johnnyscriv/E+ via Getty Images

Investment Overview

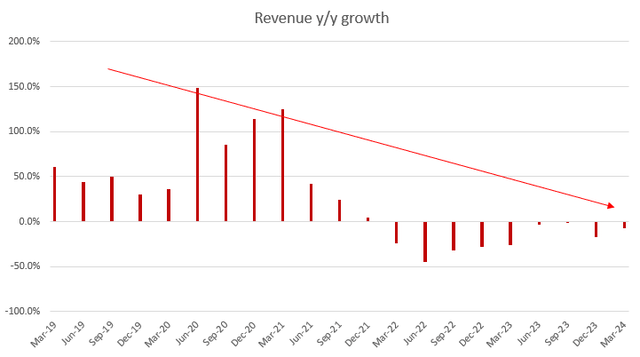

I give Cricut, Inc. a Sell rating.Nasdaq:CRCTWe expect demand to remain weak in the near term as the macro environment remains weak. Consumer discretionary spending remains under pressure. Demand for CRCT’s core products (machines) will decrease, directly impacting demand for platform services, accessories and materials.

Business Contents

CRCT is in the business of providing computer-controlled cutting machines to help home crafters better design and create the products they love. We have attached some pictures below to give you a better idea of what the products they sell are like.

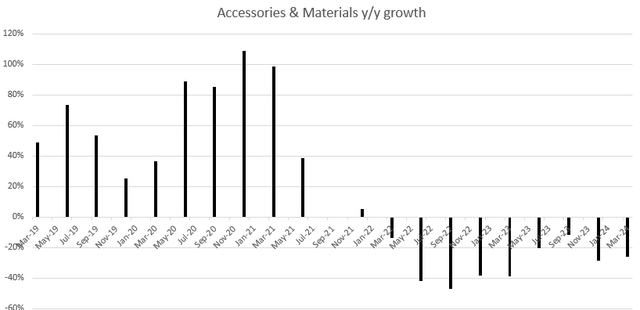

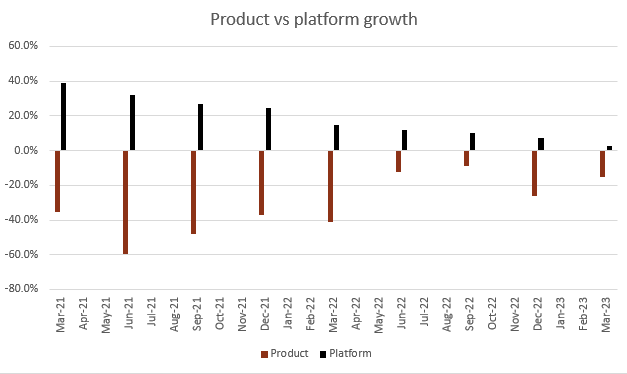

The primary business divisions (segments) are Products (60% of FY23 revenue), Platforms (40% of FY23 revenue). For reference, the previous business had three primary segments – Connected Machines (26% of FY23 revenue), Platforms (40% of FY23 revenue) and Accessories & Materials (34% of FY23 revenue).

The latest quarter (Q1 2024According to CRCT’s second quarter (first quarter of 2023) financial results announced on May 7, CRCT’s total revenue was $167.4 million, down 7.6% quarter-on-quarter, gross profit margin was 54.7%, a significant improvement from 42.3% in the previous quarter, EBITDA margin was 20%, a significant improvement from 10.9% in the previous quarter, and net profit margin was 11.7%, up 670 basis points from the previous quarter. Earnings per share (EPS) were $0.09 compared to $0.04 in the previous quarter.

Negative business outlook

I am very pessimistic about the near-term (6-12 months) outlook for the business. Despite very strong profitability in the latest results, the reality is that the business continues to experience negative growth and I do not see any catalyst to drive positive growth in the near term.

First, my view is that the CRCT will continue to feel pressure, starting with the worsening macroeconomic situation, which continues to squeeze consumer purchasing power and has no near-term visibility as to when this situation will end. Recent US inflation data shows that: Inflation remains highly volatileOn a three-month moving average, the economy is back where it was in Q3 2023. This is very negative for consumer spending and means two things:

- The impact of high interest rates is not as apparent as it should be.

- Interest rates will likely remain high for the foreseeable future, but the scary thing is that the Fed Did not exclude the possibility of further rate hikes.

Investment Ideas for May

The nature of the CRCT business is highly dependent on how much consumers are willing to spend on discretionary items. The entire sales model revolves around CRCT selling their flagship products (machines). Consumers then join CRCT to design patterns and purchase tools and accessories to facilitate the cutting process. In my opinion, weak macro conditions will significantly reduce demand for their flagship products. Note that these machines are not cheap products under $50. According to CRCT’s website, these machines range in price from $100 to $1,000+. Reduced demand will directly impact platform revenue as fewer customers (product owners) are added to the CRCT customer base, and CRCT’s financials are already showing this weakness.

There are several other signs of weak demand, including:

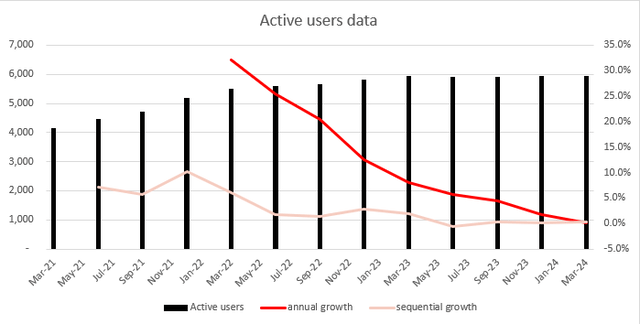

- The number of active users has been declining both quarter-over-quarter

- User engagement over the past 90 days fell 5% to 3.5 million.

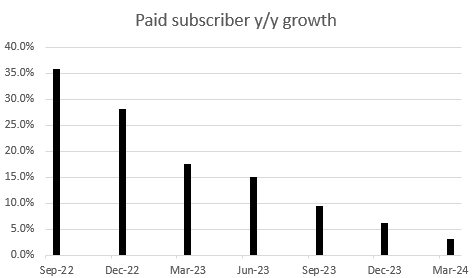

- Most importantly, annual paid subscriber growth has slowed for the seventh consecutive quarter, falling from 35% in Q3 2022 to just 3% in the most recent Q1 2024.

Investment Ideas for May

“I believe all these data points are enough to prove my contention that demand is slowing and is at an inflection point that could turn negative if macroeconomic conditions remain soft. Management’s commentary on Q2 2024 results does not include any encouraging signs of recovery or stabilization, noting that retailers remain cautious about replenishing inventory and that they expect the weak consumer spending trend to continue.”

This is of particular concern as management cites competition, in addition to weak macroeconomic conditions, as a major headwind for the Accessories & Supplies division, which represents approximately 33% of the business and is the division with the lowest barriers to entry (there are thousands of arts & crafts stores where consumers can shop). Management expects this division to continue to hold back overall growth as it is impacted not only by weak macroeconomic conditions (lower product sales impacting demand for accessories and supplies) but also competition.

Confused by new capital return program

I am also very troubled by the new capital return program, which includes a $50 million share repurchase authorization, a special dividend of $0.40 per share, and a new semi-annual dividend of $0.10 per share. While this may sound good for shareholders, my inference from this move is that management had no better options to allocate this amount of cash. I would have expected them to find a way to reinvest in the business and restore growth (I am concerned that CRCT has no way to restore growth even by allocating capital).

So even with this capital return program, we’re not going to get positive until we see signs of demand stabilizing or recovering and underlying user metrics improving.

evaluation

Investment Ideas for May

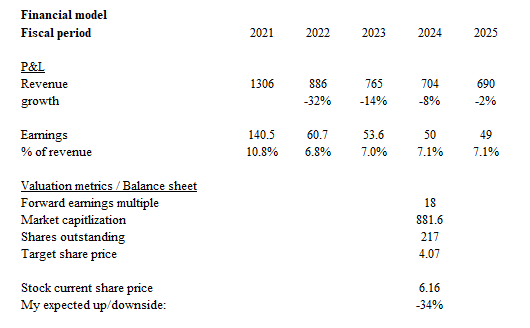

Based on my research and analysis, the expected target price for CRCT is $4.

- With no near-term catalyst to boost growth, we expect revenues to continue to decline at the same rate as in Q1 for the remainder of FY24 (FY24). That said, the macro environment in FY25 should be better than FY24 and CRCT should see some sort of recovery. For FY25, we have assumed a 2% decline following a 600 bps YoY growth increase (-8% growth in FY24 was up 600 bps from FY23).

- Regarding margin expectations, given that management demonstrated strong margins in the first quarter of fiscal 2024, I am confident that the company will be able to achieve its guidance for fiscal 2024 and maintain it in fiscal 2025.

- CRCT is currently trading at close to its historical average of 24x, which I believe does not accurately reflect the ongoing slowdown in its business. Just a few months ago, the stock was trading at 18x forward PE, which I believe represents a potential downside that CRCT could face. Assuming CRCT trades at 18x, that would put the stock at around $4.

danger

Given that growth in subscription revenue and accessory and materials revenue has lagged behind connected machine sales, higher than expected connected machine sales would prove my revenue estimates too conservative, especially as Cricut recently entered several new international markets that could result in faster than expected growth.

Conclusion

Given the weak demand and outlook, we give CRCT a sell rating. We believe the deteriorating macro environment will continue to pressure consumer discretionary spending, which will directly impact sales of CRCT’s main machines. We expect this weakness to translate into reduced platform subscriptions and demand for materials and accessories. Additionally, user metrics show a clear downward trend, which is very worrying. Finally, the new capital return program seems like a desperate attempt to appease shareholders and does not address the fact that growth is slowing/may turn negative.