Rockaa/E+ via Getty Images

Investment Thesis

PagSeguro (recommended to purchase)New York Stock Exchange:Pug)KK Q1 2024 The financial results were released on May 23. As a growth company, PagSeguro saw a strong increase in net profit, up 31.7%. Another highlight was that the company The number of customers has reached 31.4 million, of which 17.3 million are active customers.

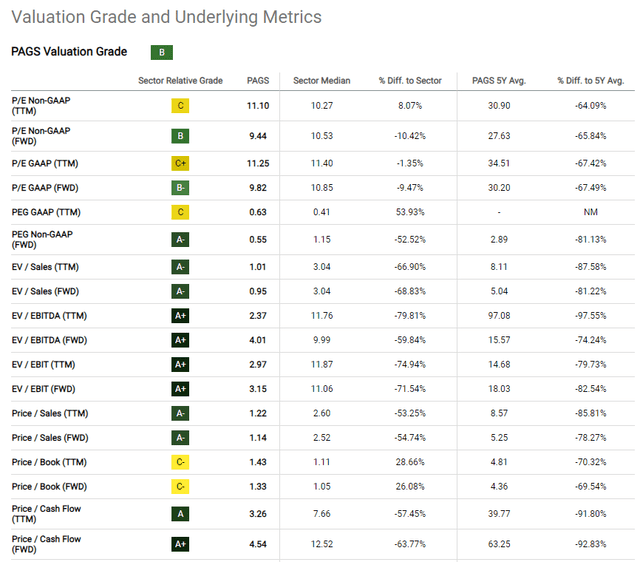

Additionally, the company is experiencing growth with low-risk, profitable products while launching promising new products, which is important when operating in an industry characterized by competition and innovation.Finally, PagSeguro continues to trade at a 9.47% discount to the industry average on a P/E multiple, which looks like a great opportunity to me.

PagSeguro’s first quarter 2024 performance review

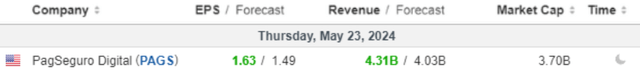

Now, let’s talk about PagSeguro’s results. Below we compare the reported results with market expectations.

As you can see, the result is Beating expectations. The company beat revenue expectations by 6.9% and profit expectations by 9.4%. I’ll now go into more detail on each segment of PagSeguro’s performance.

Revenues – Strong with focus on acquisition

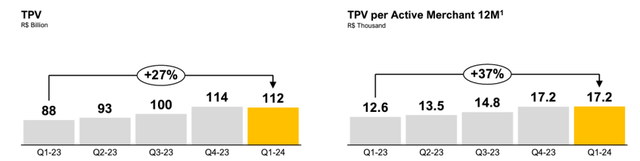

PagSeguro’s consolidated net revenue was $860 million, up 15% year-over-year. It is worth noting that the company has two large revenue segments: acquiring and fintech.Acquisition SegmentTotal transaction volume (TPV) totaled $22.4 billion, representing annual growth of 27%.

In the fintech space, PagSeguro achieved $13.2 billion in cash in, up 48% year-over-year. Cash in is a measure of the amount of funds received from other financial institutions into PagSeguro accounts, excluding acquiring. Highlights include: Pixcorporate account products, payroll portability and more.

In my opinion, this result is very strong given that the first quarter is typically a seasonally weak period for customer acquisition. PagSeguro also highlighted that its customer base reached 31.4 million (up 9.5% year-over-year), of which 17.3 million were active customers. This strong revenue growth supports my buy recommendation.

Loan Portfolio and Non-Performing Loans – Growing Safely

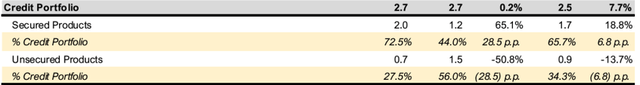

With regard to the loan portfolio, the increase was primarily due to guaranteed products, including: Salary LoanAdvance FGT Birthday withdrawals and limited credit cards linked to PagSeguro financial products.

These guaranteed products already account for nearly three-quarters of the loan portfolio and have contributed to the over 90% reduction in non-performing loans.In my view, PagSeguro has a good credit strategy in safer products combined with servicing small and medium-sized enterprises.

Now, let’s talk a little bit about costs and expenses.

Costs and Expenses – Growing Safely

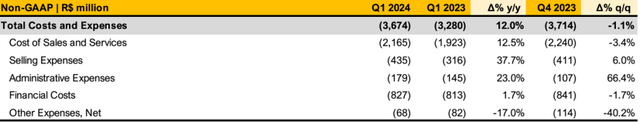

Costs and expenses were $729 million, up 12.0% year-over-year and down 1.1% sequentially, driven by higher TPV, slightly higher interchange and card scheme fees, and higher amortization of intangible assets.

Additionally, sales expenses increased 37.7% due to an increase in the sales team for geographic expansion and marketing expenses. Finally, administrative expenses increased 23% due to an increase in technical services and bonus provisions. I view these expense increases as “growing pains.”

Net Income – Strong Growth

Finally, the company achieved net income of $96 million (up 31.7% year-over-year, down 4.3% quarter-over-quarter) due to increased billings and credit revenue from acquiring services. Other highlights that caught my attention were the new product launches.

Pug Seguro Release In the first quarter, we saw expansions in Business Insurance, Tap to Pay Online and PagBank partnership. In a competitive industry, it is important to continue to launch products, improve them and launch new and better products to stand up to the competition.

The company’s pursuit of innovation supports my recommendation to buy the stock, and we will now analyze valuation to see if PagSeguro remains attractive.

Rating – Very attractive

my Early press articlesI use Seeking Alpha’s metrics to evaluate companies.

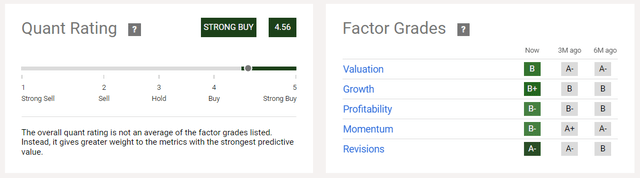

As you can see, this company scores very highly across most metrics, and a look at Seeking Alpha’s Quant Rating and Factor Grades tools gives me confidence in this recommendation.

Quantitative evaluation and factor evaluation (IR company)

While the opportunity appears to be great, it is important that investors are aware of the risks to this thesis, which we discuss below.

Potential threats to the bullish thesis

I listed the main risks of the paper as follows: Insurance Coverage ReportTo be honest, we don’t see any new significant risks to the business in our Q1 2024 results.

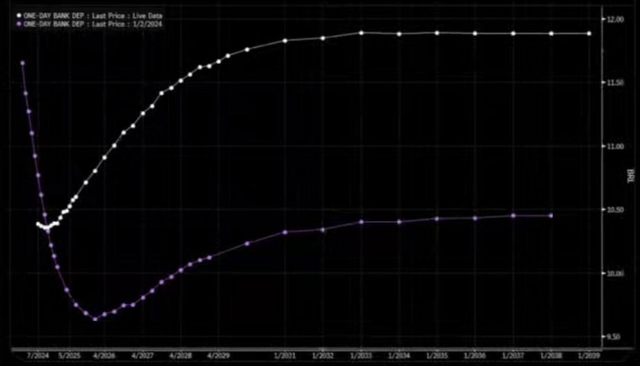

Therefore, I will focus on the macroeconomic risks related to the Brazilian economy. In this sense, the Central Bank of Brazil is independent, although at the end of the year the current president will be able to appoint a new Central Bank governor.

Presidential Latest Speeches It’s about intervention to lower interest rates, which is worrying from an investor perspective, and this has caused a big rally at the long top of the yield curve.

Future Interest Rate Curve (Bloomberg)

The purple curve is for January 2, 2024, and the curve today is the white one. As you know, this directly affects consumption, investment and asset price decisions. The risks associated with investing in PagSeguro are manifold and investors should pay attention to them.

Conclusion

PagSeguro has been growing steadily in the areas of acquiring and fintech. Its best-selling products are guaranteed and the company’s credit operations are healthy.

Despite being a growing company, PagSeguro exhibits excellent profitability and above all, when analyzing its P/E (FWD), it is trading at a 9.47% discount to its peers.

Based on this analysis, I recommend buying PagSeguro shares. In my opinion, investors should stick to growth with profitability and attractive valuations. The risk-reward ratio looks very attractive.