Abstract Aerial Art

Are you worried that inflation will pick up again? Your response will depend on the source. Let’s say China hits bottom and their economy starts to pick up. What will happen to commodity prices? They will probably rise as Chinese demand picks up. Cost-push inflation will occur, and if it does occur, SPDR S&P® North American Natural Resources ETF (NYSEARCA:NANR) makes sense as a way to avoid risk and benefit from it.

NANR is an exchange-traded fund that seeks to match the price and yield performance, before expenses, of the S&P North American Natural Resources Index. The index measures the performance of publicly-traded U.S. and Canadian companies in four different sub-industries (Energy, Metals & Mining, and Agriculture) within the Natural Resources & Commodities sector. All index constituents are tradable on U.S. exchanges. The index is rebalanced quarterly and It has a 45% allocation to Energy, 35% to Metals & Mining, and 20% to Agriculture, and NANR gives you access to this for just a 0.35% fee.

Top Holdings

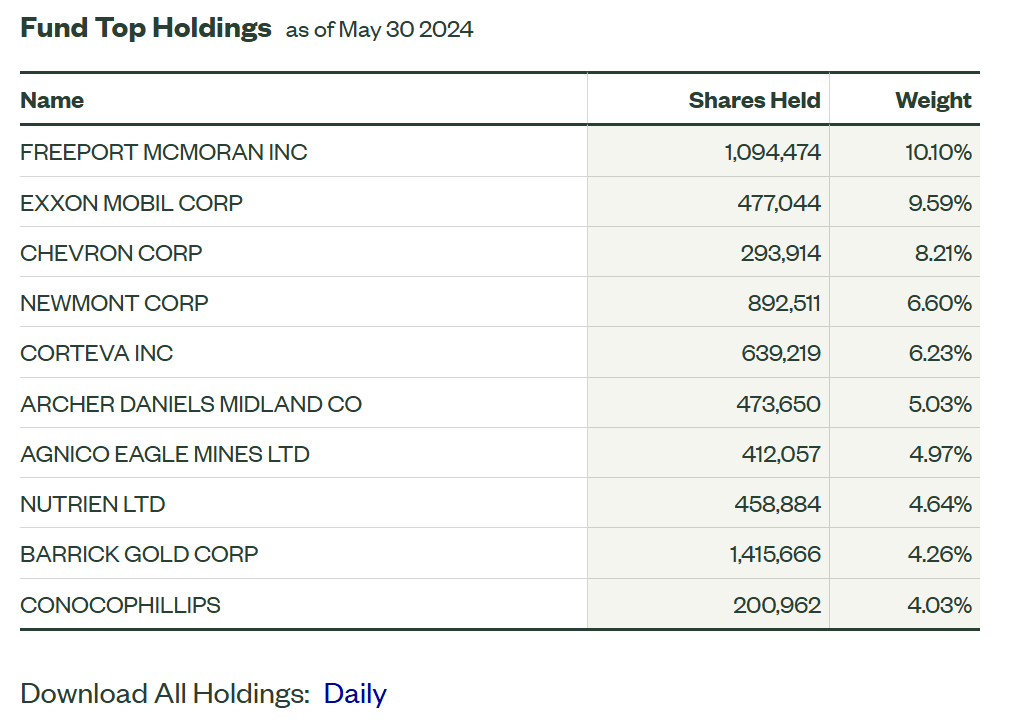

The fund is slightly top-skewed in terms of holdings, with the top 10 stocks making up 63.66% of the fund, with Freeport-McMoRan alone accounting for over 10%, and number one ExxonMobil balancing it out at 9.59%.

ssga.com

Normally this kind of concentration is not a good thing, but given the weighting of the sector targets and the overall size of the companies, I don’t think this is too much of a problem.

The total holdings are just 33. One big advantage of this seemingly concentrated portfolio is that it has strong valuations: the price-to-earnings ratio is 15.66 and the price-to-book ratio is 1.94. This is not an expensive fund, so in theory it should provide a bit of a cushion in the event of a market correction.

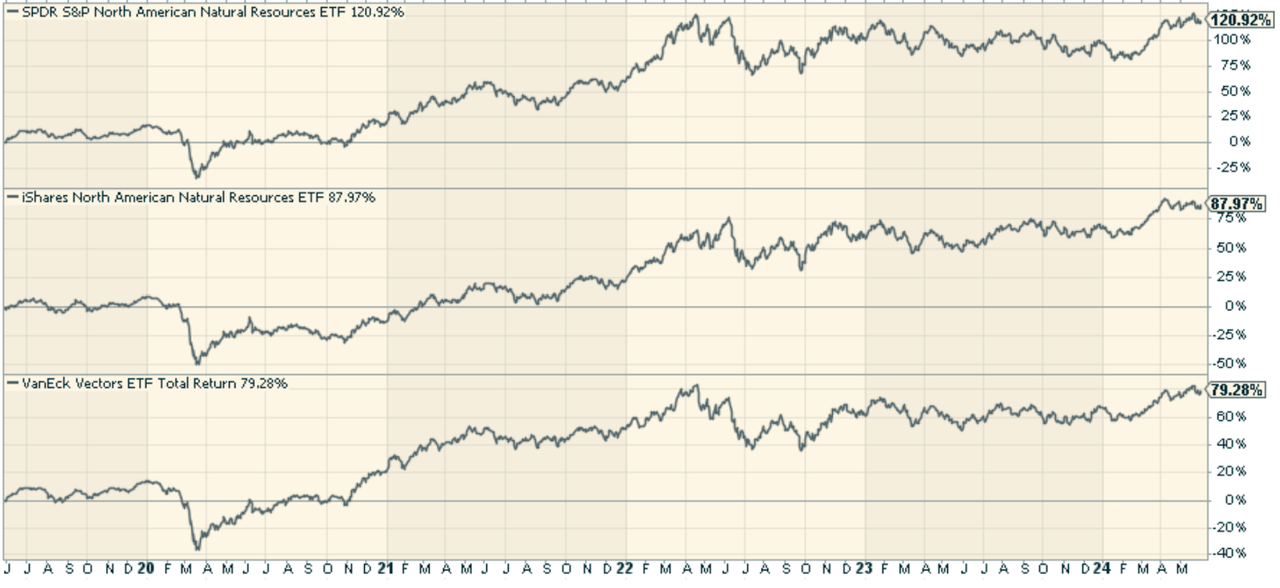

Peer Comparison: Evaluating Alternative Natural Resources ETFs

NANR is invested in through the iShares North American Natural Resources ETF (I.G.E.) and the VanEck Natural Resources ETF (HappIGE is heavily biased towards energy, investing around 80% of its portfolio in energy companies. This has been a major contributing factor to the company’s performance, as energy has been one of its best performers over the past few years. However, this makes the fund more volatile and more vulnerable to general economic weakness in the future. HAP is more diversified, investing in energy, forestry, agriculture, mining, water, and more. This broader range of investments makes the portfolio more resilient.

Comparing the performance, NANR outperforms all others. This combination worked.

Pros and Cons of Investing in Natural Resources

The natural resources sector poses special opportunities and challenges for investors. On the plus side, commodity prices tend to rise in most inflationary regimes and are currently more expensive than in the past, making the sector a useful inflation hedge (although overall not enough to offset the effects of inflation). Furthermore, many natural resources are scarce in nature, and growing demand for them around the world is likely to be a permanent feature.

However, investing in natural resources also carries significant risks as the sector is particularly cyclical. The resources sector is also often very capital intensive and requires large upfront investments, leaving it highly exposed to further interest rate increases and tighter credit terms. All these factors suggest that the sector may face difficult times ahead as the trend towards renewable energy is likely to continue. Similarly, the possibility of stricter environmental regulations for fossil fuel mining companies in the future is also a long-term negative for the traditional energy and mining sector.

Conclusion

NANR offers broad and balanced exposure to the natural resources sector, making it a less volatile way to gain exposure to the sector. Tailored to include a mix of energy, metals and mining, and agriculture, the fund overall has a solid composition and the performance to back it up, making it a worthwhile addition to your portfolio.

Predicting crashes, corrections and bear markets

Predicting crashes, corrections and bear markets

Are you tired of being a passive investor and ready to take control of your financial future? Introducing Lead-Lag Reports, an award-winning research tool designed to give you a competitive advantage.

The Lead-Lag Report is your daily source for identifying risk triggers, discovering high-yield ideas, and gaining valuable macro observations. Stay one step ahead with key insights into leaders, laggards, and everything in between.

Move from risk-on to risk-off with ease and confidence. Subscribe to the Lead-Lag Report now.

Click here to access and try the Lead-Lag report free for 14 days.