1b …

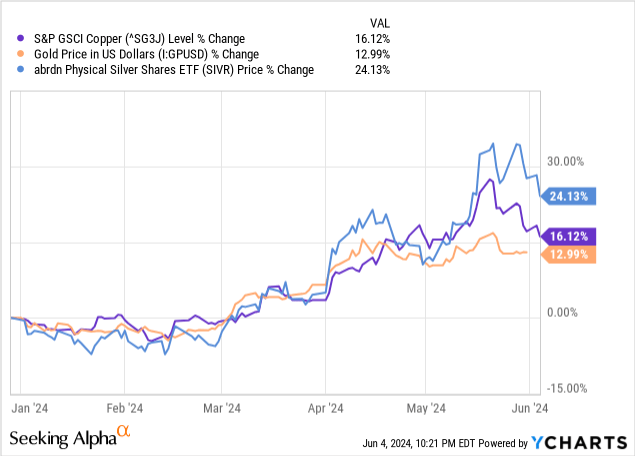

Gold, silver and copper have seen incredible gains since the start of the year.

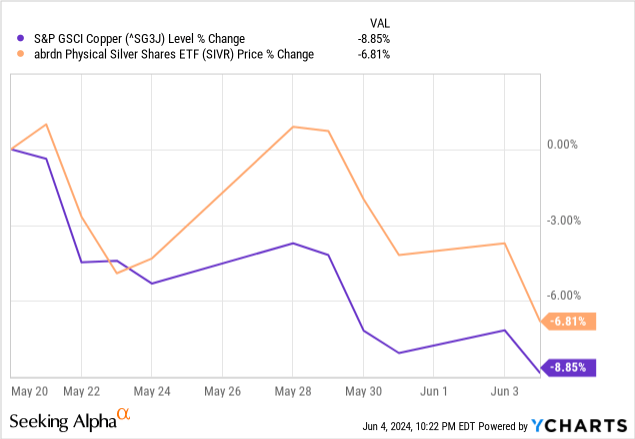

However, gold has fallen slightly in recent days, while copper and silver prices have fallen even more sharply.

In this article, I will explain why this is happening and why I view this drop as a great opportunity to gain more exposure to these already excessive metals.

Gold, Silver, Copper Bull Market

Gold prices have started the year strong thanks to very strong central bank demand as they look to diversify their reserves away from the US dollar. The move has also been driven by concerns over sanctions imposed by the US and Europe on the Russian economy following the invasion of Ukraine, as well as high and runaway inflation rates. The US government’s budget deficit. In addition, the BRICS countries, led by China and Russia, are increasingly trying to move the world economy away from the dollar in order to weaken the US’s geopolitical influence.

In addition, Chinese consumers are aggressively buying gold as the sluggish stock market and the bursting of the real estate bubble leave them with no attractive alternatives at home. Rising geopolitical concerns in Eastern Europe, the Middle East and especially the Far East are also driving increased demand for gold as a safe haven in case rising geopolitical tensions escalate into full-blown conflict, threatening to lead to a global economic recession and large fiscal deficits. Both of these are likely to be bullish events for gold.

Meanwhile, silver has also risen in tandem with gold. Strong industrial demandSilver plays a key role in electrifying the global economy. Similarly, copper plays a key role in all electrical appliances, which has led to strong demand and a surge in prices. It is expected that silver and copper production will not be able to keep up with demand in the coming years, which will drive prices even higher.

For these reasons, I am investing in the iShares Silver Trust ETF (SLV) and SPDR Gold Trust ETF (gold), I hold both and sell options. Also, mining companies (GDX)(G.D.G.) is heavily invested in gold and copper. One of my favorite stocks right now is Barrick Gold (Money) and Newmont Corporation (Nemu), these companies are not only trading at attractive prices relative to their underlying net asset value, but also have strong balance sheets and return significant capital to shareholders through dividends and share repurchases, which is why I have previously reviewed Southern Copper Corporation (SCCO) and made a big profit, but will sell to secure an attractive return and may repurchase if the current decline continues. On the other hand, the current decline is, in our view, a very attractive opportunity to further increase our holdings. As a result, we are very grateful for this.

Why are gold, silver and copper falling?

What’s driving this? Gold’s declines have been minor so far, likely due to profit taking and concerns that the Fed will keep interest rates high for a long time, which have been headwinds for gold prices. Additionally, high gold prices may have slightly dampened Chinese demand for gold, making gold jewelry less attractive for Chinese consumers to buy.

Meanwhile, copper prices Global inventory increaseDespite the decline in inventories, stocks on the London Metal Exchange have risen to 116,000 tonnes from a low of 103,100 tonnes in early May. In addition, the Shanghai Futures Exchange warehouses are It holds a whopping 321,695 tonnes of copper.This is the highest level since April 2020. This is due to the normal seasonal stock build-up during the Chinese New Year holiday season, and not the typical decline in copper inventories following the holiday. Instead, copper continues to accumulate in the Shanghai Futures Exchange warehouses, increasing by 20,731 tonnes last week alone. Given that China is the world’s largest buyer and consumer of copper, it will be difficult for copper prices to rise until these inventories decline.

On the other hand, silver is likely to be sold off just like copper since it is also used for electrification purposes, and since silver also functions as a monetary metal, it has been trending down due to profit taking and concerns about a secular rise in interest rates.

Investor lesson: Buy low!

The retreat is likely to be justified. Even if you are healthy We remain unsure of the long-term demand story for these metals, especially copper and silver. However, we see a long-term shortage of copper and silver as still a very likely scenario, and we are also very concerned about the geopolitical risks facing the world, especially the Chinese Communist Party’s ambitions towards Taiwan. We also believe that the US dollar will likely continue to lose significant value over time as a result of the US government’s runaway deficit spending and global central banks increasingly moving away from the US dollar. As such, we believe the current dip represents a great buying opportunity for silver, copper and gold. As a result, we plan to continue to buy increasingly more of these metals in all forms, including physical, ETFs for options trading, and mining stocks.