Eric Isaacson

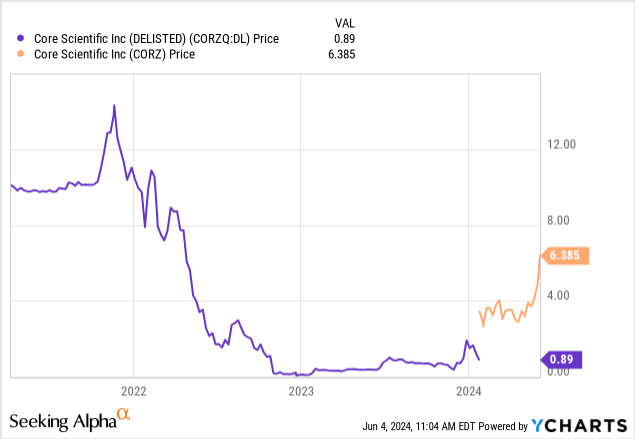

I The last one we looked at was Core Scientific (Nasdaq:Colts) to Seeking Alpha. Since this “sell” call, CORZ shareholders have been on quite a journey to say the least.

immediately According to a CORZ article in late October 2022, the cryptocurrency market experienced the collapse of FTX, further lowering the prices of cryptocurrency coins and proxies such as Bitcoin (BTC-USD) mining stocks. Specifically, Core Scientific filed for Chapter 11 bankruptcy and re-emerged with a restructuring plan that emphasized debt reduction and a 60% equity stake for shareholders of the delisted shares. Admittedly, things could have been worse for CORZ holders, and the relisted shares have performed quite well this year.

Recently, CORZ’s stock price has been soaring in response to the company’s efforts in the AI data center field. Acquisition proposal from a major HPC services client. In this update, we look at CoreWeave news, Q1 2024 financials, and the company’s mining operations.

Core Scientific and CoreWeave

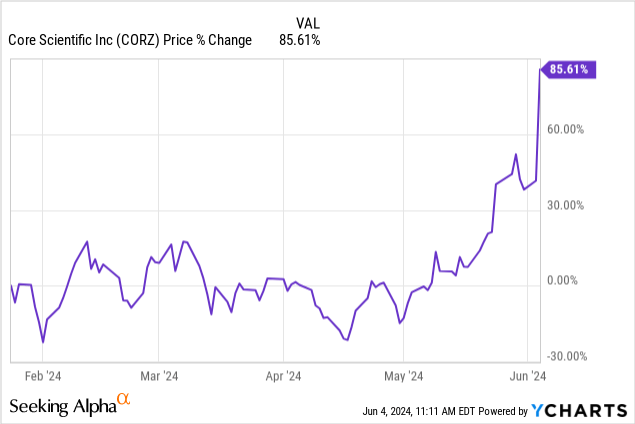

On June 4, Bloomberg Offer from CoreWeave The company announced it would acquire Core Scientific for approximately $1 billion, or $5.75 per share, the day after Core Scientific announced a significant expansion of its HPC services contract. Use CoreWeaveCORZ shares have risen nearly 50% on the news and are trading at about 20% above CoreWeave’s asking price as of this posting. According to the company’s June 3 press release, the newly announced HPC contracts cover 200 MW of HPC infrastructure and will run for 12 years with the potential to expand. Core Scientific says the contracts will generate approximately $290 million in annual recurring dollar revenue.

This is an expansion of Core Scientific’s existing relationship with CoreWeave. From 2019 to 2022, CoreWeave utilized Core Scientific for GPU hosting. Most recently, Core Scientific deployed 16 MW of capacity for CoreWeave in its Austin, Texas data center earlier this year. It is important to point out that GPUs and ASICs are not interchangeable. To grow revenue from HPC services, Core Scientific needs to modify some of its existing infrastructure to better align its mining and HPC segments. Core Scientific estimates that CoreWeave will fund $300 million of the capital investment required for the infrastructure modifications. The site modifications are expected to begin later this year, with operations beginning in early 2025.

Q1 2024 Revenue and Balance Sheet

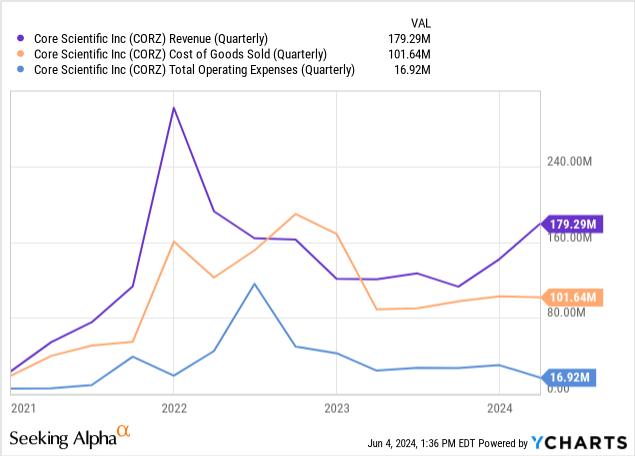

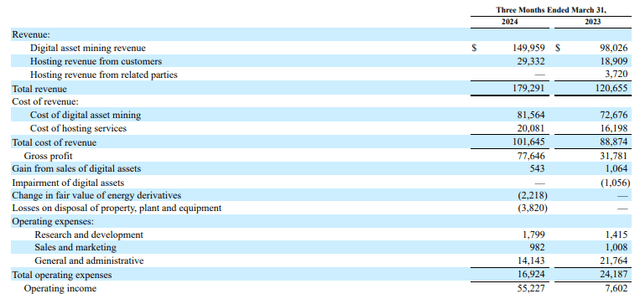

News of the potential acquisition from CoreWeave and plans to expand with the company comes on the heels of a fairly impressive turnaround in recent quarters for Core Scientific, which reported revenues of over $173 million, cost of sales of $101.6 million and total operating expenses of $17 million as of the end of March 2024.

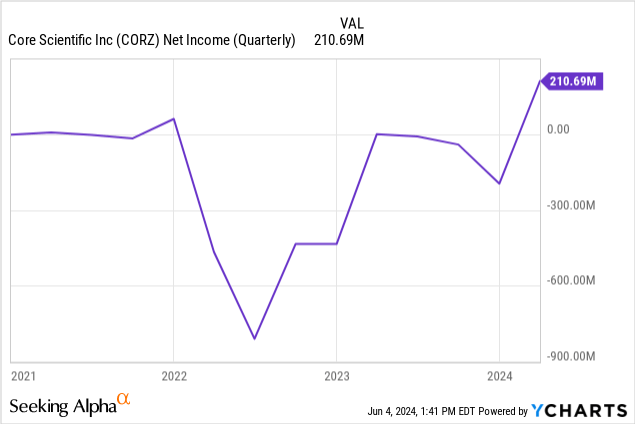

Factoring in more than $111 million in net restructuring items, including the extinguishment of loans, leases and bonds, net income for the quarter was just under $211 million.

This marks the company’s first net profit positive quarter since December 2021. Looking at revenue by segment, we can see that Core Scientific remains heavily reliant on digital asset mining, which accounts for approximately 84% of the company’s total revenue, with hosting making up the remainder.

10-Q (Core Scientific)

In Q1 2023, Core Scientific achieved a gross margin of approximately 14% on hosting revenue from customers. This figure more than doubled to over 31% in Q1 2024. On the surface, the Mining division saw a similar increase in gross margins, improving from last year’s gross margin of 26% to approximately 45% in Q4. We’ll discuss the Mining division in a bit more detail in the next section.

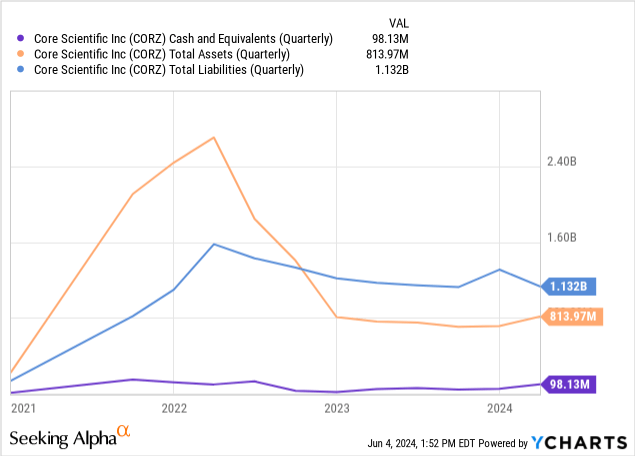

A quick look at the balance sheet shows that Core has around $98 million in cash, $814 million in total assets, and over $1.1 billion in total liabilities.

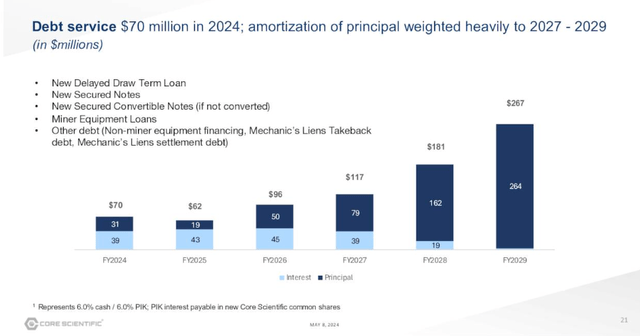

May Investor Presentation, Slide 21 (Core Scientific)

Fortunately, most of the company’s debt has not fallen due for several years, with over $500 million of principal due after 2027. With the company’s HPC revenue from CoreWeave expected to grow in 2025, Core Scientific’s financial situation is not as bad as I previously suspected. However, Core Scientific’s future seems to hinge on CoreWeave. From my perspective, this also explains why an acquisition offer for CoreWeave came on the heels of an expansion of the HPC services relationship. It would probably be much more beneficial for CoreWeave to simply own its infrastructure rather than rent it from Core Scientific.

Bitcoin Mining Business

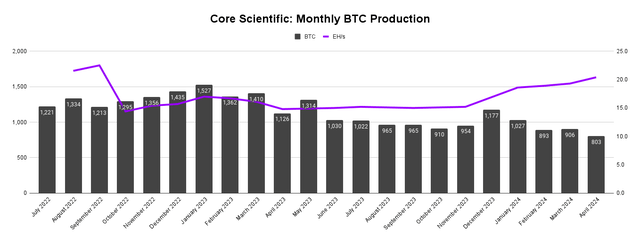

Frankly, CoreWeave’s HPC services agreement couldn’t have come at a better time, given the recent halving of Bitcoin’s block reward subsidy. While production data for May is not yet available from the company, the trend over the past few quarters is pretty clear: as Bitcoin’s hash rate increases globally, miners’ share of the block reward will decrease if they are unable to continue to scale their owned production capacity in line with the global hash rate.

BTC Production (Authors’ chart, Core Scientific filings)

Since January 2023, Core Scientific’s monthly BTC production has been on a downward trend despite continued growth in its own-mined EH/s.

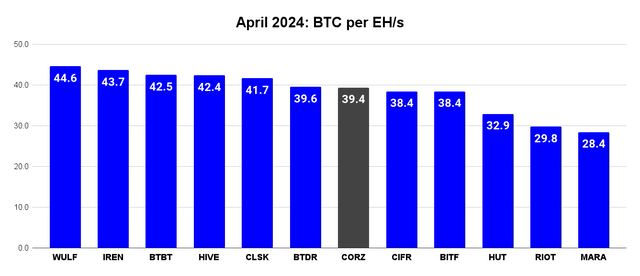

BTC / EH/s April (Author’s chart, company filings)

In April, Core Scientific’s bitcoin production per EH/s was moderate compared to most top publicly-listed bitcoin mining companies. If we revise April’s data downward by 50% to create an estimate for May and assume that revenue from transaction fees remains sporadic, we would get 19.7 BTC per EH/s going forward. Using Core Scientific’s April mining capacity, we can estimate 402 BTC for May. Unless BTC prices rise permanently or transaction fees increase significantly, Core Scientific’s bitcoin mining business could worsen in the coming months and quarters. That said, the company’s mining division could certainly benefit from a rise in BTC prices later this year and next.

Closing Summary

Taking Core Scientific’s May BTC production of 402 as my estimate and creating an annualized revenue table based on Bitcoin prices, it would take a six-figure BTC price to approach $500 million in annualized mining revenue.

| BTC Price | Monthly Revenue | Annualized |

|---|---|---|

| $70,000 | $28,140,000 | $337.68 million |

| $80,000 | $32,160,000 | $385.92 million |

| $90,000 | $36,180,000 | $434.16 million |

| $100,000 | $40,200,000 | $482.4 million |

Source: Author’s calculations, assuming 402 BTC mined per month

Assuming the BTC price reaches $100,000 by 2025 and HPC services revenue from CoreWeave reaches $290 million that year, Core Scientific stock is trading at $7 per share, or roughly 1.5 times sales. That’s roughly a 47% discount to the information technology sector median. Given that, I wouldn’t actually be that surprised to see the stock trading above CoreWeave’s acquisition offer.

Lastly, I want to state that I have no stake in this fight. I have never shorted CORZ, despite calling it a “sell” two years ago. I still think there is risk in this stock, despite the takeover bid. I personally believe that “AI” as an investment idea is more hype than reality. Given that, this rally may be a great opportunity for previous cycle shareholders to survive a previous bankruptcy story not too far away.