Henrik Sorensen

Investment Thesis

Dutch Brothers (New York Stock Exchange:Brothers) The company has a competitive advantage in the U.S. coffee chain industry due to higher restaurant-level profit margins and lower operating costs. It’s IPO time. The market is in the same mood. But I think the company has a lot of potential, and the pandemic and inflationary pressures should help accelerate the company’s growth. I expect the stock price to be revalued soon.

Company Background

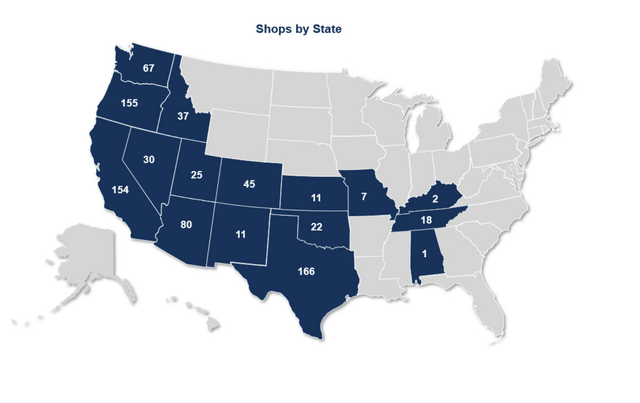

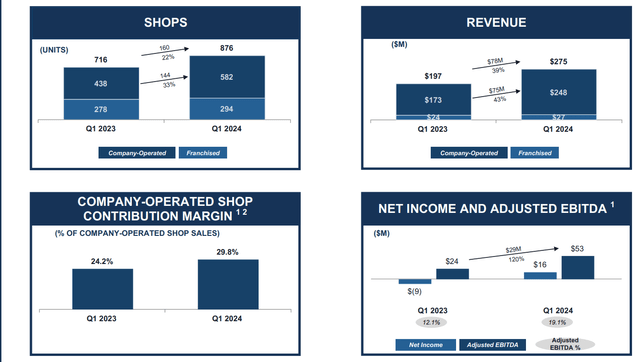

Dane and Travis Boersma founded Dutch Brothers in Oregon in 1992. They have since expanded the business to include: 876 The company operates stores in 17 states. It received investment from private equity firm TSG and went public in 2021. Despite going public, Travis Retain ownership 12 million A shares, B shares and TSG It held 30 million shares, equivalent to 34.5% of the shares issued.

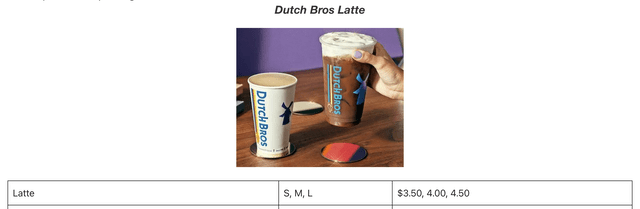

During the IPO, the company 4,000 Dutch Brothers has unveiled plans to open 4,000 stores in the U.S. This ambitious expansion strategy is likely a factor in the founders and private equity firms deciding to retain a significant stake, seeing the IPO as the beginning, not the end, of the company’s growth trajectory.

Competitive Advantage

The company is competing with major rival Starbucks (NYSE:SBUXHigher profits at the restaurant level should give the company a competitive advantage and lead to success at the micro level.

Unit Economics

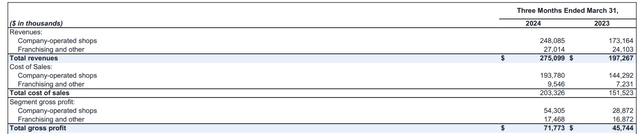

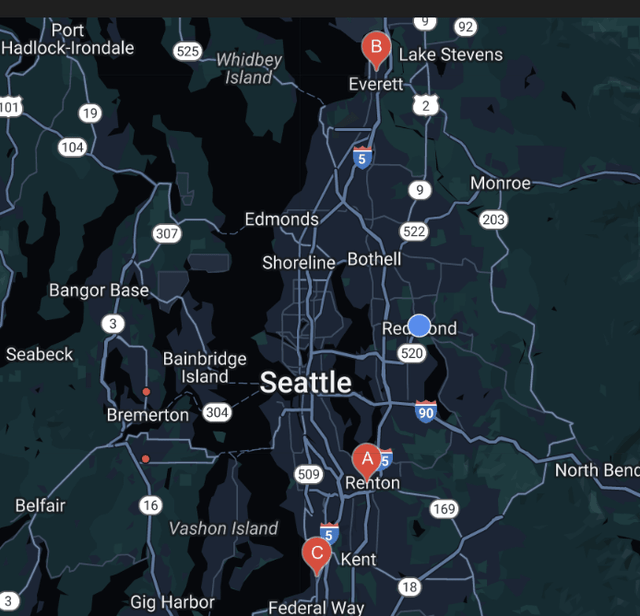

Starbucks doesn’t disclose store-level profit margins, but it does disclose segment operating margins, which include licensing revenues in their margin calculations. However, licensing operations typically have higher margins than company-operated stores. As a result, despite including this higher-margin business in its North American operations calculations, Starbucks’ operating margins are 18% As of the first quarter of 2024, that’s lower than Dutch Bros. restaurant-level profit margins. 21.9%(For comparison, we used a 21.9% contribution margin rather than a 29.8% margin.)

margin (Dutch Brothers presentation)

margin (Starbucks presentation)

Additionally, Starbucks publishes its store operating expense statistics for calculation purposes, and when comparing this metric with Dutch Brothers, we conclude that Dutch Brothers’ operating expense ratio is significantly lower than Starbucks’ (44% vs. 53%).

Expense ratio (Images created by the author based on the presentation materials of each company)

How can the company keep its operating costs down and boost its profit margins? The answer is that drive-thrus make up about 90% of Dutch Brothers’ business, and its retail stores are generally smaller than Starbucks’.

The company believes its drive-thru business strategy prioritizes convenience for consumers while reducing costs and maintaining a personal experience.

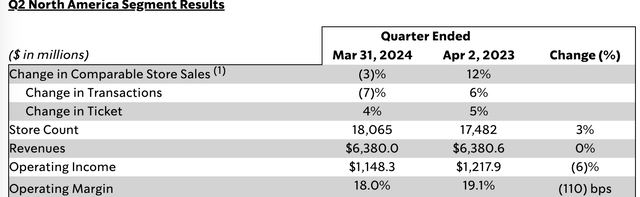

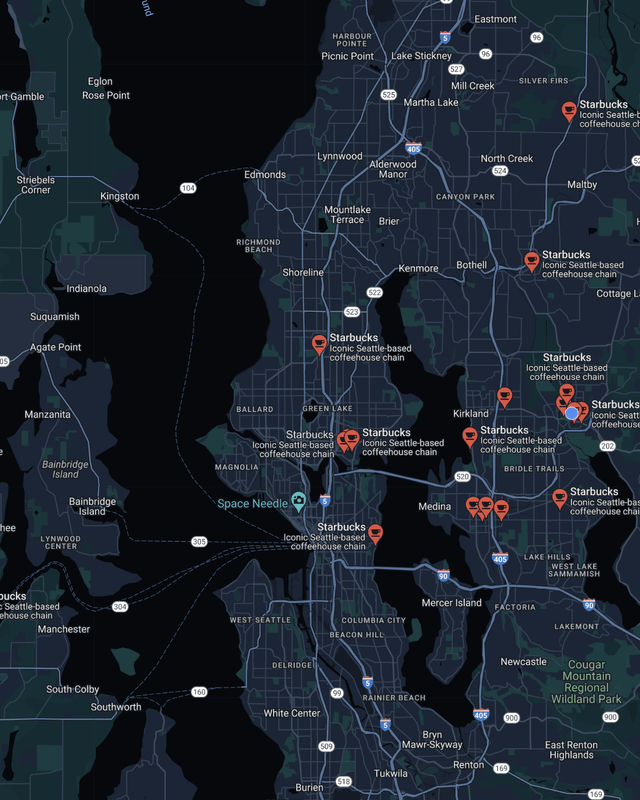

The company’s low occupancy costs can also be explained by its location strategy. Take Washington State for example, while Starbucks has many stores in urban areas, Dutch Brothers opened stores in rural areas. This also reduced Dutch Brothers’ rent and occupancy costs.

Dutch Brothers Location (Google Maps) Starbucks Location (Google Maps)

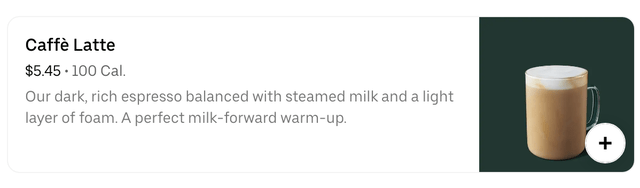

As a result, Dutch Bros. is able to charge less than Starbucks for its products: In the Renton, Washington area, for example, Dutch Bros. sells a medium latte for $4 while Starbucks sells it for $5.45, a 36% markup.

Starbucks website Dutch Bro website

Mobile App Strategy and Loyalty Programs

Dutch Bros.’ success is tied to the rise of mobile ordering. The company has used its app as a powerful customer acquisition and retention tool to drive traffic to its stores. The 2020 pandemic accelerated the expansion of drive-thru restaurants and promoted mobile ordering. Dutch Bros. took the opportunity to launch a loyalty program in 2021, and the company estimates that Dutch Rewards members will account for approximately 10% of all stores by the end of 2023. 65% of every purchase. Loyalty programs help a company retain customers and also strengthen the company’s low-cost barrier of defense.

Luckin Coffee Comparison

Dutch Bros. is well positioned to grow in the U.S. by capitalizing on the rise of mobile ordering, freshly brewed coffee, and low occupancy costs. And Dutch Bros. isn’t the only one employing this strategy. In fact, Chinese coffee company Luckin Coffee (OTCPK:LKNCYLuckin has already implemented this business model in China, with restaurant-level profit margins. twenty two% It will achieve similar growth to Dutch Brothers in 2023. Luckin Coffee was founded in 2017 and listed in the United States in 2019, setting a record for the fastest IPO in history. Despite being delisted in 2020 due to financial fraud, Luckin Coffee continues to grow rapidly, surpassing Starbucks in China with sales of more than 1,000 stores in 2023. 10,000 Store.

Expansion speed comparison

Market potential (Dutchbro’s S-1 filing)

When Dutch Brothers went public, it set a goal of opening 4,000 stores in the U.S. As of the end of the first quarter of 2024, Dutch Brothers had 876 stores in North America, while Starbucks had 18,065. This represents significant upside potential for the company. However, Dutch Brothers is not expanding as quickly as its Chinese peer Luckin, which is opening an average of 1,500 stores per year. Dutch Brothers had planned to open 150 stores in 2024, in an attempt to be both profitable and expanding at the same time. This is in part due to differences in construction pace and regulatory requirements between the U.S. and China.

Opportunities for expansion

Dutch Bros currently has a presence in 17 states, and I see many opportunities for the company to expand in both emerging and established markets.

Inflationary pressures

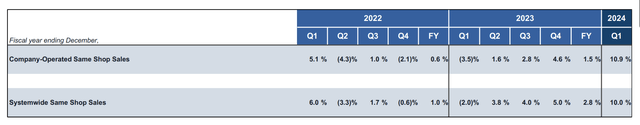

Dutch Bro’s same-store sales growth accelerated in 2023, reaching an impressive 10.9% in 1Q24.

Growth of competition (Dutchbro presentation)

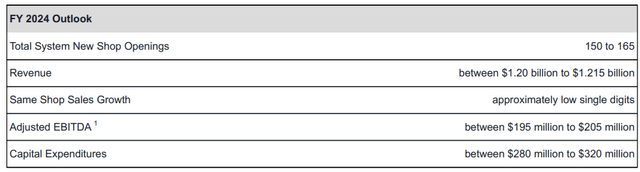

I believe inflationary pressures on consumers are driving the accelerating companion trend: while overall inflation is falling, many people’s wages are not keeping up, causing some to down-trade. Walmart (World Trade Center) points out. As a result, Dutch Brothers appears to be benefiting from this. With a strong first quarter performance, the company Raise annual guidance.

Outlook (Dutchbro presentation)

DCF Valuation

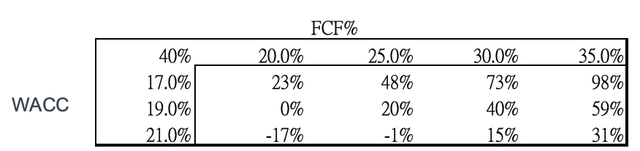

When valuing high growth companies, I like to use a discounted cash flow (DCF) valuation model. It gives you a long-term perspective rather than just looking at short-term metrics. To calculate the required equity ratio of 19.1%, I used a beta of 2.44x, a risk-free interest rate of 4.5%, and a risk premium of 6%. Combined with a cost of debt of 15.7%, this results in a WACC of 19%.

Baseline Scenario

My base case was a 10-year forecast of 4,000 stores, $2 million AUV, and 2% inflation based on management’s expectations. This equates to a 23% CAGR over the next 10 years. I also assume the company can maintain a 20% free cash flow margin. I believe these assumptions are conservative given that the company’s revenue grew 39% in 1Q24 and contribution margin reached 29.6% (excluding depreciation and amortization).

Finance (Dutchbro presentation)

With net debt of -$29 million and a terminal growth rate of 3%, the market cap would be $5.5 billion, or $31.2 per share, 13% above the current price.

DCF forecast (Image created by the author based on data from company financial statements)

Bullish scenario

Based on my analysis, I believe management’s projections are conservative. In the first quarter of 2024, the company’s revenue grew 39% and its store count grew 22%. The 33% growth in franchised stores outpaced company-operated stores. This indicates that higher revenues could lead to further market penetration and increased franchisor interest. The company is likely to raise its guidance in the coming quarters.

As a result, my bull scenario assumes the company will reach 6,000 stores within 10 years, accounting for one-third of Starbucks’ North American presence; free cash flow margin of 30%, which is similar to contribution margin; this implies a 30% sales CAGR and a valuation of $8.8 billion, or $50 per share, an increase of 40% from current levels. The sensitivity analysis below shows that the margin of safety is robust.

Sensitivity Test (Image created by the author)

If Dutch Brothers can replicate Luckin’s success in China and surpass Starbucks in the U.S. with similar profit margins, my current valuation would be conservative, assuming terminal growth of just 3% in 10 years’ time.

Bearish scenario

My bearish view is that the company is not growing as fast as I expect, slowing to a 17% CAGR (the equivalent of 150 stores per year at the current pace) and maintaining free cash flow margins at 25%, which implies a market cap of $3.3 billion, $19 per share, and downside risk of 47%.

Competitive Risk

Dutch Bros.’ expansion could slow if Starbucks or other convenience businesses like gas station grocery stores copy the idea of opening small rural stores with a similar mobile app strategy, which could not only reduce the company’s upside potential but also hurt its profit margins.

This is exactly what happened in China, where multiple convenience store chains acknowledged Luckin’s success. However, Luckin was able to defend itself against competition and retain its customer base by implementing a loyalty program, which Dutch Brothers is currently implementing. Therefore, investors should monitor competitive risk while paying close attention to the growth of Dutch Brothers’ loyalty program, which measures customer base retention.

catalyst

I understand why the market values the company’s shares at around $6 billion. This is consistent with my base case, as management remains committed to its plans to open 150-165 stores in 2024. Although the company’s same-store sales are accelerating, the market has not fully captured the company’s growth potential in this inflationary environment. Even if the company maintains its current growth rate, I believe inflation will encourage more customers to seek lower-priced options. This could lead to higher sales and improved profit margins. Therefore, I expect the market to recognize the company’s growth potential within the next 6-9 months, at which point the stock should be repriced accordingly.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.