Dilok Kraisatapong/iStock via Getty Images

ProShares Direxion Daily S&P 500 Bull 3x ETF (NYSEARCA:SPXL) is one of the most popular products to trade in a bull market. It is the ProShares UltraPro S&P 500 ETF 3x Shares (Eupro).Every day of The 3x leverage factor is a source of drift, which can be positive or negative. It needs to be closely monitored to detect changes in the drift regime. In this article, we explain what we mean by “drift”, quantify it for 22 leveraged ETFs, and comment on historical data for SPXL.

Why do leveraged ETFs fluctuate?

Leveraged ETFs often underperform the underlying index they are leveraged to by the same factor. ETF declines come from four factors: beta slippage, roll yield, tracking error, and management costs. Beta slippage is the primary factor for equity leveraged ETFs. To understand this, imagine a highly volatile asset going up 25% on day one and down 20% the next day. A perfect 2x leveraged ETF would go up 50% on day one. Then on the second day it fell by 40%. At the close of the second day, the underlying asset returned to its initial price.

(1 + 0.25) × (1 – 0.2) = 1

Over the same period, the perfect leveraged ETF lost 10%.

(1 + 0.5) × (1 – 0.4) = 0.9

This is a normal effect of leverage and rebalancing. In trending markets, beta slippage can be positive: if the underlying index rises 10% for two consecutive days, it will rise 21% on the second day.

(1 + 0.1) * (1 + 0.1) = 1.21

The perfect 2x leveraged ETF rose 44%.

(1 + 0.2) * (1 + 0.2) = 1.44

Moreover, beta slippage depends on the path: if the underlying index rises 50% on day 1 and falls 33.33% on day 2, it will return to its initial value as in the first example, except that the 2x ETF will lose one-third of its value instead of 10% as in the first case.

(1 + 1) × (1 – 0.6667) = 0.6667

Even without proof, we can see that the higher the volatility, the higher the decay rate.

Monthly and Yearly Drift Watch Lists

There is no standard definition of drift for leveraged ETFs. My definition is based on the difference between the performance of the leveraged ETF and Ñ times the performance of the underlying index over a given period, where Ñ is the leverage factor. In most cases, this factor defines a daily target relative to the underlying index. However, some dividend-focused leveraged products are defined with monthly targets (mostly defunct ETNs: CEFL, BDCL, SDYL, MLPQ, MORL, etc.).

Let’s start with a definition of “Return”. It is the return of a leveraged ETF over a given period, including dividends. “IndexReturn” is the return of a non-leveraged ETF of the same underlying over the same period, including dividends. “Abs” is the absolute value operator. “Drift” is calculated as follows:

Drift = (Return – (Index Return x N))/ Abs(N)

“Damping” means drifting in the negative direction.

index | N | Ticker | 1 month return | 1 month drift | 1 year return | 1 year drift |

S&P 500 | 1 | 5.40% | 0.00% | 28.04% | 0.00% | |

2 | 10.34% | -0.23% | 51.03% | -2.53% | ||

-2 | -9.09% | 0.86% | -32.15% | 11.97% | ||

3 | 15.60% | -0.20% | 77.34% | -2.26% | ||

-3 | -13.44% | 0.92% | -46.42% | 12.57% | ||

ICE US20+ Tbond | 1 | 2.13% | 0.00% | -8.85% | 0.00% | |

3 | 4.99% | -0.47% | -38.80% | -4.08% | ||

-3 | -5.12% | 0.42% | 36.18% | 3.21% | ||

Nasdaq 100 | 1 | 6.92% | 0.00% | 30.38% | 0.00% | |

3 | 21.18% | 0.14% | 82.60% | -2.85% | ||

-3 | -18.00% | 0.92% | -53.54% | 12.53% | ||

DJ30 | 1 | 2.43% | 0.00% | 19.80% | 0.00% | |

3 | 5.99% | -0.43% | 46.33% | -4.36% | ||

-3 | -6.04% | 0.42% | -33.49% | 8.64% | ||

Russell 2000 | 1 | 4.82% | 0.00% | 20.04% | 0.00% | |

3 | 13.11% | -0.45% | 36.45% | -7.89% | ||

-3 | -12.57% | 0.63% | -44.70% | 5.14% | ||

MSCI Emerging | 1 | 1.85% | 0.00% | 12.37% | 0.00% | |

3 | 4.32% | -0.41% | 16.84% | -6.76% | ||

-3 | -4.83% | 0.24% | -24.04% | 4.36% | ||

Gold Spot | 1 | 0.71% | 0.00% | 18.09% | 0.00% | |

2 | 0.53% | -0.45% | 26.62% | -4.78% | ||

-2 | -0.76% | 0.33% | -21.42% | 7.38% | ||

Silver spots | 1 | 14.38% | 0.00% | 28.46% | 0.00% | |

2 | 28.39% | -0.19% | 41.79% | -7.57% | ||

-2 | -25.66% | 1.55% | -44.39% | 6.27% | ||

S&P Biotech Select | 1 | 2.06% | 0.00% | 6.23% | 0.00% | |

3 | 3.49% | -0.90% | -16.81% | -11.83% | ||

-3 | -6.09% | 0.03% | -37.79% | -6.37% | ||

PHLX Semiconductor | 1 | 13.18% | 0.00% | 48.44% | 0.00% | |

3 | 41.37% | 0.61% | 131.19% | -4.71% | ||

-3 | -31.54% | 2.67% | -76.40% | 22.97% |

Leveraged Biotechnology ETF (love) is the biggest loser, down -0.90% and -11.83% for the month and year, respectively.socks) has the largest monthly and annual positive drifts, at +2.67% and +22.97%, resulting in significant losses.

Positive drifts occur with a steady trend in the underlying asset, regardless of trend direction or ETF direction. That is, a positive drift can be accompanied by a gain or loss for the ETF. Negative drifts occur with volatility in daily returns (a “whipsaw”). Whipsaws occur more frequently with a downtrend in the underlying asset.

SPXL History of Drifting

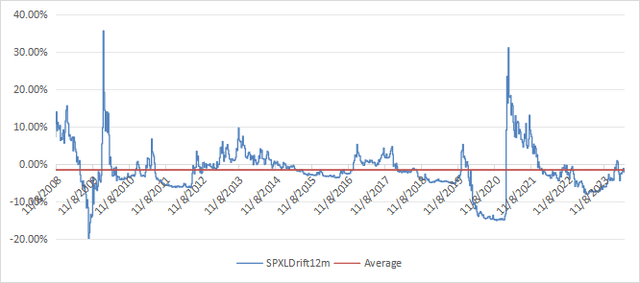

In the table above, SPXL shows mild negative drift over both periods: The following chart shows the drift over the 12 months since inception (November 5, 2008): The 12 months prior to inception data used in the calculation is a composite price calculated from the S&P 500 daily returns.

SPXL’s progress over the 12 months since its inception. (Figure: Author; Data: Portfolio123)

The average 12-month drift over this period has been negative, at -1.63%. Although SPXL has fallen since inception, the drift has been small compared to the bullish trend, with a total return of 3813% (26.55% annualized).

In the March 2020 crash, the drift fell into negative territory. In April 2021, the drift jumped to +31% after the stock market had its strongest ever rally, leading to large positive slippage. While SPY returned about 39% over the year, SPXL rose 162%. This is about 4x the underlying index return, showing the positive side of beta slippage in bullish trends. Then, between March 1, 2022 and March 1, 2023, the price movement of SPXL was horrific. SPXL fell about 36% while SPY fell 6.7%, bringing the apparent leverage factor for this period close to 6.

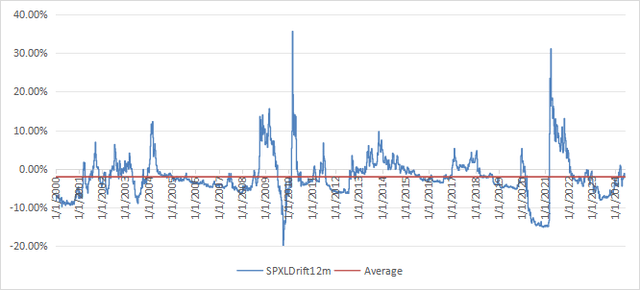

The simulated performance starting in January 2000 is concerning. There were two bear markets during this period, with SPXL’s annualized return lower than the unleveraged index (4.36% vs. 7.34% for SPY) and a maximum drawdown of -98%. This is a strong warning against a buy-and-hold strategy. The following chart shows the drift over a hypothetical 12-month period starting in January 2000. The average is -2.14%.

12-month drift since January 2000 (synthetic prices) (Figure: Author, Data: Portfolio123)

SPXL and other 3x leveraged ETFs are not long-term investments. They are trading and hedging vehicles intended for use for limited periods by experienced traders who understand their behavior well. For hedging purposes, ProShares UltraShort S&P 500 ETF (Safety Data Sheet) are relatively safe, but can experience large declines during periods of high volatility (Analysis of SDS history).