Kirill Gorlov

introduction

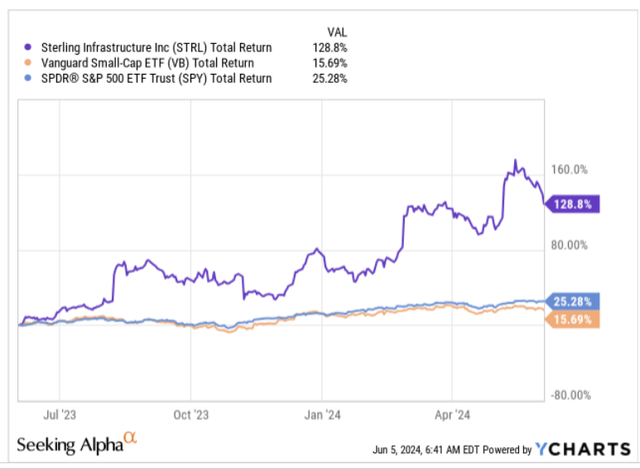

Sterling Infrastructure shares (Nasdaq:Research Institute), a gauge of small-cap stocks representing diversified U.S. infrastructure services, has proven to be a great source of alpha in recent years. Over the past year, its peers It has produced returns within the mid-teens threshold, and while the leading benchmark has produced a return of 25%, our hot stock STRL has soared a whopping 129%.

Attractive business

First, note that STRL offers a degree of diversification across the infrastructure sector that is typically found in larger companies, rather than smaller companies like STRL: Through STRL, you can participate in the infrastructure story that connects data centers, e-commerce warehouses and distribution centers, power generation, highways, bridges, airports, and port construction, and even single-family homes and multifamily housing.

STRL is The company operates primarily in mid-sized markets, which tend to be too small for multinational construction companies and too large for small local contractors, so it has taken various measures.

Of these end markets, STRL believes the data center construction sector has the brightest prospects, as there seem to be no limits here: Data center construction capacity in North America is already at an all-time high, driven by the rapid growth of AI, digital and cloud services. 3078MW Notably, 83% of this capacity had already been pre-leased before these projects were even completed.The pipeline of new data center projects in the U.S. currently stands at a staggering $160 billion, with roughly 20% of that taking place in Virginia alone, and while STRL has a significant presence in Virginia, there are similar projects happening in other Mid-Atlantic regions.

These data centre projects are typically highly profitable and contributed significantly to the improved operational performance in Q1 for STRL’s largest division, e-Infrastructure Solutions (48% of Group revenues), despite a 10% decline in revenues, mainly due to weather-related issues (based on the first quarter backlog, management is forecasting high single-digit to low double-digit growth for the remainder of the year, so revenue prospects for the remainder of the year remain positive).

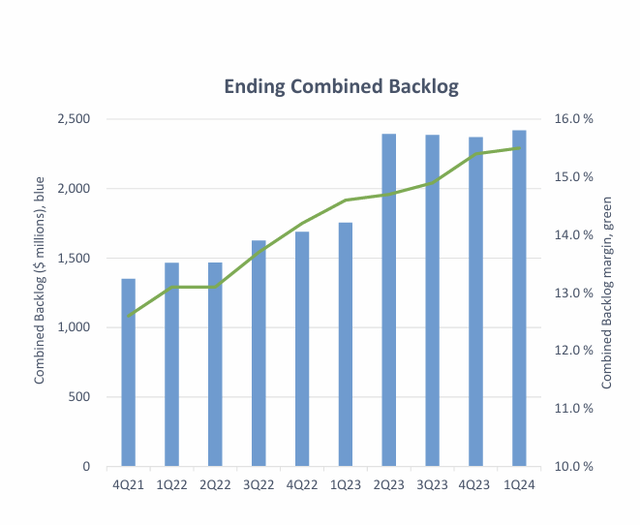

Quarter-over-quarter, STRL’s backlog has been growing at a healthy 13% pace, recently reaching $2.35 billion (STRL’s backlog typically takes 16 months to convert to revenue). It’s not just the healthy pace of backlog growth that’s important, but the quality of that backlog as well. About three years ago, STRL was signing contracts with gross margins of about 13%; now it’s approaching 16%.

In addition to the shift towards centres, it has also helped that within STRL’s traditional business, transport solutions (32% of group revenue), it has shifted focus away from big, low-bid highway projects to alternative deliveries and higher-margin work such as airport development, commercial works and shoring.

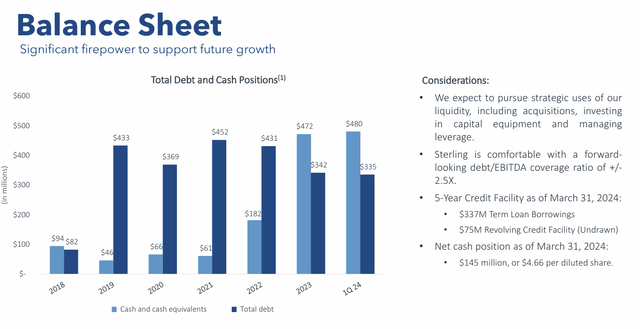

In such a capital-intensive business, it also helps that STRL currently has a strong balance sheet. For the four years prior to FY23, debt on its books exceeded cash, but in the last few quarters that has completely reversed and STRL now maintains a net cash position. 500 million Currently (which makes cash the largest portion of GiKen’s asset base at 26%), GiKen has plenty of room for M&A and share buybacks.

Indeed, late last year the company announced a $200 million share repurchase plan (more than 5.5% of its current market cap) that is expected to be completed in just two years (most companies do not set deadlines for their share repurchase plans, which mirrors STRL’s efforts well). The improving cash generation profile is in part due to the company’s focus on e-infrastructure services and data center construction. timing Cash payments are more advantageous from a working capital perspective.

Summary – Why you shouldn’t buy STRL stock now

Despite some positive stories surrounding Sterling Infrastructure, we don’t think investors should buy the stock at any price. Valuations currently look expensive and some of the bullish momentum appears to be fading.

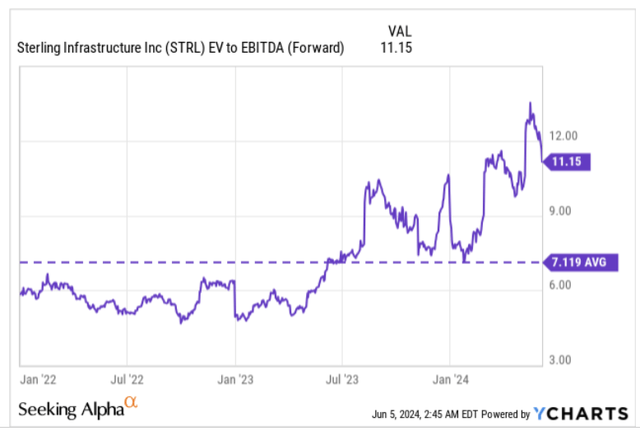

First, regarding valuation, STRL’s current stock price is priced at a very high EV/EBITDA multiple of over 11x, which represents a 57% premium to the long-term moving average.

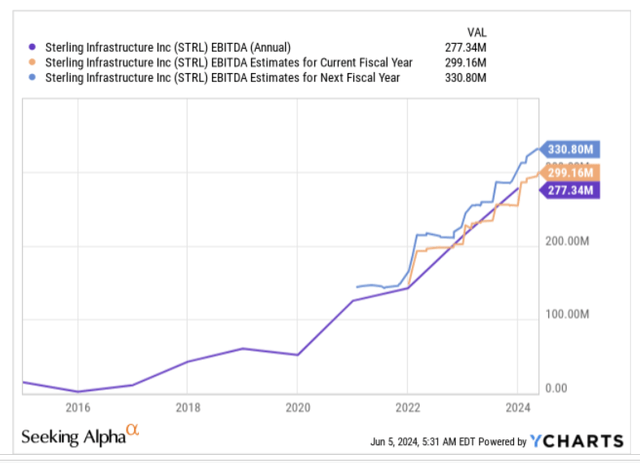

To get such a multiple, one would need very strong medium-term EBITDA growth, or at least EBITDA growth that is commensurate with the multiple offered, but consensus forecasts for the next two years suggest an EBITDA CAGR of just 6% through FY25.

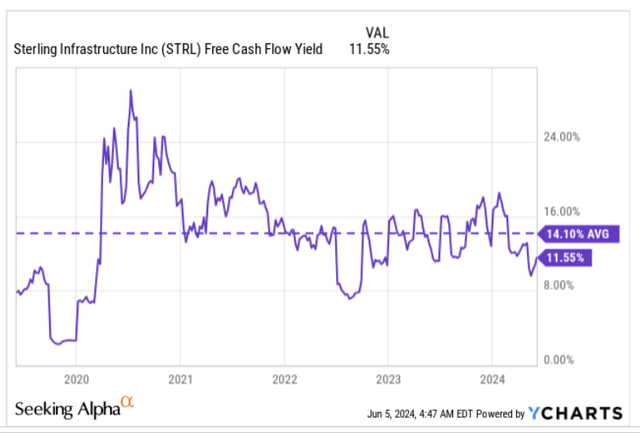

And, as mentioned above, STRL has a fairly solid cash position and has managed to generate very healthy FCF over the long term, but consider that at current price levels, the resulting FCF yield (11.55%) is over 250bps lower than the typical yield on the stock (14.1%), reducing the incentive to take a long position here.

And investors looking for suitable infrastructure-oriented U.S. stocks that could benefit from mean-reversion momentum are unlikely to be attracted to STRL at this point, given how steep STRL’s strength currently looks relative to its infrastructure peers. For context, its current relative strength ratio is roughly 3x higher than its long-term average of 0.85x, which means STRL is indeed quite vulnerable to mean reversion on the downside.

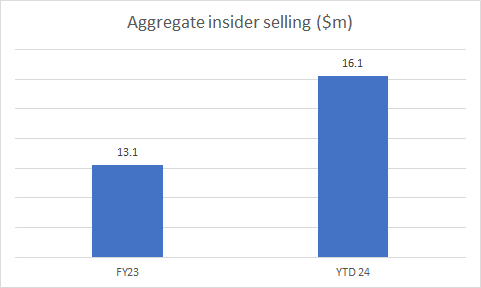

In fact, investors may want to consider that prominent insiders, including the CEO and CFO, have taken advantage of the stock’s rally this year to sell off significant portions of their holdings. For perspective, total insider sales for all of last year were over $13 million. This year is not even halfway through and we’ve already seen $16.1 million worth of insider sales.

bar graph

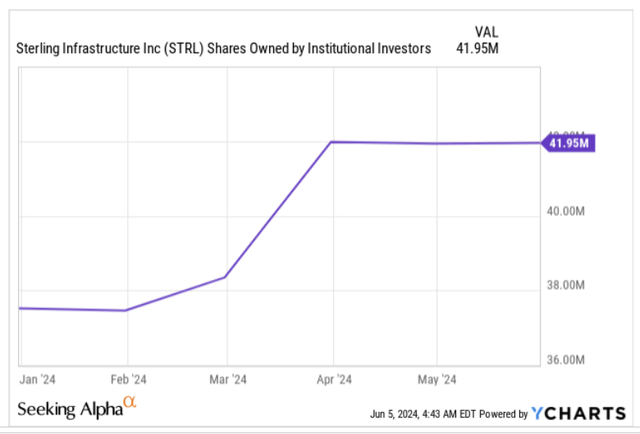

Investors may also want to consider how smart investors are positioning themselves: on a year-to-date basis, they are definitely bullish on STRL stock, increasing their holdings by 12%, but they have not increased their positions over the past few months.

The lack of sufficient institutional interest is also reflected in the monthly chart movement, where there seems to be a bit of buying fatigue at higher levels and the stock price appears to be due for some correction.

Please note that for nearly two years, the stock price has been trending up within a particular ascending channel (marked by the two black lines). Last month, it looked like the stock would spike above the upper limit, but that never materialized due to a long wick outside the channel boundaries. June has just begun, but so far, the price action has not been good. In any case, the stock price is still quite far from the lower limit of the channel, so we do not believe new long positions should be considered here. STRL is a hold.