pictafolio/E+ via Getty Images

last year, Coherent Corporation (New York Stock Exchange:Coal) announced earlier this week Jim Anderson appointed as new CEOAbout a year ago, investors Follow Monster Rally $54.87. The stock price soared despite there being no news at the time.

Is this recent uptick any different? When it comes to benefiting a company, leadership change is one of the highest-ranking positive factors.

About Coherent’s New CEO Jim Anderson

After a thorough investigation, Coherent’s board of directors Jim Anderson appointed Anderson will serve as the company’s new CEO. Anderson will also join the board of directors. Anderson previously served as president and CEO of Lattice Semiconductor Corporation (LSCCThe press release highlighted Anderson’s responsibility for driving Lattice’s corporate strategy, enhancing its product roadmap and delivering record earnings and gross margins.

Anderson Coherent’s outgoing chairman and CEO.

The board expects Anderson to maximize the growth potential of artificial intelligence. Coherent has an AI-related data communications portfolio. The company said in its third-quarter conference call, AI mentioned 12 timesThe company reported that its non-GAAP earnings per share increased by approximately 50% quarter-over-quarter. Demand for 800G datacom transceivers drove its performance in the first quarter and is expected to continue that momentum in the coming quarters.

In fiscal 2023, 800G revenue is expected to be $20 million, up from $50 million in the first quarter and just over $100 million in the second quarter. Coherent forecasts $200 million in revenue in the third quarter and more than $250 million in revenue from 800G sales in the fourth quarter.

Coherent was seeing signs of improving demand in the industrial markets, including stabilization in the measurement and electronics markets. At the time, Coherent’s stock price was trading in the $53 to $58 range. The stock price fell prior to the announcement of the hiring of a new CEO, which helped the stock price rise from under $56 to around $70 on June 3rd.

Opportunities for AI

The adoption of AI tools is an opportunity for Coherent, but it’s still early days, so investors should wait until the company achieves higher profit margins.

Over the next five years, shareholders expect 800G to grow at a 60% CAGR (compound annual growth rate). The GPUs that power the AI servers require optical bandwidth. As the number of GPUs increases, so do the optical bandwidth requirements. This is a boon for Coherent’s long-term growth.

Operationally, Coherent is executing on synergy and restructuring plans, including globally designing a new ERP implementation. Readers should not view this as a positive driver for the stock price, as the installation of such a system may face unforeseen delays.

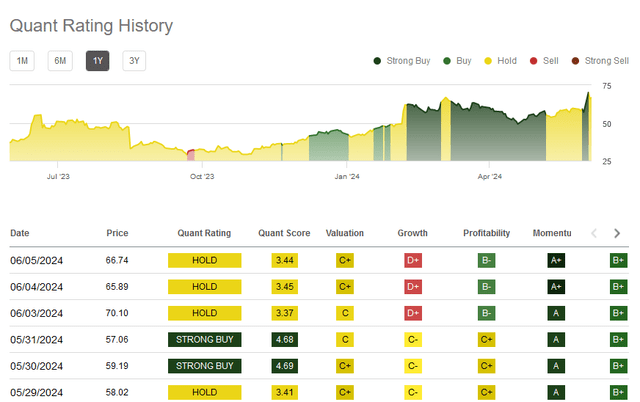

COHR Stock Quantitative Rating

The quant rating for Coherent changed from a “hold” rating on May 29 to a “strong buy” rating on May 30. The reversion to a “hold” rating suggests that readers should not chase the recent rally. The stock price is now pricing in the positive outlook for Coherent’s new management.

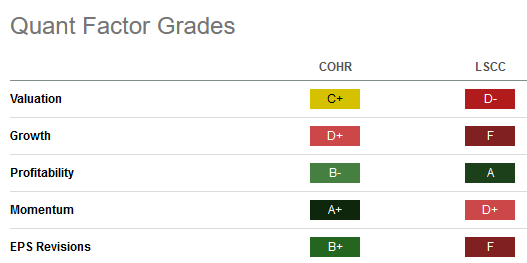

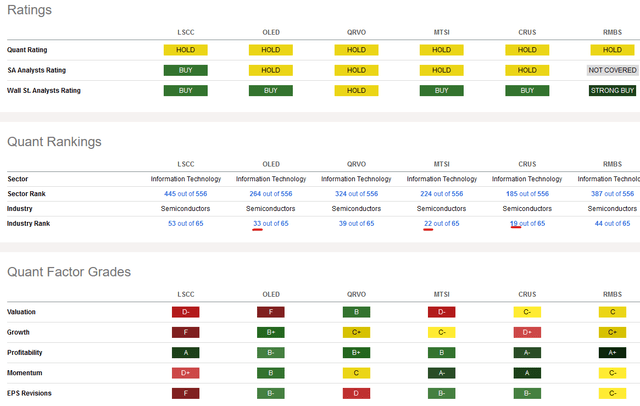

Coherent has outperformed Lattice stock so far this year. LSCC is undervalued, especially in terms of growth. Analysts have lowered their EPS estimates. EPS revised grade “F” in Lattice Stock.

Lattice’s weak outlook suggests the CEO is leaving the company at the right time.

Semiconductor investors include Macom Technology (MTSI) or Universal Display (Organic EL) These companies have better profitability, momentum and EPS revision ratings compared to Lattice Semiconductor.

Corbo (question) Shares fell sharply last month. The June quarter was worseInvestors should avoid companies that fail to meet consensus estimates. Qorvo has struggled due to weak demand for smartphones.

Your takeaway

Add Coherent Corp. stock to your watchlist after the stock’s solid gains. The new CEO is a leadership change the company needs. As the AI hardware investment cycle picks up, shareholders should expect Coherent’s 800G sales to grow by more than 20% over the next few years.