SeventyFour/iStock via Getty Images

Omega Healthcare Investors, Inc.New York Stock Exchange:OHI), founded in 1992 and headquartered in Hunt Valley, Maryland, is a REIT that owns and manages skilled nursing and assisted living facilities (SNF/ALF) in the United States.

I believe it OHI has not performed well in the past, it is uncertain when the markets it serves will recover, and the dividend coverage is currently insufficient, so investors looking for a stable source of income should consider other investment avenues.

Additionally, the stock is not trading at a large enough discount to make it worth investing in. However, investors should be aware of the strength of this REIT’s portfolio and liquidity and keep an eye on OHI, as a rise in price could provide an investment opportunity.

portfolio

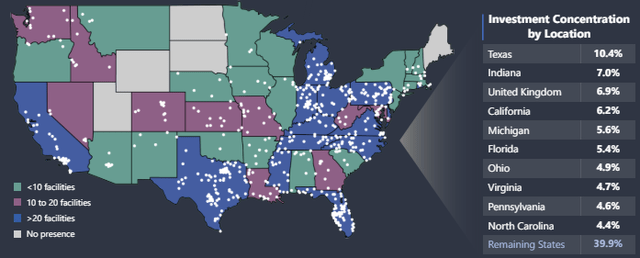

Omega Healthcare owns 862 facilities in 42 states, according to its most recent investor presentation, released in March. UK This is primarily concentrated in the West and the UK, with Texas having the largest exposure at 10.4%, and UK property making up 6.9% of the REIT’s investment.

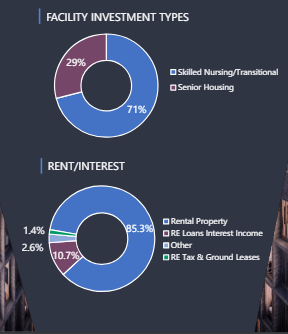

Still, this is a broadly diversified portfolio of SNFs and ALFs. Moreover, SNFs make up 71% of the portfolio, with the remaining 29% being senior housing.

Investor Presentation

As you can see, the majority of the revenue comes from rental income, but a significant portion (10.7%) also comes from real estate loan investments.

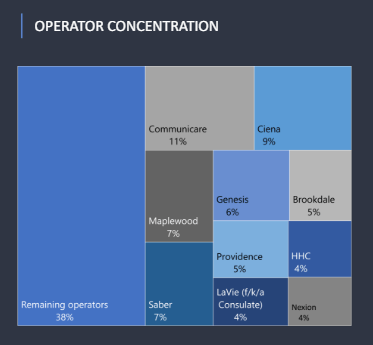

One thing I don’t think is very diversified is the tenant base. The company is heavily reliant on a few carriers, the largest of which is Communicare at 11%.

Investor Presentation

As such, those 10 tenants will account for a large portion of the rental income, creating a risk to profitability that investors need to take into consideration.

performance

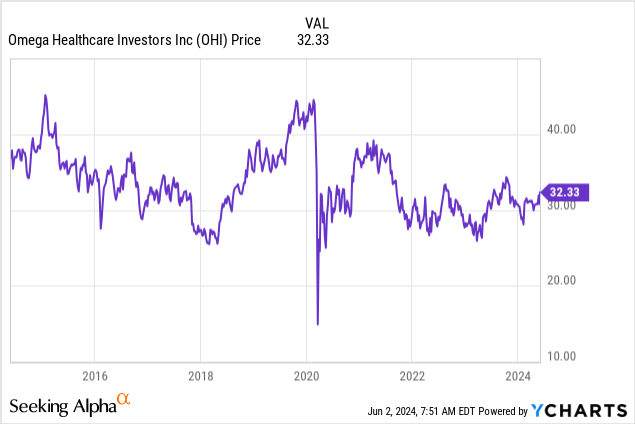

Now, OHI’s price performance has been disappointing over the past decade.

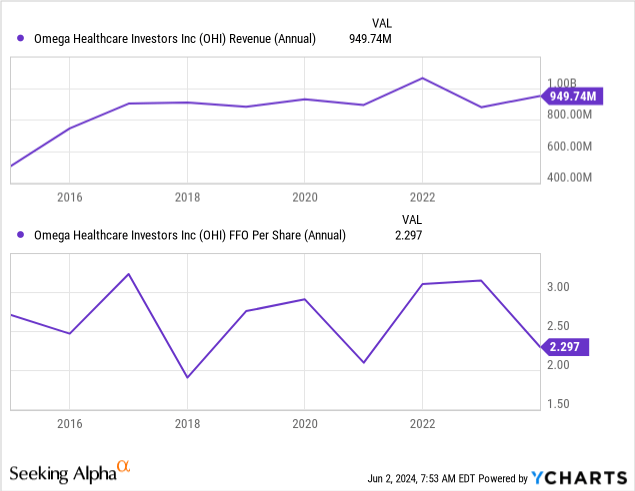

While revenue has grown steadily, FFO per share has not grown during this period.

So, price performance is not surprising given the volatility of FFO. Recent results have not been very good either. Below we compare the annual numbers taken from the most recent quarterly report with the average numbers for the past three fiscal years, and as you can see, rental income and cash NOI are roughly flat, with only AFFO increasing slightly.

| Rental income growth | -0.65% |

| Cash NOI Growth | -0.77% |

| AFFO Growth | 11.25% |

However, when comparing the latest results to those from the previous year, things look a bit better: rental income increased 9.29% year over year, interest income jumped 26%, cash NOI increased 9.59%, and AFFO increased 3.87% year over year.

However, it should be noted that the company has recently had problems collecting rent from its tenants. One of its largest tenants, Maplewood, underpaid rent in Q2 2023 and has not paid since then. In Q1 2024, the company also underpaid (36.5% of contractual rent outstanding). In 2023, Omega Healthcare covered a portion of the rent not paid in 2023 with a security deposit, indicating that Maplewood is unlikely to repay. This security deposit has now been exhausted. The REIT has had similar issues with Ravi, Guardian and Agemo, which do not contribute as much to rental income as Maplewood.

Additionally, there’s plenty of room for improvement, as 79.1% of Omega’s portfolio is leased; consider that other healthcare REITs have averaged around 90% recently. On the bright side, the weighted average lease term here is 9.4 years, with just 4.4% of leases expiring in 2024 and the two years after that. However, it’s worth noting that 14.4% of those leases expire in 2027.

Leverage and Liquidity

However, the company’s solvency is very good. Only 55.9% of the company’s assets are funded by debt, consisting of credit facilities, secured borrowings, senior notes, and other unsecured borrowings. The debt/EBITDA ratio is low at 6.2x based on the most recent quarterly financial results, and similarly, the interest coverage of 3.7x also reflects the REIT’s strong liquidity. Additionally, Omega had approximately $360 million in cash and cash equivalents as of the end of March, which represents approximately 4% of its total assets. The average interest rate on its debt is also 4.38%, which I believe is very low today.

Finally, the maturity schedule looks good overall, with the exception of the 2025 maturity, which represents 30% of the debt. The remainder (until 2033) represents less than 14% of the debt.

Dividends and Valuation

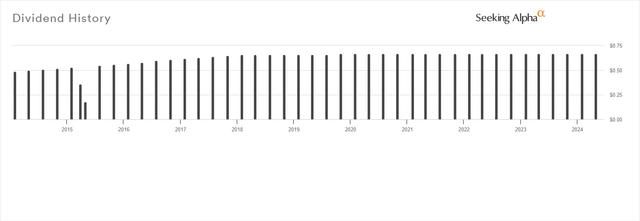

OHI currently pays a quarterly dividend of $0.67 per share with a forward yield of 8.28%. While the yield is fairly high, I think a cut is inevitable these days, as the dividend payout ratio based on AFFO in the most recent quarterly report is 117.91%. The REIT needs to do more to stabilize rental income and FFO to mitigate this impact.

Its payment record is also less than attractive, suggesting slow growth.

Additionally, OHI is trading at an implied cap rate of 7.22%, which is higher than the average of 6.75%. Report by JLL Q4 2023. If we base it on the senior housing average as a more appropriate rate, the NAV is currently $35.35 per share. With the current price of $32.33, the discount rate suggested here is 8.55%, which seems reasonable given the risks associated with the potential investment.

risk

Unfortunately, such discounts are not large enough to provide investors with a sufficient margin of safety, which limits the upside potential and at the very least represents an opportunity risk.

The dividend may also be cut, which could increase selling pressure on OHI as many people may hold it as an income vehicle.

verdict

So I don’t think the prospects here outweigh the risks, so I’m keeping OHI Ownership Until it becomes clearer that the dividend is safe, or the share price falls substantially to suggest a bigger upside.

What do you think? Do you own or have you been thinking about owning this REIT? Let me know. Also, leave a comment if you found this article helpful. I’m so happy! Thanks for reading.