Robert Way

PVH Corp. shares (New York Stock Exchange:PVH) has seen a solid but volatile performance over the past year, rising more than 50%. PVH shares fell sharply after reporting their most recent quarterly earnings, but Urged Investors bought in at the lows, and the stock has risen about 10% since then. I argue the company is likely to beat its conservative guidance, and on Tuesday afternoon, PVH raised its EPS guidance for the year to within my range. With shares roughly flat in after-hours trading and approaching my price target in the low $120s, now is a good time to reconsider the stock. I’m raising my price target, but I’m still a buy.

The company First QuarterPVH earned $2.45 Quote Revenues were down 10% year over year to $1.95 billion. Excluding the sale, revenues were 7%. Adjusted EPS does not include a $0.10 gain from the sale of Heritage Brands’ lingerie brands. First quarter results beat guidance by $0.30. Although sales were down $206 million, lower input costs and a decision to sell less to the lower margin wholesale channel helped margins increase 350 basis points to 61.4%, limiting gross margins to a $52 million decrease. Management also noted improved pricing power. Additionally, SG&A was down more than 4% as management continues to carefully manage costs.

Geographic differences remain significant with the US leading the way, and Asia is also performing well, while PVH has strategically reduced lower margin sales in Europe. North American revenue increased 3% driven by growth in both direct-to-consumer and wholesale channels. Globally, DTC revenue increased 1% and 3%, respectively, in constant currency. Interestingly, brick-and-mortar grew 3%, while online declined 6%. Wholesale revenue declined 17%, and 11% excluding divestitures. Europe is seeing wholesalers being particularly cautious. PVH has also made the strategic decision to reduce sales through lower margin channels in Europe.

While this decision reduced revenue, the impact to the bottom line was much less, as evidenced by significant margin expansion. By streamlining sales, we were also able to reduce our inventory to $1.35 billion, 22% less than a year ago, which freed up working capital and allowed us to repurchase shares. Additionally, with less inventory, we are less likely to face excess merchandise, reducing the need for discounting and further maintaining the profitability of our sales.

Given that the company is focused on maximizing sales value rather than maximizing revenue, the CEO of PVH Europe departureHe also had global responsibility for the Tommy Hilfiger brand, which has relied more on lower-margin channels than the Calvin Klein division. The focus on profit growth rather than sales growth has already started to pay off at the Calvin Klein division and in the U.S. more broadly. Achieving similar results at Tommy Hilfiger Europe would be a big plus for the company.

Taking a closer look at each brand’s performance, we start with Tommy Hilfiger. The company’s sales fell 10% to $1.01 billion, with North America up 2% and international down 14%. 71% of Tommy Hilfiger’s revenue comes from international locations. Tommy’s sales were particularly affected by planned cuts in Europe, but the company expects the quarter to be its worst year-over-year decline. Tommy Hilfiger’s U.S. profits increased from $2 million to $24 million as sales grew and inventory rationalization efforts improved margins. International profits fell from $126 million to $76 million due to lower sales. Overall, profits fell about 25% to $101 million.

Calvin Klein sales were flat at $887 million, down 2% internationally and up 4% in North America. 68% of sales came from internationally. The wide discrepancy in brand performance and the need to refresh Tommy Hilfiger’s European strategy, in particular, explains why PVH made the leadership changes. Calvin Klein’s revenue was about 13% lower than Tommy Hilfiger’s, but its profits were higher. Improvements in North America helped propel profits up 30% to $133 million.

Overall, I view this as an encouraging quarter. PVH has made progress in revising its distribution strategy in Europe, which showed very strong margin performance. The strong performance in North America and the strong performance of Calvin Klein speak to the benefits of a leaner wholesale strategy, which, if successfully applied to Tommy Hilfiger, could have a significant benefit to earnings over the next 18 months. The company also maintains a healthy balance sheet with $376 million in cash and $2.1 billion in debt, and interest expense decreased by $4 million to $18 million, due in part to the higher yield on cash. During the quarter, PVH took advantage of the decline in its share price to buy back $200 million of its own stock. As a result, the company’s share count is 8% lower than last year, and management plans to buy back $400 million of its own stock for the full year, which will reduce the share count by a further 3%.

As for the outlook, I expect second quarter sales to be down 6-7%, or down 3% excluding divestitures, which is a significant improvement from the first quarter, supported by easier comparisons and the transition from the European reset. For the full year, PVH reiterated its expectation of full year sales declining 6-7%. However, EPS guidance was raised to $11.00-$11.25 from $10.75-$11.00. In April, I argued that sales could decline about 5% this year, with EPS in the range of $11.00-$11.25. Currently, PVH is in line with my EPS expectations, but sales are still a bit lower. I believe that the share count reduction has been front-loaded due to more aggressive share repurchases, and margin expansion has been stronger than I expected, which has allowed me to raise my EPS expectations. Currently, I continue to believe there is room for upside in sales, and based on the first quarter margin results, I see EPS coming in at $11.20-$11.40 this year.

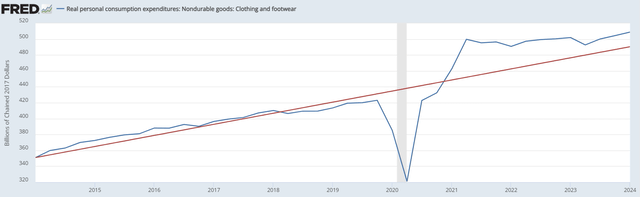

With regards to North America, we are pleased with the macro backdrop for apparel retail. Employment remains strong and disposable income is increasing. Importantly, Macy’s (Ma) is significantly reducing its inventory, which should eliminate headwinds from the wholesale channel entirely. Additionally, after spending unsustainable amounts on apparel in 2022, spending is stagnating in 2023 and is now within 3% of trend. With spending closer to long-term trends, we believe the backdrop will lead to modest apparel consumption growth of 0-2%. This should enable continued sales growth for PVH’s North American business.

Federal Reserve Bank of St. Louis

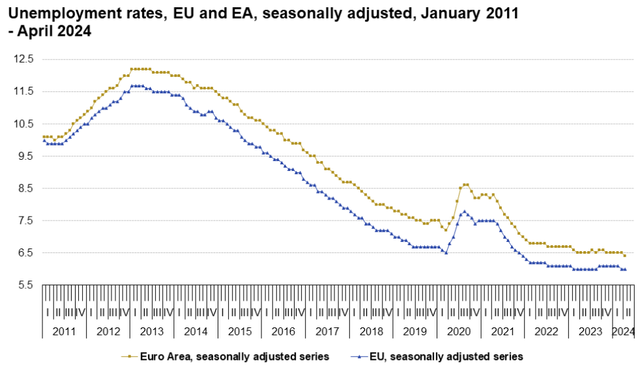

As we’ve noted, PVH is roughly 70% overseas, limiting its growth in the U.S. Importantly, we feel comfortable with the company’s exposure to Europe. Post-COVID, Europe is 6-12 months behind the U.S., and just as U.S. retailers were de-stocking last year, U.S. retailers are now de-stocking, which is why wholesale is weak. Once that process is complete this year, the headwinds should abate. Also important is that the European economy is doing pretty well, with unemployment rates below pre-COVID levels.

A bigger challenge for Europe is that energy inflation has been extremely high as the company seeks to reduce its exposure to Russian natural gas. This has severely pressured consumer incomes. Importantly, natural gas prices have fallen substantially over the past 18 months due to increased LNG exports, freeing up consumer income for more discretionary items such as clothing. I believe this lower inflation pressure also means that the ECB is more likely to cut rates before the Fed. Europe may not be a fast-growing market, but I believe it should provide a tailwind compared to current conditions, allowing some increased sales activity and enabling PVH to beat earnings guidance.

Last quarter, I thought PVH had set an overly conservative baseline for 2024, and with a quarter into the year and guidance raised, that appears to have been correct. However, I still see risk to further upside of guidance given somewhat more favorable macroeconomic conditions. This means the company’s European reform efforts are likely well-timed. At my $11.30 forecast, the stock trades at just 10.6 times earnings. I think about 12 times earnings, or an earnings yield of about 8%, is the appropriate multiple for this business.

PVH’s European expansion will likely be viewed with caution, as fashion tastes are volatile, which will likely limit the expansion of the stock price multiple. To compensate, the company has a well-known brand and a strong balance sheet. Assuming long-term growth of 2-4%, or slightly below global nominal GDP growth of 4-5% (as Europe is growing a bit slower), with a 60% earnings dividend, PVH could generate long-term returns of about 10% (5% annual share buybacks, about 5% annual growth) at a 12x stock multiple. This could push the stock to the low $130s. As investors gain confidence in the company’s European transformation and guidance increases further, I expect the stock to continue to recover. I remain a Buy.