Musa 81

There are many “Buffett-isms” out there and most people know his quote “Be greedy when others are fearful and fearful when others are greedy” but I believe his more thoughtful and insightful statement is “Markets are designed to relocate”. Wealth comes from the impatient to the patient.”

That’s because, while many growth stocks are trading at what I would consider to be exorbitant prices, I am happy to buy value stocks at what I believe to be a fraction of their value.

In fact, I don’t mind if value stocks remain cheap over the long term, because it simply gives me the opportunity to dollar-cost average into value stocks and increase my income stream.

So here are two stocks, both of which have a long history of fundraising. Both have been paying dividends for over 25 consecutive years. Both trade at attractive valuations for patient investors who are willing to wait out the headwinds to earn above-average yields. Let’s get started!

1st place: Medtronic

Medtronic (MDTC(NYSE: BT) is a healthcare technology company serving the cardiovascular, surgical, neuroscience and diabetes segments, including specialized devices such as pacemakers, insulin pumps, spinal implants, ventilators and surgical navigation systems.

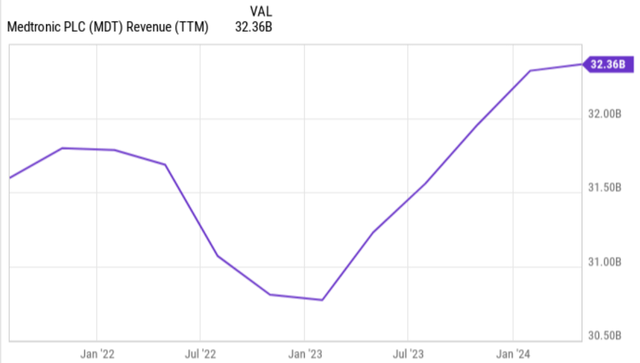

MDT’s stock price continues to trade weakly compared to its all-time high of $135 in the fall of 2021. At a current price of $81.37, the stock has fallen 40% over that period. MDT’s weak stock price underscores the strength of the company’s overall business. As shown below, MDT’s revenue has recovered since bottoming out in the second half of 2022, with TTM revenue of $32.4 billion.

MDT continued this growth trend in the fourth quarter of 2024 (ended April 26), with organic revenue increasing 5.4% to $8.6 billion. Exceeded That beat Wall Street analysts’ expectations by $150 million. MDT’s adjusted EPS hit the high end of guidance at $1.46, and free cash flow increased 14% year over year to $5.2 billion, which was also encouraging. MDT’s sales growth was fueled by mid-single-digit growth in the U.S. and Europe, as well as strong 13% growth in emerging markets, including China, as they emerged from COVID-related lockdowns.

Management is forecasting organic revenue growth in the range of 4% to 5% for the ongoing fiscal year 2025, based on expectations that MDT will expand its leadership in key areas, including the introduction of the Aurora EV-ICD, an implantable extravascular defibrillator to treat sudden cardiac arrest, surgical innovations such as the Hugo robotic-assisted surgery system, and the upcoming integration of Simplera Sync sensors with MDT’s MiniMed 780G system for diabetes care.

Meanwhile, MDT has an “A” credit rating from S&P and maintains a strong balance sheet, including a safe net debt to TTM EBITDA ratio of 1.87x, well below the market’s generally safe ratio of 3.0x for non-REIT/utility companies.

This supports MDT’s 3.4% dividend yield and makes it a safe bet. 53% The dividend payout ratio is 6.7% and the five-year dividend CAGR is 6.7%. MDT is not necessarily cheap at its current share price of $81.37 and forward PE of 14.9, but it is well below its historical PE of 18.2, as shown below.

I believe MDT’s Dividend Aristocrat status and 46 consecutive years of annual dividend increases lend credence to its durability and make it worthy of trading at a historic PE. Additionally, the recent promising growth and analyst forecasts mentioned above make it a good buy. 7% Considering the annualized EPS growth rate over the next two years, MDT could reasonably achieve market-level performance without reverting to the mean valuation.

2nd place: Altria

Artoria (MissouriPhilip Morris International Inc., a spinoff of the company, officially became a Dividend Aristocrat in 2008, despite having cut its dividend.afternoon) ensured shareholders benefits from its own dividends in terms of cash flow and has increased its dividends every year since.

If you follow the tobacco industry, you probably know that it is currently undergoing its biggest transformation in decades, with smokers given more options, including e-cigarettes, heat-not-burn tobacco products, and nicotine pouches.

Altria is also looking to buy its failed Juul shares and rival British American Tobacco.BTI) leads in e-cigarettes, while Philip Morris International leads in heated tobacco products through IQOS and nicotine pouches through Zyn.

MO is facing a challenging sales environment in the U.S. as smokers switch to alternatives and illicit e-cigarettes, with revenues net of excise taxes declining 1% year-over-year in the first quarter of 2024. This was primarily due to a 10% year-over-year decline in cigarette sales volumes due to a natural decline in smoking, rising gasoline prices, and switching to both legal and illicit products in the e-cigarette space.

While the current business environment is challenging, I believe it would be a mistake to give up on Altria at this early stage in the nicotine transition, given strong volume growth for MO NJOY, which continued to grow market share by 0.6% quarter-over-quarter to reach 4.3% at the end of the first quarter, and MO nicotine pouch On!, which grew market share by 0.7% quarter-over-quarter to reach 7.1%.

In addition, MO has recently PMTA submitted NJOY has received FDA approval for blueberry and watermelon flavors for its NJOY ACE 2.0 platform, which has Bluetooth-enabled age restrictions to prevent youth use, which, combined with a crackdown on illegal e-cigarettes, could be a boost for the company that the market has yet to fully price in.

It is also worth noting that MO still owns 8.1% of Anheuser-Busch InBev shares (Bud) at the end of the first quarter, which could continue to provide capital for share repurchases. MO also has a BBB credit rating from S&P, a secure net debt to EBITDA ratio of 2.1x, and a strong balance sheet, including the fact that MO paid down $1.1 billion worth of debt in the first quarter alone.

This supports MO’s 8.5% dividend yield and makes it a safe bet. 79% This is in line with MO’s historical payout ratio of approximately 80%. Given management’s projected payout ratios through 2020, MO’s dividend is likely to grow again this year. 2% to 4.5% EPS growth this year.

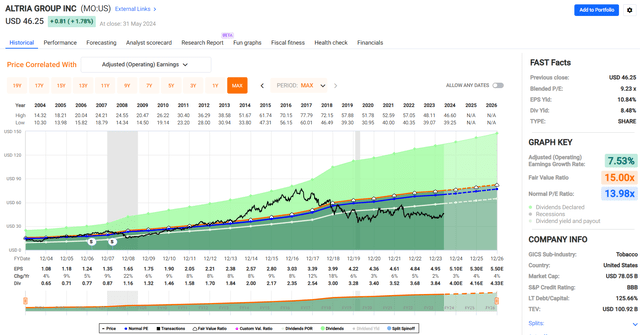

I see value in MO at the current price of $46.25 and a forward PE of 9.1, which is well below the typical PE of 14.0 as shown below.

Sell-side analysts following company forecasts 4-5% Annual EPS growth over the next two years is likely to be driven by price elasticity of traditional smoking products and growth in new categories such as On! nicotine pouches and NJOY, as well as share repurchases. Thus, MO is positioned to deliver above-market total returns when combined with dividend yield and the lower end of management’s EPS guidance, which does not include potential share price appreciation relative to MO’s long-term historical valuation.

Investor View

Medtronic and Altria offer attractive opportunities for patient investors focused on value stocks with strong dividend track records. Medtronic, the medical technology leader, offers a 3.4% yield, buoyed by 46 consecutive years of annual pay raises and solid growth prospects for its cardiovascular and diabetes divisions.

Altria maintains an 8.5% yield and potential upside from its NJOY e-cigarette business and strategic investments despite recent challenges in the tobacco industry. Both companies are well-positioned to deliver long-term value through dividends and potential capital appreciation with strong balance sheets and a commitment to shareholder returns.