Matthew Coll

My Paper

Amid rising geopolitical uncertainty, gold prices will continue to reach new highs in 2024, and I’m looking to take advantage of this trend. Barrick GoldNew York Stock Exchange:Money) looks like a strong buying opportunity to gain high quality exposure The rise in gold prices.

The company is one of the largest in its industry worldwide, and its operating efficiencies are evident when comparing its profitability with that of the largest gold mining companies in North America. GOLD boasts a strong balance sheet, and its operating efficiencies are supported by a focus on the highest quality assets.

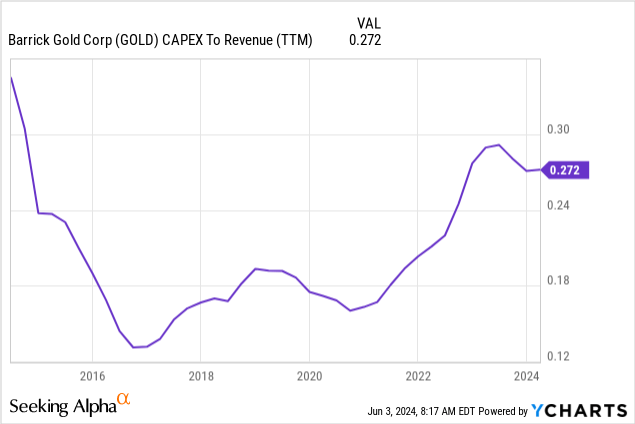

GOLD is making significant capital expenditures which will likely help expand production and support sales, especially in the current favorable environment of high gold prices. The company’s shares are attractively valued both relative to its closest rivals and from a dividend discount model perspective.

We expect gold prices to remain higher as the global geopolitical situation becomes increasingly complex and the war between Russia and Ukraine has recently escalated to new levels of conflict escalation, which will likely see investors seek safe havens.

GOLD Stock Analysis

Barrick Gold Corporation is one of the world’s largest gold mining companies, with operations across multiple continents. Latest Annual ReportThe company produced 4.05 million ounces of gold and 420 million pounds of copper in 2023.

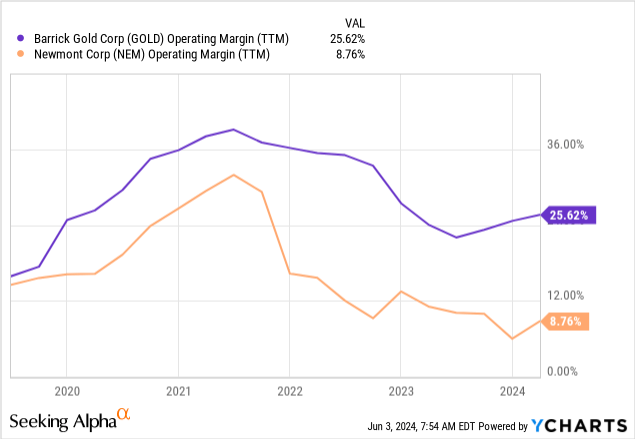

GOLD’s closest competitor in North America is Newmont Corporation.Nemu), production volume is about 5.5 million ounces of gold in 2023When deciding where to invest, I like to allocate my capital to the most efficient companies in their industries, and looking at the trends in the operating margins of these two companies, we can see which is more efficient.

The graph below shows that over the past five years, GOLD has been consistently more efficient than NEM, and the gap is widening. Also note that NEM produces roughly 40% more gold than Barrick, giving it much more potential to leverage economies of scale. And yet, GOLD’s TTM operating margins are nearly 3x higher.

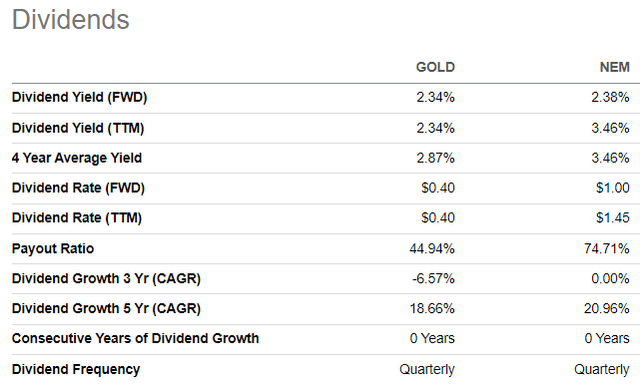

Improved operational efficiency has also improved GOLD’s balance sheet. The company’s cash reserves have increased by about $1.5 billion, and its debt has been reduced by half. GOLD’s dividend payout ratio is about 45%, which is significantly lower than NEM’s. Therefore, I believe GOLD is a better option for investors in terms of dividend safety. In addition, the forward dividend yield is about 2.3%, almost the same.

The only aspect where NEM has an advantage is 136 million ounces of gold reserves As of the end of 2023, Barrick will hold 1 million ounces of gold compared to 77 million ounces of gold. However, I don’t see that as a big advantage given the huge difference in operational efficiency between the two companies. Moreover, Barrick First-tier subcontractors The company is aggressively leveraging its gold assets, which also makes it more efficient. Six of its 13 gold mines are considered Tier One, meaning they are a concentration of high-quality assets. Additionally, the company reinvests about a quarter of its earnings into capital expenditures, which is likely to help grow its asset base in the long term.

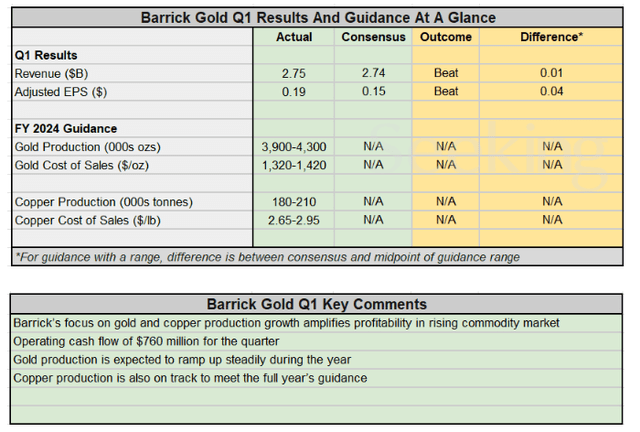

As my analysis shows, Gold is a high quality company with strong profitability and a strong balance sheet, highlighted by a comparison with the much larger Newmont Corporation. Gold’s fundamental strength and my bullish outlook are supported by recent quarterly results. Exceeding expectations for Q1 2024 Management reiterated its production targets for the full year.

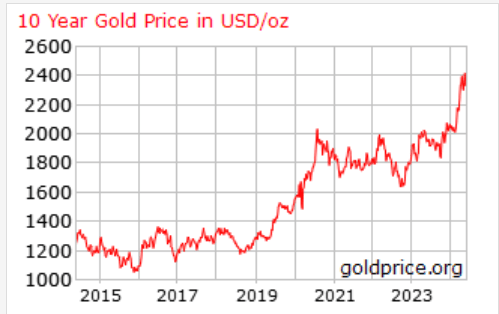

The performance of any mining company is heavily dependent on commodity prices, and since Barrick’s revenue is primarily derived from gold, let’s take a look at how the gold price is doing.

Gold Price

Gold prices are now twice as high as they were at the beginning of the last decade, and the major turmoil in the world over the past five years – the COVID-19 pandemic, the war in Ukraine, and the war between Israel and Hamas – are likely the main reasons for this surge in demand for gold.

While the pandemic seems to be a thing of the past, the situation surrounding these two wars is becoming more complicated: the war in Ukraine, for example, has recently escalated to a new level. Joe Biden allowed it. Ukraine plans to use US weapons to attack several targets on Russian territory; Germany and France Permission is likely to be granted Use weapons produced in these countries in the same way.

The conflict between Israel and Hamas also seems far from resolved. The Israeli Prime Minister A permanent ceasefire in Gaza is “unfeasible” until long-standing conditions to end the war are met.

Meanwhile, China continues to maintain tensions over Taiwan. Recent military exercises China’s defense minister patrols around the island Dongjun said: In a recent speech, President Trump said the Chinese military was prepared to “forcefully” prevent Taiwan from gaining independence.

“So, the global geopolitical situation is becoming more complex by the day, and it is unlikely that a ceasefire will come to fruition in either Ukraine or Gaza in the near future. Demand for gold as a defense asset is likely to remain high due to these factors, and I believe Barrick is likely to continue to benefit from this favorable trend.”

Calculating Intrinsic Value

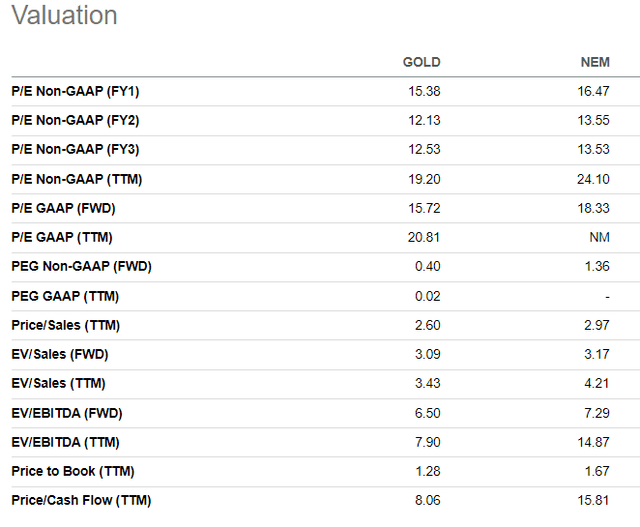

I would like to conclude my direct comparison of GOLD vs NEM by looking at the valuation metrics of the two companies. Despite GOLD being much more profitable and having a significantly stronger financial position, GOLD is cheaper when comparing valuation ratios. In the table below, none of GOLD’s valuation ratios are higher than NEM’s. To me, this indicates that the stock is attractively valued.

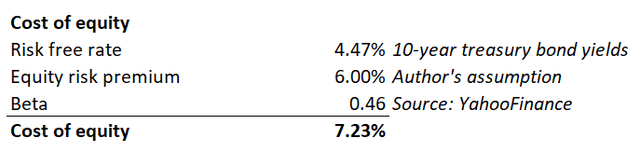

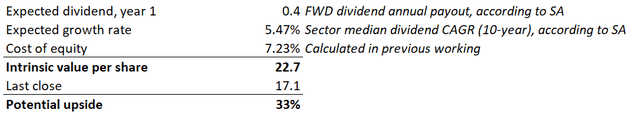

Discounting future dividends is also a good way to understand valuation attractiveness. The intrinsic value of a stock is calculated using the Dividend Discount Model (DDM). The discount rate in this approach is the cost of equity capital, and it is calculated as follows:

The cost of equity capital is 7.23%, and the DDM formula involves subtracting the expected growth rate from that. Gold’s dividend CAGR over the past 10 years is 7.18%, which is roughly equal to the discount rate, making the DDM irrelevant. Therefore, we need to implement more conservative dividend growth assumptions, Sector average CAGR over the past 10 years: 5.47% It seems suitable. Dividend ScorecardFuture annual payments will be $0.40.

Given the stock’s estimated real value of $22.7, the potential upside is 33%. Given the solid fundamentals, the 33% discount is a real bargain.

What could go wrong with my paper?

As I said earlier, gold is a defensive asset and demand increases during times of uncertainty. Currently, the world geopolitical situation is extremely complicated with two wars ongoing. However, history shows that all wars end in peace. I am not a political or military expert, so I may be wrong in my assessment that the two wars are unlikely to end anytime soon. I believe that if geopolitical tensions ease, demand for gold may weaken significantly, which would contradict my argument.

Gold mining companies often expand their mine portfolios through multi-billion dollar acquisitions. Large scale transactions are inherently risky and expose the company to various legal and regulatory risks. In addition, acquisition prices are calculated based on long-term projections and many assumptions, which may be overly optimistic. Therefore, there is always a growing risk that GOLD will pay too much for a potential acquisition, to the detriment of shareholders.

summary

For investors looking to profit from the strong momentum in gold prices, GOLD is a great buy. The company has demonstrated strong profitability, multiple Tier One assets, and a strong financial position to continue investing in expanding production. Additionally, the stock is very attractively valued with 33% upside potential.