Sorapop/iStock via Getty Images

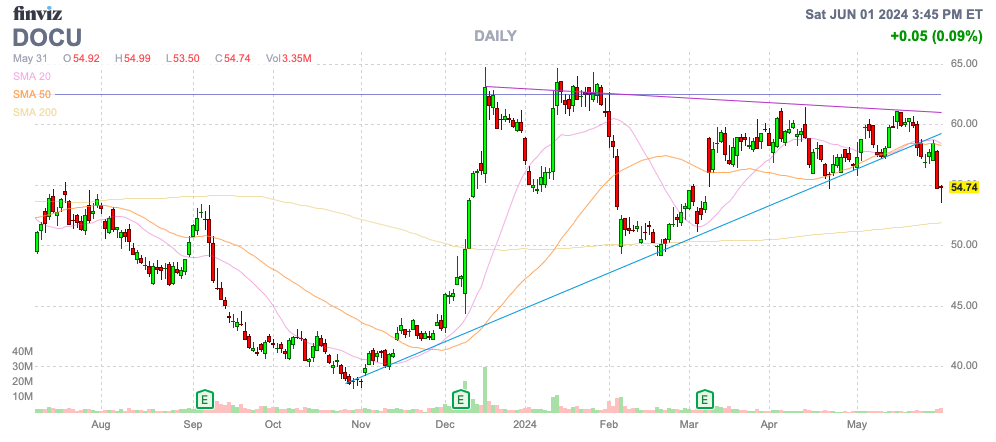

DocuSign Inc. (Nasdaq:documentary) is releasing a new quarterly report amid rising hopes for a business turnaround. The e-signature company expects an expansion of its AI product portfolio to drive growth in FY25. Investment Thesis I am bullish on the cheap stock, especially given the recent sell-off leading up to the release of Q1’25 earnings.

Source: Finviz

Finding the bottom of the cycle

DocuSign is buoyed by a strong revenue increase for the fourth quarter of 2024 and signs that AI could help drive growth opportunities for its contract management business. Investors will be hoping for solid indications that the company is on track to deliver a strong second-quarter revenue boost when it reports after the market closes on Thursday.

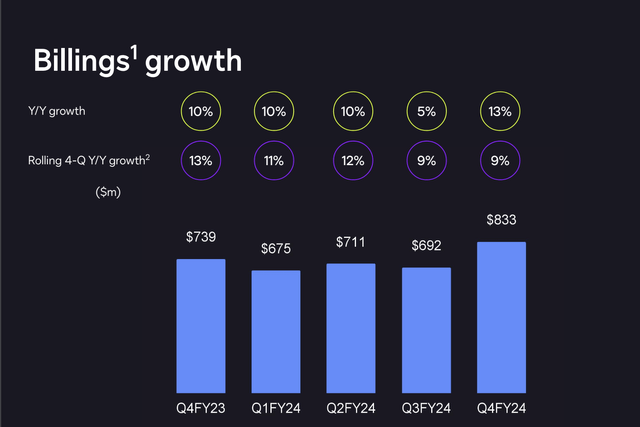

When the company released its fiscal 2024 results three months ago, DocuSign reported a surge in revenue toward the end of the year. Its January quarter revenue was up 13% year over year. E-sign predicted that current growth rates for the April quarter would be modest.

Source: DocuSign FQ4’24 presentation

The company attributed the sharp increase in billings in part to strong renewals, including early billings from large customers. DocuSign suggests usage continues to grow despite overall weakness in major residential markets.

Billing guidance for fiscal 2025 is around $3 billion, up just 3.5% from the $2.9 billion just reported for fiscal 2024. The guidance did not support any expected recovery or increases from AI.

If DocuSign can identify a bottom line for its business, the stock could start to gain momentum — otherwise, revenue growth of just 3% is not very appealing.

The company announced the following figures for the first quarter of 2025:

Total Revenue | $704 | To | $708 |

Subscription Revenue | $686 | To | $690 |

Billings | $685 | To | $695 |

Non-GAAP Gross Margin | 81.0% | To | 82.0% |

As mentioned above, all eyes are on billings. Last quarter, DocuSign billed $675 million, so anything below the midpoint would represent essentially flat growth and suggest the business won’t turn around after the CEO change in 2022.

AI is the next opportunity to gain momentum in contract management concepts. Customers need better ways to monitor huge numbers of contracts, and AI’s assistance is a great opportunity.

DocuSign has recently Acquires LexionAcquired Lexion, a provider of AI-powered contract management software, for $165 million in cash. The company has a large cash balance and generates strong cash flows, resulting in only a small cash outlay. The key question is whether Lexion can accelerate the growth of intelligent contract management (IAM) with AI innovation.

Downside risks are limited

The main reason the offer was unattractive was the valuation and limited downside risk at current levels: DocuSign shares are trading near $55, just 17 times its fiscal 2025 EPS target of $3.24.

The company generated nearly $1 billion in free cash flow last fiscal year, so selling shares at a market cap of $11 billion doesn’t make sense. Not to mention, DocuSign ended last quarter with a cash balance of $1.2 billion and paid down all of its outstanding debt during the last quarter.

For a company with a $3 billion revenue base and existing total TAM of $50 billion, the AI opportunity is very attractive, especially considering DocuSign has reduced costs and expects FY25 operating margins of 27%+ and annual free cash flow of approximately $800 million.

The macro environment is not encouraging end-user software demand. Opportunities remain to own DocuSign based on its strong cash flow business, gain additional market share, and expand the contract management market with its AI solutions.

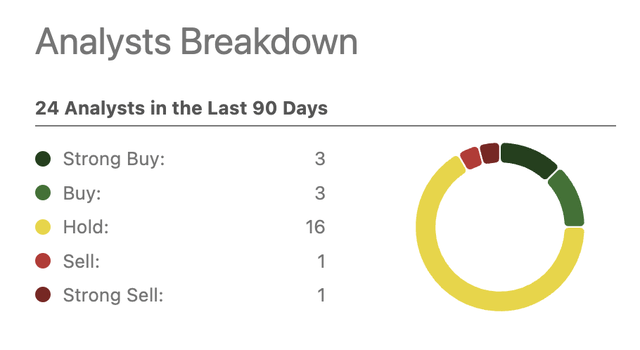

Wall Street analysts are not bullish on the stock, with 16 stocks rated with a Hold rating and only 6 with a Strong Buy/Buy rating. The lack of bullish analysts could be a contrarian indicator.

Since businesses don’t appear to be investing aggressively in AI software, it’s unlikely that DocuSign will significantly surpass its initial billing targets. However, the company has recently provided conservative guidance that suggests it may surpass expectations. The real question is whether Q1 2025 billing growth represents the bottom of the current long-term cycle.

remove

The key takeaway for investors is that DocuSign appears to have a strong catalyst in its AI-powered software solutions, and while the market is not positive on the upcoming opportunity, downside risks appear limited due to the strong cash balance and cash flow generation.

DocuSign is unlikely to see a surge anytime soon, but the stock is expected to continue to rise through next year.