Morsa Images/DigitalVision via Getty Images

Investment behavior

I Purchase Rating Progyny Co., Ltd. (Nasdaq:PGNY) I did not mention this in my article in mid-March of this year because I believe the long-term growth prospects remain attractive. Based on my current outlook and analysis, I believe BUY rating. The main update to my thesis is that I don’t believe the weak Q1’24 earnings indicate a structural long-term impediment to growth. The historical progression of the US ART cycle suggests a strong long-term growth trend, and as downturns are typically followed by strong recoveries, I am confident we will see a recovery eventually. Also, leading indicators suggest that utilization rates are already back on track.

review

A simple touch Latest ResultsPGNY reported earnings in early May, reporting sales up 7.6% to $278 million, below market expectations of $290 million. Among the growth, fertility benefits services increased 8.1% to $169.8 million and pharmacies increased 6.9% to $108.3 million. Gross margins decreased 18 basis points to 25.7% and EBITDA margins increased 14 basis points to 18.1%, for an absolute figure of $50.3 million. Overall, Q1 2024 results were disappointing, with weak utilisation leading to weak revenue growth and a significant drop in the stock price from an initial estimate of $32 to $26 today. Below, I explain why I believe the shortfall is only a temporary issue and why I believe the stock is still trading at very attractive levels.

I don’t believe the lower than expected performance is due to structural factors. We started the year well, with utilization rates in January and February comparable to 2023. However, utilization rates dropped sharply in mid-March, which is why we fell short of our revenue expectations. I believe many patients are adjusting their expectations around access to maternal care in light of COVID-19. Alabama Supreme Court decisionAlthough uptake has lagged, particularly in states with the most restrictive laws on women’s reproductive rights, I believe it has not been permanently undermined. Recent Senate Bills (Should help clear up some confusion.) In fact, management has already said that utilization rates have stabilized and improved from rock bottom in April. It is also important to note that while utilization rates have declined in states with more stringent laws regarding women’s reproductive rights, demand for PGNY fertility benefits among employers in affected areas has not decreased. This is important because it means that employees continue to have access to affordable IVF (potential demand and increased utilization in the future).

With several indicators suggesting demand remains robust, I expect PGNY to see growth accelerate again in the coming quarters. First, based on early indications, the pipeline is very strong so far this year. You specifically noted a more active pipeline compared to last year. In particular, the pace of industry hiring appears to be accelerating: (1) PGNY is seeing increased early commitments from the strong pipeline you mentioned last November, and (2) PGNY has seen strong commitments in healthcare, automotive, manufacturing, and more. My take on the rising hiring rate is: fact Forty-five percent of large employers offer IVF coverage to their employees, up from 23% in 2019. In aggregate, there has been a 10 percentage point increase in coverage for IVF treatment in 2023 compared to 2020, according to statistics.

Conditionally speaking, not participating at this time made up the majority of the early commitments we received, and 2024 is proving to be no different with strong early commitments from leading brands in healthcare, automotive manufacturing, travel & leisure, and media, as well as multiple state and local governments. Announcement of first quarter 2024 financial results

Another indicator that demand remains healthy is that engagement is maintaining levels well into 2022 and beyond, suggesting that the current hiring uptick and pipeline growth is not a one-time freak event.

The long-term perspective is reassuring, as demand for IVF has historically been stable and no major catalysts are on the horizon to change this trend. CDC We have historical data on the ART cycle, and based on that, the ART cycle has been rising for the past 20 years, and the only times growth has turned negative have been during COVID and subprime, and growth has He recovered quickly. After the respective crises ended, growth rates in the ART cycle turned negative in 2009 and 2010, but quickly recovered to 3.2% in 2010, similar to the pre-crisis growth rate (average growth rate of 3.7% in 2005-2008). The same was true during the COVID period, falling to -1% in 2010, but recovering to 3.2% in 2011. Growth of approximately 27% in 2021.

evaluation

Author’s works

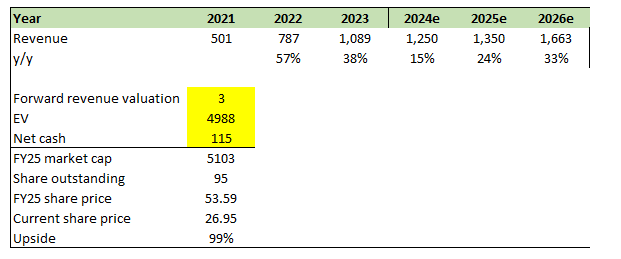

My view on PGNY has not changed. I still believe PGNY can eventually accelerate growth to above 30% as all near-term issues are resolved and the economy recovers. The question is when growth will re-accelerate. Previously, I expected growth to exceed 30% in FY25, but have now extended my forecast by a year to be more conservative given the prevailing issues and persistently weak economic outlook. Using the midpoint of my FY24 revenue revised guidance of $1.25B (implying 15% YoY revenue growth), I now forecast a linear expansion to 33% YoY growth in FY26, implying that PGNY will generate $1.66B in revenue in FY26. This is a business that grew 38% last year alone, so I don’t think this is a high hurdle.

I believe the market should respond favorably to several years of accelerated growth and PGNY should trade at least 3x forward earnings, where it traded in FY23 when growth exceeded 30%.

Based on these assumptions, I have a FY25 target price of approximately $54.

danger

Given the volatility of occupancy rates, I believe investors will be fairly conservative in their expectations, especially since the guidance includes a recovery in the second half of 2024. Until PGNY shows improved occupancy rates on a reported basis, the stock is likely to remain range bound in the near term. Also, past cycles have shown that PGNY would be directly affected if the economy continues to slow or fall into a recession.

Final thoughts

Despite lower-than-expected Q1 2024 revenue, I recommend a Buy rating. I believe the lagging demand is due to recent legal uncertainty and not structural factors. I still believe in the long-term prospects of the business, as historical trends show that demand for IVF is resilient and has shown strong recoveries following economic downturns. There are also leading indicators that suggest a recovery in utilization has already begun.