59 days

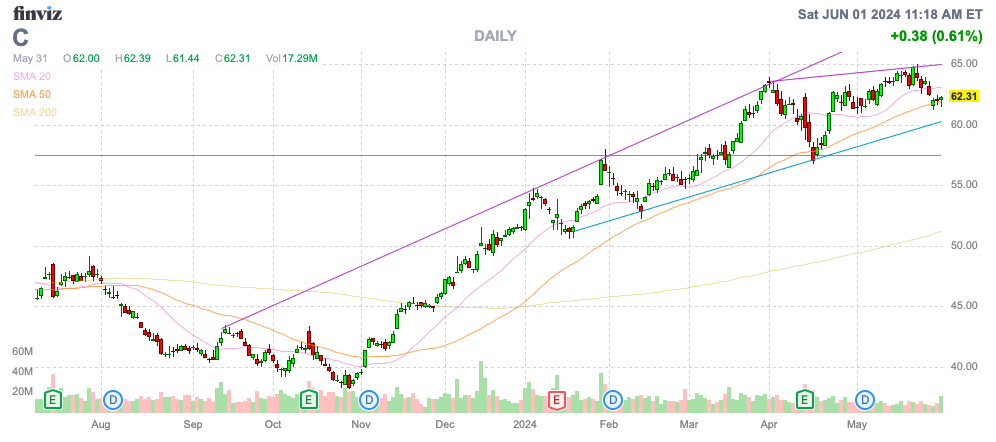

Citigroup (New York Stock Exchange:C) has long been one of the most undervalued bank stocks, but the company has struggled to generate growth that will reward shareholders. The stock finally joined the big bank rally as Citigroup Inc. rallied from its November lows. It is trading at less than half its tangible book value. Investment Thesis We remain very bullish on the recovery of major bank performance.

Source: Finviz

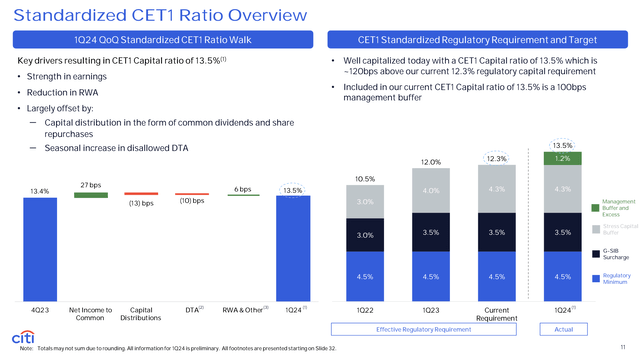

Reduced capital requirements

A big part of what’s negative about big banks over the past few years has been never-ending increases in capital requirements — and the more restrictive the capital requirements, the harder it is for banks to buy back cheap stock to reward shareholders.

Citigroup ended the first quarter with a CET1 capital ratio of 13.5%, a ratio that has increased by 300 basis points over the past two years due to higher capital requirements and proposed Basel III banking rules that are already expected to significantly increase capital. The current regulatory capital ratio is 12.3%.

Source: Citigroup Q1 2024 Presentation

upper Announcement of first quarter 2024 financial resultsCFO Mark Mason spoke about the company’s current strong capital position:

Our provisional CET1 capital ratio ended the quarter at 13.5%, approximately 120 basis points, or more than $13 billion, above our regulatory capital requirement of 12.3%. That said, our current capital requirement does not yet reflect our simplification efforts, transformation benefits, or full execution of our strategy, all of which we expect to reduce our capital requirements over time.

As mentioned above, Citigroup ended the first quarter with $13 billion in surplus capital, but banking regulators were expected to raise capital requirements through 2020. An additional 19% Through new capital requirements. These plans are in the process of significantly reducing already prohibitively high capital requirements. Large banks with assets of more than $750 billion now hold about 13% of their risk-weighted assets as capital, up from just 7% before the financial crisis.

Barclays estimates that the big eight banks would need up to $150 billion in additional capital under the initial proposed rules. Banks were already building up capital for the new rules, which aren’t due to take effect until 2025 and be fully phased in by 2028.

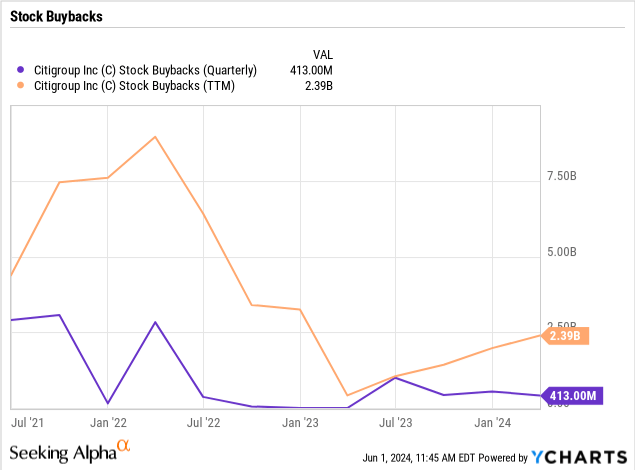

Citigroup has resumed share buybacks after making significant cuts in 2023. Citigroup bought $413 million worth of stock in the first quarter and has spent $2.4 billion on share buybacks in the past 12 months.

That’s a significant amount, considering Citigroup’s market cap is only $120 billion, even after the big gains over the past six months. The banking giant already pays a 3.4% dividend yield, so share buybacks only add to the capital return calculation, returning $1.5 billion to shareholders in the first quarter of 2024 alone.

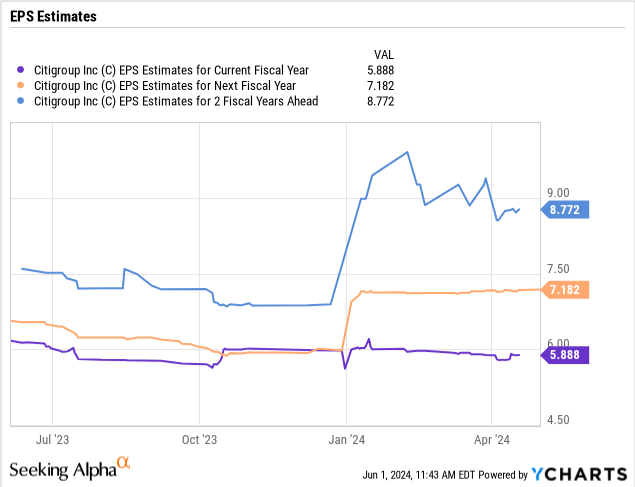

Improved profitability

Ultimately, the EPS situation is one where Citigroup needs continued growth to justify its share price rise: The bank makes about $6 a year in profits, and consensus estimates predict it will post substantial gains over the next two years, with EPS hitting $8.77 in 2026.

In the first quarter, Citigroup delivered profits of $3.1 billion and a RoTCE of 7.6%, which investors should view as a benchmark that it has the ability to achieve double-digit RoTCE, in line with other large banks.

Management continues to target a medium-term RoTCE target of between 11% and 12%, fueling the potential for strong EPS growth. The 2026 EPS target will bring Citigroup closer to its 11% RoTCE target.

The odd thing is that this big bank’s stock has always traded well below its tangible book value: Citigroup increased its tangible book value to $86.67 in the first quarter, up 3% from a year ago, but its shares ended the week at just $62.31.

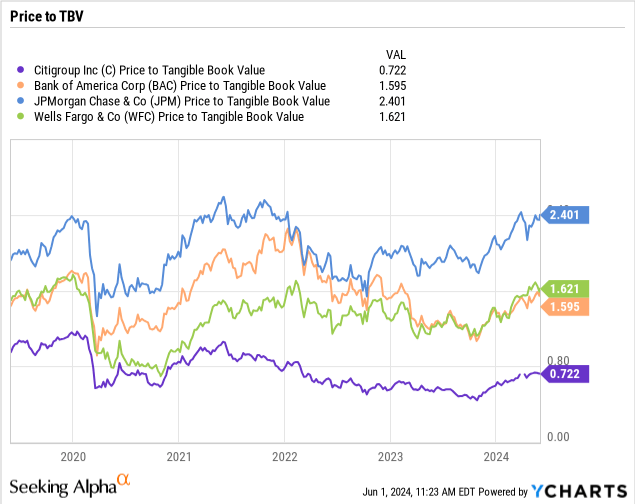

The stock is currently trading at 0.7x TBV, while other large bank shares are trading at at least double TBV. JPMorgan Chase (JPM) stock price recovered to 2.4 times TBV, Bank of America (Blood alcohol content) and more Wells Fargo (World Economic Forum), is held back by an asset cap and is trading at just over 1.5x TBV.

Meanwhile, Citigroup has undertaken multiple turnaround plans without success. The company’s stock has consistently traded below its TBV due to its past failure to improve its business and sustainably grow revenue and profits. The bank’s stock should never fall to $40, but investors could find the stock stuck at $60 if management again fails to turn around its financial situation.

remove

The key takeaway for investors is that Citigroup shares remain very cheap: While the banking giant has a path to strong EPS growth, primarily through strong returns, it can’t afford to trade below TBV when industry stocks are trading at multiples of at least 2x.

Investors should continue to buy shares given the stock price is just $60 and the potential for growth driven by growth drivers. Needless to say, some reduction in expected capital requirements will help boost capital returns.