Taizhan Sakimbayev/iStock via Getty Images

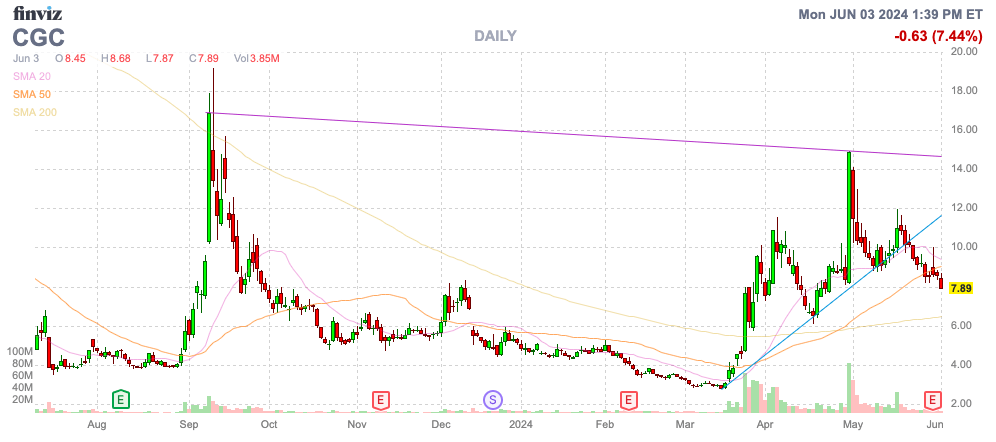

After the big gathering, Canopy Growth Corporation (Nasdaq:C.G.C.) is starting to slide in line with its weak financial results. The Canadian cannabis LP still can’t even come close to generating positive adjusted EBITDA. After years of promises. My Investment Thesis The bearish streak for cannabis stocks continues as investors lose interest in the company.

Source: Finviz

Another Ugly Quarter

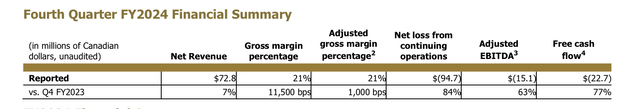

Canopy Growth spent a lot of time talking about improving its fiscal year during its fourth-quarter 2024 earnings call. March Quarter In fact, it is up 7% year-on-year, and 16% if you exclude the sold business.

Cannabis companies reported fourth-quarter numbers that highlighted their dire businesses: Canopy Growth posted adjusted gross margins of just 21%, a steep net loss and an adjusted EBITDA loss of C$15 million. The company also burned through an additional C$23 million. It continued to burn through cash during the quarter.

Source: Canopy Growth Q4 2024 earnings call

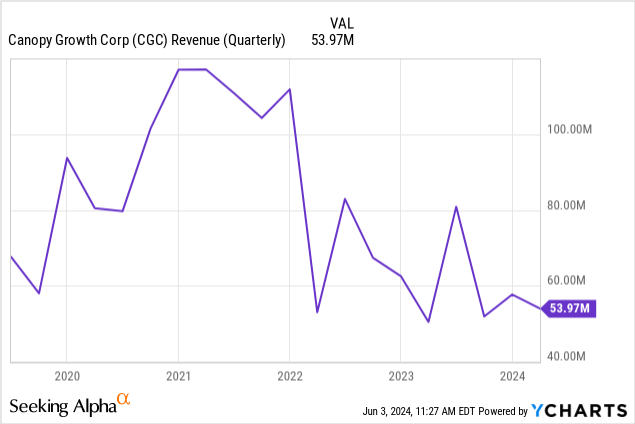

Even after years of restructuring, Canopy Growth is still far from running a sustainable cannabis business. Consistent with past complaints about the company, it has too many operations to effectively manage, with no underlying business to support its investments around the world.

Canopy Growth is expected to see its international cannabis sales grow 32% to C$12 million, and while that business is strong, its Canadian cannabis business continues to struggle, with sales from its main adult-use business down 4% year over year.

In general, Canopy Growth has simply been cycling from successful to struggling businesses without any real progress across the business. FQ4 revenue was near its lowest level in over five years. Canopy Growth actually generated revenue that was more than double its 2021 peak sales.

Investors have no reason to be interested in Canopy Growth based on the turnaround of its existing business. Their only real hope is that their U.S. investment will eventually pay off.

US Play

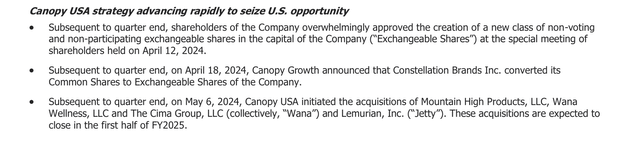

Canopy Growth has been making further investments in the U.S. over the past year through complex structures, which are described below.

Source: Canopy Growth Q4 2024 earnings call

Initially, Canopy Growth was unable to control its U.S. cannabis business due to listing requirements: Federal regulations mean that U.S. MSOs (multi-state businesses) are operating illegally and therefore cannot be listed on major stock exchanges.

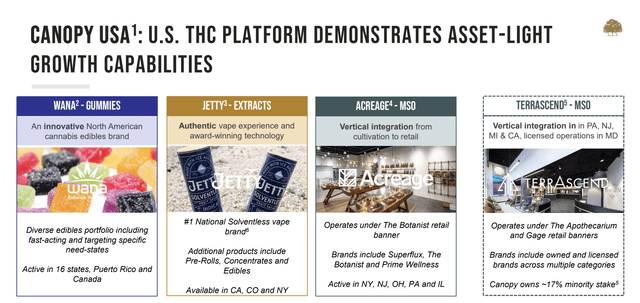

The complexity of the new non-voting share structure for ownership of Canopy USA shares is unlikely to benefit the stock price much. Canopy USA has the following positions in the United States:

Source: Canopy Growth FQ3’24 Presentation

Canopy USA owns 100% of the outstanding shares of Wana and approximately 75% of the outstanding shares of Jetty. Even more interesting is its investment in MSO. Acreage Holdings Inc. (OTCQX:ACRF, OTCQX:ACRDF) and Terra Ascend Inc. (OTCQX:TSNDF).

Given its lackluster performance in Canada, one really has to wonder how Canopy Growth will juggle these additional businesses in the U.S. under its complicated ownership structure.

upper 2024 Q4 Financial Results AnnouncementCEO David Klein acknowledged that conditions at the company’s longest-standing investment in the U.S. are less than ideal (emphasis added).

Regarding Acreage, I would like to take this opportunity to tell you that our company recently Non-performing assetsHowever, Acreage believes there is still significant upside potential. Recently, Acreage entered the New York market and continues to grow its presence in other key states, including Ohio, the seventh-largest state in the U.S., where adult use of cannabis began in June, and with plant dispensaries in Cleveland, Canton, Akron, Columbus and Wickliffe, business is booming.

Canopy Growth ended the quarter with CA$200 million in cash and CA$600 million in debt. The company has a market capitalization of $800 million and an enterprise value of over $1 billion.

The company is only expected to have a $220 million revenue base in FY25. Despite its Acreage business generating more than $200 million in annual sales, Canopy Growth has loss-making assets outside the U.S. and is largely distressed in the U.S., giving shareholders limited reason to hold onto the stock at $8.

remove

A key takeaway for investors is that Canopy Growth has recently rallied on hopes for its U.S. operations and the possibility of reclassifying cannabis as Schedule 3. Investors should sell the company’s shares as its weak operations and complex U.S. structure won’t help the overall business, as evidenced by Acreage’s fall to distressed asset status.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.