Industrial Donut Pick/iStock via Getty Images

Notes:

I’ve got you covered Hyzon Motors Co., Ltd. (Nasdaq:Hizzun, Nasdaq:HYZNW) so investors should view this as an update. my Previous Post About the company.

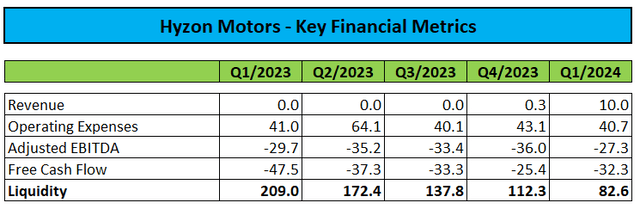

Earlier this month, Hyzon Motors Inc. (commonly known as “Hyzon”) Q1 2024 Results Increased revenue from end customer acceptance of 10 motorcoaches and 1 garbage truck in Australia:

But the company continues to burn through cash at an alarming rate and will need significant additional capital to get through next year.

As a result, management was forced to include a going concern warning for Hyzon. Quarterly Reporting Form 10-Q (emphasis added):

The Company has recorded a net loss since inception. Net cash used in operating activities was $31.2 million and $46.0 million for the three months ended March 31, 2024 and March 31, 2023, respectively. As of March 31, 2024, the Company had $52.4 million of unrestricted cash and cash equivalents, $30.2 million of short-term investments and $6.0 million of restricted cash. The Company incurred net losses of $34.3 million and $30.3 million for the three months ended March 31, 2024 and March 31, 2023, respectively. Accumulated deficits amounted to $276.9 million and $242.6 million as of March 31, 2024 and December 31, 2023, respectively.

The Company has concluded that, as of the date of this filing, it believes that its financial resources, existing cash resources and additional sources of liquidity are insufficient to support its planned operations beyond the next twelve months and therefore that there is significant doubt about its ability to continue as a going concern.

upper Conference callManagement has said it will prioritize strategic investors, but with the FCEV truck market still in its early stages and the company’s stock price at an all-time low, it’s unlikely there will be a large influx of potential investors.

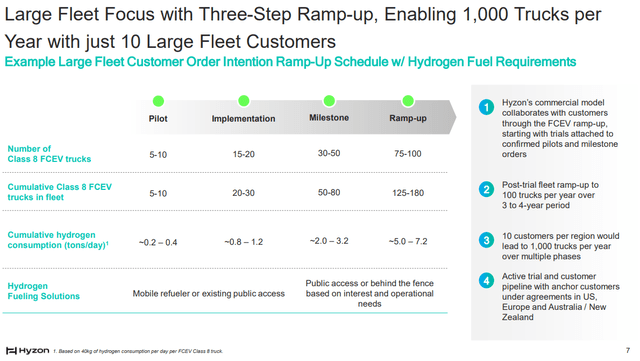

Like its larger competitor, Nikola Corporation or “Nikola” (NKLA), Hyzon is focused on large fleet deployments.

However, this approach is likely to face an uphill battle due to several key issues.

- Extensive testing requirements.

- The decision-making process is lengthy, especially when it comes to new technologies.

- the continuing lack of hydrogen infrastructure;

- concerns about the company’s financial viability;

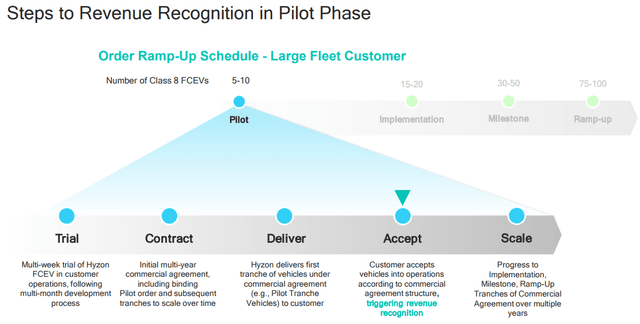

- Customers want companies to bear the financial risks associated with new technologies.

In particular, the latter point impacts the timing and treatment of revenue recognition in the early stages.

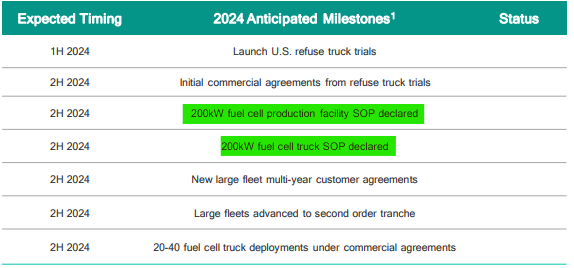

The company aims to introduce 20 to 40 FCEV trucks this year, the majority of which will still be powered by Hyzon’s conventional 110kW fuel cell system.

But as management noted on the conference call, achieving these relatively modest targets will require additional capital.

We are purposefully managing our working capital and associated net cash burn by placing fewer trucks per fleet across our prioritized larger fleets, while maximizing the commercial foundation we have in place to enable expansion in 2025 and 2026. Hyzon is tied to progress on a strategic capital raise, which may be adjusted pending the results of this year. Finally, we are focused on strengthening our balance sheet and securing additional capital to fund our operations.

The company continues to aim for commercial production of the new 200kW fuel cell system in the second half of the year.

Company Presentation

But by any standards, Hyzon will need significant new capital later this year to execute its business plan.

Assuming a quarterly cash burn of $28 million, the company will need more than $100 million to get through next year.

Given Hyzon’s market capitalization of $128 million, a full-scale share issue would almost certainly result in significant dilution for existing shareholders.

The company has no debt, but it also doesn’t have significant assets, so issuing secured debt is not an option.

But like Nicola, Hyzon Toxic Convertible Bonds Similar to a direct equity offering, albeit aimed at specialized institutional investors, shareholder approval would be required to increase the total number of authorized shares significantly above the current 400 million share threshold, as outlined in the company’s quarterly report on Form 10-Q (emphasis added).

We intend to improve our liquidity through a combination of equity and/or debt financings, alliances or other partnership arrangements with entities interested in our technology, and the liquidation of certain inventory balances.

If we raise capital by issuing equity securities in the future, dilution to our stockholders could occur, which could be substantial, and we may be required to seek stockholder approval to increase our authorized capital and issue equity securities. The equity securities issued may also be given rights, preferences and privileges senior to those of common stockholders.

If we raise funds in the future by issuing debt securities, these securities may have rights, preferences and privileges senior to those of our common stockholders.

The terms of our debt securities or borrowings may impose significant limitations on our business. (…)

Given Hyzon’s large cash requirements, lack of scale, and slow pace of FCEV truck adoption, it is unlikely the company will be successful in its search for a strategic investor, especially given the fact that its largest shareholder and core IP provider remains Chinese company Horizon Fuel Cell Technologies.

Given these issues, we expect Hyzon to hit the market with some sort of equity-linked initial public offering later this year, but given the amount of money required, it also seems likely that significant dilution would occur.

Therefore, I strongly encourage existing shareholders to consider selling their shares and taking the next step.

risk:

While this seems highly unlikely, an unexpected strategic investment on favorable terms would likely drive the stock price up quite substantially from its current all-time lows.

Conclusion:

Hyzon Motors will require significant additional capital later this year to continue executing its business plan.

Management is seeking a strategic investor, but given that even much larger competitor Nikola has not been able to attract a strategic investor in recent quarters, I believe a highly dilutive share offering or sale of equity-linked securities is the most likely outcome at this point.

Our remaining liquidity is rapidly depleting and we are facing an increased risk of significant dilution in the near term as we require additional funding for our planned vehicle deployment later this year.

As a result, existing shareholders should consider selling their shares and taking the next step.

Editor’s Note: This article features one or more microcap stocks. Please be aware of the risks associated with these stocks.