Cimmerian

High dividend stocks typically have limited growth prospects and tend to be subject to relatively high financial and business risk.

The theory behind this is that to mathematically offer an attractive yield, the multiple (or price) must be low relative to the current income stream. There is not enough real value to generate a real yield. On the other hand, if there is not much growth potential (e.g., a flat future cash flow profile) or there is too much uncertainty about the company’s ability to deliver the same or improved results going forward, the multiple will be low. This uncertainty can result from a variety of reasons, both idiosyncratic (e.g., high leverage, struggling business lines, litigation) and systemic (e.g., high interest rates, weak demand in the industry).

How these dynamics play out is The most common high dividend investment segments:

- REITs (Real Estate Investment Trusts) – Growth is limited as rents are typically fixed at fixed prices and based on long-term contracts with only modest rental increases. Additionally, valuations have declined across the board as interest rates have soared, with headwinds from more expensive debt refinancing, and sales growth is not enough to offset rising interest costs.

- MLP – Growth is also limited as in most cases sales are linked to fee-based revenues or segments that are regulated by policymakers (e.g. fixed or slightly increasing fees).

- BDCs – Limited growth with above average risk. BDCs must comply with certain regulations, one of which caps the leverage a BDC can undertake. Besides the use of external leverage and reinvestment of retained cash flows (usually low due to high dividends), BDCs also have limited potential for significant growth. In the case of BDCs, the market also assigns a slightly higher discount rate since the underlying business is based on investing in companies that have difficulty raising capital from traditional banks or capital markets, where the cost of raising capital is more favorable than from a BDC.

That being said, I have no doubt you can find some opportunities that combine high yields with moderate growth factors. It gets even harder when you apply durability/defensibility as an additional criterion. But it’s still possible.

Here, we take a closer look at two options that can deliver high yields and strong growth without sacrificing the balance sheet.

Pick #1: EnbridgeENNB)

ENB is a hot player in the midstream segment with a market capitalization of over $77 billion. It is currently backed by a strong financial position and offers an attractive 7.3% dividend yield.

As is typical for midstream companies, the majority of ENB’s EBITDA generation comes from fee- or tariff-based segments, providing an important layer of safety. 80% of EBITDA It is linked to periodic price (earnings) increases that help stimulate the organic growth element in ENB’s business.

The business is further de-risked by a strong capital structure supported by an investment-grade balance sheet. As of Q1 2024, ENB’s debt-to-EBITDA ratio was 4.4x, which we view as conservative given the inherent stability and predictability of its cash generation profile.

Overall, ENB has paid dividends for over 20 years straight (except for 2012, when leverage was astronomical), so the risk of it suddenly cutting its dividend is very low.

Currently, ENB is only distributing around 60% of its DCF, leaving it with around $1.9 billion of new liquidity per quarter, and given the fact that its balance sheet is very robust, it is certainly possible that ENB could develop a more ambitious growth strategy.

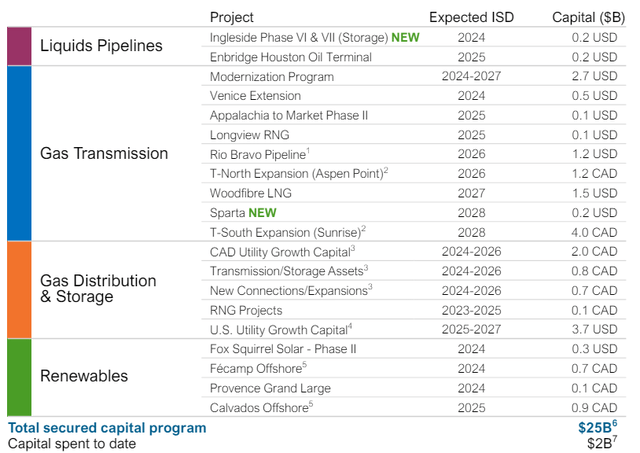

Looking at the outlined CapEx list, it’s clear that ENB has some pretty aggressive growth plans in place over the next few years: the total size of the already planned CapEx projects list is around $25 billion, which equates to roughly one-third of ENB’s current market capitalization.

Investor Day 2024

Also seen in the above table is a notable emphasis on the gas transmission and distribution & storage segments, which are more defensible than the liquids pipelines that currently account for a significant portion of ENB’s EBITDA generation. Expanding the utility-based business segment will not only ensure higher EBITDA but also further de-risk the business, helping to further lift multiples from here.

ENB has stable cash flows from its regulated and fee-based segments, plus a conservative capital structure and dividend distributions, so funding this ambitious capex plan will not constrain its balance sheet (or risk jeopardizing its investment grade rating).

Pick #2: Essential Properties Realty Trust (EPRT)

EPRT is a retail focused equity REIT that currently yields 4.3% and has an FFO payout ratio of approximately 60%, so there is plenty of liquidity remaining in the system to fund significant growth opportunities.

EPRT has a diverse portfolio of over 1,700 properties across 48 states. The properties are leased to approximately 360 tenants, with the top 10 tenants accounting for less than 17% of the total rent exposure. EPRT’s focus on experience and service-based properties that are less impacted by negative trends in retail (such as the shift from traditional brick-and-mortar stores to e-commerce platforms) puts it in a very unique position as a REIT.

As with ENB, EPRT’s cash flow profile is also fairly predictable, which lends itself to implementing a meaningful growth program: the underlying cash flows are based on very long-term lease commitments with a weighted average maturity of 14.1 years. Average unit-level coverage is 3.9x, which indicates a strong portfolio (i.e. low tenant-related financial risk). Additionally, the majority of these leases come with annual rent escalators, adding a nice, moderate growth component to the equation.

The balance sheet is clearly in investment-grade territory, with net debt to EBITDA at 3.5x and available liquidity of approximately $830 million, which represents roughly 18% of EPRT’s current market cap.

Therefore, EPRT has significant growth potential not only from its strong capital structure and ample retained FFO, but also from the market side where real estate cap rates are becoming increasingly attractive. Here are some recent comments from Peter Mavoides, President, CEO and Director: Earnings Report It provides great background information on how EPRT is approaching opportunities.

Generally, we’re taking a stance of doing as many deals as we can. We have a great opportunity set. Our opportunity set is up 20% in 2023 over 2022, and we expect it to grow again this year. And really the growth in this opportunity set is being driven by increased demand for sale-leaseback capital, both because the pricing of this capital is more attractive than other financing methods available to these mid-market operators, and also, going back to my earlier comment, because of reduced competition.

It’s already clear that EPRT is using the strength of its balance sheet to go on the offensive: In the most recent quarter, EPRT funded 36 acquisitions with $250 million, generating a weighted average cash yield of 8.1% and a GAAP yield of 9.3%, the highest in the company’s history.

EPRT still has plenty of room to grow and profit by taking advantage of the current market environment, which offers attractive cap rates that are sufficient to support a revenue-accretive M&A strategy.

Conclusion

Interest rates are high these days, but finding attractive dividend stocks isn’t that hard. But identifying stocks that combine an attractive yield with decent growth prospects is harder, and even harder when investment-grade credit ratings are a requirement.

However, both ENB and EPRT meet the necessary criteria: These companies enjoy strong cash flows backed by defensive business models and investment-grade balance sheets. With conservative cash dividend profiles and solid capital structures, both ENB and EPRT have adopted very ambitious growth strategies that will help stimulate growth in the near future.