Hapabapa

Dollar Tree (Nasdaq:DLTR) has just announced its first quarter results, ExpectationsAs we go to press, the stock price is my Last Update Just before the company went public and fiscal year ending 2023. In that update, the company maintained its bullish stance on the stock, citing the company’s expanding customer base.

Despite DLTR’s underperformance so far this year, I remain bullish on the stock. The company is making impressive progress in its ongoing transformation efforts. The stock was previously trading at Announcement of the plan The company plans to close about 600 Family Dollar stores in the first half of 2024. While I could view this as a negative, I see it more as a positive given the division’s poor performance in recent years.

According to a report released just before the company’s announcement, The Wall Street Journal report Dollar Tree is working with advisors to conduct a strategic review of its Family Dollar division. Options reportedly include a sale or spin-off. This initial report was confirmed in a company press release, which stated the company would not comment further on the details. Although details have yet to be released as of this writing, this is a major development for Dollar Tree investors.

Current results indicate that DLTR continues to gain share in the consumables space and traffic trends remain favorable, which correlates with the company’s ongoing success in multi-price product expansions. We expect these continued product expansions to increase market share and contribute to sustainable revenue growth in future periods. The bright outlook for DLTR’s ongoing transformation efforts, along with intriguing reports surrounding the fate of the company’s Family Dollar division, make DLTR stock worth paying further attention to.

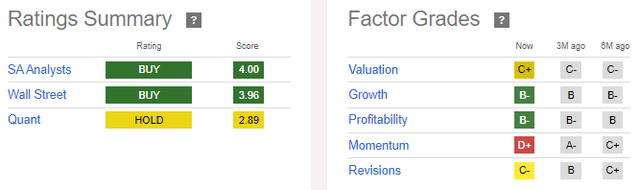

DLTR stock key indicators

Despite DLTR’s underperformance so far this year, sentiment on the stock remains bullish. Both the Seeking Alpha (SA) analyst community and Wall Street currently rate the stock a “Buy,” with Wall Street seeing roughly 25% upside potential for the stock. Consensus EstimatesMeanwhile, SA Quant rates the stock more Neutral, mainly due to a combination of negative momentum and current trading multiples.

Seeking Alpha – DLTR Stock Rating Summary

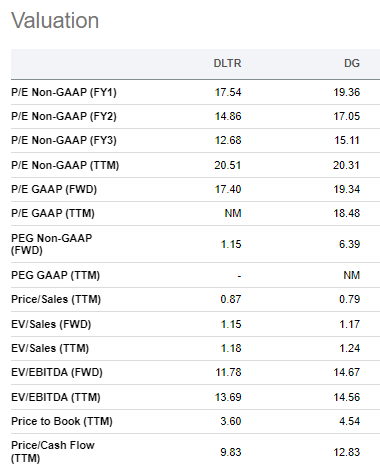

In terms of valuation, I would compare DLTR to its competitor Dollar General (PresidentDLTR currently trades at about 17.2 times expected full-year EPS, compared to over 19 times for DG. 5-year average A multiple of 18.4.

Seeking Alpha – DLTR vs DG Comparison Metrics

In my view, a rerating of DLTR’s price-to-earnings ratio is justified given its ongoing transformation efforts. In 2023, DLTR rolled out multi-price merchandise to 5,000 Dollar Tree stores, and in 2024, the company plans to further expand its multi-price assortment to 3,000 stores. I remain bullish on the continued success of this effort and believe growing consumer acceptance is a key aspect of the bull case for DLTR.

What did DLTR expect going into the bottom line?

Heading into the first quarter of printing, DLTR Previously Guided Full-year EPS is expected to range from $6.70 to $7.30 per share, with a midpoint of $7.00. Compared to comparable earnings in 2023, the midpoint would represent an EPS increase of approximately 20%.

In commenting on fourth-quarter earnings, CFO Jeff Davis noted that full-year consolidated sales are expected to be in the range of +$31 billion to +$32 billion, with Enterprise comparable net sales growth at a low to mid-single-digit percentage. Overall growth is expected to be driven by the Family Dollar division, which is expected to grow at a low single-digit percentage, while its namesake division is expected to grow at a mid-single-digit percentage.

First quarter net sales are expected to be +7.6 billion to +7.9 billion, with comparable net sales growth expected to be in the modest low to mid single digit percentage range for both the Enterprise and namesake companies, compared to the Family Dollar segment, which was expected to see flat growth in the period.

On the margin front, full-year gross margins are expected to be in the range of 36% to 36.5% for the Dollar Tree division, 24.5% and 25% for the Family Dollar division. Combined with sales, full-quarter diluted EPS is expected to be in the range of $1.33 to $1.48 per share.

DLTR First Quarter Financial Results Summary

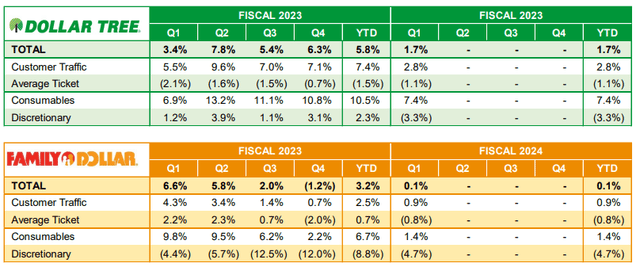

Enterprise same-store net sales increased 1% during the quarter, driven by same-store sales increases of 1.7% and 0.1%, respectively, at the company’s namesake and Family Dollar divisions. Sales growth was driven by traffic at the Enterprise level, which increased 2.1%.

DLTR First Quarter Earnings Announcement – Individual Segment Performance Breakdown

Diluted EPS was $1.38 per share, approximately the midpoint of the company’s guidance range, supported by revenue growth and a 30-basis point increase in gross margin.

release The announcement also included details of damage to the company’s distribution center in Oklahoma caused by a recent tornado. The facility was a total loss, but teeth This is expected to be offset by claims recoveries. In future periods, this may have a negative impact on the company’s renewal rates, but is not otherwise expected to pose a negative headwind to earnings.

Most notably, the company announced a strategic review of its Family Dollar division, signaling potentially big changes for the company that, in my view, should have a positive impact on shareholders given Family Dollar’s underperformance in recent years. No details were released, but this is one development investors should keep an eye on going forward.

Should you buy, sell, or hold DLTR stock?

In previous updates on DLTR, I noted that a 20x earnings multiple is justified given the continued success of DLTR’s transformation efforts. Recently, the company has expanded its multiprice product offerings and closed underperforming stores in its Family Dollar division. The former attracts a significant customer base to the company’s stores, while the latter action promises to preserve capital for more productive purposes.

A recent report from the Wall Street Journal regarding the possible sale or spin-off of DLTR’s Family Dollar division is also a major development for investors. In my view, DLTR’s acquisition of the division in 2015 was a mistake. Poor performance in recent years has led to increased investment in the division’s stores and an increase in store closures. In my view, a sale or spin-off of the division would be a net benefit to DLTR’s namesake division.

First quarter results showed that DLTR continues to make progress on its transformation efforts. Overall, results were mixed, but the company continued to gain share in the consumables category, signaling continued strong traffic in its Dollar Tree division. Full-year guidance was also maintained.

Management is targeting EPS of $10 per share by 2026. I believe this is an achievable goal, especially considering that revenue is expected to grow about 20% this fiscal year. At a multiple of 20x, the stock could be fairly valued at the $200 per share level. This goal is consistent with my past outlook for the stock. Today’s results did not negatively impact my outlook; rather, they strengthened it. The news regarding Family Dollar’s fate is also a big development for investors to watch closely in the coming months. For investors looking for value stocks within a broader index, DLTR may be worth continuing to keep an eye on.