Carl Weatherly

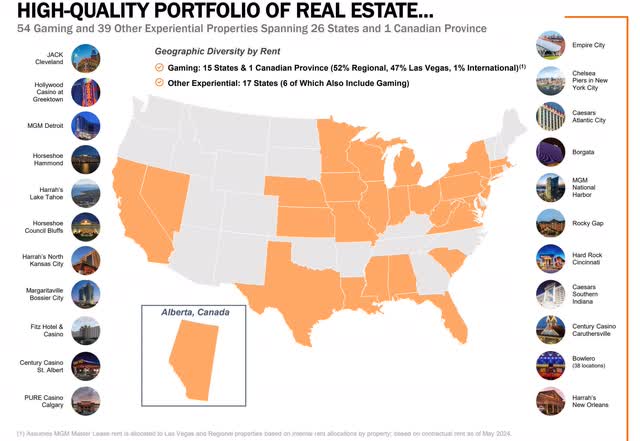

VICI Properties (New York Stock Exchange:Vichi) is a REIT focused on owning prime real estate in Las Vegas, but also owns properties in other areas such as Chelsea Piers in New York. It has a focus on gaming and hospitality. The company has successfully acquired Harrah’s Las Vegas, Caesars Palace Las Vegas, MGM Grand, The Venetian Resort Las Vegas, and many other iconic properties totaling 127 million square feet. Many large hospitality companies lease these properties from VICI Properties, meaning rent payments are almost certain and for a very long time. This makes VICI Properties an ideal stock for income investors, and the recent share price decline makes it even more attractive. Let’s take a closer look.

chart

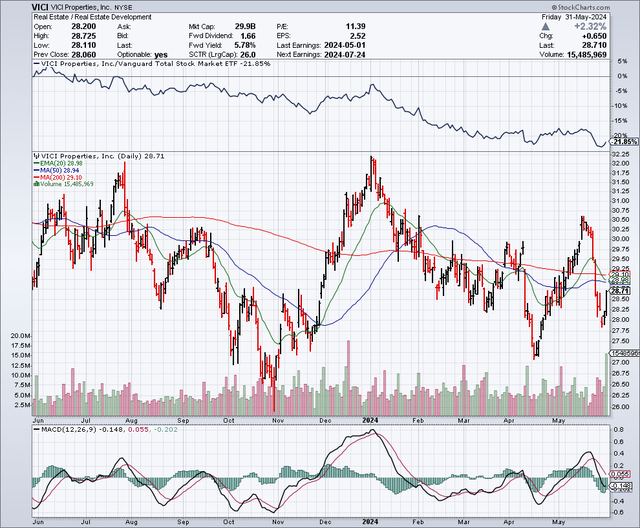

As the chart below shows, the stock has recently It is trading above $30 per share, but like many REIT stocks, the stock has been declining as investors focus on “longer term higher interest rates,” which has had a major impact on the sector. The 50-day moving average is at very similar levels at $28.94 and the 200-day moving average is at $29.10. I believe the recent decline represents a buying opportunity, especially since the stock is trading slightly below these moving averages.

Revenue forecast and balance sheet

Analysts are predicting The company is expected to earn $2.55 per share FFO on revenue of $3.83 billion in 2024. In 2025, FFO is expected to rise to $2.67 per share on revenue of $3.93 billion. This means the price-to-earnings ratio is about 11, indicating that the stock is undervalued relative to its peers. (We’ll discuss valuation in more detail below.)

about Balance sheetVICI Properties has approximately $17.61 billion in debt and approximately $485.32 million in cash. Moody’s has “BA1” credit rating Have a positive outlook.

Growth Outlook

This company Guided FFO growth in 2024 is approximately 4%. I expect FFO growth to be higher from 2025 onwards due to further property acquisitions. While many of VICI’s property costs are fixed, inflation-adjusted rent increases are also a factor. However, I do not believe FFO growth is the catalyst for my investment thesis on this stock. My thesis is based on my belief that interest rates will fall significantly over the next few years, which is primarily based on the Federal Reserve’s projections.

dividend

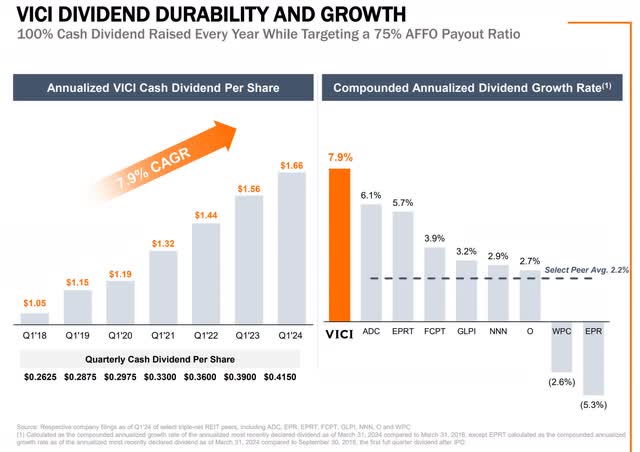

VICI Properties is an ideal stock for dividend growth. In 2018, VICI Properties paid a quarterly dividend of $0.18 per share. However, Consistently increasingIn 2019, the dividend more than doubled to $0.415 per share. On an annualized basis, the dividend stands at $1.66 per share, yielding about 6%. The payout ratio is about 66%, leaving plenty of room for earnings fluctuations without any concerns about the safety of the dividend. As shown below, VICI Properties targets an AFFO payout ratio of 75% for its dividends, which also suggests the potential for further dividend growth. It also shows that over the past few years, the company has offered a much higher dividend growth rate compared to its peers.

evaluation

VICI Properties is a Realty IncomeohFor example, Realty Income uses FFO as $4.23 per share The year is 2024. The current stock price is about $53 per share, so the P/E is about 12.5 times.

Agree Real Estate (Advanced) is a popular REIT among investors and is expected to generate profits. $4 per share With the current share price of around $61, that puts the P/E ratio at just over 15.

Gaming and Leisure Facilities (GLPI) occupies a similar niche within the REIT sector as it also focuses on casinos and hotels. Analysts say the company $3.76 per share Based on the current share price of about $45, the P/E ratio is 12, which is similar to but slightly higher than VICI Properties’ P/E ratio of about 11. Real Estate Portfolio It is not at the same level and therefore does not deserve the same valuation. VICI Properties owns some iconic properties in the gaming sector and for this reason we believe it deserves a premium.

Interest rates could fall sharply between now and 2026

In the first quarter of 2024, the Federal Reserve prediction This means that the federal funds rate will be significantly reduced by 2.25 percentage points by the end of 2026. This means that the target for the federal funds rate will be lowered from the current range of 5.25% to 5.5% to the range of 3% to 3.25%. This will significantly reduce money market fund yields, potentially as low as 3%. Investors currently earning 5% or more yields on “risk-free” money market funds may find that there is a significant opportunity risk to staying invested in money market funds for the long term as yields will plummet and investors will look for other options to maintain their accustomed income streams.

I believe there are too many investors with too much money in money market funds right now. If yields on these funds were to plummet, that could send a lot of cash searching for new investments. According to the latest data from the Federal Reserve, $6 trillion in money market funds For now. When interest rates eventually fall, I believe the REIT sector will benefit as income investors will be eager to reallocate their capital to higher-yielding assets. This should boost the share prices of VICI Properties and other high-quality REIT stocks.

My stock price predictions for 2026

If money market yields fall by about 40% to the low 3% range, I believe VICI Properties stock could sustain a yield of around 4% to 4.5%. This means that valuation could be revalued to a higher level. Based on an annual dividend of $1.66 per share, a 4% yield would put the stock at around $40. I believe this calculation is conservative and based on a current premium. VICI Properties’ current yield is only less than 1% higher than the typical money market yield of just over 5%. My projections suggest a future premium of around 1% to 1.5% over money market yields, which is higher than the current premium. Thus, an investor who buys this stock now for around $29 per share could earn a capital gain of around 40% between now and the end of 2026, plus a (fixed) yield of around 6%. This means total revenue could approach 50% over the next few years, or about 25% annualized.

Potential downside risks

If tourism and gambling revenues in Las Vegas actually slow or are perceived to slow, that could impact investor sentiment and the stock’s price. This hospitality- and Las Vegas-focused REIT may be viewed as less recession-proof than other REIT stocks.

The REIT sector is highly sensitive to interest rates, and these stocks have generally underperformed over the past few years as interest rates have risen. While the Federal Reserve is expected to begin reversing these rate hikes later this year, inflation has proven to be more robust than expected, leading some market watchers and analysts to believe the Fed will need to keep interest rates high for an extended period of time or even raise them further. In this scenario of interest rates remaining high or even rising further, REIT stocks will continue to find themselves in a tough spot and may even fall further.

REIT stocks have fallen sharply in the COVID-19 market correction of 2020, suggesting that any potentially significant economic shock could be another potential downside risk to consider.

In summary

A nearly 6% yield at a time when money market fund yields are just above 5% may not seem all that appealing, but with the Federal Reserve predicting a sharp decline in interest rates, that could change over the next 1-2 years. Over the next 2-3 years, we could see federal funds rates and money market fund rates fall to the 3% range, which would increase investor interest in REIT stocks. Based on this scenario, these stocks could experience significant upside. Over the next 2-3 years, we expect the combination of a nearly 6% dividend yield and stock price appreciation to generate a total return of 25% on an annualized basis.

No warranties or representations are made. Hawkinvest is not a registered investment advisor and does not provide specific investment advice. Information is for informational purposes only. Always consult with your financial advisor.