JHVE Photo

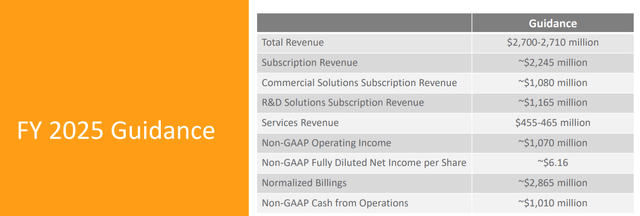

I have a “strong buy” rating on Veeva Systems.New York Stock Exchange:VEEV)The previous coverage The report, published in March 2024, highlights the company’s powerful clinical platform solutions. 1st Quarter of FY25 The company announced its results on May 31st and revised its full-year earnings forecast downward. We lowered our revenue guidance by $30 million. While we are disappointed with the guidance cut, we believe the Company’s long-term growth prospects in its data cloud and clinical platform are favorable. We reiterate our Strong Buy rating with a one-year price target of $220 per share.

Guidance lowered amid tough macro environment

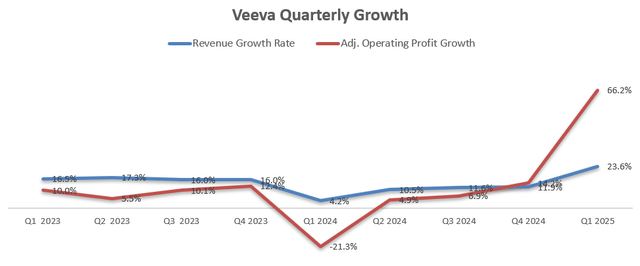

In the first quarter of fiscal 2025, the company saw revenue grow 23.6% and operating profit increase 66.2%, demonstrating significant margin expansion, as shown in the chart below.

But the company disappointed the market by lowering its full-year revenue guidance by $30 million, mainly due to slower-than-expected growth in services prioritized by its big pharma clients. As the management explained, regarding IT investment in the AI field, Earnings Report.

Here’s what I think about their guidance cuts:

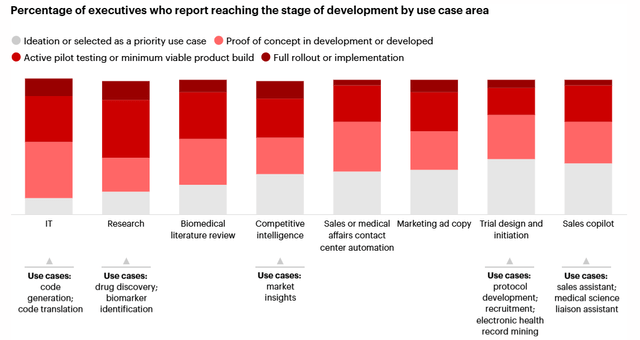

- be investigation According to a survey conducted by Bain & Company, 40% of pharmaceutical companies have factored expected savings from AI into their 2024 budgets, and pharma companies are applying AI across different departments, particularly in IT and research (see chart below).

It is clear that global pharmaceutical companies are prioritizing AI investments in 2024, which may result in them postponing investments in other IT software solutions.

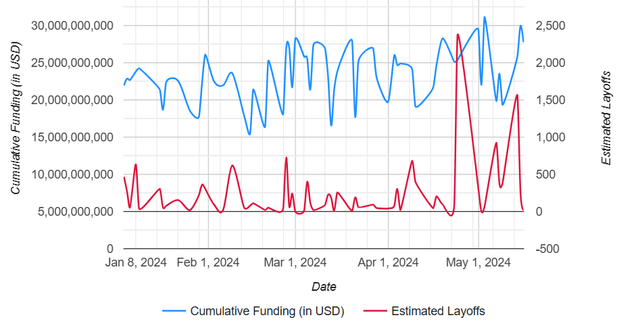

- As we noted in our previous report, the high interest rate environment is making it difficult for small and medium-sized pharmaceutical companies to raise capital, which has forced them to tighten budgets and make cuts to navigate the tough environment. report According to Drug Discovery and Development, layoffs will continue in the pharmaceutical industry in the first half of 2024, affecting more than 20,600 workers. As shown in the chart below, in April 2024 alone, there were approximately 3,548 layoffs in the biotechnology and pharmaceutical industry.

Drug Discovery and Development

Therefore, I believe Veeva’s guidance cut is due to weak macroeconomic conditions, IT budgets geared towards AI, and workforce cuts in biotech and pharma companies. However, these issues are short-term and the situation could improve once the Fed starts lowering interest rates. Additionally, I am optimistic about the long-term growth prospects of the biotech industry, which is driven by innovative gene therapy, stem cell, and mRNA technologies.

Short-term outlook

I expect Veeva to grow revenue by 14% in the near future, for a few key reasons:

- Veeva’s normalized billings are expected to grow 10% in FY25, below the historical average of 15%. The weak one-time billing growth is driven by tighter pharma client budgets and delays to several large deals, particularly in the services segment. Going forward, we expect Veeva’s billings to recover to mid-teens growth as capital funding conditions improve.

- The growth of Veeva’s CRM platform is tied to the growth of sales teams in the pharmaceutical industry. Although growth will be constrained by industry-wide headcount reductions, I am optimistic that the pharmaceutical and biotech industries will continue to grow as the economy normalizes.

- As indicated during the earnings call, existing Veeva CRM customers are expected to begin migrating to Vault CRM in 2025, which could help improve Veeva’s margins. Veeva has been developing migration tools to simplify the platform transition.

So, assuming subscription services, which include CRM, development cloud, and commercial cloud, grow 15% and professional services grow 10%, Veeva expects to achieve 14% revenue growth in the near future.

Rating Update

Veeva achieved strong operating margin expansion in the first quarter of FY25 driven by disciplined expense management and focused hiring activities. Over the longer term, Veeva expects to generate margin expansion from gross margin and sales/marketing expenses.

As Veeva begins to migrate existing CRM customers to its platform, Veeva could generate greater margins. Additionally, we expect Veeva to continue to control sales and marketing expenses, even in a challenging macro environment. We expect Veeva’s total operating expenses to grow 12% for the year, with 50 bps of margin expansion driven by 20 bps from gross margins and 30 bps from sales and marketing leverage.

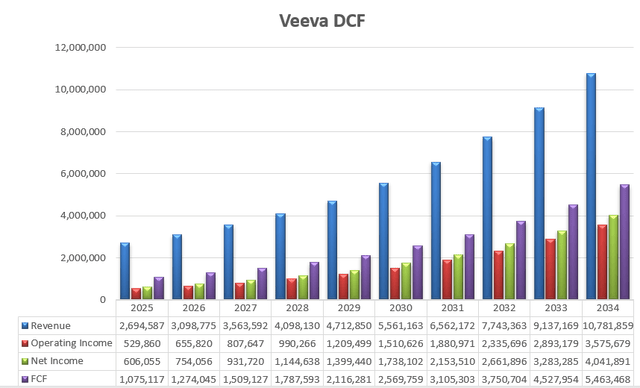

Veeva DCF – Authors’ calculations

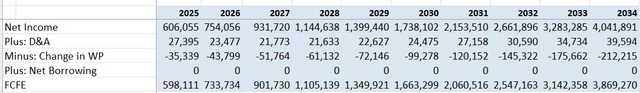

Free cash flow from future capital is calculated as follows:

Veeva FCFE – Author’s calculations

The cost of equity capital is a risk-free rate of 4.22% (the yield on the 10-year U.S. Treasury bond) and a beta of 1.33 (Find Alpha); equity risk premium 7%.

My calculations estimate that, discounting all future FCFE, the one-year target price is $220 per share.

Main risks

In 2023, Veeva will acquire existing SalesforceCustomer Relationship Management) platform into its homegrown Vault CRM system. In April 2024, Salesforce Announced Expanded partnership with IQVIA (IQVIQVIA is a Veeva competitor. IQVIA is licensing its Orchestrated Customer Engagement (OCE) platform to Salesforce to accelerate the development of its Life Sciences Cloud. Veeva executives revealed during the earnings call that OCE products have been on the market for 6-7 years but have not seen much traction with pharmaceutical and biotech companies.

It’s too early to tell if Salesforce will be able to leverage the OCE platform to build the next generation CRM for the pharma/biotech industry, but we encourage investors to stay tuned for developments in the near future.

Conclusion

I value Veeva’s technology leadership in CRM, development cloud, and commercial cloud in the global pharmaceutical and biotech markets. I believe the challenges the company currently faces are macro-driven and temporary. I reiterate my Strong Buy rating with a one-year price target of $220 per share.