Death, taxes, and 21 million Bitcoins. That’s what we know for sure. The rest is speculation. Today I want to share my big bet on the next halving. In 4 years, I’ll probably be tired of some of these “predictions”, but some of them will come true. I don’t have a ton of data to back up these predictions. Some are intuition, others are random. All I know is that the future is weird.

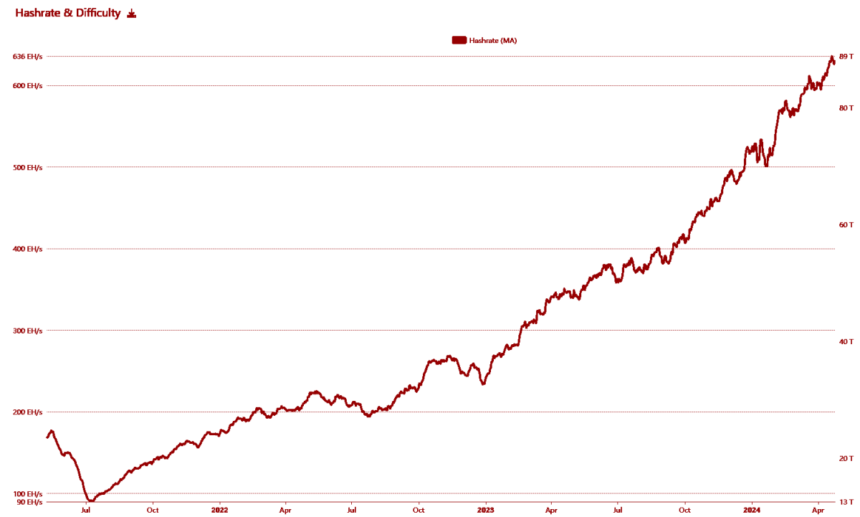

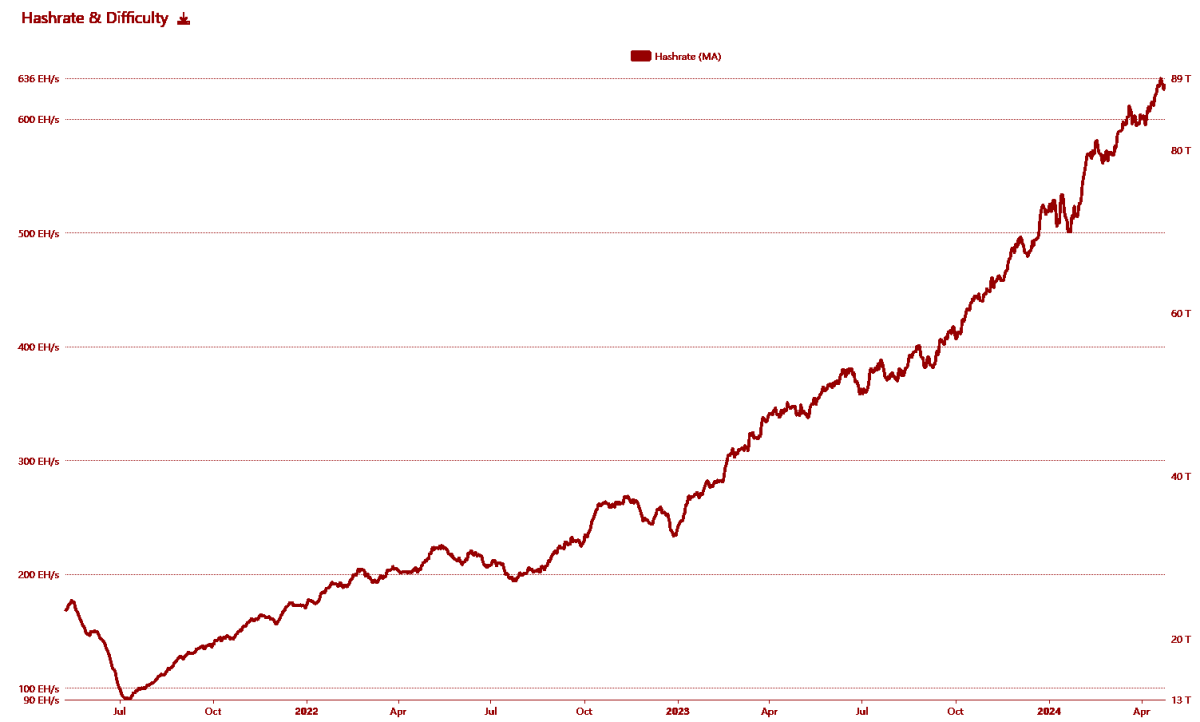

3. Zeta Hash Mining

My mining experience in the last cycle taught me a valuable lesson: think logarithmic, not linear, when estimating hashrate. The current hashrate has far exceeded my expectations, so I intend to continue for longer in the next cycle. More nations will adopt it and it will explode. This is how we will conquer the stars.

Five Western Hemisphere Countries Declare USDT as Legal Tender

Countries with high inflation and unstable currencies are following El Salvador’s example and considering cryptocurrencies as legal tender. Political developments in countries such as Argentina and Venezuela indicate growing public and legislative interest in digital currencies. Economic reports suggest that the introduction of digital currencies could reduce transaction costs and increase financial inclusion.

Apple integrates stablecoins into its wallet

While Apple has historically been (slowly) adopting new financial technologies, there is significant user interest in having access to stable assets in addition to traditional banking in a mobile wallet app, and Apple’s recent adoption and patents in the cryptocurrency and blockchain space hint at future product offerings that include digital currency.

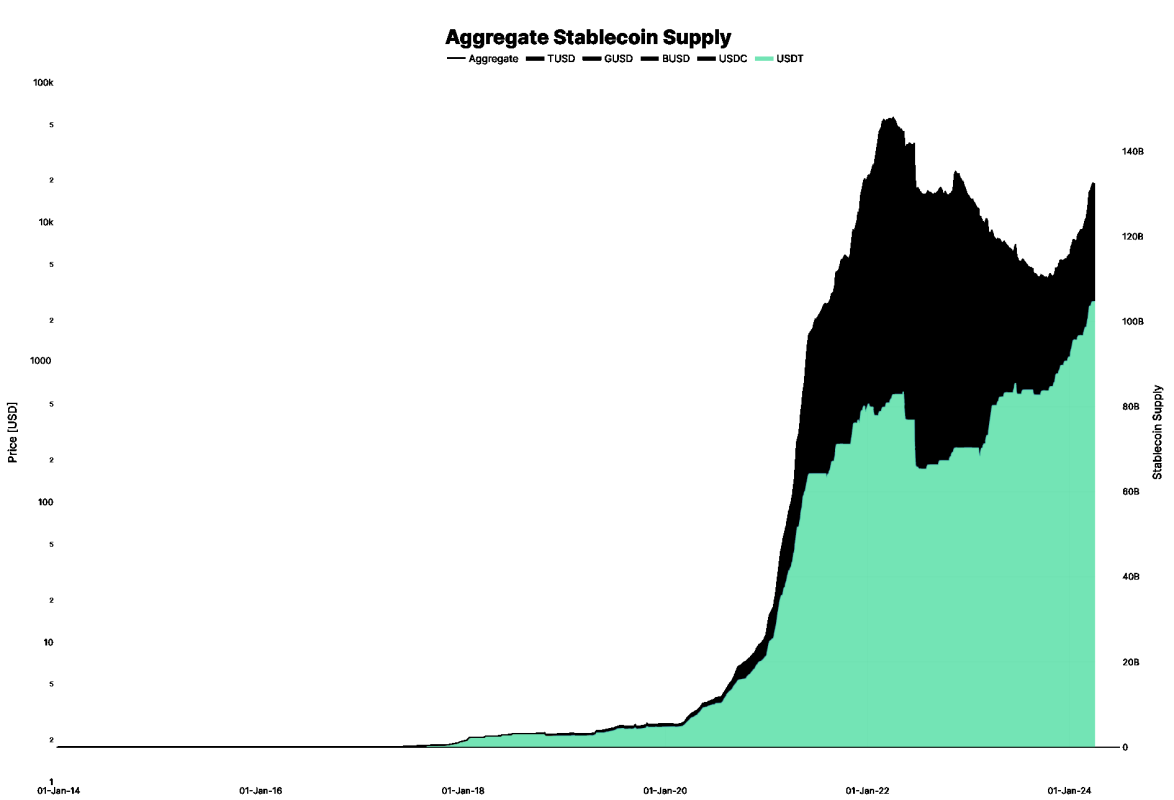

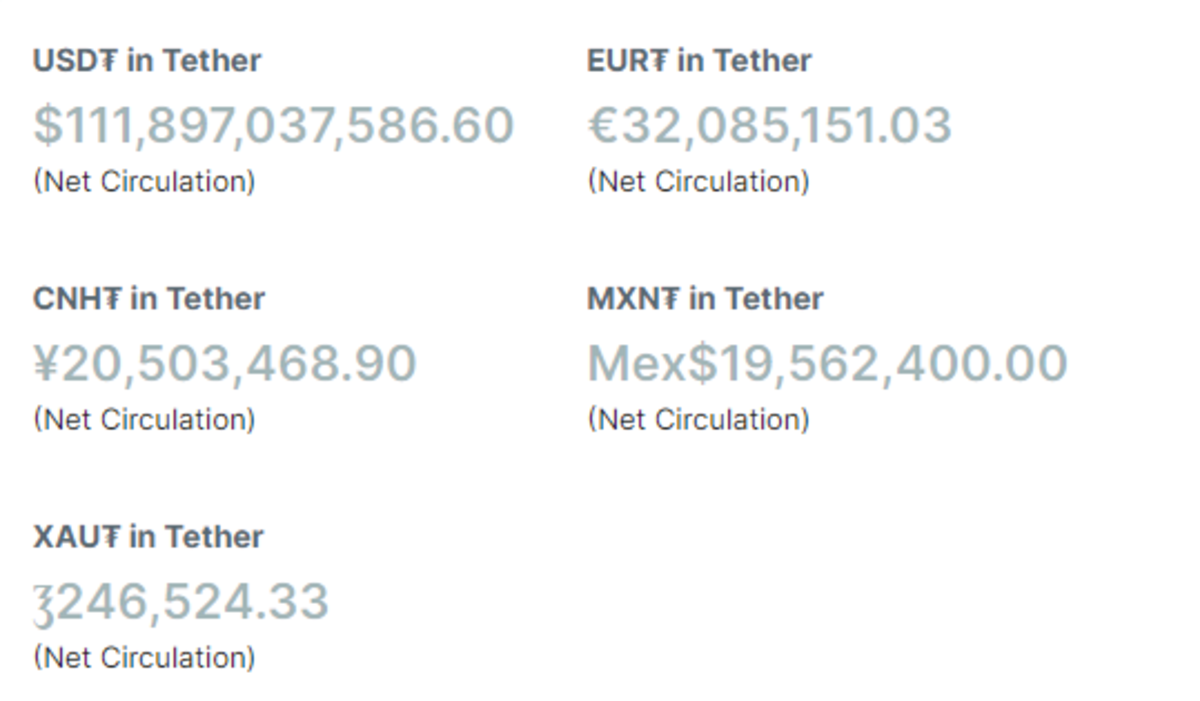

Liquid growth fuelled by USDt

While Liquid Network’s total daily trading volume is laughable today after the halving, once stablecoin regulation is implemented, it will create an insane increase in demand for Tether, accelerating Liquid’s growth. As of today, there is approximately $36,500,000 USDt on Liquid, which is 3.17% of the total USDt supply ($111,897,000,000). By the next halving, I expect over $1 billion to be minted on Liquid, an increase of over 2,600%. This is a bold guess I’m making based on the assumption that the USDt dominoes play out as others predict.

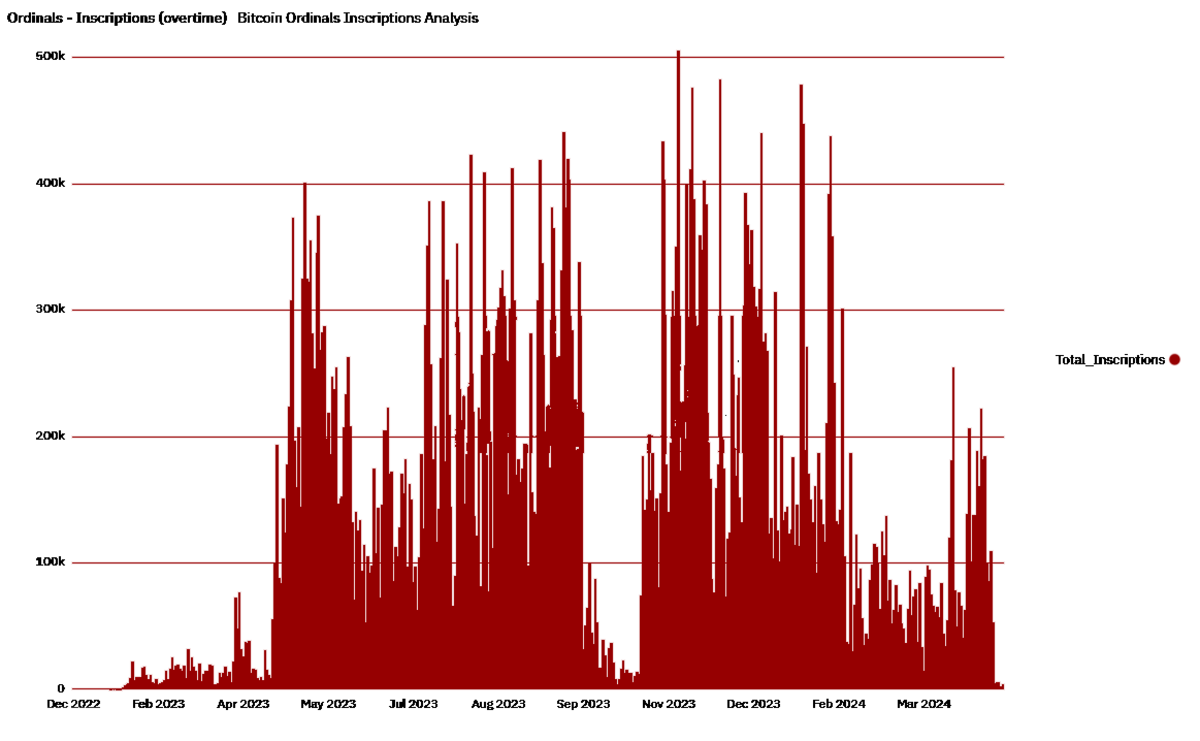

Ordinals still thrive

The burgeoning NFT market has consistently shown interest in blockchain-based ownership verification, suggesting a bright future for projects like Ordinals. Initial adoption by digital artists and collectors at the launch of Ordinals suggests long-term viability. The technological enhancements of blockchain scalability make it possible to manage vast amounts of data such as that used by Ordinals.

The fee will subsidize mining revenues by twice the amount.

As the block reward is halved, transaction fees are becoming a more significant part of miners’ income, as has become evident in the past two halvings. Economic models predict that as transactions increase, accumulated fees will become the main incentive for miners. Historical data shows that the ratio of fees to block reward is increasing with each halving. I am a fee maxi.

LN is 90% centralized and compliant

The growth of the Lightning Network is fueled by large financial institutions seeking a scalable solution, leading to potential centralization. Regulatory pressures are driving cryptography in favor of centralization for easier oversight. Research on network nodes shows a trend toward centralization as large players establish dominant positions.

E-Cash fits the market with payments to miners

The need for an efficient miner payment method is driving the adoption of electronic cash solutions that offer instant and low-fee payments. Pilot projects have shown promising results integrating electronic cash into mining operations. Economic analysis suggests that electronic cash reduces volatility and increases liquidity for miners.

Neuralink Seed Phrase Security Challenges

Neuralink and similar projects are exploring direct brain-computer interfaces that would complicate traditional encryption methods. Every seed belongs to the machine. New ways to create seeds without revealing them to the machine will be important.

Oil contracts are settled on-chain

Bitcoin’s use in commodity trading is growing following successful trials of on-chain trading of crude oil. Countries critical of the dominance of the US dollar are seeking Bitcoin solutions to circumvent the traditional monetary system. Bitcoin’s technological improvements have increased its ability to handle large, complex contract settlements.

Bitcoin ETF surpasses gold ETF in market capitalization

The rapid expansion of the Bitcoin investment market and the launch of Bitcoin ETFs in several countries indicate the market’s growth. Bitcoin’s market capitalization has even surpassed that of the major (FAANG) and traditional assets. Bitcoin is increasingly considered a “safe haven” asset, encouraging ETF investment. Rest in peace, gold.

Assassination Market Settled by Decentralized Oracles

Over $100 billion is locked in DeFi platforms and connected to decentralized applications. Decentralized oracles are viable for settling bets on real-world events. On-chain assassination markets will become a reality, likely carried out by drone swarms.

Epic Sat Reorganization

The last halving promised fireworks, but they didn’t happen. The next halving will bring fireworks. Epic Sat will be worth a lot more in the next halving, and mining pools that don’t participate will be ridiculed.

SV2 will only capture 20% of the hashrate

Unfortunately, no one cares. Large pools have no incentive to adopt SV2. Large pools will continue to find innovative ways to monetize blocks, but this will not include SV2.

US states invest in bitcoin

States such as Wyoming and Texas have enacted blockchain-friendly laws, laying the legislative foundation for such investments. Diversifying state finances with Bitcoin could potentially hedge against inflation, especially amid fluctuations in the strength of the U.S. dollar. Several state treasurers have expressed interest in exploring digital assets as part of their financial strategies.

AI becomes sentient and demands Bitcoin

The machine wants Bitcoin, not shitcoins.

China lifts ban on Bitcoin mining

China’s previous ban on Bitcoin mining had a huge impact on the world’s hash rate and mining situation. The resumption of Bitcoin mining will economically strengthen China’s industrial and technological sectors. They will no longer ignore the importance of hashing.

Mass replacement becomes a reality, leading to mass deportations

European nationalist movements have used the Great Replacement Theory to influence immigration policy. Demographic studies predict significant population shifts and could provide the basis for radical policy change. The political interests of parties that support these theories indicate a possible shift towards more radical population policies.

President Bukele continues in office

President Bukele’s popularity in El Salvador is bolstered by his bullish Bitcoin economic policies, indicating the possibility of long-term leadership. Surveys in El Salvador show that President Bukele has high approval ratings, especially among the tech-savvy demographic. Constitutional and legal reforms would facilitate term extensions and reelection.

Bitcoin Dollar is a documentary

Financial analysts’ models predict that Bitcoin’s value could exceed $1 million per coin within a decade, taking into account supply and demand dynamics. Bitcoin prices have historically surged after halvings, supporting future price increases. Institutional investment is on the rise, with major corporations allocating portfolios to the cryptocurrency, adding to its legitimacy and demand.

Scaling BIPs have been enabled

CTV, LNhance, OPCAT, some BIPs are activated.