PM image

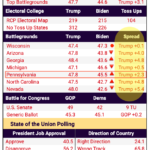

Generational market peaks such as 1929, the Nifty Fifty of the 1970s, and the tech bubble of 2000 are often characterized by a set of powerful stocks with parabolic charts and irrationally exuberant return expectations. In today’s market, we have the Magnificent Seven and, to a lesser extent, the Big Five. In contrast, market capitalization-weighted indexes such as the S&P 500 (spy) and NASDAQ 100 (Hehehehe) appears to have peaked. It is prudent to invest in attractive value investments that are less popular but are in less popular sectors and asset classes where investors trade less. Specifically, small cap, value, international, emerging market, commodity, and money market stocks offer better return profiles than the Magnificent 7 and market cap weighted index ETFs such as SPY and QQQ.

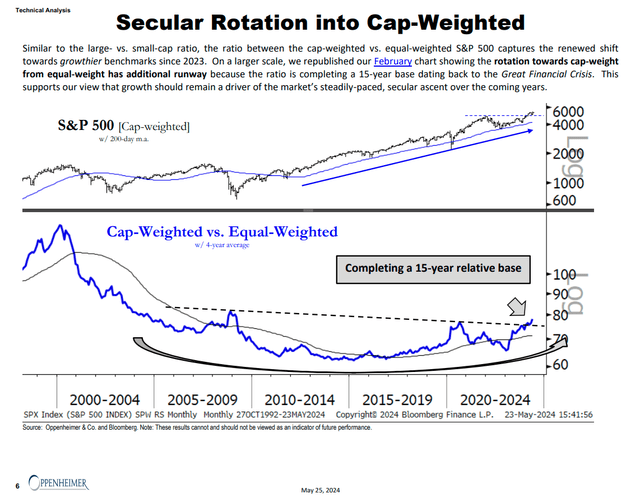

The following graph from Ari Wald of OPCO shows the equivalent The S&P 500 is rising relative to market-cap weighted indexes. We should see this new leadership emerge and sustain over the next few years, outside of popular mega-cap stocks and market-cap weighted indexes.

Improving Equal-Weighted and Market-Cap-Weighted S&P 500 Relative Strength (Oppenhiemer & Co. Ari Wald)

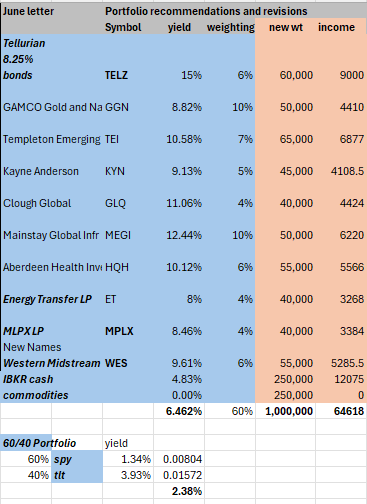

Additionally, the secular decline in interest rates and inflation that began in 1981 ended with rising inflation and interest rates around 2020. Investment strategies such as a 60/40 allocation of stocks and bonds no longer offer the attractive return profile they did in 1981 and the decades that followed. As a result, we believe a 25% cash, 25% commodities, 25% stocks and 25% bonds allocation is a more prudent retirement asset and retirement income allocation than the popular 60/40 strategy that is at the core of many financial plans and investment portfolios.

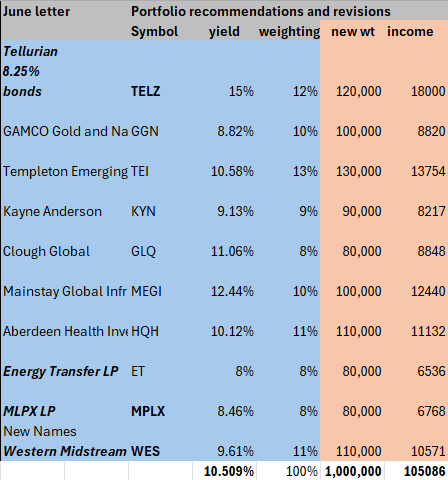

We applied non-traditional investment thinking to an income portfolio to create a 10.5% yielding stock and bond portfolio with moderate risk. This non-traditional portfolio invests in high yielding closed-end funds, master limited partnerships, and high yield bonds that trade at a discount to net asset value (NAV). Depending on the individual and their risk tolerance, such a portfolio could be a 50% core stock and bond allocation in a 25/25/25/25 portfolio. 4.83% Money Market With a 25% allocation to funds and non-yielding instruments, our nominal 25/25/25/25 portfolio is Yield: 6.46%, providing more flexibility and inflation protection compared to a hypothetical 60/40 (60% SPY and 40% TLT portfolio) yield of 2.376%.

Portfolio Weight and Yield for 10.5% Portfolio (Income Growth Advisors)

Below is a 25/25/25/25 portfolio with 25% allocated to Money Market on Interactive Brokers for a 4.83% yield and 25% allocated to Commodities for a zero yield: At the bottom of the chart, I’ve calculated the yields on SPY and TLT with a 60%-40% allocation to represent the yield of a 60/40 portfolio for comparison.

25/25/25/25 Portfolio, Core 10.5% (Income Growth Advisors, LLC)

Portfolio investment with a 10.5% yield

- TELZ is the bond between the babies of the Earth. The notes will mature on Nov. 30, 2028 at $25 per note. The coupon is 8.25%. The bonds trade at $13.90 per bond and currently yield 14.83%. Tellurian Corporation is a distressed LNG project developer seeking to finance a 27.6 MPTA natural gas liquefaction facility near Lake Charles, Louisiana. The company’s representatives are involved in the construction of 78% of the LNG production facilities in the United States, and Tellurian is one of the few projects fully authorized by the DOE and FERC, making it the only major LNG project not hindered by Biden’s LNG moratorium. With a nearly four-year head start on the greenfield LNG plant and an investment of about $1 billion, Driftwood is positioned to secure financing as global energy markets embrace LNG as a transition fuel to address climate, economic and energy security concerns. The Haynesville asset sale plan announced last week will pay off Tellurian’s most problematic debt associated with continuing operations, but the company needs to announce more deals like the HOA for Aethon Energy Management LLC (Aethon) to take over 2 MPTA of LNG. Aethon is a major Louisiana E&P company, in part EIG Partners“We believe this bond is risky, but could represent a significant return if Tellurian is successful in raising capital or if the company is sold.”

- GAMCO Gold, Natural Resources & Income Trust (GGN) is a gold and natural resources closed-end fund that issues call options on positions to add income to its portfolio. The fund yields 8.8% at a 1.5% discount to NAV. Historically, the fund has been positively correlated with rising gold prices.

- Templeton Emerging Markets Income Fund (Tei) is a closed-end mutual fund that invests primarily in government bonds of emerging market countries around the world. It offers a yield of 10.49%, and emerging markets are expected to perform well over the next few years as the U.S. stock market stabilizes.

- Kane Anderson (Kin) is a closed-end MLP oriented energy infrastructure fund that yields 8.89% and has a 14.9% discount to NAV. The fund uses leverage to boost yield but also can lead to a significant downturn like the one experienced during the COVID crash in March 2020. We were an active buyer of KYN stock in the spring of 2020 and wrote about a rare opportunity for KYN stock. March 2020, Seeking Alpha.

- Clough Global (GLQ) is a closed-end fund that trades at a 16.75% discount to NAV and yields 11.03%. GLQ is an attractively priced way to gain exposure to many of the large tech stocks we’ve covered with a low risk exposure. Microsoft, Amazon, and Alphabet are the fund’s three largest positions, making up 17% of the portfolio. Distributions are more likely to represent capital gains than interest income, which some tax-sensitive investors may dislike.

- Mainstay CBRE Global Infrastructure (Barberry) is a closed-end fund with a 12.9% discount to NAV and a yield of 11.5%. The firm invests in global infrastructure properties that are generally associated with durable cash flow businesses, but uses leverage, which could cause problems in the event of a significant market downturn.

- Abulun Healthcare Investors (Highest quality) Also known as Telka Healthcare Investors, it is a closed-end fund that trades at a 12.75% discount to NAV and has a yield of 14.25%. The fund invests in the biotechnology, medical device and pharmaceutical industries, as well as small to mid-cap companies that generate free cash flow. HQH owns Amgen, Regeneron and Gilead Pharmaceuticals, which make up about 20% of the portfolio.

- Energy Transfer LP (E.T.) is a large master limited partnership with a yield of 8.18%. The company owns energy infrastructure assets across the U.S., including over 20,000 acres of natural gas pipelines. ET has even been rumored to be a potential acquirer of Driftwood LNG, as the Lake Charles LNG facility is affected by Biden’s moratorium and Energy Transfer is well positioned to transport cheap natural gas from the Permian Basin to Driftwood. Because MLPs pay distributions rather than dividends, they cannot be owned by retirement plans and require annual K-1 filings.

- MPLX LP (Multiple XMPLX is a master limited partnership subsidiary of Marathon Oil. It has a yield of 8.36% and is required to file a K-1 annually for tax-advantaged distributions. MPLX operates midstream energy infrastructure and logistics assets in two segments: Logistics & Storage, and Gathering & Processing. Marathon Oil is Last week, ConocoPhillips.

- Western Midstream Partners (Wes) is a natural gas-focused master limited partnership that offers a 9.38% yield. Fixed income guru Bill Gross cites WES as an attractive source of income and praises the company’s focus on natural gas, the cleanest of the three fossil fuels we’ll need in the coming decades.

risk:

- Closed-end funds may employ leverage and may incur margin calls at the fund level in extreme market conditions.

- The liquidity of some CEFs means that large purchases or sales can cause price fluctuations in the underlying CEF, making it costly to buy or sell large positions.

- TELZ is a high-yield bond, and while the underlying company, Tellurian Inc., could go bankrupt, its assets far exceed its liabilities and it’s likely that they will be sold before filing for bankruptcy.

Conclusion:

The benefit of rising inflation is that higher-yielding investment opportunities have become available. Given that financial markets and bank deposits have been at near zero for a decade, the prospect of investing $1 million and earning nearly $100,000 per year is very attractive. For non-traditional retirement-minded investors, select closed-end funds, master limited partnerships, and certain distressed corporate bonds offer attractive income-generating investments that can help you achieve your retirement planning goals.

Unfortunately, the limited liquidity of this portfolio does not allow institutional investors to take advantage of these particular opportunities at any scale. However, this letter illustrates the non-traditional return opportunities and benefits of investing in lesser known securities. Whether this approach makes a “big difference” depends on understanding the details of each security.