Stella Levy

The pursuit of disruptive innovation, with its tightly linked earnings and future themes, continues to capture the interest of investors around the world. ARK Israel Innovative Technology ETF (Bat:India)teeth, We’re looking at disruptive innovation emerging from Israel’s burgeoning technology sector. How? By tracking the ARK Israel Innovation Index, which provides exposure to companies leading disruptive innovation in Israel and around the world within five innovation platforms: genetic engineering and genomics, healthcare innovation, biotechnology, industrial innovation, and internet and information technology. The fund does this with an expense ratio of 0.49 percent.

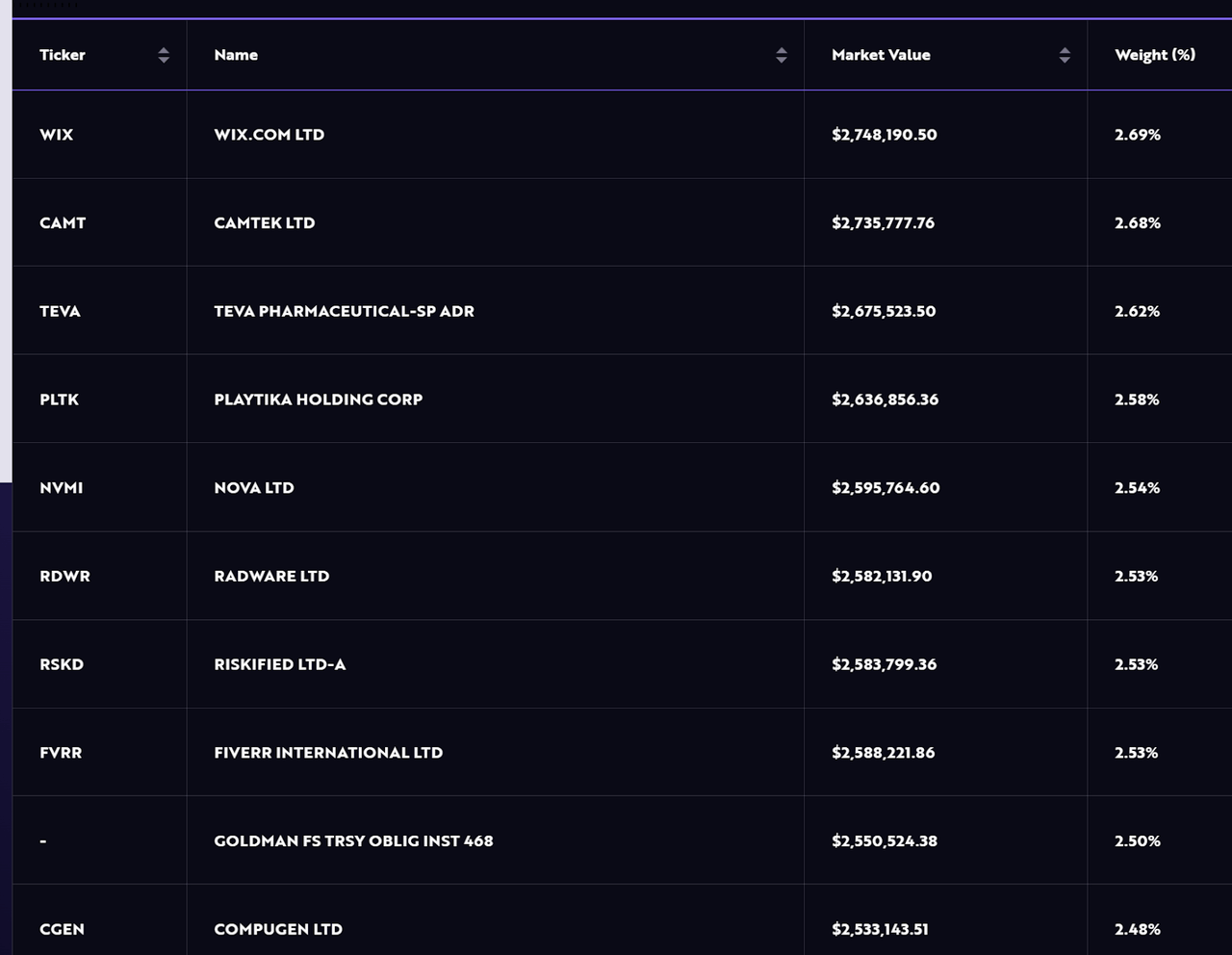

ETF Holdings

One of the great things about this fund is the composition of its top holdings. I personally don’t know much about any of the companies outside of Wix.com, Teva, and Fiverr, but that’s why Think of the ETF like this: No single position makes up more than 2.69% of the fund, providing good diversification overall.

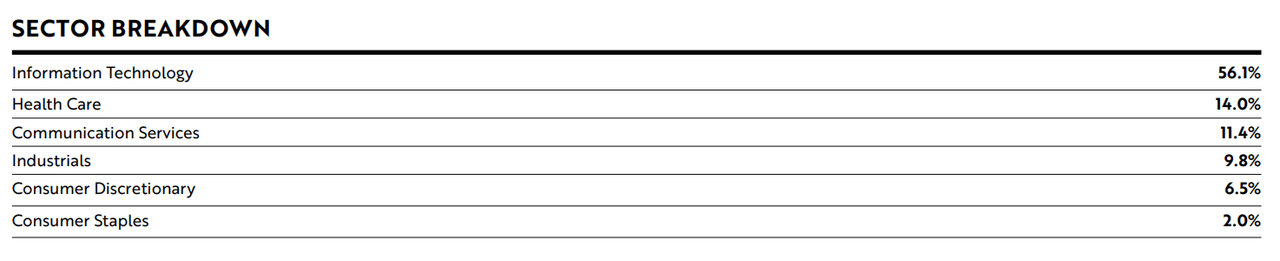

Sector Composition and Weightings

IZRL’s sector mix is heavily concentrated in Information Technology, which represents the largest weighting in the fund at 56.1%. The remaining sectors are Healthcare at 14.0%, Communication Services at 11.4%, Industrial Products at 9.8%, Consumer Discretionary at 6.5%, and Consumer Staples at 2.0%. This broad sector mix allows the fund to benefit from many facets of disruptive innovation that I have discussed previously, from medical discoveries to new digital communications and automation for the industrial sector.

Something to note about the sector mix is the overall market cap weighting. The majority of this fund is in the small cap range, which as we all know has been a tough part of the market since 2021. This could be a good thing if small caps outperform large caps in the next cycle.

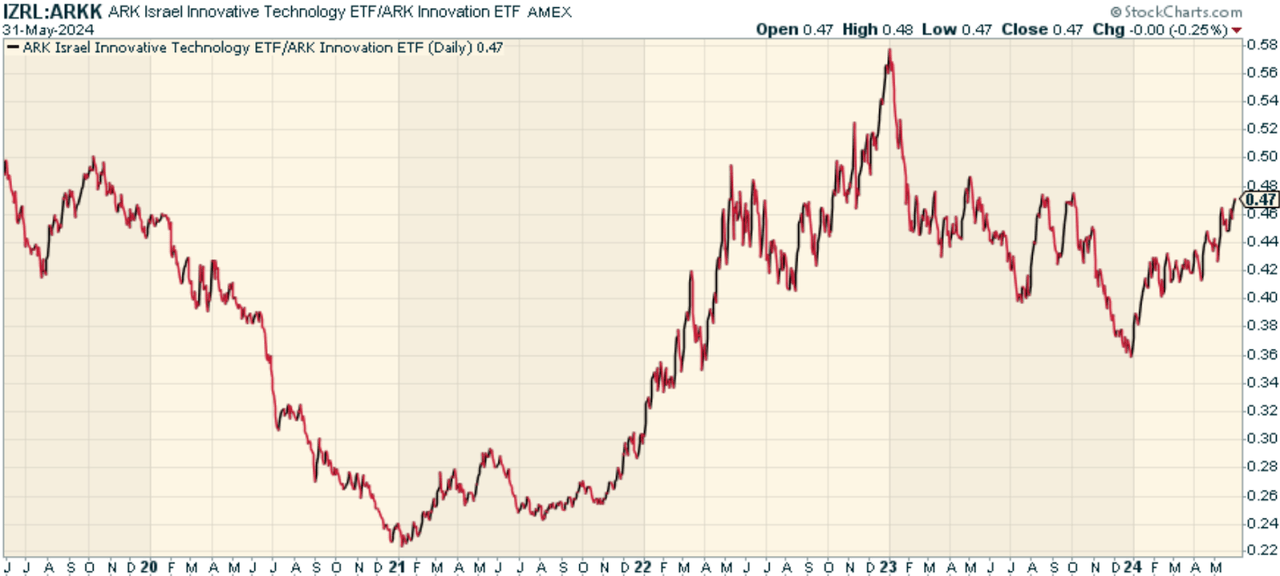

Peer Comparison

IZRL is targeted at investors looking for exposure to Israeli technology, so it doesn’t see any pure competition. That said, it has competition from the more general ARK Innovation ETF, which is not Israel-specific.arc). Looking at the price ratio, IZRL has been performing well and is likely to continue to do so in the future.

Pros and Cons of Investing in IZRL

In recent years, Israeli companies have been at the forefront of many global technology trends, including cybersecurity, medical technology, and software development. This fund is well-positioned to invest in those trends. In addition, with a highly diversified stock allocation, IZRL investors will not be overly invested in any one company. This diversification reduces the individual risk of downside.

But there are risks. The main one? Geopolitical instability in the region. Israel sits at the center of a historically unstable world region, so political unrest, war, and conflict could drive IZRL shares lower in value. Investors considering buying this stock should prepare for market turmoil and geopolitical risks. Another risk is that investing in a country fund like this means you are committing your money to one group of innovators. Israeli technology may be innovative, but it represents only a small portion of the overall market. In other words, the fund’s performance is very closely tied to the performance of Israeli entrepreneurs and companies. If there is bad news across the Israeli technology sector, the fund could take a hit.

Conclusion

Overall, we believe the ARK Israel Innovation Technology ETF is unique; it offers investors targeted access to Israeli tech stocks. IZRL’s strategic investment approach, with its focus on disruptive innovations in medical technology, cybersecurity and software development, makes it well-suited to spot future technology trends. This targeted access is further highlighted by the fact that IZRL invests exclusively in companies domiciled in Israel. Given its diverse sector mix and fairly low fee burden, IZRL may be an interesting candidate for those looking to add exposure to Israeli tech stocks to their portfolios.

Predicting crashes, corrections and bear markets

Are you tired of being a passive investor and ready to take control of your financial future? Introducing Lead-Lag Reports, an award-winning research tool designed to give you a competitive advantage.

The Lead-Lag Report is your daily source for identifying risk triggers, discovering high-yield ideas, and gaining valuable macro observations. Stay one step ahead with key insights into leaders, laggards, and everything in between.

Move from risk-on to risk-off with ease and confidence. Subscribe to the Lead-Lag Report now.

Click here to access and try the Lead-Lag report free for 14 days.