Miscellaneous photos

ABT Stock: Wall Street Favorite

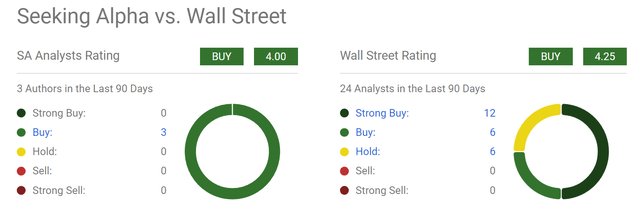

Those of you who follow our articles know that we are contrarian investors, and typically invest against Wall Street ratings. However, Abbott Laboratories (New York Stock Exchange:ABT) stocks, we agreed. Here’s how it compares to Wall Street. Specifically, the chart below summarizes the current sentiment towards ABT stock from Wall Street analysts (and also Seeking Alpha writers). As you can see, Wall Street analysts rate the stock a “Strong Buy,” with 12 out of 24 giving it this rating in the last 90 days, giving it an overall rating of 4.25. Seeking Alpha writers are less enthusiastic, but still have an overall score of 4.0, which also indicates a solid buy.

In the rest of this article, you’ll find out why I rate this stock a “Buy.” Indeed, this stock is While it faces some risks and headwinds to earnings (more on that in the final section), I would argue that A) these risks are relatively small compared to the upside and B) they are already more than adequately compensated for by the discounted valuation of the stock.

ABT Stock: A Great Business at a Discount Price

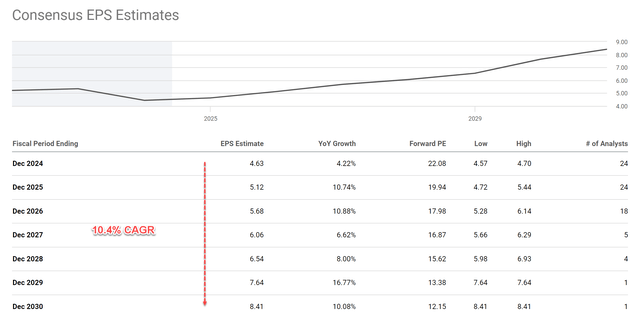

First, let me talk about the growth outlook and factors behind the growth. The graph below shows: Consensus EPS Estimates Outlook for ABT stock over the next six years. As we can see, analysts expect ABT’s EPS to grow at a compound annual growth rate (CAGR) of 10.4% over the next six years. This means EPS will grow from $4.63 in FY2024 to around $8.41 by FY2030.

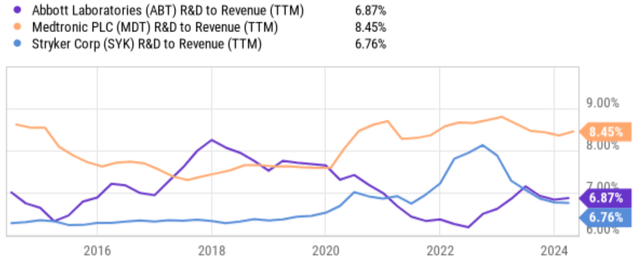

Given the unique strengths of ABT’s business model, I am very optimistic about these growth prospects. In my view, two key factors that differentiate ABT from other healthcare product companies are its diverse product lineup and focus on innovation. Unlike many of its peers that focus on specific areas such as pharmaceuticals or medical devices, ABT boasts a diverse portfolio across diagnostics, medical devices, pharmaceuticals, and nutrition. This diversification reduces risk by reducing reliance on the success of any single product or therapeutic area. ABT also continues to invest heavily in research and development (see chart below). This enables a steady pipeline of new products and technologies, helping ABT stay ahead of the curve in a rapidly evolving healthcare environment.

With a strong current lineup and pipeline combination, ABT is well positioned for long-term growth, with a number of drivers for profitability. Notable examples, in our view, include its diabetes care products, electrophysiology, neuromodulation, and structural heart segments.

The company has also launched a number of new products, including Amplatzer, Amulet, Navitor, TriClip and AVEIR. Given the company’s track record to date, we are optimistic about the success of these new products. Finally, we believe FreeStyle Libre will be a strong driver of the company’s long-term growth trajectory. This popular blood glucose monitoring system is one of ABT’s most successful assets in the diabetes care space in our view. It is also ABT’s most profitable product, accounting for approximately 15% of the company’s sales. FreeStyle Libre is experiencing solid growth. (Revenues in the first quarter of 2024 grew more than 22% year-over-year, and given its user base and unique features, this momentum is expected to continue.

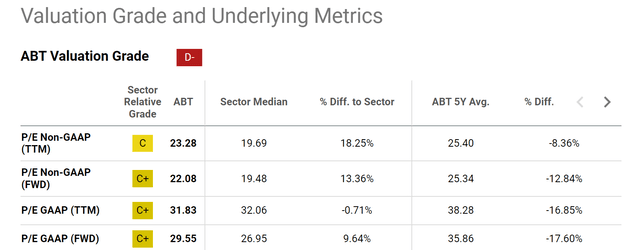

Despite the robust growth outlook, the stock is undervalued in our view. Recalling the chart above, ABT’s forward P/E ratio is around 22x and is expected to decline rapidly with EPS growth (only to 12.15x by 2030). Admittedly, the current forward P/E ratio of 22x may be a bit underwhelming compared to the sector median (around 19.5x). However, we believe the premium is fully justified given the strength of the business. Given the differentiators we just mentioned, in our view, it makes more sense to compare the current P/E to the company’s historical average, which represents a significant discount of around 13% on its forward non-GAAP P/E.

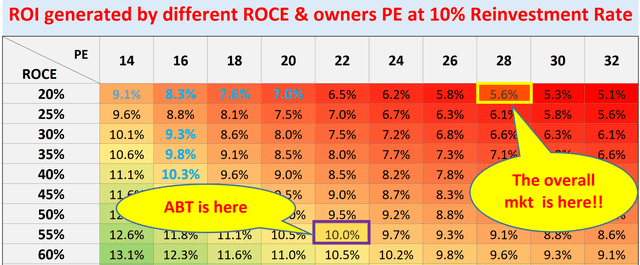

We then better contextualize our valuation by comparing it with the broader market.

ABT Stock: Valuation Rating and Projected Earnings

The chart below shows how that valuation (and expected return) compares to the overall market in the current climate: The concepts behind this chart are explained in more detail in our free report. Blog PostThe key concepts involved here are ROCE (return on invested capital) and Owner’s Earnings Yield (“OEY”), which we summarise below:

- Long-term ROI for a business owner is determined by two things: A) the price paid to acquire the business, and B) the rate at which the business grows (reflecting its quality and superiority).

- Specifically, Part A is determined by the Owner’s Earnings Yield (OEY) at the time we acquire the business. Part B is determined by the long-term ROCE and RR (reinvestment rate).

- In other words, Long Term ROI = OEY + Growth Rate = OEY + ROCE*Reinvestment Rate

- For ABT, I’m conservatively estimating OEY as earnings yield: with the current FY1 P/E of 22x, ABT’s OEY is around 5%.

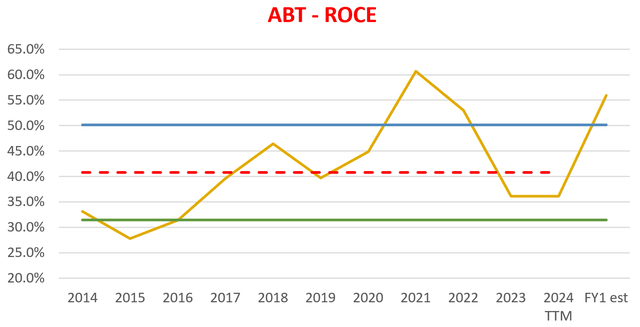

Meanwhile, ABT has maintained an average ROCE of around 41% over the long term (see second chart below), which contrasts with the broader market’s level of around 20%, while the broader market’s P/E is also high (the SP500 is valued at around 28x P/E as of this writing). Given its strong ROCE and low P/E multiple, we expect ABT’s annual total revenue potential to be closer to double digits, compared to the mid-single digits for the broader market.

Other risks and final considerations

With regard to downside risks, ABT shares many commonalities with its healthcare industry peers. First, ABT and its competitors face the challenge of navigating a constantly changing regulatory landscape for pharmaceuticals and medical devices. Regulatory hurdles could delay product approvals and impede revenue growth (e.g., FDA regulations). In addition, ABT and its competitors must contend with constant pressures on healthcare costs, which are not only a business issue but are often viewed as sensitive political issues. Such pressures could lead to price controls and reductions in reimbursement.

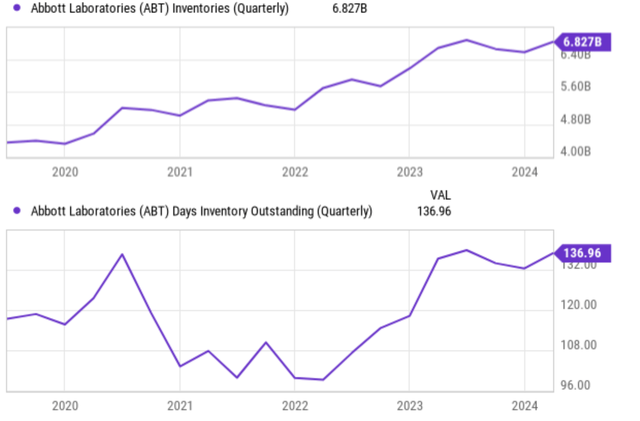

However, we also see some risks specific to ABT. The first is continued weakness in the diagnostics division, where sales continue to suffer due to lower demand for Abbott’s COVID-19 test kits. In the longer term, we believe this is merely a temporary headwind and an issue to be expected. We don’t think any investor seriously expected demand to sustain at the levels seen during the pandemic. As can be seen in the chart below, inventory is a sign of concern, both in terms of value and days of inventory balance. Such rising inventory could increase cost pressures and balance sheet risk in the near term.

Overall, the positives outweigh the negatives. We believe ABT is an attractive investment for investors looking for long-term total returns. Analysts expect EPS to grow steadily at a CAGR of over 10% over the next few years. We agree with this robust forecast given the company’s diversified business model and strong pipeline of new products. Additionally, ABT’s current P/E ratio is well below its historical average, suggesting the stock may be undervalued. This combination of strong growth potential, high ROCE, and discounted valuation makes ABT well-positioned to deliver above-market returns.