution company with a 15% market share (more than 30% in key markets) in a market with an estimated size of $195 billion in 2022. This market grew by 2.6% last year. Over the past 5 years the market grew by 4%/year and 5%/year over the past 10 years. The market is expected to grow in the mid to high single digits per year through 2030 driven by AI and the “internet of things”. The top four firms in the distribution market have a 40% market share worldwide. Two Asian firms dominate the Chinese and Taiwanese markets (combined 35% market share), one firm dominates the Japanese market (23% market share) and two US firms have 30%+ market share in the rest of the world.

Authorized electronic component distributors can be thought of receiving a royalty on a capital-intensive semiconductor industry. Value-added services (such as design services and outsourced supply chain management (SCM) services) will enhance returns on capital and add stickiness to customer relationships. The relevant market share is a country/regional market share versus an international market share. ARW is a competitor in all markets, many of which ARW is the leading firm.

ARW also competes in the IT Products distribution market. The competitors in this market provide OEM products to value added resellers and systems integrators and smaller customers. This market has historically grown at GDP levels of 2% to 3% per year.

Another aspect of electronic component and IT product distributors versus other firms in the electronic component value chain is the capital light nature of these firms. Most semiconductor and IT product manufacturers are more capital intensive and have lower free cash flow conversion. The capital light nature of the business leads to higher returns on capital. These factors, as well as consolidation have generated above-average returns on capital for the large, more scaled firms in the components distribution industry.

Component and IT distribution is a slow-moving business with many firms in this business being over 70 years old. This allows consolidation to occur, with disruption being less of a threat than in telecom, media or computer hardware industries.

As described above, organic growth in these segments is expected to be 5% annual growth rate(1) with any other growth coming from identified growth projects, acquisitions or share repurchases. In this case, buybacks add about 9-10% growth on a per-share basis.

ARW operations have become better over time as acquisitions accelerated ARW’s scale quicker than competitors. The return on equity have increased from 6% in 2012 to 2014, to 28% in 2022 and is expected to normalize in the high 10%s. Free cash flow conversion also increased from 84% in 2014 to about 93% in 2023. The return on equity drivers included increases in net income margins from 2.2% in 2014, to 2.7% in 2023, and decrease in inventory turnover from 8.8x in 2014, to 5.5x in 2023. Leverage also increased slightly from 1.6x to 2.1x EBITDA.

ARW’s 5-yr average RoICs have also increased from 10% from 2014-18 to 13.5% from 2019-23. ARW’s two closest competitors, Avnet (AVT) and TD Synnex (SNX), had lower 5-year average RoICs in 2023 (8.4% for Avnet and 10% for TD Synnex) and declines in RoICs from 2014-18 to 2019-23.

The incremental return on invested capital over the past five years is close to 100%, which has increased ARW’s RoE over the past five years. See the calculations below.

Arrow | |||||||||||||

2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 102.6% | ||

Capital Invested | 393.9 | 484.1 | 285.4 | 666 | 228.8 | 183.2 | 449.4 | 163.9 | 124.3 | 60.9 | 78.8 | 877.3 | |

2-yr sum | 769.5 | 951.4 | 894.8 | 412 | 632.6 | 613.3 | 288.2 | 185.2 | 139.7 | ||||

4-yr sum | 1664.3 | 1363.4 | 1527.4 | 1025.3 | 920.8 | 798.5 | 427.9 | ||||||

CFO | 663 | 622.8 | 718.6 | 711.2 | 748.7 | 750.9 | 986.4 | 722 | 848 | 1358.6 | 1651.2 | 900.3 | |

2yr change | 55.6 | 88.4 | 30.1 | 39.7 | 237.7 | -28.9 | -138.4 | 636.6 | 803.2 | ||||

4yr change | 85.7 | 128.1 | 267.8 | 10.8 | 99.3 | 607.7 | 664.8 | ||||||

5-yr avg | |||||||||||||

2-yr ROIIC | 7.2% | 9.3% | 3.4% | 9.6% | 37.6% | -4.7% | -48.0% | 343.7% | 574.9% | 180.7% | |||

4-yr ROIIC | 5.1% | 9.4% | 17.5% | 1.1% | 10.8% | 76.1% | 155.4% | 52.2% | |||||

Equity | 3987 | 4185 | 4159 | 4195 | 4466 | 4998 | 5376 | 4866 | 5149 | 5341 | 5611 | ||

RoE | 6.7% | 1.4% | 10.4% | 0.2% | 13.8% | 11.7% | 9.1% | 12.2% | 14.1% | 24.3% | 28.0% | 17.5% |

Downside Protection

ARW’s risks include both operational and financial leverage. Operational leverage is based upon the fixed vs. variable costs of the operations. There are economies of scale in terms of purchasing and local logistics operations.

Financial leverage can be measured by the debt/EBITDA ratio. ARW has a lower net debt/EBITDA of 2.1 versus other electrical components and IT product distributors (like Avnet, CEC Port, Macnica, ScanSource, Supreme Electronics, TD Synnex, WPG and WT Microelectronics). The history and projected financial performance for ARW is illustrated below.

Management and Incentives

ARW’s management team has developed an M&A engine and an operationally efficient firm in the electronic component distribution and value-add building products. They perform M&A when targets are available at the right price and can expand their product or geographic scope partially financed by debt, pay down debt, and return capital via buybacks when there are not opportunities to invest organically or via M&A.

The base compensation for the management team (top five officers) ranges from $11.6 million per year for the chairman of the board to $2.9 million per year for the Senior Vice President and Chief Information Officer. Over the past year, the top 5 management folks total compensation was about $35 million per year, about 2.5% of net income per year. The CEO currently hold 128,107 shares and options (worth $15.6 million), which is more than 11 times his 2022 salary and bonuses. The CEO’s compensation is structured to include a $1.1 million base pay and up to a $10.5 million performance bonus. Short-term management incentive pay is based upon meeting stretch EPS target and strategic goals and is paid in cash. Long-term management incentive paid in RSUs that include a 50% time based and 50% performance-based vesting schedule. The performance-based vesting is based upon relative EPS growth to a peer group and the difference between the return on invested capital and the firm’s weighted average cost of capital goal. In addition, performance-based vesting is based upon meeting a net income threshold.

Board members have a significant investment in ARW. The board and management owns 630,128 shares, about 0.6% of shares outstanding ($77 million). Option grants, provided to management and employees, were equal to 0.8% per year of the shares outstanding over the past three years. The CEO is required to hold 5x his salary in common stock, and other C-level management are required to hold 3x their salaries.

Valuation

Arrow Electronics | |||||||

Sensitivity Table | |||||||

Price | Upside | ||||||

Current Adjusted Earnings * | $17.12 | $557.72 | 0.052 | ||||

7-year Expected EPS Growth Rate | 15% | 0.1% | $126.68 | -0.6% | |||

Historical EPS Growth Rate | 14% | 5.0% | $267.99 | 110.3% | |||

Current AAA Bond Rate | 5.2% | Growth Rate | 7.5% | $340.42 | 167.1% | ||

Implied Graham Mutiplier ** | 32.58 | 10.0% | $412.86 | 224.0% | |||

Implied Value | $557.72 | 12.5% | $485.29 | 280.8% | |||

Current Price | $127.44 | 15.0% | $557.72 | 337.6% | |||

* Normalized earnings (2023 norm revenues * norm margin/shares outstanding) * (2*Growth Rate + 8.5) | |||||||

The key to the valuation of ARW is the expected growth rate. The current valuation implies an earnings/FCF increase of 0.1% in perpetuity using the Graham formula (EPS multiple = (8.5 + 2g)). The historical 5-year earnings per share growth has been 14% per year including acquisitions and the current return on equity of 17%. To estimate ARW’s growth rates, I started with estimates of future growth in the electronic components and IT products markets and market share growth was used to estimate an organic revenue growth rate of 6% for ARW. Factoring in operational leverage and planned buy-backs, the estimated EPS growth rate is 15%. Historically, ARW’s EPS growth rate was 14% per year driven by fourteen smaller and one larger acquisition over five years. Using a 15% expected growth rate, the resulting current multiple is 33x of earnings, while ARW trades at an earnings multiple of about 7x. If we use a 5% growth rate, which implies a 4% earnings decline with a 9% buyback per year, the implied multiple is 15x. If we apply 15x earnings to ARW’s current 2023 earnings of $17.12, then I arrive at a value of $256 per share, which is a reasonable short-term target. If we use a 15% seven-year growth rate, then we arrive at a value of $558 per share. This results in a five-year IRR of 23%.

Growth Framework

Arrow | |||||||||||||||

EPS Growth | 17.9% | ||||||||||||||

2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | $ 127.44 | 3.76 | 5-yr fwd PE | 7% growth PE | |||

19.4% | 9.43 | Earnings/FCF Yield | 22.5 | ||||||||||||

Revs | $34,477 | $37,124 | $33,107 | $29,700 | $31,500 | $33,000 | $35,000 | $37,000 | $38,850 | ||||||

8% | -11% | -10% | 6% | 5% | 7% | 7% | 5% | 6% organic growth | |||||||

2% Operation Lev | |||||||||||||||

NI | $1,137 | $1,465 | $977 | $620 | $780 | $891 | $1,015 | $1,130 | $1,187 | 9% Repurchase | Future SP | $762.98 | |||

3.3% | 3.9% | 3.0% | 2.1% | 2.5% | 2.7% | 2.9% | 3.1% | 3.1% | 17% Total EPS growth | IRR | 43% | ||||

EPS | $16.70 | $24.70 | $13.52 | $12.76 | $17.64 | $22.14 | $27.72 | $33.91 | $39.13 | ||||||

48% | -45% | -6% | 38% | 26% | 25% | 22% | 15% | History | EPS GR Rate | ||||||

Buyback | 5 | 19% | |||||||||||||

9% /year | 68.1 | 59.3 | 53.4 | 48.6 | 44.2 | 40.2 | 36.6 | 33.3 | 30.3 | ### | 10 | 14% | |||

Another way to look at growth and the valuation of companies is to estimate the EPS five years into the future and see how much of today’s price incorporates this growth. I am also assuming 70% of net income will be used for buybacks, consistent with historical buyback levels. Using the same revenue described above results in a 2028 EPS of $33.91, or 3.8x the current price. Assuming a steady-state average growth rate from 2027 on of 7%, then this results in a fair value Graham multiple of 22.5x or $762 per share, higher than the five-year-forward valuation above of $558 per share.

Comparables and Benchmarking

Below are the building product distribution firms located in the United States. Most of ARW’s competitors are private firms. Comparatively, ARW’s debt is on the low end of the range, its inventory turns and margins are better and it has higher return on tangible equity (RoTE). The low debt allows ARW to return much of its generated cash flow to investors via share buy-backs. ARW also has the one of the highest RoTEs with multiples lower than firms that have similar RoTE (WY Microelectronics).

Price | Book Value | Tang Book Value | 2024 Earnings | Inv Turns | EBITA Margin | RoE | RoTE | P/E | P/BV | Net Debt/EBITDA | EBITDA Int Coverage | |

Component Distribution | ||||||||||||

Arrow Electronics | 127.44 | 107.89 | 67.42 | 11.85 | 5.51 | 4.9% | 11.0% | 17.6% | 10.8 | 1.18 | 2.19 | 5.44 |

Avnet | 48.53 | 51.94 | 43.41 | 5.75 | 4.10 | 4.3% | 11.1% | 13.2% | 8.4 | 0.93 | 2.89 | 4.05 |

WPG | 91.7 | 48.63 | 45.36 | 3.28 | 6.01 | 1.5% | 6.7% | 7.2% | 28.0 | 1.89 | 9.38 | 1.77 |

WT Microelectronics | 140.51 | 78.56 | 74.8 | 10.14 | 6.19 | 1.4% | 12.9% | 13.6% | 13.9 | 1.79 | 1.09 | 3.75 |

Macnica | 6993 | 3815 | 3700 | 693 | 4.49 | 6.4% | 18.2% | 18.7% | 10.1 | 1.83 | N/A | N/A |

CECport | 18.07 | 4.86 | 4.82 | 0.36 | 4.18 | 2.0% | 7.4% | 7.5% | 50.2 | 3.72 | 13.50 | 4.90 |

Supreme Electronics | 178.2 | Neg | 27.62 | N/A | 3.0% | N/A | 6.5 | N/A | 0.99 | 4.90 | ||

IT Distribution | ||||||||||||

TD Synnex | 116.31 | 93.3 | 34.7 | 12.04 | 6.78 | 2.8% | 12.9% | 34.7% | 9.7 | 1.25 | 1.75 | 7.41 |

ScanSource | 41.59 | 37.91 | 27.83 | 3.4 | 4.74 | 3.6% | 9.0% | 12.2% | 12.2 | 1.10 | 3.14 | 7.15 |

Risks

The primary risks are:

- slower-than-expected market growth (currently projected to be 5% growth rate) due to slower than expected AI and/or internet of things roll-outs;

- lower-than-expected free cash flow conversion; and

- a lack of new investment opportunities (mergers and acquisitions) coupled with higher stock prices making buybacks less accretive.

Potential Upside/Catalyst

The primary catalysts are:

- faster-than-expected market growth due to quicker roll out of artificial intelligence and internet of things roll-outs; and

- higher than expected free cash flow conversion.

Timeline/Investment Horizon

The short-term target is $256 per share, which is almost 50% above today’s stock price. If the continued component growth due to AI and internet of things thesis plays out over the next five years (with a resulting 15% earnings per year growth rate), then a value of $600 (midpoint of the two methods described above) could be realized. This is a 39% IRR over the next five years.

Footnotes 1Based upon management’s estimates of 3-5% market growth rate plus market share gains. The total 5-year projected annual revenue growth is 5% (14% on a per share basis) with the historical revenue annual growth rate of 3% (12% on a per share basis). Disclaimer This letter does not contain all the information that is material to a prospective investor in the Bonhoeffer Fund, L.P. (the “Fund”). Not an Offer: The information set forth in this letter is being made available to generally describe the philosophies of the Fund. The letter does not constitute an offer, solicitation or recommendation to sell or an offer to buy any securities, investment products or investment advisory services. Such an offer may only be made to accredited investors by means of delivery of a confidential private placement memorandum, or other similar materials that contain a description of material terms relating to such investment. The information published and the opinions expressed herein are provided for informational purposes only. No Advice: Nothing contained herein constitutes financial, legal, tax, or other advice. The Fund makes no representation that the information and opinions expressed herein are accurate, complete or current. The information contained herein is current as of the date hereof but may become outdated or change. Risks: An investment in the Fund is speculative due to a variety of risks and considerations as detailed in the Confidential Private Placement Memorandum of the Fund, and this letter is qualified in its entirety by the more complete information contained therein and in the related subscription materials. No Recommendation: The mention of or reference to specific companies, strategies or instruments in this letter should not be interpreted as a recommendation or opinion that you should make any purchase or sale or participate in any transaction. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.