Barončič

My original argument for acquiring The Estée Lauder Companies was,New York Stock Exchange:Elle) is one of the dogs of the Dow Theory, but is not included in the 30 stocks in the Dow Jones Industrial Average. In 2023, Estee Lauder lost 40% of its stock value. Stocks have soared after bouncing back from a lackluster 2022. Obviously, this price movement alone isn’t a reason to buy or sell a company, but it does provide a filter to evaluate whether a company’s shares are selling at a discount.

I like to buy companies like A lasting competitive advantage I always check stocks that are discounted. It’s great if the reason they are discounted is market specific and there is no internal turmoil within the company, but that’s not the case every day. I wish I had that kind of patience, but I’m not the best at market timing, so just waiting for the perfect market opportunity can be a drag. I have been on the sidelines during many bull markets because I believe it is better to be fully invested than to time things perfectly. As a result, many of the companies I buy have issues that I believe are temporary in nature.

At Estee Lauder, Worst Return I was surprised to see a company on this list that I’ve always thought was a good company, having been in the S&P 500 for the past two years. Below is a chart showing its performance over the five-year period beginning at the end of 2022.

EL 5-year chart (Seeking Alpha)

As a result, I decided to take a closer look at Estee Lauder and see if the stock is worth buying.

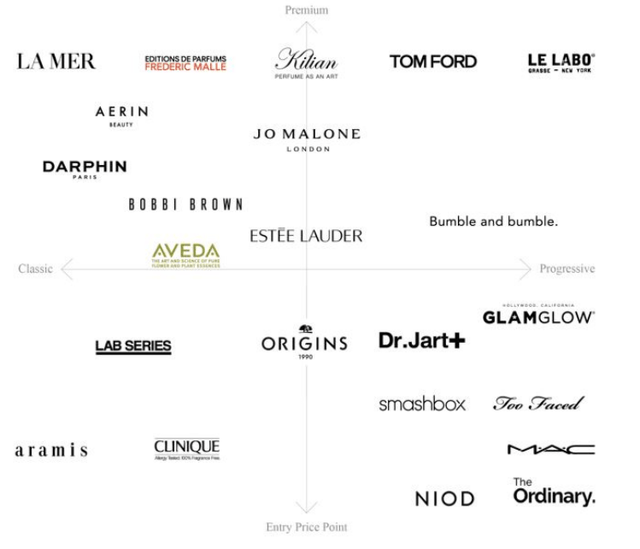

Estée Lauder is a diversified beauty products company that sells cosmetics, fragrances, skin care, and hair care products. It is the second largest beauty company in the world after L’Oréal.OTCPK:LRLCF). The beauty industry is heavily focused on branding, and Estée Lauder’s brand is one of their competitive advantages. You can go into any retail store and buy a facial moisturizer for under $10. Some of these products are brands under the Estée Lauder umbrella, such as The Ordinary. You can also spend over $200 for more complicated products owned by Estée Lauder brands, such as La Mer or Clinique. These diverse price ranges are true for other beauty lines as well, allowing companies in this industry to thrive no matter what the economic environment. Below is an illustration of Estée Lauder’s brand.

Estee Lauder Brands (Estee Lauder Annual Report)

Beauty has historically been a pretty good industry because it’s a relatively inexpensive luxury item and tends to be quite resilient.

How did Estée Lauder get here?

Estée Lauder’s woes, while partly due to dynamics in the post-COVID supply chain environment, seem largely self-inflicted. The company couldn’t have done anything wrong in 2021. After spending so much time alone at home in the spring of 2020 and again in the winter of 2021, beauty purchases surged as people began to gather again, aided by massive government stimulus packages. Increased disposable income The average U.S. consumer

This surge in business led to very strong financial results, but the market extrapolated these results and expected them to continue indefinitely. Looking back at the last few years of this company, including many of the Seeking Alpha articles from that time, it’s pretty amazing. Investors were crazy about this company when the stock was trading in the high $200s to $300s. The majority of articles were rave reviews and buy recommendations. The company backed it up with its financial results. No one could have predicted that a company that was making $7.79 per share in fiscal 2021 would only be making $2.79 two years later.

In 2022, Estée Lauder’s stock price began to fall and the cracks started to show. COVID-related issues In China, the company had a relatively strong performance through most of fiscal 2022. However, that all changed in the fall of 2022 when it released its results and forecast for the first quarter of 2023 (quarter ending September 30, 2022). Despite the headwinds, the company continued to predict growing confidence heading into the second half of fiscal 2023, but that did not materialize. The stock price continued to fall.

Estée Lauder faced significant challenges. The post-COVID supply chain environment and the shutdown of China were outside of the company’s control and caused changes in demand for its products. But the bigger problem for the company was its inability to predict and react accordingly.

Barclays analysts this He said of Estée Lauder’s predicament:

“To summarize how Estée Lauder got to where they are today, we believe the two biggest issues were poor demand forecasting and a long-standing legacy supply chain. In our view, these were specific operational challenges that needed to be addressed and are unrelated to EL’s brand equity, which we believe remains strong.”

another Barclays analyst, Lauren Lieberman said Estée Lauder’s revised 2023 guidance was “not what Wall Street expected” and questioned whether management has “control or understanding” of sales through China’s travel retail channel.

This is not what you would expect from a company with annual revenues of $16 billion. Poor forecasting led to excess inventory being shipped to channel partners, resulting in an overstock situation that took several quarters to resolve. While the supply chain environment contributed to the problem, this appears to be largely a problem of their own making.

Reasons to buy now:

So now that we know what happened in the past, the question remains: is this fixable? I think the answer is yes.

The problems Estée Lauder has faced are unfortunate, but by no means fatal. The brand is still Holds valueand it’s not because the company mismanaged its forecasts or because China’s economy has changed. While current earnings have been affected, the company’s long-term earnings outlook has not changed and it represents a good buying opportunity as long as the current issues do not persist. Indeed, the market’s view of the company has changed and now is the time to be a contrarian.

Management has been clear that the second half of fiscal 2024 will be a turning point for the company, mentioning the turning point five times in its third quarter 2024 earnings guidance. Earnings ReportEstée Lauder is on track to turn things around this year and return to the growth and profitability it had hoped for, given that the third quarter ended on March 31. According to the company’s most recent earnings report, its channel inventory issues had been resolved as of the end of the third quarter.

moreover, Profit Recovery Programis focused on restructuring its gross margins, which it expects to grow by $1.1 billion to $1.4 billion between 2025 and 2026, consistent with the company’s previous announcements. The company expects to have more details on this in August after its fourth-quarter earnings release, but the savings should come from improved management of current inventory, which will reduce markdowns and write-downs. But more importantly, the company is working with its supply chain to drive further savings through leveraging its expense base.

risk

The most significant risk to my thesis is that the enduring competitive advantage of Estée Lauder’s brands is somehow eroded. In today’s world of social media influencers, brands are established and promoted differently than they are in the cosmetics aisles of Macy’s and Bloomingdale’s at the mall. My concern is that these brands will stagnate over time, and the next generation will buy products they’ve never heard of but that somehow have 15 million followers and promote on TikTok. I do think that an explosion of previously unknown brands is possible, but I don’t see it actually hurting a company like Estée Lauder, which employs the same techniques with Instagram and Facebook. Tick tockBut we also have a marketing budget that can compete with any startup.

My other big question is whether management is overselling this recovery to Wall Street and whether they can actually execute on a profit recovery program. This is not really a concern for me as it will only delay the recovery. Additionally, the Q3 conference call mentioned the rollout of a new “integrated business planning process,” which sounds a lot like the basic forecasting/FP&A capabilities you would expect from a $45B market cap company. They also mentioned that they have complemented their advanced planning techniques with AI to improve accuracy, which is an immediate red flag for me. It seems to me like management is trying to bring AI into a discussion where it doesn’t need to be. That being said, I would understand if management is viewed as a question mark by some and that would cause investors to pull out quickly.

Evaluation – Another Risk

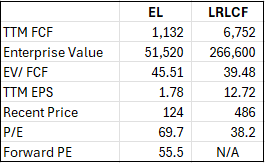

Even at these levels, the valuation is not attractive. For a self-identified value investor, Estée Lauder, like many of the other stocks I own, is not exactly value. The P/E ratio is currently in the stratosphere, and even the forward P/E is very high at 55x. The EV/FCF is high at 43x, which doesn’t make sense for a company that has struggled so much. This is clearly not what we should expect going forward, especially given the restructuring and profit recovery program. Can the company return to around $2-3 billion in annual revenue in FY2025 or FY26, as it did in FY2021-2022? At this point, analysts are right to be skeptical, and currently none of them expect the company to reach this level by the end of next fiscal year. They need to prove it with results.

But let’s be clear: this company is not on the brink of bankruptcy as it is profitable and has positive free cash flow, and it pays a dividend of over 2% that is well covered by annual free cash flow, giving you a decent payout while you wait for a recovery.

For comparison, we looked at two other beauty companies that sell similar products to Estee Lauder. However, the only direct competitor is L’Oreal, even though its revenue is three times that of Estee Lauder. These are both large, mature beauty companies with a long history and very similar characteristics. The other company we looked at, Elf Beauty (fairy) has a great story, but with just $1 billion in revenue, it’s a relatively new company in the beauty/fashion industry. It’s not a comparable company.

Estee Lauder vs. L’Oreal Valuation Comparison (Author’s calculations using financial data from Seeking Alpha)

As you can see, Estée Lauder’s valuation is higher compared to L’Oreal, given its recent underperformance. L’Oreal also does not offer an attractive value relative to other market opportunities, but this is likely due to the strength of its stock price rather than declining earnings in recent years.

Conclusion

It’s never easy to invest in what is essentially a recovery. I feel like I’ve given plenty of reasons to be cautious rather than bullish on Estée Lauder. One only needs to read the company’s latest analysis to see the market pessimism, which seems natural. But getting bullish once the recovery has already arrived is no good, or you’ll miss out on the biggest gains. Sometimes you need to bet that the turning points highlighted by management will materialize.

Sentiment towards the company is very negative right now, which is one of the reasons why I feel there is limited downside. If the company can execute on its profit recovery plan, I believe there is much more upside potential than downside potential if it cannot. I would buy the stock at these levels and will remain interested in the $130-135 range.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.